ACCA (Association of Chartered Certified Accountants) subjects refer to the core papers that students must complete to become a qualified ACCA professional accountant. The main ACCA subjects cover areas like financial accounting, management accounting, taxation, auditing, and corporate and business law.

The ACCA syllabus make up the backbone of one of the most popular global certifications for budding accountants and financial practitioners. The ACCA, short for Association of Chartered Certified Accountants, offers a student program that imparts a solid understanding of accounting, finance, and management. Students undertake 13 core papers over three levels under the ACCA program to build their theoretical knowledge as well as develop practical skills. This article discusses ACCA subjects at all levels, fees, duration, and difficulty, providing a holistic guide for Indian students as well as international candidates.

What is ACCA?

The Association of Chartered Certified Accountants (ACCA) is a globally recognized professional body offering certification in accounting and finance. ACCA certification is ideal for those aiming to work in top multinational companies or start their accounting practices.

Importance of ACCA

The ACCA qualification is highly valued worldwide for its global recognition and professional credibility. It equips students with the skills needed for diverse roles in finance and accounting. With its flexible structure, ACCA supports both students and working professionals in advancing their careers.

- Global Recognition: ACCA is recognized in over 180 countries, making it ideal for international career opportunities.

- Flexible Learning: Students are at liberty to take their exams at any time given and then work at their own pace based on the results of hard work. The need is growing for specialists who can manage their own time and the schools are therefore adjusting to it.

- Diverse Roles: ACCA certification opens doors to roles in auditing, taxation, consulting, and financial management.

- Practical Exposure: The program combines theoretical learning with practical application.

What are the 13 Papers of ACCA?

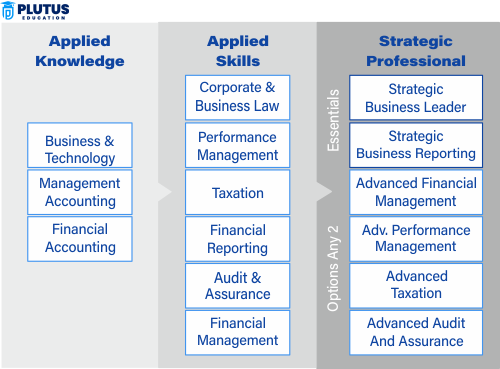

The ACCA qualification is made up of thirteen (3+6+4) papers divided in three levels: Knowledge (3 papers), Skills (6 papers), and Professional (4 papers). These cover main topics like financial accounting, taxation, audit, and strategic business leadership, which will give them a solid grounding in the application of accounting and finance. The 13 ACCA papers (which are exactly the same as before), are as follows:

- Paper F1: Accountant in Business

- Paper F2: Management Accounting

- Paper F3: Financial Accounting

- Paper F4: Corporate and Business Law

- Paper F5: Performance Management

- Paper F6: Taxation

- Paper F7: Financial Reporting

- Paper F8: Audit and Assurance

- Paper F9: Financial Management

- Paper P1: Governance, Risk and Ethics

- Paper P2: Corporate Reporting

- Paper P3: Business Analysis

- Paper P4-P7: Advanced papers covering various specialized areas of accounting and finance.

ACCA Subjects on Level 1: Applied Knowledge

The first level of outstanding accounting practice, Applied Knowledge, lays the groundwork for the most important financial concepts and acquaints students with the activities of the financial market. These subjects are the foundation for the advanced learning in the subsequent levels.

- Business and Technology (BT): Covers organizational structures, business environment, and governance. Helps students understand the role of technology in modern business.

- Management Accounting (MA): Focuses on budgeting, cost analysis, and decision-making techniques. Prepares students for roles in cost management and internal auditing.

- Financial Accounting (FA): Introduces the principles of financial reporting, ledger maintenance, and trial balances. Lays the groundwork for preparing financial statements.

ACCA Subjects on Level 2: Applied Skills

The second level, Applied Skills, expands on the basics, introducing complex topics that test analytical and problem-solving abilities. This level is more rigorous, preparing students for practical challenges in the finance industry.

- Corporate and Business Law (LW): Covers laws affecting businesses, including contracts, employment, and corporate governance.

- Performance Management (PM): Focuses on advanced costing techniques, performance evaluation, and risk management.

- Taxation (TX): Provides insights into tax laws, computations, and compliance in different jurisdictions.

- Financial Reporting (FR): Teaches how to prepare and interpret complex financial statements.

- Audit and Assurance (AA): Focuses on audit planning, risk assessment, and reporting.

- Financial Management (FM): Covers investment decisions, financing options, and risk management strategies.

ACCA Subjects on Level 3: Strategic Professional

The final level, Strategic Professional, focuses on leadership, strategy, and advanced financial management. This level is designed to transform students into global business leaders.

Core Papers (Mandatory)

- Strategic Business Leader (SBL): This part of the course helps you become a better leader by focusing on how to lead a team, make ethical decisions, and plan strategies for business success. You will practice making decisions by working through real-life case studies, which helps you apply what you learn to real business situations.

- Strategic Business Reporting (SBR): This section teaches you how to deal with financial reports. You will learn how to understand complicated data, ensure it is correct, and gather key information from it. These skills are essential for jobs that require you to think outside the box and analyze data creatively. By mastering these skills, you will be well-prepared to handle complex financial data and make informed decisions in any business setting.

Optional Papers (Choose 2)

- Advanced Financial Management (AFM): Discusses risk management and derivatives trading.

- Advanced Performance Management (APM): Devises performance appraisal and business control costing.

- Advanced Taxation (ATX): Discusses tax management and tax planning in international context.

- Advanced Audit and Assurance (AAA): Discuses internal audit and covers management accounting.

ACCA Fees, Duration & Difficulty

The ACCA qualification helps people become recognized accountants globally. To get this certification, you need to invest time and money well. Some exams are easier, while others are more challenging. By planning carefully and working hard, you can earn this important certification and improve your career opportunities.

ACCA Total Cost

The cost of studying ACCA in India varies from ₹2,50,000 to ₹3,00,000. This amount covers several expenses, including registration, exam fees, annual subscription fees, tuition, and study materials. We’ll look at each of these costs to give you a clear understanding of the total expenses involved.

- Registration Fees: Initial registration fee: ₹6,000 to ₹7,000. Includes student enrollment into the ACCA program.

- Annual Subscription Fees: Paid every year to maintain your student status: ₹8,000 to ₹9,000 per year. Most students take 2–3 years to complete ACCA, so plan for ₹16,000–₹27,000.

- Exam Fees: ACCA has 13 papers divided into three levels: Applied Knowledge, Applied Skills, and Strategic Professional.

- Applied Knowledge (3 papers): ₹8,000–₹9,000 per paper (₹24,000–₹27,000 total).

- Applied Skills (6 papers): ₹10,000–₹12,000 per paper (₹60,000–₹72,000 total).

- Strategic Professional (4 papers): ₹12,000–₹15,000 per paper (₹48,000–₹60,000 total).

- Tuition Fees: Classes for each level can range from ₹1,00,000 to ₹1,50,000. This cost includes coaching, study materials, and mock tests. Plutus Education is one best institutes in India, which provides expert faculty, Flexible classes, and regular assessment.

- Study Materials: Books and additional resources: ₹10,000 to ₹15,000 for the entire course.

ACCA Course Duration

Most students take around 2 to 3 years to complete the ACCA qualification in India. The time required depends on the number of papers they need to clear and the pace at which they study.

- ACCA has 13 papers, but some students can get exemptions based on their previous education. For example, if you have a degree in commerce, you might get exemptions for the Applied Knowledge Level papers, reducing the total number of exams you need to take.

- Students who study full-time often complete the program faster, usually in about two years. However, students who balance ACCA with work, college, or other commitments may take closer to three years.

- The time also depends on how many exams you attempt in each session. ACCA permits learners to sit for up to four papers on a single exam date, however, the vast majority of candidates favor the one or two-a-time mode per session aiming at effective learning.

Is ACCA Difficulty?

However, due to increasing hard-and-fast principles in regulations and perceptions, prospective accountants are required to adhere to anything that has a hypothetical standing. The examinations thus exist in View of acceptance of knowledge that pertains; hence its work is categorized into 3 sections: Applied Knowledge, Applied Skills, and Strategic Professional. Each part has its dimension of difficulty and focus, hence students must prepare from this perspective. The details are enunciated here as follows.

- Applied Knowledge Level: This beginner level includes three papers: Business and Technology (BT), Management Accounting (MA), and Financial Accounting (FA). It focuses on basic accounting and finance concepts. Regular study and practice make it easy to complete.

- Applied Skills Level:At this level, we have six papers, which include Corporate and Business Law (LW) and Financial Reporting (FR). It is the application of concepts to real-life situations. The difficulty is considerable but can be managed if effort is applied consistently.

- Strategic Professional Level: The final level consists of four papers: two required ones, SBL and SBR, and two that you can choose. This level is the toughest because it tests your ability to think strategically and show leadership skills. To succeed, you must prepare thoroughly and use critical thinking effectively.

ACCA Subjects FAQs

How many subjects are in ACCA?

There are 13 subjects in ACCA, divided into three levels: Applied Knowledge, Applied Skills, and Strategic Professional.

How long does it take to complete ACCA?

Most students complete ACCA within 2-3 years, depending on their study pace and exemptions.

Is the ACCA hard or easy?

The ACCA (Association of Chartered Certified Accountants) qualification is one that is challenging, yet can be achieved and pursuing this route requires a firm commitment on the part of the student, as well as a thorough knowledge of the accounting principles and theory.

Can I pursue ACCA after the 12th in India?

Yes, students can start ACCA after completing 12th grade, provided they meet the eligibility criteria.

What is the total cost of ACCA in India?

The total cost of pursuing ACCA in India ranges from ₹2,50,000 to ₹3,00,000.