When considering a career in accounting and finance, you may come across two popular qualifications: ACCA or ACA. Both can lead to rewarding career paths, but they have differences worth exploring. ACCA offers global recognition, flexibility, and a curriculum tailored for those seeking opportunities worldwide. On the other hand, ACA may be favoured in specific industries or regions due to its local focus and specialized regulatory knowledge. Understanding the distinctions between ACCA and ACA can help you decide which qualification aligns best with your career goals and aspirations.

What is ACCA?

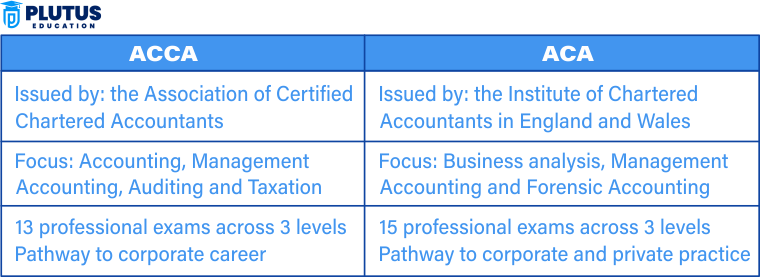

ACCA full form is the Association of Chartered Certified Accountants. It is considered the leading global professional accounting body. ACCA is headquartered in London, United Kingdom. It has a presence in over 180 countries globally. ACCA qualifications are recognized globally. The ACCA qualification enables individuals with a complete knowledge of accounting principles, financial management, taxation, and strategic business management. ACCA can be considered to be a passport for accountants to work globally.

The Association of Chartered Certified Accountants (ACCA) is renowned for its comprehensive and globally recognized qualification, providing accountants and finance professionals with a robust career foundation.

What is ACA?

ACA stands for Associate Chartered Accountant. The Institute of Chartered Accountants in England and Wales (ICAEW) – one of the world’s oldest and most famous accounting groups, offers this course. It is very often associated with positions in corporate finance and other areas of accounting firms and organizations. The training program of ACA is structured. It usually contains a training contract with an approved business. Along with the testing procedure, on-the-job training is also provided in this contract.

Difference Between ACA and ACCA

Despite the similarities in the acronyms, key differences between the two qualifications are worth highlighting. The primary difference between the ACA and ACCA is that the ACA qualification is more appropriate for those working in practice, whilst the ACCA may be more suited to those working in industry.

| Aspect | ACCA | ACA |

|---|---|---|

| Offered by | Association of Chartered Certified Accountants | Institute of Chartered Accountants in England and Wales (ICAEW) |

| Introduction | Provides access to various career paths within the UK financial sector, including public practice and consultancy. | A global accounting qualification recognized in over 180 countries. Emphasizes international accounting standards and covers various accounting and finance areas. |

| Practical Experience | A broader range of business and financial management skills. | Requires completion of practical work experience with an authorized training employer. |

| Career Opportunities | Offers diverse global career opportunities in public practice, industry, government, and non-profits. | Provides access to a variety of career paths within the UK financial sector, including public practice and consultancy. |

| Membership Benefits | Access to a global network of professionals and continuing professional development opportunities. | Becoming a member of the ICAEW offers professional support services and networking opportunities. |

| Focus | Completed HSC (10+2) with a minimum of 65% in English, Accounts, Maths, 50% in other subjects, or a Bachelor’s degree in any discipline. | A broader range of business and financial management skills. |

| Structure | Four levels: Applied Knowledge, Applied Skills, Essentials, Options. | A broader range of business and financial management skills. |

| Course Duration | Typically 3-4 years. | Typically 3 years. |

| Eligibility | Completed HSC (10+2) with a minimum of 65% in English, Accounts, Maths, 50% in other subjects or a Bachelor’s degree in any discipline. | Bachelor’s degree from an accredited university in the UK or Ireland, or a recognized accounting degree. |

| Salary (INR) | Starting salary: ₹5-7 Lakhs per annum. | Three levels: Certificate, Professional, and Advanced. |

ACA vs ACCA Qualification

If you’re unsure whether to take an ACCA or ACA exam, learning their differences may help you make an informed decision.

ACCA Qualification

The minimum admission requirements for ACCA are five secondary school qualifications. These can be three GSCEs in any subject, grades 4 to 9, or similar equivalents. At least two must be your A-Levels at grades A* to C. At least two of those GSCE’s have to include English and mathematics. There are no preconditions regarding finishing a university degree to enroll in this course. However, upon graduation from the relevant university degree recognized by ACCA, there might be exemptions on certain exams. Despite these entry conditions, you may apply for membership at ACCA but start this course at the foundation level.

ACA Qualification

There are several entry routes to getting the ACA qualification. Relevant degrees, GCSEs, and A levels or Scottish Qualification Certificates (SQCs) are accepted by ICAEW. In addition, a possible entry route is through some other professional accountancy qualifications. Before registering for the ACA qualification, you must get a training agreement with an ICAEW-authorised training employer.

ACA vs ACCA Salary

Generally, the average starting salary for ACCA-qualified professionals in India hovers around ₹5 to ₹7 lakhs per annum, which shows that the demand for ACCA-certified accountants has been valued in all sectors around the world, from multinational corporations to finance industries.

However, where ACA is generally recognized both domestically in the UK and worldwide, it is compensated by higher induction pay here at INR 7-10 lacs a year. Both qualifications offer attractive career prospects; however, preliminary salary figures indicate that ACA qualifiers stand to gain marginally more money in the earlier years of practice.

ACA UK vs ACCA Course Duration

ACCA students must complete all exam parts within 10 years of their first passing result. However, on average, it usually takes students around three to four years to finish the certificate program. This can be longer depending on how long you live between completing your studies and undertaking the practical experience component of the course. Completing candidates for the ACA qualification have three years to complete. The ACCA certification is quite helpful to candidates who want to acquire expertise in accounting, management accounting, and taxation. The ACA qualification, on the other hand, is suitable for candidates interested in business analysis, management accounting, and forensic accounting.

ACCA vs ACA Fee

The total cost of an ACCA course generally ranges from INR 180,000 to 230,000 based on your learning pace and the institution where you prepare. The cost variation is due to differences in exam fees based on the time of registration.

The fee for the ACA qualification varies with the level of course you complete. The cost ranges from INR 6400 to INR 15,500 from certificate to advanced level. The case study component of the course costs INR 23, 800. Often, employers pay for some or all of the costs for this qualification if completed while working for them. Yet, independent students must fund the annual standard student fee, examination fees, and tuition fees on their own.

ACA vs ACCA Exams

The ACCA qualification has a maximum of 13 exams that you must sit with, along with the ethics and professional skills module. The amount of experience and qualifications you have determines whether you need to take all of these exams or if you are exempt from some of them. Another condition of the course is that you must gain three years of practical experience in a relevant position where you can work while studying. You can also fulfil the practical experience requirement before or after your studies. This three-year experience is approximately equivalent to 450 hours of work.

ACA UK also requires students to undergo a relevant work experience of 450 days. Most desired are roles in accounting, tax, financial management, information technology, and insolvency. The institution requires students to complete this experience with an authorized training principal or employer. This work experience usually lasts for three to five years. With the work experience component, students sit 15 exam modules across the course’s certificate, professional, and advanced levels.

ACA vs ACCA Difficulty Level

The ACA qualification is generally considered more difficult than the ACCA because it is viewed as the best way into private practice. It is a highly demanding area that demands extensive knowledge in accounting and finance. This is supported by the rigorous training offered by the ACA, which encompasses a wide range of accounting theories and digs deeper into practical applications in the business world.

While the ACCA might be slightly less intimidating overall, it is also not without its difficulties for students to grapple with. One obvious example is the strategic professional level within the ACCA, especially in terms of optional papers under this level. These are famous for their depth and complexity. These papers had the worst records in the ACCA examination, generally recording the lowest pass rate within 30%-40%. That’s quite an understatement: only very challenging and complicated materials at a high analytical level may cause such an extremely low pass rate.

ACA vs ACCA Which is Better?

ACCA and ACA are prestigious qualifications that offer excellent opportunities for individuals aspiring to pursue careers in accounting, finance, and business. The choice between the two depends on career goals, geographical preferences, and individual strengths. While ACCA provides a broader, more globally recognized qualification focusing on international standards, ACA offers a more specialized route, deeply rooted in UK accounting practices and regulations. Ultimately, the choice between ACCA and ACA depends on career goals, geographical preferences, and individual strengths. Whichever path one chooses, dedication, hard work, and a commitment to ongoing professional development are key to achieving success in the dynamic realm of accounting.

ACA and ACCA FAQs

Which qualification is more globally recognized, ACCA or ACA?

ACCA is generally more globally recognized due to its international focus and presence in over 180 countries. However, ACA also holds considerable prestige, particularly within the UK and Commonwealth nations.

What are the main differences between ACCA and ACA?

ACCA offers a broader, more global qualification covering a wide range of accounting topics, while ACA is more specialized and focused on UK accounting standards and practices.

Which qualification is better for someone aspiring to work in the UK?

ACA is often preferred by those aiming to build their careers in the UK, as it provides a comprehensive understanding of UK accounting regulations and practices, which employers in the region highly value.

How do the examination structures differ between ACCA and ACA?

ACCA exams are modular, allowing candidates to progress at their own pace. ACA exams follow a more structured format with set sessions throughout the year.

Which qualification offers better opportunities for career advancement?

Both ACCA and ACA can lead to rewarding career opportunities and advancement in the accounting profession. The choice depends on career goals, industry preferences, and geographical location.