Across the world of finance and accounting, the most famed professional certifications are the Chartered Financial Analyst (CFA) and the Association of Chartered Certified Accountants (ACCA). The vast majority of the globally recognised professional certifications of such nature have lots of prestige and give significant career advantages, highly rewarding salaries, and global mobility. Nevertheless, these two distinct designations vary in specialisation, difficulty level, career path, and extent of commitment. Understanding the disparities between CFA and ACCA is imperative for students and working professionals aspiring towards successful careers in accounting or finance. This article will help you compare CFA vs ACCA, including their curriculum, scope, difficulty, salaries, and industry relevance, to find out which option best meets the professional goals you set for yourself.

Understanding CFA Qualification

The credential Chartered Financial Analyst (CFA) is a globally recognised certification in investment management, financial analysis, and portfolio management. It is awarded by the CFA Institute (USA) and is regarded as the ‘gold standard’ by many professionals aspiring to achieve top-tier roles in global finance.

Focusing on Investment and Financial Analysis

CFA is focused on investment banking, asset management, portfolio analysis, risk management, and equity research. Those desirous to work in capital markets, hedge funds, or asset management will find the CFA course ideally designed for them.

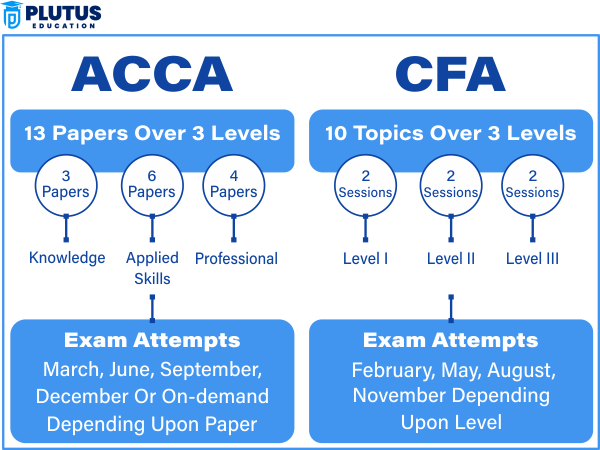

Three Levels of Exams

CFA contains three exam levels (Level I, II, and III), where the levels get tougher after the first. Level I deals with fundamentals, while Levels II and III provide a more complicated and analytical approach to the managerial and portfolio management concepts.

Recognition and Career Path

However, once a CFA is attained, it opens many doors to candidates such as financial analysts, investment bankers, risk managers, and portfolio strategists. Most reputable companies within the finance sphere prefer to hire CFA charterholders for mid- to senior-level roles.

Difficulty and Commitment

CFA-level examinations are incredibly challenging, setting the students back an average of 4+ years of hard study and finance experience. The average pass rate is about 40%, thus making it one of the hardest finance credentials in the world.

Examination Schedule and Cost

The CFA exams are now held at different times during the year for Level I and on two occasions within the year for Levels II and III. The total amount ranges between $3,000 and $4,000, depending on the enrollment time and the study materials.

Understanding ACCA Qualification

The ACCA (Association of Chartered Certified Accountants) is a recognised global qualification that opens doors to possible careers in accounting, auditing, taxation, and corporate finance. It is highly recognised in multinational corporations and public accounting firms.

Broad Financial Curriculum

ACCA comprises many aspects, including financial accounting, management accounting, taxation, corporate law, and audit assurance. Thus, it is a more widely diverse finance-oriented certification than CFA.

Career Roles Offered Via ACCA

Candidates may consider a future as an ACCA graduate in careers such as financial controller, auditor, accountant, and tax advisor. ACCA graduates are versatile and apt for either practice or industry.

World Recognition

ACCA is recognised in more than 180 countries worldwide, especially in the UK, India, the UAE, and Southeast Asia. A global presence is an attractive option for moving overseas on an international platform.

Flexibility and Format of Exams

On the contrary, ACCA exams involve a computer-based element and are held multiple times a year. This gives it a high degree of flexibility compared to the fixed exam windows of the CFA.

Cost and Duration

The ACCA program usually lasts 3 to 4 years, and the total program cost usually varies between 2,000 and 4,000 dollars, depending on where one studies, the number of attempts, and the exemptions attempted.

Salary Comparison: CFA Vs. ACCA

In the CFA vs. ACCA salary comparison, remuneration depends on the industry. Nevertheless, both professions have excellent prospects for remuneration.

Average Salaries of CFA

Entry-level CFA charter holders earn between $50,000 and $880,000 per year. With this experience, it is easy to exceed 100,000, especially in the investment banking and asset management professions.

Average Salaries of ACCA

Most careers start at the lower salary range, approximately $40,000-$60,000 annually. Of course, multinational scopes can further boost the income of senior accountant professionals, finance managers, and CFOs with ACCA qualifications.

Factors Affecting Salary Growth

Both qualifications are based on experience, certifications, and regional market demand. CFAS earn higher average pay in investment-heavy sectors, while ACCAS offer steadier opportunities across industries.

Geographical Variation

ACCA and CFA will be in high demand across markets such as the UK, the UAE, and Singapore. InCA has recently gained popularity. At the same time, CFA remains at the top of the income chain due to its international reputation for global finance roles.

Potential Earnings in the long term

In the long run, CFA holders tend to earn higher incomes because of the niche nature of finance roles that are also very high-paying. However, compared to CFA, ACCA gets individuals into more intermediate positions fairly rapidly, especially in corporate finance and audit.

CFA Vs ACCA

The heavy dependence of the decision on one’s career interest, academic strength, and long-term perspective will govern whether one chooses CFA or ACCA. The advantages of both courses depend on the career class you want to follow.

Specialisation Preference

If investment management, trading, or equity research is your passion, then the CFA is the right course. If, however, you are more inclined toward accounting, audit, taxation, or management finance, then ACCA would be your best bet.

Global Career Aspirations

Both have a global standing, with CFA ranking higher in finance-intensive economies. ACCA is the most well-established for career roles related to accounting and corporate finance.

Ease of Completion

ACCA is easier than CFA, with higher pass rates and flexible scheduling. CFA is more demanding in terms of commitment, with a more intensive exam structure.

Industry Demand

CFA is preferred in investment banking and asset management, while ACCA is preferred in corporate and consulting accounting and finance firms.

Long-Term Career Goals

Both lead in the direction of senior positions. CFA would lead you to finance-related positions with a high financial stake, while ACCA would take you to the leadership of finance and compliance functions.

| Criteria | CFA | ACCA |

| Full Form | Chartered Financial Analyst | Association of Chartered Certified Accountants |

| Focus Area | Investment banking, financial analysis, equity research | Accounting, auditing, taxation, and financial management |

| Career Roles | Portfolio Manager, Investment Banker, Risk Analyst | Auditor, Accountant, Finance Manager, Tax Consultant |

| Recognition | Highly recognised in investment & finance globally | Globally recognised in over 180 countries |

| Exams | 3 Levels (I, II, III) – paper-based, now computer-based globally | 13 Papers – computer-based, flexible timing |

| Difficulty Level | Very high – average pass rate ~40% | Moderate – average pass rate ~50% |

| Time Required | 4+ years (including work experience) | 3–4 years, depending on prior qualifications |

| Eligibility | Graduation + 4 years work experience for charter | Open to 10+2 students, graduates, professionals |

| Exam Fee | $3,000 – $4,000 | $2,000 – $4,000 |

| Best Suited For | Those interested in finance, analysis, and investments | Those interested in accounting, auditing, and taxation |

| Job Market | Investment banks, asset managers, private equity, and hedge funds | MNCs, public practice firms, corporate finance departments |

So choosing between CFA and ACCA is not a matter of which is objectively better, but which is better for you. If you see yourself working in investment banking, asset management, or research, go for CFA; if accounting, taxation, and financial reporting seem more interesting, then ACCA provides more options. Both have challenging, not-so-challenging, costly, not-that-costly, time, and specialisation. Choose for yourself based on your vision for your career, strengths, and interests, and you cannot go wrong.

CFA vs ACCA FAQs

1. ACCA vs CFA: Which is harder?

CFA is more difficult generally due to its low pass rate and content requiring complex analytical knowledge across three levels of exams.

2. Which has more global recognition: CFA or ACCA?

Both are globally revered, but CFA is more recognised in finance and investment, while ACCA is more prominent in accounting and audit roles.

3. What is the main difference between CFA and ACCA?

CFA is concerned with financial analysis and investment management, whereas ACCA is concerned with accounting, audit, and tax.

4. Can I do both CFA and ACCA?

Yes. Many professionals pursue both to broaden their career options across finance and accounting. But it is a substantial commitment in terms of time and effort.

5. Which qualification offers better salary growth?

CFA typically leads to higher-paying roles in investment firms, while ACCA can lead to lucrative roles in corporate finance that facilitate faster progress.