Two of the most respected qualifications among professionals in the world of finance and accounting are CIMA and ACCA. These qualifications are recognized worldwide, offer well-rewarded careers, and, in terms of career paths and skill sets, lie slightly different from one another. Therefore, in this article, we shall discuss in a comprehensive manner CIMA vs ACCA: let us help you understand the differences between them and present you with the benefits of each, so that you may understand better your chosen path to upward mobility within your career.

What is ACCA?

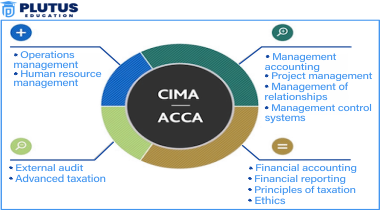

The ACCA qualification has, among other things, provided the extended knowledge of financial and management accounting to place its holder in a career in financial accounting and taxation. The ACCA program sets out to develop technical skills, strategic thinking, and ethical decision-making abilities among professionals with a wealth of finance and management activities.

Key Features of ACCA

- Focus: This is an examination that places more emphasis on financial accounting and taxation.

- Flexibility: The exam has a flexible structure of 13 papers divided into three levels: Applied Knowledge, Applied Skills, and Strategic Professional

- Duration: Usually takes between 3 and 4 years but then it depends on the prior qualifications held and how fast one studies.

- International Recognition: Accepted in more than 180 countries, the best qualification for students who wish to migrate to any country.

What is CIMA?

The CIMA is one of the principal professional bodies having special interest and concern in management accounting as well as business strategy. Under the CIMA qualifications, the people are mainly catered towards the management roles where they can employ their respective skills on planning and decision-making and also on performance management. The CIMA is more attuned towards financial analysis, risk management, as well as strategic planning, equipping professionals to be ready for any kind of leadership position within businesses.

Key Features of CIMA

- Focus: Emphasis on management accounting, business strategy, and risk management.

- Structure: Consists of four levels: Certificate in Business Accounting, Operational, Management, and Strategic levels.

- Duration: Can be completed within 2-3 years with full-time study, but duration varies based on individual study pace and prior experience.

- Global Presence: Over 230,000 members and students in 179 countries, with a strong emphasis on business and management roles.

ACCA vs CIMA: Understanding the Key Differences

| Qualification | ACCA | CIMA |

|---|---|---|

| Organizing Body | Association of Chartered Certified Accountants (ACCA) | Chartered Institute of Management Accountants (CIMA) |

| Recognition & Acceptance | Recognized globally with 300 Approved Learning Partners worldwide. | Global Acceptance |

| Exam Pattern | – Applied Knowledge – Applied Skills – Professional Skills | – Operational – Management – Strategic – Professional |

| Course Duration | Three years | Three years |

| Course Complexity/ Pass Percentage | Hard/30% to 40% | Moderate/50% to 60% |

| Program Fees | Registration: £30 Applied Skills: £129 per exam Professional Skills Exam: £71 per exam Strategic Professional: 227 per exam Strategic Business Reporting: £162 per exam Total: A student can spend between £1500 and £2000 | Registration: £85 Management Accountants Gateway: £85 CIMA Professional Registration: £425 Operational Level Exam: £120 (test) and £205 (case study) per exam Management Level Exam: £140 (test) and £210 (case study) per exam Strategic Level Exam: £195 (test) and £299 (case study)per exam Total: A student can spend between £2500 and £3000 |

| No. of Papers | 13 | 16 |

| Study Focus | Accounting and Taxation | Business Strategy and Management Accounting |

| Skills Gained | Technical knowledge of accounting and financial concepts | Strategic Decision-making and Business Management |

| Job Prospects | – Financial Consultant – Taxation Manager – Finance Manager – Accountant | – Management Consultant – Forensic Analyst – Project Manager – Finance Controller |

| Average Salary | 6 to 8 LPA | 5 to 8 LPA |

| Who Should Do It? | ACCA is best suited for those who: – Have a liking for numbers – Wish to carve out a career in Accounting or Taxation – Aspire to set up their own consulting practice and work independently | CIMA is best suited for those who: – Nurture an interest in business strategy and management – Wish to carve out a career in Management Accounting – Aspire to rise to top leadership positions within the organization |

Choosing Between CIMA or ACCA: Factors to Consider

When choosing between CIMA and ACCA, several factors should be taken into account to ensure you select the qualification that aligns with your career aspirations:

1. Career Goals

If you wish to specialise in taxation and financial reporting, then ACCA will be a better fit for you. If your aspirations and future career remain in management roles or positions with a strategy basis within the company, then CIMA would be better suited for you.

2. Industry Preference

ACCA is highly in demand in public accounting firms, financial services organizations, and consultancy companies. CIMA is preferred in industries mainly focusing on strategic management, performance analysis, and decision support.

3. Skill Set

- ACCA develops your expertise in technical accounting, regulatory standards, and ethics.

- CIMA enhances skills in strategic thinking, business analysis, risk management, and financial planning.

Is ACCA Longer Than CIMA?

The duration varies according to the amount of prior experience held and the pace maintained while studying. Normally, ACCA is completed within 3-4 years, and CIMA is completed within 2-3 years. However, the actual time taken is strongly dependent on the number of exams cleared on the first attempt and exemptions based on the qualifications held.

Can I Study ACCA or CIMA via an Apprenticeship?

Yes, ACCA and CIMA also offer an apprenticeship route through which you can earn while learning. These routes allow students to attain practical experience within an accounting role while working toward their qualifications. This type of work-study balance does decrease the load of taking the qualification in terms of financial situations.

Conclusion

In summary, choosing between CIMA and ACCA depends largely on your career ambitions and the industry you aim to work in. While ACCA offers a broad range of financial accounting and taxation opportunities, CIMA focuses more on management accounting and business strategy. Both qualifications hold great value and are respected worldwide, making them solid choices for anyone pursuing a career in accounting or finance.

CIMA vs ACCA FAQs

Which qualification is harder, ACCA or CIMA?

The difficulty level varies based on individual strengths. ACCA is more technical and focuses on accounting principles, while CIMA demands a strategic approach to business and management concepts.

Can I do CIMA after ACCA?

Yes, many professionals complete ACCA first and then pursue CIMA to gain a strategic edge in management accounting.

Is ACCA higher than CIMA in terms of salary prospects?

Salary levels depend on the role and industry. Generally, ACCA professionals might start with higher salaries in accounting roles, while CIMA professionals can command higher pay in management positions.

Does CIMA have global recognition similar to ACCA?

Yes, CIMA is globally recognized, particularly in roles related to management accounting and business strategy.

Can I switch between CIMA and ACCA courses easily?

While switching is possible, it often involves additional exams and assessments to meet the criteria of the new qualification. It’s best to decide early on to avoid extra time and cost.