Accounting formulas are the foundation of the financial world analytical presentation, and within their application, they provide a standardized approach for financial data analysis and reporting. From the assessment of asset base to liabilities and the determination of equity share capital, there’s a need to apply all of these formulas within finance arithmetic. This article explores the fundamental accounting formulas within the financial anatomy.

What is Accounting?

Accounting is the systematic process of recording, classifying, summarizing, and interpreting financial transactions. The field hence has been critically used in keeping track of how things are going financially for businesses, organizations, and individuals concerning income and expenditure for what can be described generally as an individual’s financial status.

The Accounting Equation Formula

The accounting equation is the cornerstone of the double-entry accounting system. It represents the relationship between a company’s assets, liabilities, and equity.

Formula:

Assets = Liabilities + Shareholder’s Equity

Current Assets Formula

Current assets include cash and other assets expected to be converted into cash within a year. Understanding current assets is crucial for evaluating a company’s liquidity.

Formula:

Current Assets = Cash + Accounts Receivable + Inventory + Other Short-term Asset

Net Fixed Assets Formula

Net fixed assets represent the value of a company’s long-term investments, such as property, plants, and equipment, after accounting for depreciation.

Formula:

Net Fixed Assets = Gross Fixed Assets – Accumulated Depreciation

Total Assets Formula

Total assets represent the sum of a company’s current and fixed assets, providing an overall view of the resources owned by a business.

Formula:

Total Assets = Current Assets + Net Fixed Assets

Current Liabilities Formula

Current liabilities are the obligations a company expects to settle within a year. Tracking these is essential for maintaining a healthy balance sheet.

Formula:

Current Liabilities = Accounts Payable + Short-term Debt + Other Current Liabilities

Shareholder’s Equity Formula

Shareholder’s equity represents the residual interest in the assets of a company after deducting liabilities.

Formula:

Shareholder’s Equity = Total Assets – Total Liabilities

Total Liabilities & Equity Formula

This formula provides a snapshot of the overall liabilities and shareholder’s equity, crucial for ensuring that assets balance with liabilities and equity.

Formula:

Total Liabilities & Equity = Total Liabilities + Shareholder’s Equity

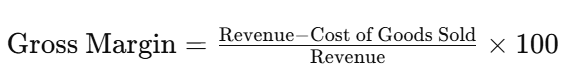

Gross Margin Formula

Gross margin measures a company’s efficiency in producing goods or services compared to its cost of production.

Formula:

Operating Expenses Formula

Operating expenses include costs required for a company’s day-to-day functions, excluding direct production costs.

Formula:

Operating Expenses = Selling Expenses + General and Administrative Expenses

Income From Operations Formula

Income from operations, or operating income, assesses a company’s profitability from its core business operations.

Formula:

Income from Operations = Gross Margin – Operating Expenses

Net Income Formula

Net income is the final profit a company earns after deducting all expenses, taxes, and interest from revenue.

Formula:

Net Income = Total Revenue – (Total Expenses + Taxes)

Accounting Formulas FAQs

What is the importance of accounting formulas in financial analysis?

Accounting formulas provide a standardized way to assess a company’s financial health. They simplify complex financial data into key metrics, essential for informed decision-making.

How does the accounting equation ensure accuracy in double-entry bookkeeping?

The accounting equation ensures balance in double-entry bookkeeping by showing that all assets are funded by liabilities and shareholder equity.

Why is it essential to calculate net fixed assets?

Calculating net fixed assets helps assess the long-term value of a company’s assets after depreciation, important for accurate financial reporting.

What is the significance of the gross margin formula?

Gross margin indicates the profitability of a company’s core activities by comparing revenue with the cost of goods sold, highlighting operational efficiency.

How does shareholder’s equity reflect a company’s financial health?

Shareholder’s equity represents the owner’s claims on the company’s assets after liabilities, reflecting financial stability and the value shareholders retain.