Accounts from incomplete records are one form of maintaining accounts wherein not all the transactions are recorded systematically. This is unlike a double-entry system that is common in smaller businesses or sole proprietorships wherein full accounting records are not maintained. The characteristic of accounts from incomplete records is partial and unsystematic entries, which often give rise to great difficulties in preparing accurate financial statements. The system relies heavily on assumptions and estimations to obtain profit and financial positions.

What is Incomplete Records?

As the name itself suggests, incomplete records is the position in which all of the business transactions of the firm are not completely recorded. It lacks the comprehensive nature of a full-fledged double-entry system. Firms that avail themselves of this system will only maintain a cash book, personal accounts of debtors and creditors, and very a few other records. The aim is to obtain the financial results, though records are incomplete.

In simpler terms, the incomplete records system includes:

- Cash book: Records of cash transactions.

- Personal accounts: Limited records of debtors and creditors.

- Stock records: Sometimes partial, making it difficult to ascertain the actual stock on hand.

Why Are Records Incomplete?

The reasons for maintaining incomplete records vary. Small businesses may not afford or may not understand how to maintain a complete double-entry system. Others may prefer ease and convenience over accuracy, just recording cash transactions or personal accounts. Such methods, though easier to follow, bring considerable difficulties in ascertaining an accurate financial position.

Reasons for Incomplete Records

The reasons are either due to intentional or unintentional incomplete records. The most common reasons include the following:

- Lack of Expertise: Most small business owners do not know much about accounting as a function that ought to be undertaken concerning their finance base to ensure appropriate record-keeping.

- Cost Constraints: Hiring trained people or accountants to develop and implement full-pledged accounting systems is costly, and the small business firms often opt to have a relatively simpler system.

- Time Constraints: Business owners neither have time nor sources to ascertain that complete records are kept, and in the course of duties, this is negated.

- Nature of Business: The business may not be active enough and possibly only on a cash basis or too petty for the requirements of full records. For a business that is highly transactional, or both cash and non-cash transactions, it doesn’t feel the need for detailed records.

- Ease of Use: The single-entry system is simpler than double-entry bookkeeping and may be preferred because it is easy to do.

Features of Incomplete Records

The characteristics that are unique to incomplete records are a differentiation of features from a standard accounting system. Some of them are:

- Single-Entry System: The system is a single-entry system. Unlike in double entry, this system affects at least two accounts per transaction. Only one side of a transaction will be recorded.

Lack of Systematic Recording: There is no fixed procedure or framework for recording transactions. Thus, it results in incomplete records and inconsistent record-keeping. - Inaccuracy in Financial Statements: It does not provide comprehensive recording and thus makes it even more complicated to present correct financial statements.

- Depends on Estimates: The process of final accounts preparation often requires estimations, like, for example depreciation, expenses, or even stock.

- Limited Scope: It only presents cash, personal accounts of debtors and creditors and very few income and expenses items.

Example of Incomplete Records

Let’s assume a small retailer only deals with cash transactions and keeps creditor and debtor accounts. The retailer need not keep accounts of changes in the inventory or wear and tear of assets, or all revenue details. Towards the close of the financial year, the profit would be determined based on estimates or variations in net assets. That is, a difference between capital at the beginning of the year and capital at the end of the year.

Limitations of Incomplete Records

The following are some of the inherent limitations of an incomplete records system, making it less reliable and not so accurate:

- Inaccurate: Incomplete records provide many instances of inaccurate financial results, and hence improper decisions might be taken.

- No Trial Balance: With the help of incomplete records, preparing a trial balance is not possible. A trial balance is prepared to check the accuracy of account records.

- Difficulty in the Calculation of Profit: As the entire record of all transactions is not maintained with incomplete records, correct calculations of profits become problematic. Profits are usually derived through estimates or capital variations.

- Makes Decisions Wrong: Businesses that use incomplete records may make decisions based on faulty financial information, which may be wrong.

- Flaws non-Compliance: In most states, incomplete records may be violating laws applicable to such business enterprises, especially the larger ones.

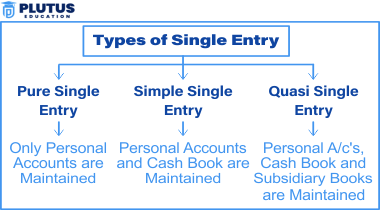

What is the Single Entry System?

The single entry system is the simplified system of record-keeping, which is mainly used by small businesses. In this system, only one aspect of a transaction is maintained, and that mostly deals with cash and personal accounts. The completeness of the double entry system where each transaction will have an accompanying debit and credit entry is excluded in this one.

Key Features of Single Entry System

- Simplified Approach: It only records cash and personal accounts, hence a very straightforward method for small businesses.

- Lack of Double-Entry: The transactions are not based on the double-entry system. Hence, there is no cross-verification between debits and credits.

- Incomplete Information: It does not contain records of assets, liabilities, and other essential financial information, leaving some blank spaces in the presentational mode of the information.

- Limited Control Over Error: Since no such check is given by the trial balance. It becomes quite difficult to trace and correct errors.

Conversion to Double-Entry System

Though much easier, the single-entry method will eventually prove unyielding for businesses. In that case, incomplete records need to be changed over to the double-entry system. This provides accurate data and statutory compliance. This includes:

- Establishing Missing Records: Establish the missing records, such as assets, liabilities, revenue, and expenses.

- Adjusting opening and closing Balances: Adjust the opening balances so that the integrity of the financial position is kept intact.

- Profit or loss to be calculated: Difference between change in capital and difference drawn and additional investment.

Conclusion

Accounts from incomplete records produce a system, although very simple, but flawed for small businesses. It is an easy source; however, it has significant drawbacks in terms of accuracy, reliability, and understanding accounting principles. Therefore, more reliable information would be achieved if accounting was done on a double-entry system or with professional help to maintain proper accounts for the organization.

Accounts from Incomplete Records Class 11 Solutions FAQs

Can incomplete records be converted into a double-entry system?

Yes, incomplete records can be converted into a double-entry system by identifying and reconciling all missing entries, adjusting opening and closing balances, and recording all necessary financial data.

What businesses use incomplete records?

Incomplete records are typically used by small businesses, sole proprietorships, or businesses with limited transactions where maintaining full accounting records is considered unnecessary or costly.

Why is the single-entry system used in incomplete records?

The single-entry system is used because it is simpler and easier to maintain. It records only one aspect of a transaction, typically focusing on cash and personal accounts.

What are the main limitations of incomplete records?

The main limitations include inaccurate financial statements, difficulty in calculating profits, inability to prepare a trial balance, and potential non-compliance with legal requirements.

How do you calculate profit from incomplete records?

Profit in incomplete records is typically calculated by comparing the change in net assets (opening capital vs. closing capital), adjusted for drawings and additional investments during the period.