The world of finance is changing fast. More companies now use machines and data to make decisions. That is why AI in finance courses is becoming more important. These courses teach how Artificial Intelligence (AI) helps in banking, accounting, stock markets, and financial planning. AI does not replace jobs—it changes how finance jobs work.

AI in finance courses equips you with the practical skills to use smart tools that read big data, find trends, and give better advice. You’ll learn how to apply AI for faster accounting, secure banking, intelligent investments, fraud checks, and even customer service in fintech. This practical knowledge will make you feel prepared and capable, whether you’re a student, finance professional, or small business owner.

Yes, AI in finance courses truly helps. They prepare you for the future of work. Companies want people who can use AI tools. If you know how AI works in money matters, you will stand out.

What is AI in Finance?

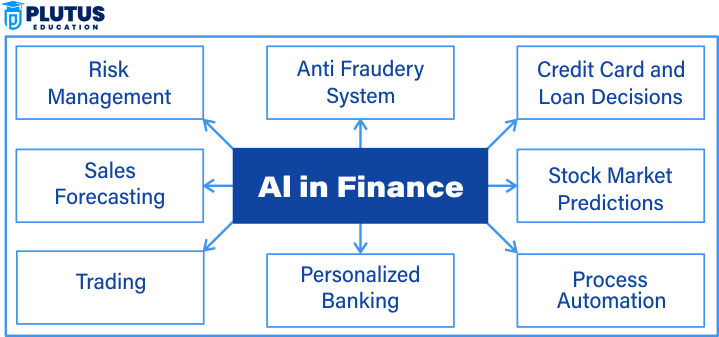

AI means machines that think and learn like humans. In finance, AI reads data and gives better money advice. It also makes work faster and smarter.

Why Finance Now Needs AI?

In the past, people did all the finance work by hand. They used paper files and basic software. Today, finance uses data, apps, and cloud systems. AI helps find errors, check fraud, and even predict the stock market. Banks, insurance firms, and even startups use AI now.

AI in finance saves time and money. It also reduces human error. That’s why many finance jobs now ask for AI skills. These include roles like financial analyst, audit associate, investment planner, and more.

AI tools used in finance:

- Machine learning for pattern detection

- Chatbots for customer support

- AI risk models for loans and insurance

- Robo-advisors for investment

- OCR for invoice scanning

- Natural language processing (NLP) for reports

AI is already in apps you use—UPI fraud checks, online credit scores, and bank chatbots. So, it’s clear that AI in finance courses can teach you real-world tools that finance jobs use today.

Why Learn AI in Finance Courses in 2025?

Learning AI in finance has become important for students and working professionals. You need more than traditional finance knowledge now. You also need tech skills to match industry changes.

AI is Now a Job Skill, Not Just a Tech Trend

Companies don’t just want accountants or finance managers. They want people who can use AI to make money smartly. If you learn AI in finance, you will become ready for digital jobs in banking, insurance, and investment firms.

AI skills are also needed for business owners who want to track money and prevent fraud. If you know tools like Python, Excel, AI add-ons, Power BI, or RPA software, you can speed up work and grow faster.

Key Reasons to Choose AI in Finance Courses:

- Job readiness: Most jobs in banking and fintech ask for AI or automation knowledge.

- Better salary: AI finance skills give you an edge in interviews.

- Global demand: AI skills are wanted in the US, UK, Canada, and Dubai markets.

- Smart decision-making: You will learn how to predict trends using AI tools.

- Freelance or remote options: You can work from home on AI finance tasks like data modeling or report automation.

If you’re a student in the B.Com, BBA, MBA, or CA foundation, AI skills will give you a solid future. If you’re a professional or even a fresher, you’ll get more opportunities if you take AI-based finance courses.

Topics Covered in AI in Finance Courses

These courses are not just about theory. They are about learning to use real tools and software. They provide step-by-step practice, enabling you to apply what you learn in real-world scenarios.

Learn Tools that Help You Think Like a Smart Finance Analyst

Most courses start with finance basics. Then, they teach Python, Excel automation, and tools like Tableau, Power BI, or AI chatbots. Some courses also include projects where you use AI to solve real problems.

| Module Name | What You Learn |

| Introduction to AI | AI types, machine learning basics, and finance use cases |

| Data Analytics | Excel, Power BI, Python data reading |

| Forecasting & Modeling | Building prediction models for stocks and markets |

| RPA & Automation | Making bots for accounts, audits, and reporting |

| NLP in Finance | Reading reports, creating summaries with AI |

| Risk & Fraud Detection | AI tools for fraud alert, credit risk analysis |

| Investment AI | How robo-advisors and AI tools help in wealth planning |

Each course has small tests and final projects. Most offer certificates, too. These help when you apply for jobs or internships.

Best Platforms Offering AI in Finance Courses

Not all courses are equal. Some are free; some are paid. Some give certificates from big names. Choose based on your goal, time, and learning style.

Whether you prefer to learn at your own pace or attend live sessions, these courses cater to your learning style and schedule. With some platforms offering recorded videos and others providing live classes with doubt sessions, you can choose the learning format that suits you best. Additionally, the option to select short weekend courses or longer 3-month programs gives you the flexibility to tailor your learning experience to your needs.

Top Platforms for AI in Finance Courses

| Platform | Highlights | Fee Range |

| Coursera (by Wharton, Michigan) | Certificates + practical labs | ₹2,000–₹6,000 |

| Udemy | Low-cost + beginner-friendly | ₹500–₹2,500 |

| Great Learning | Guided learning + job prep | ₹5,000–₹10,000 |

| UpGrad | PG programs + career help | ₹25,000+ |

| Skill India / NSDC | Free or low-cost government-backed courses | ₹0–₹1,000 |

Some Indian platforms like NPTEL, Swayam, and IIT Madras also offer AI-finance content. You can also check TCS iON, Infosys Springboard, or EduBridge for industry-ready learning.

Make sure the course includes project work, hands-on labs, and certification. This makes your profile stronger in job portals like Naukri or LinkedIn.

Career Opportunities After AI in Finance Courses

One of the most exciting aspects of these courses is the abundance of career opportunities they open up. AI in finance is a rapidly growing career track, with more companies seeking AI-literate finance staff. Your salary and role can significantly improve when you add AI to your skill set, providing you with a promising and motivating career path.

Roles You Can Apply For

| Job Title | Job Type | Avg Monthly Salary |

| Financial Data Analyst | Full-time/Corporate | ₹30,000 – ₹70,000 |

| AI Audit Assistant | Mid-level/CA Firms | ₹25,000 – ₹50,000 |

| Fintech Risk Executive | Fintech/Startups | ₹35,000 – ₹65,000 |

| Data Consultant – Banking | Remote/Contract | ₹40,000 – ₹1,00,000 |

| RPA Developer – Finance | IT + Finance Blend | ₹50,000 – ₹1,20,000 |

You can also work as a freelancer doing Excel automation, Power BI dashboards, or stock forecasting projects. Even if you’re a fresher, AI skills help you enter a company as a finance analyst or assistant and grow faster.

With AI, you can also launch your financial content channel, start a consultancy, or even automate your shop’s billing, tracking, or tax planning.

How to Choose the Right AI in Finance Course?

Choosing the right course saves time and gives real results. You must look at more than just the price.

Checklist to Choose a Good AI Finance Course:

- Look for beginner-level content if you are new

- Ensure it teaches hands-on tools like Excel, Python, Power BI

- Check if it includes projects or case studies

- Look for a certificate from a known name

- Read reviews or testimonials

- See if it gives career support or job placement help

You don’t need to learn coding if you don’t want to. Many tools like Microsoft Power Automate, Tableau, or Excel plugins are no-code and easy to learn. If you’re a student, you can even add this course to your LinkedIn profile, CV, or college projects. It shows recruiters that you’re future-ready.

AI in Finance Courses FAQs

1. Do I need coding to take AI in finance courses?

Not always. Many courses teach no-code tools like Excel AI, Power BI, or drag-drop bots.

2. Are these courses good for commerce students?

Yes. They’re great for B.Com, BBA, and MBA students who want to add tech skills.

3. How long does it take to finish a course?

Most take 4 to 12 weeks, depending on depth and schedule.

4. Do I get a job after the course?

Courses with certificates and projects increase your job chances a lot.

5. Are there any free AI in finance courses in India?

Yes. Skill India, Swayam, and Infosys Springboard offer free or low-cost options.

6. Can I do this along with college or a full-time job?

Yes. Choose self-paced video courses or weekend programs.

7. Will AI take over all finance jobs?

No. AI helps, but it needs skilled humans to guide it. If you upskill, you stay ahead.