In accounting, two related but distinct processes are used when referring to the depletion of assets: amortization and depreciation. Even though the words are often used interchangeably, they refer to the description of which asset’s value is reduced over time. Tangible assets, such as machinery buildings, or automobiles, have depreciation usually occurring. Amortization is used for intangible assets, for example, patents, trademarks, and goodwill.

Amortization Meaning

Amortization refers to the gradual decline in the cost of an intangible asset against its useful life. Intangible assets are those assets that do not have a determined material form. Examples of intangible assets include copyrights, patents, goodwill, trademarks, and franchises. Amortization expenses for the asset costs spread over its useful life to match revenues generated by the asset.

Key Features of Amortization:

- Intangible Assets: Amortization is only applied to assets with no physical existence.

- Fixed Schedule: The expense of an intangible asset is mostly amortized linearly. Thus, it spreads the cost evenly over its life.

- No Salvage Value: Amortization does not include any salvage values; this only deprecates the amount without any form of taking salvage value into consideration.

- Examples: Amortized: patents over 20-year period, goodwill over its useful life, unless there is impairment.

What is Depreciation?

Depreciation is an accounting process within the cost-allocating technique in the method. It is a special formal technique to spread out the cost incurred by tangible assets such as vehicles, machines, buildings, and equipment over their useful lives. Depreciation accounts for the diminution of economic wealth attributed to an asset over its lifespan and with the wearing down of the asset.

Key Features of Depreciation:

- Tangible Assets: The depreciation method is applied to tangible assets, which include machines, buildings, and equipment.

- Methods in Depreciation: The different methods to calculate the basis of depreciation are mostly diversified depending on the type of asset it is and its usage.

- Salvage Value: Unlike in amortization, depreciation salvage value can be considered in the concept of having a salvage value, which is the residual value of the asset at the end of the useful life of the asset.

- Example: Buildings will depreciate for 30 to 40 years, while equipment may have a useful life of 5 to 10 years.

Depreciation Methods

Depreciation is calculated through several methods, each tailored to different types of assets and their usage. The three most common methods are:

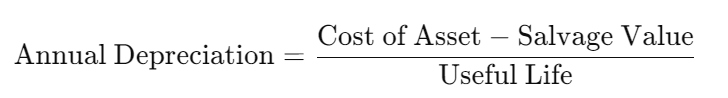

1. Straight-Line Method

This is the most straightforward method of depreciation. This is a method used in distributing an asset’s cost throughout its life. The straight-line method can be calculated with this formula:

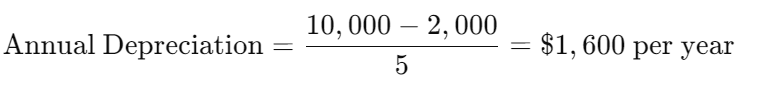

Example: If a machine costs $10,000, has a salvage value of $2,000, and a useful life of 5 years, its annual depreciation would be:

2. Declining Balance Method

This fixed percentage accelerating depreciation method takes a fixed percentage of the remaining book value of the asset. It forces an increasing depreciation expense in the earlier years of the life cycle of the asset. The formula is:

3. Units of Production Method

This method bases depreciation on the asset’s usage, which makes it ideal for equipment where wear and tear depend on the amount of use. The formula is:

Example: A piece of equipment is expected to produce 10,000 units over its lifetime. If it cost $50,000 with a $5,000 salvage value and produced 2,000 units in a year, the depreciation would be:

Differences Between Amortization and Depreciation

Amortization and depreciation are both methods of allocating the cost of an asset over its useful life, but they apply to different types of assets and follow distinct processes. Below is a deeper exploration of the key differences between amortization and depreciation, focusing on various accounting and practical aspects:

Type of Asset

- Amortization: Amortization is a decrease in the value of intangible assets, like patents and trademarks, because of obsolescence and expiration over time.

- Depreciation: This simply means the reduction in value of tangible assets; that is, buildings, machinery, etc. The utility life finally declines because of wear, becoming old, or the upgrade of technology.

Asset Lifespan and Useful Life

- Amortization: Intangible assets such as patents and copyrights are amortized over their legal or useful life, whichever is shorter. Useful life is considered the period during which benefit from an asset is expected. It is often derived from the terms of legal agreements or governing intellectual property statutes and regulations.

- Depreciation: The group of tangible assets includes the types of cars or buildings that are depreciated, and the duration over which it depreciates depends upon the type of asset. For instance, a car may be depreciated over 5-7 years; however, for buildings, it would be over 30-40 years, and as such typically wear out with obsolescence in use and frequency.

Method of Calculation

- Amortization: Amortization typically uses the straight-line method, meaning the asset’s cost is spread evenly over its useful life. The straight-line method simplifies accounting for intangible assets, as they usually don’t have complex usage patterns or wear-and-tear considerations.

- Depreciation: Depreciation can be calculated using several different methods, depending on how the asset is expected to lose value over time. The most common methods are the straight-line method and the Balance Method.

Salvage Value

- Amortization: When intangible assets do not have salvage value. It is often assumed that at the end of an asset’s useful life, value has all been depleted and there are no leftover pieces to sell or recover.

- Depreciation: The salvage value of the tangible asset is its approximated residual value at the end of its useful life. This salvage value is subtracted from the purchase price of an asset before calculation of depreciation expense.

Legal and Accounting Treatment

- Amortization: This method is tied to an asset’s legal life-for instance, patents run out after some period of years. When the value of an asset decreases too soon, the remaining value can be charged as an expense by impairment.

- Depreciation: Although it is bound by tax rules and regulations, depreciation allows, for instance, the MACRS in the United States, which accelerates depreciation and thus allows early degressive reduction of taxable income.

Regulatory Guidelines

- Amortization: Companies must amortize intangible assets such as goodwill and test them periodically for impairment under IFRS and GAAP to avoid overvaluation on the balance sheet.

- Depreciation: IFRS and GAAP discuss ways of determining depreciation, like a straight line or declining balance, to match the pattern in the rate of consumption of an economic benefit from an asset.

Tax Implications

- Amortization: Tax treatment for the amortization of intangible assets also follows accounting but tax authorities may permit faster or slower rates of amortization.

- Depreciation: Most companies opt for different types of accelerated depreciation methods like MACRS for tax purposes to reduce the tax liability while an asset is newly acquired.

Adjustments and Revaluation

- Amortization: Intangible assets are typically not revalued unless there is an impairment event. When an impairment occurs, the remaining balance of the intangible asset might be written down to reflect its reduced value.

- Depreciation: Tangible assets can sometimes be revalued, especially in industries where assets like real estate appreciate in value. This revaluation is not common in all accounting practices but is allowed under certain frameworks like IFRS.

Amortization vs Depreciation: Key Differences

| Criteria | Amortization | Depreciation |

|---|---|---|

| Type of Asset | Intangible assets (e.g., patents, goodwill) | Tangible assets (e.g., machinery, buildings) |

| Methods | Usually straight-line method | Straight-line, declining balance, units of production |

| Salvage Value Considered | No | Yes |

| Typical Assets | Intellectual property, goodwill | Equipment, buildings, vehicles |

| Useful Life Basis | Legal or contractual life | Physically useful life based on wear and tear |

| Tax Treatment | Similar to accounting treatment | Often accelerated for tax advantages |

| Revaluation | Not commonly revalued unless impaired | May be revalued depending on market value |

| Impact on Financial Statements | Reduces intangible asset value, amortization expense on income statement | Reduces tangible asset value, depreciation expense on income statement |

| Examples | Patents, copyrights, franchises | Buildings, machinery, vehicles |

Amortization vs Capitalization

Amortization and capitalization are terms of book but are somewhat related yet serve a slightly different purpose. Capitalization is the accounting term where an expenditure is capitalized and taken as an asset rather than an expense where it can be amortized or depreciated over time. Alternatively, the expenditure will be treated as capital investment. Amortization is the process of expensing out the cost of the capitalized asset over its useful life.

- Capitalization represents an expense as an asset on the balance sheet.

- Amortization is an expense that distributes the cost of an intangible asset over some time.

For example, if a firm buys a patent, its original cost is capitalized as an asset. The firm then amortizes the cost of the patent over time to represent decreasing value.

Conclusion

Two terms were used to express the difference in how the two are used in intangible versus tangible assets, but it is the application of those differences that makes amortization technically different from depreciation. Amortization would spread cost over time on tangible items like machinery. Amortization, however, would spread cost over time on intangible assets, such as patents. Fundamentally speaking, both amortization and depreciation concepts must be applied to any bookkeeping mechanism that may ensure the matching of costs of tangible and intangible asset costs against revenues generated through those resources.

Amortization vs Depreciation FAQs

What is amortization in accounting?

Amortization is the process of gradually writing off the cost of an intangible asset over its useful life.

What assets are amortized?

Intangible assets such as patents, copyrights, goodwill, and trademarks are amortized over their useful life.

Can depreciation apply to intangible assets?

No, depreciation applies to tangible assets. Intangible assets are amortized, not depreciated.

What is the difference between amortization and capitalization?

Capitalization records an expenditure as an asset, while amortization spreads the cost of an intangible asset over its useful life.

Why do companies depreciate assets?

Depreciation allows companies to spread the cost of tangible assets over their useful life, providing a more accurate reflection of the asset’s value on financial statements.