IND AS Stands for Indian Accounting Standards – The First of Its Kind in Financial Reporting by India INDAS implies the first-of-its-kind standards issued in financial reporting. It has been introduced by the Ministry of Corporate Affairs, MCA, in a bid to align Indian accounting practices with the widely accepted International Financial Reporting Standards (IFRSs) globally. Companies in India will, therefore, have to adapt to IND AS, which would have a variable dependency on the net worth and listed or unlisted status of the companies thus increasing transparency, consistency, and comparability among the financial statements. The adoption of IND AS has had a striking impact on different companies, such as listed companies, unlisted companies, and even small and medium-scale units, by adopting it in phased steps.

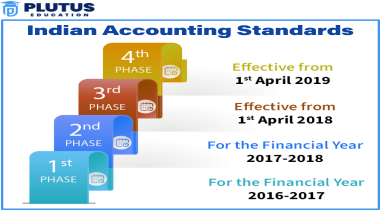

Phases of Adoption: IND AS Phased Adoption by MCA

Adoption of IND AS is done in a phased manner, so in the case of companies, a smooth transition is provided. The applicability of IND AS differs with the net worth of the company and whether it is a listed one or unlisted. The government adopted systematic steps by which the transition became easy for entities in all sectors.

Phase 1 (2016-17)

Companies listed or unlisted with a net worth of ₹ 500 crores or more had to implement IND AS. This stage mainly targeted high-net-worth companies.

Phase 2 (2017-18)

IND AS was mandated for listed companies and even not listed companies with a net worth of ₹250 crores or more but up to ₹500 crores.

Phase 3

Part of the said companies were even encouraged to embrace early or voluntarily before these dated mandates.

Phase 4 (2021-22 onwards)

Banks, Non-banking financial institutions, and insurance companies have been brought under IND AS for more stringent financial reporting.

Each phase was designed to gradually expand the scope of IND AS, allowing entities to prepare for the structural changes.

Indian Accounting Standards: Key Factors for Conversion

Conversion to IND AS, though only a regulatory requirement, is also enhancing the quality of financial reporting. Here are the key drivers for conversion:

Global Comparability: IND AS has managed to align Indian companies’ financial reporting with international standards, making it easier for foreign investors and multinational corporations to assess the performance of Indian businesses.

Transparency: The standards would enhance the transparency of the financial statements through the proper disclosure of various financial transactions.

Consistency: This would bring uniformity in the financial statements over the years. Therefore, improving consistency in multiple-year reporting.

Investor Confidence: With better comparability and transparency, investor confidence will be boosted, and more investment will flow into the Indian market.

Complexity of Transactions: The transactions are generally more intricate and relate to derivatives, foreign exchange, leasing, etc. All these require a clearer set of guidelines as offered by IND AS than the earlier accounting standards.

Calculation of Net Worth

The applicability of IND AS would depend mainly on the net worth of the company. Calculation of net worth is therefore essential in the decision over when the company will shift to IND AS.

Net Worth Formula

Net Worth=Total Assets−Total Liabilities

The net worth must be calculated based on the company’s consolidated financial statements, if they are available. The MCA requires a threshold net worth of ₹250 crores for a company to be mandated to apply IND AS.

Components of Net Worth:

- Paid-up share capital

- Reserves and surplus (excluding revaluation reserves)

- Securities premium

Net worth will be calculated on audited financial statements as of the latest balance sheet date. The threshold applies to both standalone and consolidated financial statements, which show higher net worth.

Objectives of IND AS

Enhancing the Indian financial reporting ecosystem, and following international best practices, the key objectives of IND AS are:

- Harmonization with IFRS: Convergence towards making the financial reports of Indian entities comparable with the global markets.

Better Financial Reporting: More weightage to fair values, stronger disclosures, and principle-based accounting as against traditional rule-based accounting. - Enhanced Governance: Capacity to enhance the governance whereby financial statements reflect the real status of the corporation, healthy or not

Accessibility to International Capital: Accessibility to international funds and investments in the company since overall credibility and comparability of the financial statements improve.

What are the Advantages of IND AS?

Several advantages have come with the introduction of IND AS, particularly for organizations having international operations or attracting international investment. Few of such advantages are below:

Global Acceptance: Since IND AS is by IFRS, Indian companies shall become more acceptable to foreign investors and will successfully integrate with global systems.

Consistency across Borders: Firms that operate business in more than one jurisdiction would henceforth enjoy uniform accounting practices across diverse countries.

Fair Value Measurement: IND AS emphasizes the measurement method of fair value that presents a more real version of the company’s current financial status than that presented under the traditional method of historical cost.

Increased Transparency: High disclosure requirements enable all the stakeholders, including investors, regulators, and auditors, to enjoy a more articulated view of the financial well-being of the company.

Efficient Decision-Making: Comprehensive and reliable data about the financial status of the company leads the management, investors, and creditors to be more prudent while making decisions.

Fair Value Measurement: It therefore enhances the corporate governance of a company by coming up with the framework of the company in a better way by using transparency and accountability.

Conclusion

The applicability of IND AS is a major reform in the Indian financial reporting framework, aimed at aligning domestic accounting standards with global benchmarks. It brings numerous benefits, such as transparency, comparability, and improved governance, making financial reporting more reliable. By phasing its implementation based on net worth and company type, the government has ensured a structured approach to adoption, enabling companies to gradually adapt to these robust standards.

Applicability of IND AS FAQs

What is the basic threshold for IND AS applicability?

Companies with a net worth of ₹250 crores or more are required to adopt IND AS.

Are IND AS and IFRS the same?

No, while IND AS is based on IFRS, there are some carve-outs and modifications to suit Indian regulations.

How is net worth calculated for IND AS applicability?

Net worth is calculated by subtracting total liabilities from total assets, based on audited financial statements.

What is the impact of IND AS on SMEs?

SMEs with a net worth below ₹250 crores are not mandated to adopt IND AS, although voluntary adoption is encouraged.

Why is fair value measurement important in IND AS?

Fair value measurement provides a more accurate representation of an entity’s financial position by reflecting current market values rather than historical costs.