Banking and finance postgraduate courses help students grow in one of the most respected and rewarding fields. These courses offer strong knowledge of banking systems, financial tools, risk management, economics, and investment planning. Whether you want to work in a private bank, become a credit analyst, or manage financial portfolios, these programs build your path.

Today, the world of finance keeps changing fast. With digital payments, fintech startups, and global banking growing every day, banks need professionals who understand both theory and real-time practice. Banking and finance postgraduate courses prepare you for this future. They give you deep subject knowledge and also teach practical skills like using financial software, making reports, handling risk, and even understanding how the economy works.

You can find these courses in top Indian and international colleges. Most of them take 1 to 2 years and offer either a degree like MBA in Finance, M.Com in Banking, or diplomas and certifications. Students from commerce, economics, or even engineering join these programs. Some courses also offer placements, internships, and industry training.

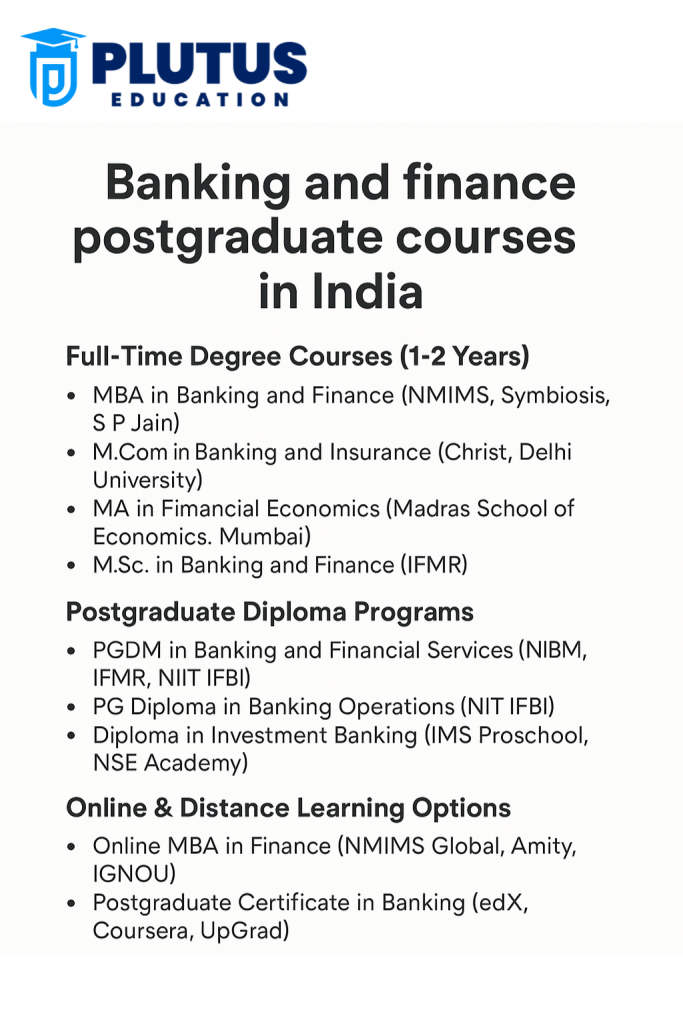

Types of Banking and Finance Postgraduate Courses in India

India has many types of banking and finance postgraduate courses. Some offer degrees, some offer diplomas, and some give certificates. This section helps you understand the different formats and what makes each one special.

Full-Time Degree Courses (1 to 2 Years)

These are regular PG programs where you attend classes, write exams, and complete projects. Universities and top colleges mostly offer them.

- MBA in Banking and Finance: Covers management skills plus core finance knowledge. Ideal for leadership roles.

- M.Com in Banking and Insurance: More focused on financial topics and banking rules. Ideal for students from commerce backgrounds.

- MA in Financial Economics: Combines economics and finance. Useful for policy roles or research jobs.

These courses usually last 2 years. Some colleges give specialization options in the second year.

Postgraduate Diploma Programs

These are shorter than full degrees and focus more on practical learning. They are ideal for students who want jobs fast.

- PGDM in Banking and Financial Services (PGDM BFSI)

- PG Diploma in Banking Operations

- Diploma in Investment Banking

They last 6 months to 1 year. Institutes like NIIT, IMT CDL, and IFBI offer these.

Online and Distance Learning Options

Working professionals often take online PG courses. These help them upskill without leaving their jobs.

- Online MBA in Finance (from NMIMS, Amity, etc.)

- Postgraduate Certificate in Banking (by edX, Coursera, etc.)

These programs offer flexibility and include recorded classes, assignments, and digital exams.

Top Colleges Offering Banking and Finance PG Courses

Choosing the right college or institute is important for learning and placements. This section lists the top names in India where you can apply for banking and finance postgraduate courses.

Indian Colleges and Universities

Here is a table showing popular colleges and what they offer:

| Institute Name | Course Name | Duration |

| IIM Bangalore | PG Program in Financial Management | 1 year |

| NMIMS (Mumbai) | MBA in Banking & Finance | 2 years |

| Symbiosis School of Banking | MBA in Banking | 2 years |

| Christ University (Bangalore) | M.Com in Finance and Analytics | 2 years |

| IFMR Graduate School of Business | PGDM in Financial Engineering | 2 years |

| NIIT IFBI | PG Diploma in Banking Operations | 1 year |

| NIBM Pune | PGDM in Banking and Financial Services | 2 years |

These institutes offer classroom and sometimes hybrid models. Their programs also include case studies and corporate lectures.

Global Options for Indian Students

Some students want to study abroad. Top international options include:

- MSc in Finance – University of London

- MBA in Finance – INSEAD, France

- MSc in Banking – Erasmus School of Economics

- Postgraduate Certificate in Finance – Harvard Extension

These programs offer strong global exposure but need higher budgets and test scores (like the GRE and IELTS).

Career Opportunities After Postgraduate Courses in Finance

You must know what jobs you can get after completing these courses. This section covers the major roles and their scopes in both private and public sectors.

Banking Roles in Public and Private Sector

After completing your degree, you can apply for:

- Bank Probationary Officer (PO): For public sector banks via IBPS/SBI exams.

- Credit Analyst: To check loan applications and credit scores.

- Branch Manager: To manage daily bank operations and targets.

- Operations Executive: For backend banking tasks like clearing, reconciliation, etc.

Finance and Investment Sector Jobs

In non-banking finance companies and investment firms, you can work as:

- Financial Analyst: Study data and help in decision-making.

- Investment Advisor: Help clients choose good investment options.

- Portfolio Manager: Manage the funds of HNI or firms.

- Risk Analyst: Control financial risks and advise safe plans.

Starting Salary After PG Finance Courses

Salaries vary based on degree type and college. Here’s an average range:

| Job Role | Average Salary (INR) |

| Bank PO | ₹5–6 LPA |

| Financial Analyst | ₹6–9 LPA |

| Credit Manager | ₹7–10 LPA |

| Investment Banker | ₹10–20 LPA |

Students from top IIMs, NMIMS, and ISB get even higher offers, especially if they take internships seriously.

Banking and Finance Postgraduate Courses Online in India

The demand for flexible, skill-based learning has increased in India—especially among students and working professionals aiming for a career in the financial sector. That’s why banking and finance postgraduate courses online in India are becoming more popular than ever. These online programs offer updated knowledge, practical skills, and placement support—all from the comfort of your home. Whether you’re a recent graduate or a full-time employee, you can now study at your own pace and still earn a recognized qualification.

Top Benefits of Studying Postgraduate Banking Courses Online

Choosing the best online finance courses in India comes with several advantages that suit modern learners:

- Flexible learning schedule – Ideal for working professionals

- Industry-recognised curriculum – Designed by leading finance experts

- Affordable fees – Lower cost compared to full-time courses

- Placement support – Career assistance through virtual hiring partners

- Skill-based modules – Learn Excel, financial analysis, risk management, and more

These courses are especially useful for students who cannot relocate or afford full-time campus programs.

Popular Online MSc in Banking and Finance in India

An online MSc in Banking and Finance is a postgraduate degree program offered by many Indian universities in a virtual format. It typically lasts 2 years and includes subjects like:

- Banking and Financial Services

- Investment Management

- Financial Statement Analysis

- Corporate Finance

- Risk and Compliance

- Financial Modelling

Top Institutions Offering Online MSc in Banking and Finance:

| University/Platform | Duration | Mode | Eligibility |

| Amity Online | 2 years | 100% Online | Graduation with min 50% marks |

| Jain University (Online) | 2 years | Online + Live | Any UG degree |

| Manipal Online | 2 years | Online | UG with 50% (Commerce preferred) |

| UPES CCE | 2 years | Online | Graduation in any stream |

These universities provide UGC-approved online master’s degree in finance India that are widely accepted by recruiters in banking, NBFCs, and fintech firms.

Postgraduate Diploma in Banking and Finance Online

If you’re not ready for a full master’s degree, consider a postgraduate diploma in banking and finance online. These short-term diploma programs focus on specific industry-relevant skills and can be completed in 6–12 months.

Popular Diploma Courses:

- PG Diploma in Banking and Credit Analysis – offered by NIBM

- PG Diploma in Financial Services – available on edX, Coursera, and NIIT

- Certificate in Investment Banking – NSE Academy, BSE Institute

These are perfect PG courses in banking and finance for working professionals who want to upskill quickly and boost their career without taking a break from work.

Best Online Finance Courses in India (Short-Term & Specialised)

Not everyone needs a degree or diploma. If you want to sharpen a specific skill, such as investment banking or credit risk, choose the best online finance courses in India that offer certificates and job-oriented content.

Popular Online Finance Certification Platforms:

- Coursera – Offers University-certified finance courses (IIM, Yale, Wharton)

- edX – Access courses from top institutes like MIT and IIMB

- UpGrad – Postgraduate programs in finance with placement support

- Imarticus Learning – Offers short-term investment banking and fintech programs

- Great Learning – Offers business finance and analytics certifications

These are flexible and affordable options for anyone aiming to enter the finance industry with practical and in-demand skills.

Who Should Choose Online PG Courses in Banking and Finance?

These online courses are ideal for:

- Graduates from B.Com, BBA, or BA Economics

- MBA aspirants seeking finance specialisation

- Working professionals in banks or NBFCs

- CA or CFA students who want a formal degree/diploma

- Entrepreneurs looking to understand financial systems

Whether you choose an online MSc in Banking and Finance, a diploma, or a short course, these programs help you gain the right mix of academic and professional skills.

Why Choose Postgraduate Courses in Banking and Finance?

Students must understand why choosing a postgraduate course in this field helps them in the long run. This section introduces the reasons that make these programs popular and relevant in today’s job market.

Banking and Finance Give Stable Careers

Banking and finance jobs are among the most secure in the job market. People always need banks, loans, savings, and investments. So, this field never stops growing. When you study advanced finance, you learn how to manage money, advise customers, create reports, and make smart decisions.

Postgraduate programs train you for both private and government jobs. You can work in RBI, SBI, LIC, or top private banks like HDFC, ICICI, Axis, and Kotak. You can also work in stock markets, insurance companies, or fintech startups.

You can apply your skills globally, too. Many students go abroad after completing these programs because banking principles are mostly the same worldwide. With the right degree and certification, you can even get jobs in global investment firms.

Courses Teach Updated Financial Skills

These courses focus not only on theory but also on real applications. You learn how banks work daily, how to manage a balance sheet, how to detect fraud, and how to handle credit risks.

You also learn software tools like Excel, Tally, SAP, and sometimes AI or data tools like Python. These help you become job-ready.

The courses include finance laws, international banking rules, corporate finance, and even digital finance trends. All this knowledge helps you build a strong base.

What You Learn in Banking and Finance Postgraduate Courses?

Postgraduate programs in finance are not just about reading books. They train students in real-world problem-solving, team projects, and data analysis. This section shows the major topics students study in most banking and finance postgraduate courses.

Core Subjects Taught in Most Programs

Most programs have a set of basic subjects that cover both banking and finance areas. These help you understand the link between policies, money, and the market.

- Financial Management: You learn how to manage a company’s money, decide on investments, and grow assets.

- Banking Operations: This subject teaches daily work inside banks, like cheque clearing, account management, and customer handling.

- Risk Management: You understand how to reduce financial loss and deal with market uncertainties.

- Economics and Markets: You learn how the economy and financial markets work together.

- Corporate Finance: This topic shows how big businesses handle their funds, shares, and credit.

- Investment Management: You study stocks, mutual funds, fixed deposits, and how to create investment plans.

- International Banking: Learn rules for global banking, forex markets, and overseas payments.

Practical Tools and Soft Skills You Gain

Apart from subjects, these courses also teach you:

- Communication and client handling

- Report writing and document drafting

- Data analysis using Excel and financial software

- Understanding financial statements and ratios

- Basics of Taxation and GST

In some courses, you also do mini-projects, case studies, or live internships. These help you see how banks really work and improve your learning.

How to Choose the Right Banking and Finance PG Course?

You must select a course that suits your goals. This section helps you choose based on career interest, time, budget, and placement support.

Step-by-Step to Decide

- Identify Your Goal: Do you want to work in banking, insurance, or fintech?

- Check Your Background: If you are from commerce, you can take finance-heavy courses. If you are from IT, you can pick fintech modules.

- Choose Course Format: If you want full-time learning, go for an MBA or M.Com. If working, try online PG diplomas.

- Compare Colleges: Look for faculty, course content, internship tie-ups, and placement support.

- Check Fee and ROI: Some courses cost more but offer better placements.

Don’t go only by the name. Read course details and success stories before joining.

Banking and Finance Postgraduate Courses FAQs

1. Which PG course is best for banking?

MSc banking and Finance is the best PG course for banking if you want a mix of academic knowledge, industry exposure, and placement support.

2. Which master’s degree is best for banking and Finance?

The master’s degree in banking and finance offered by reputed Indian universities or international colleges is ideal for banking jobs, wealth management, and corporate finance.

3. Which degree course is best for banking and Finance?

B.Com followed by an MSc in Banking and Finance or MBA in Finance is considered the best degree course for banking and finance by most industry experts.

4. What is MSc banking and Finance?

It is a 2-year postgraduate academic program focused on banking systems, financial markets, risk management, and investment strategies. It is ideal for careers in banks and financial institutions.

5. What is the difference between CFA and MSc finance?

CFA is a professional certification focused on investment analysis, while MSc Finance is an academic degree covering a broader range of financial topics including corporate finance and banking.