Banking services importance plays a key role in the smooth functioning of our daily lives. They constitute the backbone of the modern economy offering essential financial services for individuals, businesses, and governments. From managing a savings account to using mobile banking, today’s banks offer a wide range of digital banking services designed for ease, security, and financial growth. Whether you’re exploring personal loans, opening a current account, or opting for online banking, understanding these services is essential for making informed financial decisions. It would not be possible to manage the money, make payments, or have access to loans without these banking services. From savings accounts to investments in the future, banking services help to handle all our financial needs. The article will expound on the meaning, importance, types, and functions of banking services in a detailed manner.

Meaning of Banking Services

Banking services refer to the wide range of financial services provided by banks to help people and businesses manage their money. These services include opening accounts to save money, providing loans to people and businesses, and offering investment options to help grow wealth. Banks also offer credit cards and digital banking services, making it easy for customers to handle their finances from anywhere.

In simple terms, banking services are financial tools that people and businesses use to store, manage, and grow their money. Banks act as middlemen between people who have money and those who need money. They ensure that funds flow smoothly in the economy, making transactions secure and easy.

Banking Services Importance

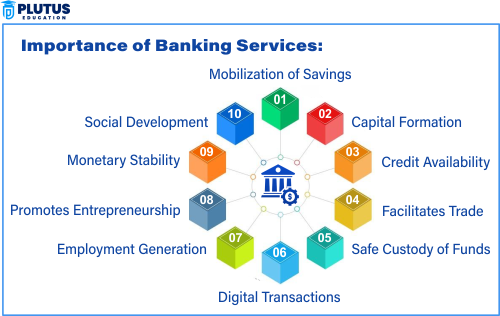

The importance of banking services in our lives is undeniable. These services not only help individuals but also play a vital role in the economic growth of a country. Let’s look at some reasons why banking services are important:

Economic Stability and Growth

Banks contribute significantly to economic growth by ensuring money circulates efficiently within the economy. They collect deposits and lend money to businesses and individuals. These loans help create jobs, fund businesses, and invest in infrastructure projects, contributing to overall economic development.

- Funding Businesses: Banks provide loans to businesses for expansion and growth.

- Stabilizing the Economy: During economic crises, banks offer credit and investment opportunities, helping maintain financial stability.

Convenience for Individuals

For individuals, banking services offer a secure and convenient way to store, manage, and grow money. With the rise of digital banking, people can easily access their accounts, transfer money, pay bills, and monitor their finances anytime, anywhere. Key benefits include:

- Secure Savings: Bank accounts protect money from theft and loss.

- Interest Earnings: Certain accounts offer interest, helping people grow their savings.

- Access via Digital Banking: Mobile apps and online banking make financial management easy.

Support for Business Operations

Banks provide businesses with the capital they need to grow. Services include loans for expansion, credit lines for daily operations, and merchant services for payment processing. These services help businesses run smoothly and expand their operations.

- Business Loans: Banks provide funding for businesses to expand or manage cash flow.

- Merchant Services: Businesses can accept payments easily via debit/credit cards.

Wealth Creation and Financial Products

Banks offer various financial products to help individuals and businesses create and grow wealth:

- Loans and Mortgages: Helping people buy homes, and cars, or fund education.

- Investment Services: Banks offer products like mutual funds, stocks, and bonds to help grow wealth.

- Insurance Services: Banks provide life and health insurance to protect individuals and businesses from financial risks.

Efficient Payment Systems

Banking services also make payments easy and secure. Services like Electronic Funds Transfer (EFT), wire transfers, debit/credit cards, and digital wallets enable fast, secure transactions. This allows individuals and businesses to pay for goods and services quickly and safely.

- Fast Transfers: Money can be transferred instantly or internationally through digital banking.

- Cashless Payments: Debit and credit cards allow for easy payments without the need for physical cash.

Financial Inclusion

Banking services promote financial inclusion by offering access to financial tools for everyone, even those from lower-income groups or rural areas. Initiatives like micro-loans and affordable credit help people start businesses, improve their financial situation, and lift themselves out of poverty.

- Access to Bank Accounts: Everyone can open a bank account, regardless of their income.

- Microloans: Small loans are provided to help individuals start businesses or improve their livelihoods.

Types of Banking Services

There are several types of banking services available to customers. These services cater to different needs, whether for personal use or business purposes. Let’s explore the major types of banking services:

Retail Banking

Retail banking is designed for individual customers. It provides services like:

- Savings Accounts: To store money safely and earn interest.

- Checking Accounts: For regular transactions like bill payments and withdrawals.

- Personal Loans and Mortgages: To help people buy homes, and cars, or pay for education.

- Credit Cards and Debit Cards: To make payments and manage spending.

Commercial Banking

Commercial banking services cater to businesses and large organizations. These services include:

- Business Loans: To help companies grow by borrowing money.

- Merchant Services: Payment processing services for businesses to accept payments.

- Business Checking Accounts: Specialized accounts for managing business transactions.

Investment Banking

Investment banking services help companies raise capital for growth and expansion. This includes:

- Capital Raising: Helping businesses raise money by issuing stocks or bonds.

- Mergers and Acquisitions (M&A): Helping companies merge or acquire others.

- Wealth Management: Offering investment advice to high-net-worth individuals.

Digital Banking

Digital banking is rapidly growing and allows customers to access banking services online. These services include:

- Online Banking: Managing accounts, paying bills, and transferring money through the Internet.

- Mobile Banking: Using mobile apps to handle banking tasks on smartphones.

- E-wallets and Payment Apps: Digital solutions for making payments and purchases online.

Functions of Banking Services

Banks perform several important functions that contribute to the smooth functioning of the economy. Here are the main functions of banking services:

- Depository Function: One of the primary functions of banking services is to act as a safe place for people to store their money. Banks offer various types of accounts, such as savings and checking accounts, where individuals can deposit their funds. In return, the bank may offer interest on certain accounts, encouraging people to save.

- Credit Creation: Banks play a major role in creating credit. When people and businesses borrow money, banks lend out a portion of the deposited funds. This lending process helps boost business activities and economic growth. Credit is also used by businesses to expand, hire employees, and create new products.

- Facilitating Payments: Banks facilitate payments through various services like checks, wire transfers, and digital payment systems. These services allow people and businesses to make payments safely and quickly. The rise of e-banking and e-wallets has made it easier for customers to send and receive money anytime, anywhere.

- Risk Management: Banks also help manage financial risks. They offer insurance products, such as health insurance, life insurance, and property insurance. These products help individuals and businesses protect themselves from financial losses due to unexpected events.

- Currency Exchange: For businesses and individuals involved in international trade, banks offer currency exchange services. These services allow people to convert money from one currency to another, making global transactions easier and faster.

Banking Services FAQs

1. What are the main types of banking services?

Banking services include savings accounts, current accounts, loans, credit cards, and online banking. Each service caters to different personal or business needs.

2. How does online banking work?

Online banking allows customers to access accounts, transfer funds, and pay bills securely via the internet, 24/7. It’s part of digital banking services.

3. What is the difference between a savings and a current account?

A savings account earns interest and is ideal for saving money. A current account offers unlimited transactions, mainly for business banking.

4. How can I apply for a personal loan from a bank?

Visit the bank branch or use the online loan application portal. Submit ID proof, income proof, and bank statements for loan approval.

5. What are the benefits of mobile banking?

Mobile banking offers instant access to banking services via smartphone apps. Benefits include real-time alerts, secure payments, and easy fund transfers