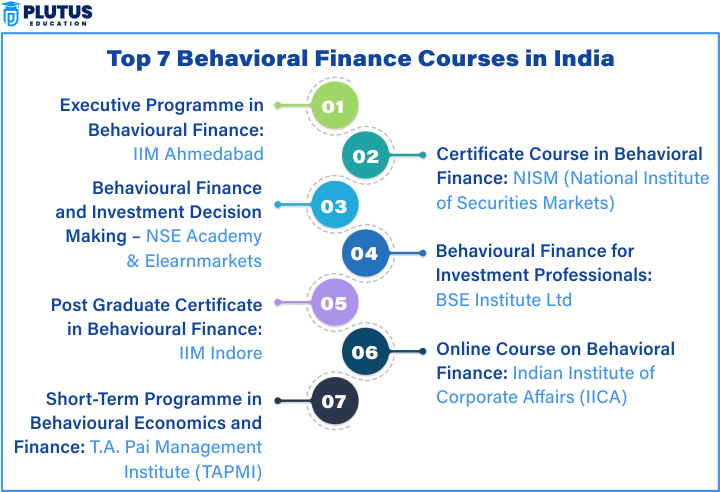

The best courses in behavioural finance focus mainly on the applications of investor psychology, market dynamics, and decision-making behavior. The courses include essential topics such as cognitive biases in finance, emotional investing, and irrational market reactions. The most popular courses to enroll in include the Executive Programme in Behavioural Finance IIM Ahmedabad, Harvard in Behavioral Finance, and Behavioral Finance edX course offerings.

Best Courses in Behavioral Finance

Learners can choose from short-term modules to executive-level programs. Such activities include behavioral finance online courses, microfinance courses, and behavioral investing training that will help students and professionals meet their personal needs. A behavioral finance MBA elective or psychology module in financial decision-making can be associated with most top B-schools and finance certifications. The aim is for the professional to learn investor behavior, handle irrational risks, and improve the long-term financial strategy.

Executive Programme in Behavioural Finance – IIM Ahmedabad

This program at IIM Ahmedabad dives deep into investor psychology, biases, heuristics in finance, and decision-making models. Behavioral patterns are explored to the extent they affect portfolio decisions, ESG investments, and financial markets. The course incorporates a hands-on approach by applying case studies and simulation exercises, encouraging learners to identify cognitive errors and enhance judgment in investment environments.

Duration & Format

The duration is 5-6 months, with weekend and online options. It is designed for working professionals and executives who want to adjust their schedules. Participants interact through live online sessions with faculty and participate in projects involving real-world financial analysis.

Career Scope

Learners are ready to occupy jobs in ESG investment, behavioral finance consultancy, impact investing, or sustainability finance strategy. The program prepares learners for roles like financial strategist, ESG advisor, and executive-level portfolio managers focusing on climate and behavioral risk. It supports advanced careers in behavioral finance executive programs and online behavioral finance program leadership.

Certificate Course in Behavioral Finance – NISM

This course presents the foundational behavioral concepts of emotional finance, market anomalies, or heuristics in investing. The course sharply emphasizes why individual financial decisions deviate from rational expectations under stable market volatility and ESG-related issues. It is excellent for entry-level finance, investing, or sustainability students.

Duration & Format

The duration ranges from 4 to 6 weeks and is available online or in hybrid mode. This teaching construct teaches theory through lectures, online quizzes, and video-based learning modules. It is popular among students and early-career professionals due to affordability and flexibility.

Career Scope

Graduates are eligible for entry-level entry-into-financial-advisory-role, retail investor, market research, or ESG compliance roles. Also, it forms a strong foundation for pursuing further advanced certifications such as a behavioral finance Coursera course, behavioral economics certification, or a financial decision-making psychology program.

Behavioral Finance and Investment Decision Making – NSE Academy & Elearnmarkets

Practical, merging academic frameworks with actionable tools. Learners go through behavioral errors prevalent while trading in the market and constructing portfolios. The cognitive biases directed towards finance are overconfidence and loss aversion, which are further examined in the context of ESG and climate-related investment decisions.

Duration & Format

The course is 6 weeks, purely online, offered in a self-paced or live session format. Participants access the content in videos and simulators and take certification exams at the NSE Academy learning platform.

Career Scope

Graduates are expected to take up jobs like investment analysts, retail investor advisors, or educators in behavioral finance. This program improves an individual’s ability to build ESG portfolios and delve into green finance, hence being suitable for those seeking behavioral investing training or online ESG certification.

Behavioural Finance for Investment Professionals – BSE Institute Ltd

This course is an advanced one for experienced professionals in finance and goes into market psychology, emotional investments, and behavioral distortions in asset pricing. Most of the teaching involves real market cases. Fumbling to translate green thumbs or creating a bubble nurturing a business with a view of the market are other ways this behavior is seen.

Duration & Format

This course is 1- to 3-month in duration, against the backdrop of both evening and weekend batches. This is a physical course at BSE Institute but can also be taken online on certain days. Certification is given upon successful assessment.

Career Scope

Opens doors for professionals in ESG investment strategy, sustainable portfolio design, and corporate finance. Many graduates occupy fund houses and financial boutiques engaged in sustainable mutual funds, green bonds, or ESG compliance frameworks. It also helps them to have a better perspective on the canons of practice as members of the behavioral finance block in MBA electives.

Post Graduate Certificate in Behavioural Finance – IIM Indore

This PG certification course offered by IIM Indore speaks to financial decision-making psychology, which examines long-term behavioral patterns and impacts on corporate and ESG finance. The program content is further enriched through its academic component, simulation, ESG cases, and group learning while enhancing the knowledge base.

Duration & Format

The course lasts nine months to one full year, with weekend live online sessions. The program has assignments, case studies, and a final project identifying accurate financial decision-making with behavioral constraints.

Career Scope

Some graduated individuals will head Sustainability teams, Climate Finance Projects, or Engagement in Behavioral Risk Solutions. The program often paves the way for many participants’ senior positions in impact investing. Some space to launch ESG reporting careers is being created, too. This program is relevant to designing behavioral life modules within the financial programs and sustainability division.

Online Course on Behavioural Finance (IICA)

An online course by IICA unfolds the domains of ethics-governance aspects, besides slowly embedding the notion of behavioral thinking in corporate finance. It accentuates psychological patterns woven into ESG disclosures, stakeholder communication, and responsible investing frameworks.

Duration & Format

The course runs over 4 to 6 weeks, online with self-paced study. The offering benefits compliance associates, CSR professionals, and financial managers at mid-management levels.

Career Scope

After this course, one would enter roles such as ESG governance consultants, head of CSR, or climate disclosure officers. It is an auxiliary qualification for those pursuing ESG certifications online, courses on behavioral economics, or a specialization in corporate sustainability reporting.

Short Term Programme on Behavioral Economics and Finance – TAPMI

This short but intense program introduces core knowledge of Behavioural Economics, Neurofinance, and Behavioural Analyses of Investors. Case studies, simulations, and interactive workshops on how they could achieve perfection in decision-making in unstable ESG-themed markets.

Duration & Format

Training is delivered over 2-3 days in a conference format. Participating students receive course materials and are even lodged and fed if residential.

Career Scope

Such sessions educate individuals on devising strategies for green financing, advise on behavioral risks, and act as a bridge to positions involving ESG decision-making. Those are mostly beginner courses that could prepare students for future commitments/build their understanding of this module in the Behavioral Finance Harvard short course. Eds Tracks, and

Comparision Chart Behavioural Finance Courses

| Course Name | Institution/Provider | Duration | Format | Key Highlights | Career Prospects |

| Executive Programme in Behavioural Finance | IIM Ahmedabad | 5–6 months | Live Online (Weekends) | Advanced course on investor psychology, ESG decision-making, real-time market simulations | ESG Advisor, Financial Strategist, Portfolio Manager |

| Certificate Course in Behavioural Finance | NISM | 4–6 weeks | Online/Hybrid | Beginner-friendly, Emotional finance & heuristics, Flexible learning | Entry-level financial advisory, ESG compliance, Retail investor roles |

| Behavioural Finance & Investment Decision Making | NSE Academy + Elearnmarkets | 6 weeks | Online (Self-paced / Live) | Practical tools, Focus on biases like overconfidence, ESG investing | Investment Analyst, Behavioral Investing Trainer, Green Finance Strategist |

| Behavioural Finance for Investment Professionals | BSE Institute Ltd | 1–3 months | Evening / Weekend (Physical + Online options) | Real market case studies, Emotional distortions in investing, ESG portfolios | Corporate Finance, Fund House Strategist, ESG Consultant |

| PG Certificate in Behavioural Finance | IIM Indore | 9–12 months | Live Online (Weekends) | Advanced PG program, ESG case studies, Final capstone project | Climate Finance Leader, Behavioral Risk Officer, ESG Reporting Manager |

| Online Course on Behavioural Finance | IICA (Indian Institute of Corporate Affairs) | 4–6 weeks | Online (Self-paced) | Governance, Ethics, ESG disclosure, Stakeholder communication | ESG Governance Consultant, CSR Head, Climate Disclosure Officer |

| Short Term Programme in Behavioural Economics & Finance | TAPMI | 2–3 days | In-person Workshop (Residential available) | Intro to Behavioral Economics, Neurofinance, Interactive simulations | Green Finance Strategist, ESG Analyst, Foundation for Advanced Certifications |

Behavioural Finance Courses FAQs

1. What is Behavioral Finance?

Behavioral finance is an area of study that investigates the impact of factors such as emotions, biases, and mental shortcuts on the financial decisions made by individuals. It becomes the antithesis of the assumption that investors are forever rational and try to throw light on the many unpredictable ways the market behaves sometimes.

2. Who needs to enroll in a behavioral finance course?

Behavioral finance courses target Financial Advisors, traders, portfolio managers, MBA graduates, and all players in investment decisions. Knowledge of investor psychology improves judgment in volatile markets.

3. Are there behavioral finance courses at IIMs?

Among the top-notch courses available for professionals and executives are the Executive Programme in Behavioural Finance – at IIM Ahmedabad and the Post Graduate Certificate in Behavioural Finance – at IIM Indore.

4. How do I choose a behavioral finance course online?

Pick a course that is in line with where you are in your career. Beginner-level courses include the behavioral finance Coursera or a behavioral finance edX course; professionals may prefer IIM courses or certifications from NSE, NISM, or BSE.

5. What topics can a behavioral economics course entail?

Topics usually researched in such courses include cognitive biases in finance, emotional investing, heuristics, investor behavior, decision-making mistakes, and market psychology. Some of them may also include ESG investing and sustainability-focused decision models.