In India, finance is one of the most popular and rewarding career fields. Students from all backgrounds—commerce, arts, and even science—want to enter this growing sector. This is because finance offers strong job stability, competitive salaries, and a wide range of career paths. Whether you want to work in banks, manage investments, handle corporate accounts, or start your consultancy, you need the right education to begin your journey. That’s why choosing from the best finance courses in India becomes very important.

Finance courses in India are available in many forms. These include professional qualifications like CA, CFA, CMA, and CS. There are also academic degrees such as B.Com, BBA Finance, M.Com, and MBA Finance. For those who want quick skills, there are diploma and certification courses as well. Each course serves a different goal, depending on what kind of job or career path you want. In this article, we’ll explore all the top finance courses in India, explaining what they teach, who should choose them, and what career opportunities they offer.

Why is Finance a Great Career Choice in India?

Finance plays a central role in every type of business. From startups to large corporations, everyone needs financial experts to manage money, create budgets, analyze investments, and stay compliant with regulations. In India, the finance industry is growing quickly with rising demand in banking, insurance, fintech, mutual funds, and the stock market. This growth has created thousands of job opportunities for skilled professionals.

A career in finance not only pays well but also gives a strong professional identity. Unlike other fields, finance jobs do not rely heavily on trends; instead, they are stable and essential in every economy. With the right course, you can start working early, gain experience, and grow fast into leadership roles.

Some of the key benefits of a finance career in India include:

- Diverse job roles across industries

- Strong salary potential with growth

- Opportunities in both private and government sectors

- Flexibility to work in domestic or international markets

- Skill-based promotions and career advancement

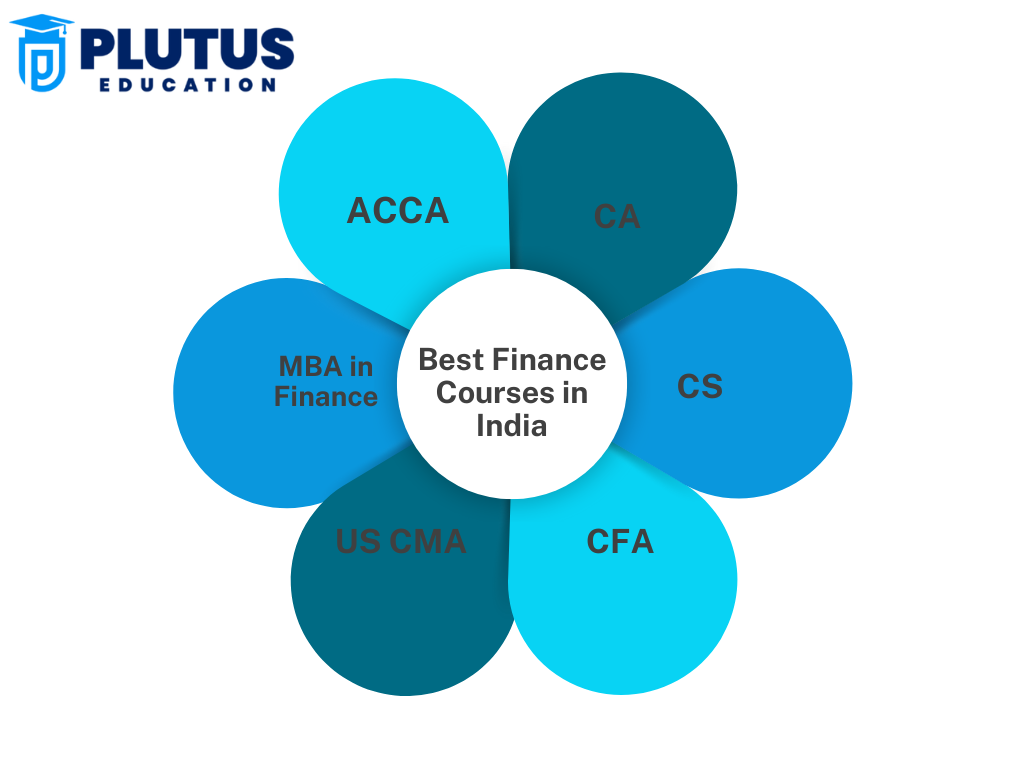

Best Finance Courses in India

Finance courses in India offer a wide variety. You can choose from long-term degrees like a B.Com, M.Com, or MBA in Finance, or you can choose from professional certifications like CA, CFA, CS, CMA, or FRM. If you’re short on time, there are also online diplomas and certificate programs in banking, financial modeling, and investment. Each course offers something unique—some focus on accounting and taxes, while others teach investment strategies or risk management.

These courses not only teach technical skills but also help you become job-ready. Many include real-world training, internships, or case studies to help you learn how finance works in actual companies. You can choose a course based on your interests, career goals, time, and budget.

Let us now explore the best finance courses in India, ranging from degree programs to professional certifications.

1. Chartered Accountancy (CA)

The Chartered Accountancy course is among the oldest and most respected finance qualifications in India. Conducted by the Institute of Chartered Accountants of India (ICAI), it is a challenging but highly rewarding course. CA professionals manage accounting, tax, audits, and financial reporting for businesses.

The course is structured into three main levels: CA Foundation, CA Intermediate, and CA Final. Along with passing exams, students must also complete three years of articleship training, which offers real-world experience in accounting and auditing practices.

The CA course suits students who want to master taxation, auditing, and finance laws. Many successful CAs go on to work with Big Four accounting firms, start their firms, or become CFOs and financial advisors.

2. Chartered Financial Analyst (CFA)

The CFA course is a globally recognized finance qualification conducted by the CFA Institute (USA). It is ideal for students and professionals who wish to specialize in investment banking, equity research, portfolio management, or financial analysis. Unlike CA, which focuses more on accounting and audits, CFA is centered on investments, valuation, and asset management.

The course consists of three levels, each testing deep knowledge of subjects such as financial reporting, quantitative methods, fixed income, derivatives, economics, and portfolio management. CFA Level 3 focuses heavily on wealth planning and ethics.

Students who complete all three levels and gain relevant experience can use the CFA designation. CFA professionals are in high demand in stock markets, mutual fund houses, and investment banks.

3. Company Secretary (CS)

The Company Secretary course, offered by the Institute of Company Secretaries of India (ICSI), is one of the best finance-related courses for those who are interested in corporate law and governance. A CS is responsible for ensuring that a company follows all legal and regulatory requirements. This includes managing board meetings, legal records, and compliance with company law.

The course is divided into three stages: Foundation, Executive, and Professional. It also requires short-term training in various law firms or corporations. The CS course is ideal for students who are detail-oriented and have an interest in law, governance, and compliance.

After completing CS, professionals can work as legal advisors, compliance officers, corporate secretaries, and even company directors. Many CS professionals work in top legal departments of MNCs, banks, and consultancy firms.

4. Cost and Management Accounting (CMA)

The CMA course, managed by the Institute of Cost Accountants of India, trains students in costing, budgeting, business strategy, and performance analysis. It is particularly useful in the manufacturing and production industries, where cost optimization and efficiency are crucial.

The course includes three levels: CMA Foundation, CMA Intermediate, and CMA Final. Students also undergo practical training, which helps them understand cost records, budget planning, and internal controls.

CMAs help businesses increase profit by reducing costs and improving financial planning. They work in various roles, such as cost accountants, financial controllers, budget analysts, and operations heads in manufacturing, service, and logistics firms.

5. MBA in Finance

An MBA in Finance is one of the most popular finance degrees in India. It is offered by top business schools such as IIMs, XLRI, FMS, NMIMS, and private universities. The MBA program includes subjects like financial management, investment analysis, corporate finance, banking, and business strategy.

What makes an MBA special is that it combines theoretical knowledge with soft skills such as leadership, communication, and decision-making. The course usually lasts for two years and often includes summer internships and placement assistance.

An MBA in Finance is perfect for students who want managerial roles in banks, MNCs, or fintech companies. It offers flexibility, a broad skill set, and better access to high-paying jobs through campus placements.

6. Bachelor of Commerce (B.Com) and M.Com

B.Com and MCom are foundational finance degrees that many students choose after 12th commerce. These degrees are offered by almost every university in India and provide core education in accounting, taxation, business law, and economics.

A B.Com course generally lasts for three years, while an M.Com is a two-year postgraduate program. These courses form the base for students who want to pursue CA, CMA, or MBA later.

Students who perform well in B.Com can get jobs in banks, small businesses, and private firms’ finance departments. Though not job-oriented on their own, they offer a great base for further specialization.

7. Financial Risk Manager (FRM)

The FRM course, run by GARP (Global Association of Risk Professionals), focuses on the field of risk management. FRM helps students understand how to measure and manage financial risks. It is especially useful in banks, credit rating agencies, and regulatory bodies.

The course consists of two parts, and candidates must also complete two years of work experience in a risk profile. Topics include market risk, credit risk, operational risk, and financial models.

FRM-certified professionals often work in the risk management teams of large banks, financial institutions, and insurance companies. The course is very helpful for students who are interested in understanding complex financial systems.

8. Certified Financial Planner (CFP)

CFP is a personal finance certification offered by the Financial Planning Standards Board (FPSB). It is perfect for those who want to become wealth advisors, tax planners, or insurance consultants.

The course includes modules on financial planning, insurance, retirement, tax, and estate planning. CFP professionals help individuals plan their money for future needs like buying a house, children’s education, or retirement.

This course is growing fast in India due to increased awareness of personal finance and financial freedom. Banks, financial service companies, and fintech platforms hire CFPs for advisory roles.

9. Diploma and Certification Courses in Finance

Students who cannot commit to long-term degrees often choose short-term finance courses. These are useful for gaining job-ready skills quickly. Many institutes offer such courses, including NSE Academy, BSE Institute, NISM, and private edtech platforms.

Some popular diploma and certification programs include

- Diploma in Banking and Finance

- Certificate in Stock Market

- Certificate in Financial Modeling

- Excel for Finance Professionals

- NSE Certified Market Professional (NCCMP)

These courses are usually 3 to 12 months long and focus on one specific skill or area. They help students and working professionals improve their CVs and enter niche finance jobs.

What is a Short Term Finance Course?

Short term finance courses are practical, career-focused programs that offer core financial skills within a short duration, usually ranging from a few weeks to 6 months.

These courses cover various aspects like accounting, taxation, investment banking, financial modeling, and fintech, depending on the specialization. They are suitable for both commerce and non-commerce background students.

Key Features of Short Term Finance Courses:

- Duration: 1 week to 6 months

- Eligibility: Varies by course; 12th pass, graduates, or working professionals

- Mode: Online, offline, or hybrid

- Certifications: Offered by top colleges, institutes, and global bodies

- Outcome: Skill-based learning and industry-relevant training

Popular Course Topics Include:

- Financial Modelling & Valuation

- Investment Banking

- GST & Taxation

- Stock Market & Trading

- Corporate Finance

- FinTech & Blockchain Basics

- Personal Finance Management

- Excel for Finance Professionals

These courses offer flexibility, affordability, and career advancement in areas where there is high demand for skilled finance professionals.

Top Colleges and Institutes Offering Short Term Finance Courses

Choosing the right college or institute is essential to get quality education, faculty support, and job placement support.

Best Institutes for Short Term Finance Courses in India:

| Institute/College Name | Location | Popular Course | Duration | Mode |

| National Institute of Financial Markets (NIFM) | Delhi, Mumbai, etc. | Certificate in Financial Accounting | 2-4 months | Offline |

| BSE Institute Ltd. | Mumbai | Financial Modelling & Investment | 3 months | Hybrid |

| IMS Proschool | Multiple cities | Financial Modelling | 3-6 months | Both |

| NSE Academy | Pan India | Stock Market & Derivatives Course | 1-3 months | Online |

| EduPristine | Online/Offline | Financial Modelling and Valuation | 5 months | Hybrid |

| Indian Institute of Management (IIMs) | Various | Executive Finance Programs | 3-6 months | Online |

| The Wallstreet School | Delhi NCR | Investment Banking Certification | 6 weeks – 2 months | Offline |

| NIIT | All India | Accounting with Tally & GST | 1-2 months | Online |

Key Points for Indian Students:

- No entrance exam is needed for most short term finance courses.

- These are open to students from any stream, preferably with basic maths or commerce knowledge.

- Institutes like IIMs or top private colleges may require work experience or graduation.

- Many programs are weekend or evening classes, perfect for working professionals.

Short Term Finance Course Fees in India

Understanding course fees is crucial for planning. Course costs vary by institution, content, and delivery method.

Average Fee Structure:

| Course Type | Average Fees (INR) |

| Basic Certificate (1-2 weeks) | ₹5,000 – ₹15,000 |

| Professional Certificate (1-3 months) | ₹20,000 – ₹60,000 |

| Advanced Certificate (3-6 months) | ₹60,000 – ₹1,50,000 |

| Executive Programs (IIMs, ISB, etc.) | ₹1,50,000 – ₹3,00,000+ |

Cost Breakdown:

- Online Self-Paced Courses (Coursera, Udemy): Budget-friendly; start from ₹1,000.

- Hybrid Training with Placement Support: Slightly expensive, but offer better ROI.

- International Certifications: Costlier, but globally recognized (like CFA Level 1 prep).

Pro Tips:

- Check for EMI options, scholarships, and early bird discounts.

- Look for placement support or internship guarantees if investing ₹50,000 or more.

- Always compare course syllabus and reviews before enrolling.

Career Opportunities After Short Term Finance Course

Short term courses can lead to entry-level and mid-level roles in various financial domains. For Indian students looking for early job entry or a career switch, these courses offer the right launchpad.

Job Roles After Completing a Short Term Finance Course:

- Financial Analyst

- Equity Research Associate

- Investment Banking Analyst

- Tax Consultant

- Credit Analyst

- Risk Management Executive

- Accounts Executive

- GST Practitioner

- Budget Analyst

- Wealth Manager

Industry Sectors That Hire Finance Professionals:

- Banking & Insurance

- Mutual Funds & Stock Broking

- FinTech Startups

- Corporate Finance Departments

- NBFCs and Credit Rating Agencies

- Big 4 Consulting Firms (Deloitte, PwC, EY, KPMG)

Average Salary Packages:

| Job Role | Average Starting Salary (INR/year) |

| Financial Analyst | ₹3.5 – ₹6 LPA |

| GST Practitioner | ₹2.5 – ₹4.5 LPA |

| Investment Banker | ₹6 – ₹12 LPA (entry-level) |

| Tax Consultant | ₹3 – ₹7 LPA |

| Stock Market Trader | Variable (₹3 – ₹15 LPA or more) |

Short term finance courses help candidates bridge the gap between theoretical knowledge and industry demands, especially when paired with internships or live projects.

Best Finance Courses in India FAQs

1. Which is the best finance course after the 12th in India?

If you want a strong finance career after 12th, go for Chartered Accountancy (CA), B.Com, or Company Secretary (CS). These courses build your foundation in accounting, law, and business. You can also take up CMA if you’re interested in cost and management accounting.

2. Can I do finance courses without a commerce background?

Yes. You can take many finance courses, even if you’re from science or arts. Courses like MBA in Finance, CFA, FRM, and certification programs in banking and financial modeling do not require a commerce background. You just need to be interested and have basic math skills.

3. Which finance course gives the highest salary in India?

Courses like CFA, CA, and MBA in Finance offer high salaries, especially if you clear them from top institutes or get placed in big companies. CFA jobs in investment banking and CA roles in audit firms offer starting salaries between ₹8 to ₹25 LPA.

4. What is the difference between CA and CFA?

- CA focuses on accounting, taxation, audit, and company law. It is based in India.

- CFA is global and focuses on investment analysis, stock markets, portfolio management, and valuation.

Choose CA if you like accounting and legal work. Choose CFA if you like markets and investing.

5. Is an MBA in Finance better than a CFA or CA?

It depends on your career goals.

- Choose MBA Finance if you want management roles, corporate leadership, or banking jobs.

- Choose CFA if you’re focused on stock market jobs or investment banking.

- Choose CA if you’re strong in taxation, audit, and accounting.

All are good. You should decide based on your skills and what type of job you want.

6. Are short-term finance certifications useful?

Yes, short-term finance courses like stock market certification, financial modeling, and banking diplomas are very useful. They help you learn skills quickly and are good for job seekers or people who want to switch careers. They are also affordable and available online.

7. Can I do both CA and CFA together?

Yes, many students do both. But both are tough courses and need time. If you manage your schedule well, doing both CA and CFA gives you a strong profile for jobs in finance, audit, investment, and consulting.