The Braden Risk Assessment Scale was originally developed for healthcare, but its core principles are now widely applied in business to assess risks that can lead to workplace injuries, financial losses, and operational breakdowns. It helps companies reduce vulnerabilities and protect stability across departments. In commerce, risk management is a vital component of any organization’s strategy. Students learning finance, business management, or operational strategy must understand how tools like the Braden Risk Assessment Scale—though born in healthcare—are highly applicable in other industries too. Businesses can adapt this scale to identify early warning signs, assess degrees of vulnerability, and implement strategies to avoid long-term losses. By learning this, you can get a practical perspective on how structured risk analysis can protect both assets and revenue.

What is the Braden Risk Assessment Scale?

Understanding what the Braden Risk Assessment Scale means is essential before applying it to business scenarios.. This provides a foundational understanding of how assessment models like Braden can help protect business value by managing internal and external risks in advance.

Origins in Healthcare

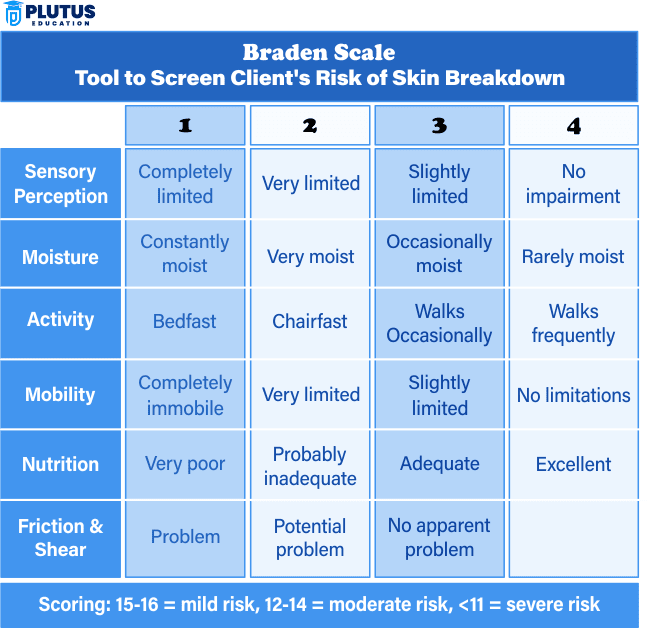

The Braden Risk Assessment Scale was developed in the 1980s by Barbara Braden and Nancy Bergstrom. Its primary purpose was to help nurses identify the risk of pressure ulcers in patients. These ulcers result from prolonged pressure on the skin due to immobility or illness. The scale categorizes risk based on six specific factors: sensory perception, moisture, activity, mobility, nutrition, and friction/shear. Each factor is scored, and the total score identifies whether a patient is at low, moderate, or high risk.

Healthcare settings use this data to guide care planning, allocate resources, and apply preventive strategies like patient repositioning or specialized bedding. The tool has proven highly effective in reducing patient complications and saving treatment costs. Its structured approach to identifying and responding to risk is what makes it adaptable across industries beyond healthcare.

Adaptation for Business Use

In business, the core concept of risk assessment remains the same: identify vulnerabilities before they cause harm. Companies have adapted the Braden framework by mapping its six categories to business-specific risks. For example, “sensory perception” in healthcare becomes “awareness and monitoring systems” in business, measuring how quickly teams can detect and respond to issues.

By giving each department or process a score across relevant categories, businesses can determine overall exposure to operational disruptions, legal risks, or financial instability. Like in healthcare, lower scores indicate higher risk and call for immediate intervention. This systematic process helps business leaders shift from reactive to proactive management, significantly reducing costs over time.

Braden Scale Meaning in Business Context

In a business context, the Braden Scale represents a method of structured risk scoring. It turns qualitative assessments (like “this area feels risky”) into quantifiable data that leaders can act on. This allows better prioritization of budget, training, and strategic focus.

For instance, if a logistics department scores low on “mobility” (adaptability), it may be at risk during market disruptions. Management can then invest in flexible vendor contracts or automation tools. In this way, the Braden Scale not only prevents problems but guides efficient resource allocation.

The scale is especially valuable in large organizations with complex operations, as it provides a standardized language for identifying and managing diverse risk types.

Why Businesses Use Braden Risk Assessment Scale

Understanding why businesses use the Braden Risk Assessment Scale gives commerce students a broader view of risk management. This section explores the scale’s application in finance, planning, and operations. It highlights how proactive assessment leads to better decision-making, cost savings, and strategic resilience. By connecting these insights to real-world business functions, students can understand how to minimize threats and maximize stability.

Early Detection Prevents Bigger Losses

- Identify root problems before they grow: The Braden Scale approach allows managers to flag vulnerabilities early, such as system failures or compliance gaps. Early warnings help avoid severe consequences that cost more to fix later.

- Less reactive, more strategic: When businesses rely on Braden-like models, they shift from crisis response to preventive action. This approach ensures that solutions are not just fast but well-planned and cost-effective.

- Lower operational disruption: Timely identification of risks prevents process breakdowns that can halt production or service delivery. This saves revenue and maintains business continuity.

- Smoother audits and inspections: Companies that assess risks regularly are better prepared for audits and compliance checks. This reduces the risk of penalties or license suspension.

- Reduces employee downtime: Preventing workplace hazards ensures fewer injuries and absenteeism, helping HR teams manage manpower effectively and save on recruitment or compensation costs.

Helps Financial Planning and Budget Allocation

- Improved fund allocation: Risk-scoring data helps finance teams decide which departments need more resources. For example, a high-risk IT department may receive funds for cybersecurity tools.

- Cost forecasting becomes accurate: By knowing where risks lie, financial planners can predict cost spikes and set aside emergency funds accordingly.

- Increases return on preventive investments: Spending money on prevention offers high returns, especially when compared to loss recovery expenses.

- Reduces wastage of capital: Investments are only made where risk levels justify the cost. This prevents unnecessary spending on low-impact areas.

- Supports loan and funding decisions: Businesses with strong risk control systems are more likely to receive credit from banks, as they show lower financial uncertainty.

Ensures Operational Continuity

- Improves supply chain resilience: Businesses that use risk scoring can spot weak links in their vendor chains. They can then renegotiate contracts or seek backup options.

- Keeps teams aligned with contingency plans: Risk scores can guide SOPs during crises, helping employees act quickly and correctly.

- Protects customer relationships: Avoiding service disruptions builds trust with clients and ensures long-term contracts remain intact.

- Minimizes compliance violations: By regularly scoring legal and safety risks, companies avoid expensive lawsuits or regulatory action.

- Promotes agile decision-making: With risk data at hand, managers can shift strategies on short notice without losing control over operations.

Enhances Workplace Safety

- Reduces accident rates: Identifying risk-prone departments helps in redesigning workflows or buying protective gear.

- Encourages staff feedback: Employees who see risk management in action are more likely to report problems, strengthening internal controls.

- Supports training programs: Risk assessments reveal knowledge gaps, enabling HR to design effective upskilling modules.

- Improves insurance coverage: Safer workplaces attract lower insurance premiums, saving money in the long run.

- Builds employer branding: Companies known for workplace safety attract top talent and retain experienced staff.

Adapting Braden’s Six Components to Business Risk Models

In business, structured risk assessment tools help managers anticipate problems before they grow into crises. While the Braden Risk Assessment Scale was originally designed for the healthcare sector, its six components are surprisingly versatile. Each component can be adapted to represent a specific operational or financial risk faced by businesses.The six Braden components—Sensory Perception, Moisture, Activity, Mobility, Nutrition, and Friction & Shear—can represent things like system awareness, environmental exposure, team productivity, business agility, resource strength, and internal conflict in the corporate world. This section explores how each factor, when adapted thoughtfully, becomes a powerful risk indicator in sectors like manufacturing, IT, finance, and logistics. These mappings offer both a diagnostic framework and a quantitative scoring model for businesses to follow.

Let’s look at each Braden component and understand its business equivalent, including how it influences organizational performance and financial health.

1. Sensory Perception → Business Monitoring & Alertness

This factor refers to the ability of a business to detect early warning signs of operational issues, compliance risks, or external market shifts. In healthcare, low sensory perception increases the risk of pressure injuries. In business, poor monitoring systems increase the risk of undetected errors.

- Example: A company that lacks regular performance dashboards, audit reports, or automated alerts may not detect workflow failures or cost overruns early.

- Financial Impact: Weak business awareness can lead to delayed responses, higher downtime, and long-term financial losses.

- Risk Level: High if the company is heavily dependent on manual tracking or has outdated systems.

- Score Guidance: 1 = No alerts/system blind, 4 = Fully automated with real-time analysis.

- Action Plan: Invest in business intelligence tools and KPI dashboards to improve awareness.

2. Moisture → Environmental & Market Exposure

In clinical terms, moisture represents skin exposure to harmful conditions. In business, it translates to the degree of vulnerability a company has to external factors like economic downturns, raw material price volatility, political instability, or competitor movements.

- Example: An import-export business highly exposed to currency fluctuations or a food business exposed to weather cycles faces high “moisture” risk.

- Financial Impact: High exposure to external risk without hedging can lead to sudden revenue drops and investor panic.

- Risk Level: High for businesses without buffers like insurance, futures contracts, or diversification.

- Score Guidance: 1 = Highly exposed with no mitigation, 4 = Fully hedged or diversified.

- Action Plan: Conduct PESTEL analysis and build contingency plans to mitigate environmental threats.

3. Activity → Workforce Engagement & Output

In the Braden model, activity measures a patient’s mobility and physical movement. In business, it corresponds to employee engagement, team output, and project activity levels. A stagnant workforce is a silent operational risk.

- Example: A call center team handling half the expected tickets or a sales team that misses field visits regularly.

- Financial Impact: Poor employee activity leads to productivity gaps, customer dissatisfaction, and eventually lower revenue.

- Risk Level: High in companies with low employee motivation or poor work tracking systems.

- Score Guidance: 1 = Minimal activity/output, 4 = Fully engaged and productive team.

- Action Plan: Implement team productivity tools, regular performance reviews, and employee wellness programs.

4. Mobility → Organizational Flexibility & Adaptability

In healthcare, mobility means a patient’s ability to change body position. In business, it signifies how quickly and effectively an organization can adapt to change, such as shifting customer preferences, technological evolution, or compliance laws.

- Example: A traditional retail store that cannot transition to e-commerce despite declining foot traffic shows poor mobility.

- Financial Impact: Rigid businesses risk becoming obsolete or losing market share during transitions.

- Risk Level: High if decision-making is slow, systems are outdated, or the organization resists change.

- Score Guidance: 1 = Highly rigid structure, 4 = Agile, tech-integrated, and innovation-driven.

- Action Plan: Foster an agile culture with adaptable SOPs, cross-functional teams, and innovation training.

5. Nutrition → Capital & Resource Strength

Just like human nutrition provides the energy to heal and function, in business, this component reflects how well-resourced or financially nourished a company or department is. This includes cash reserves, tools, manpower, and technological support.

- Example: A factory with old machinery and overworked staff or a startup with insufficient working capital faces high “nutrition” risk.

- Financial Impact: Lack of resources leads to burnout, operational errors, and project delays.

- Risk Level: High in underfunded, bootstrapped, or understaffed organizations.

- Score Guidance: 1 = Severely under-resourced, 4 = Sufficient resources and backup capacity.

- Action Plan: Secure funding, improve asset acquisition plans, and maintain a resource inventory.

6. Friction & Shear → Internal Conflict & Workflow Breakdown

Friction in healthcare refers to mechanical skin damage due to sliding. In business, it reflects conflicts between departments, lack of alignment, poor communication, or resistance to collaboration—all leading to efficiency losses.

- Example: Marketing and sales blaming each other for low performance or logistics and procurement not syncing data.

- Financial Impact: Internal friction causes decision delays, poor customer service, and reduced productivity.

- Risk Level: High in siloed organizations without cross-functional communication.

- Score Guidance: 1 = Regular conflicts and misalignment, 4 = Strong coordination and team spirit.

- Action Plan: Implement conflict resolution mechanisms, cross-team projects, and leadership alignment training.

Braden Risk Assessment Scale FAQs

1. What is the Braden Risk Assessment Scale in a business context?

Originally used in healthcare to prevent pressure ulcers, the Braden Risk Assessment Scale is now adapted by businesses to measure vulnerability in different areas like employee productivity, market exposure, system reliability, and internal operations. It helps organizations predict, prevent, and manage operational or financial risks proactively.

2. How does the Braden Scale help in risk management for companies?

The Braden Scale uses a score-based system to evaluate different risk categories. When applied to business, it helps companies assign values to internal and external threats. This structured assessment allows leadership teams to take preventive steps, improve budgeting, reduce disruptions, and ensure long-term financial stability.

3. Can the Braden Scale be used in non-health sectors like banking or retail?

Yes, absolutely. Banking institutions use Braden-style models to detect operational and fraud risk. Similarly, retail chains assess supply chain and customer service risks. Any business that wants to improve operational efficiency or reduce losses can adapt the scale to suit its risk categories.

4. Why should commerce students learn about the Braden Risk Assessment Scale?

Commerce students studying subjects like financial management, strategic planning, and risk assessment benefit greatly from understanding how structured models like Braden work. It offers real-world application in budgeting, forecasting, and enterprise risk control. Learning this gives students a competitive edge in interviews and internships.

5. How does Braden scoring improve budgeting accuracy?

By identifying risk-prone departments or processes, managers can allocate funds more effectively. For example, if a warehouse has high risk due to poor mobility (infrastructure), the budget can include preventive maintenance. This approach reduces emergency costs and improves return on investment (ROI) in operations.