The learning and practical knowledge of business risk and financial risk are core considerations for any student, entrepreneur, or professional who aims to involved in the financial and business sectors. The core of the topic can be found in their definitions and the way they affect the company. Business risk as well as financial risk are two types of risks that each business and the non-profit confront. Business risk is the result of internal and external operations of the organization. Crisis, on the other hand, occurs as a result of a company’s open working capital changes, which impacts its financial performance. In a country such as India that is seeing a good number of startups with many small businesses mushrooming day by day, it pays a lot of emphasis on these materials for their ability of survival and growth.

Business risk is a factor that affects a company’s operation and how it earns its money. Financial risk, meanwhile, refers to the company’s means of using money to perform and or pay off loans. A company that is in a position where it is facing the two risks at the same time finds it a bit problematic in that management can even crash. Knowing the differences between and applying the measures for both threats wisely can be the factor that will lead to success, even at the times of the most critical circumstances.

Difference Between Financial Risk and Business Risk

Business risk and financial risk have various differences. The principal one lies within their origin. Business risk deals primarily with the day-to-day operations of the company and depends on how management buys and sells its goods and services. Financial risk deals mainly with how management handles matters of finance, including loans, interest payments, investments, and liquidity. Whereas business risk can exist without any debt, financial risk only emerges when there is borrowing or poor cash administration.

Another contrast involves how they impact profits. Business risk directly influences operating earnings. This means the income a business produces from its core functions prior to paying any interest or taxes. Financial risk affects net income. Namely, the profit leftover after disbursing interest on borrowed funds. Therefore, even if operations run smoothly, excessive financial risk can decrease earnings.

Control is also a major disparity. Business risk proves harder to govern. It involves elements like marketplace demand, customer needs, competition, inflation, and even natural disasters. However, financial risk can be managed through good planning decisions. A corporation can choose on how much debt to take on, where to invest, or how to manage cash flows.

| Feature | Business Risk | Financial Risk |

| Source | Operational activities | Financial activities |

| Can exist without debt | Yes | No |

| Impact on Profit | Operating profit | Net profit |

| Control Difficulty | Harder to control | Easier with planning |

| Common Causes | Market demand, poor decisions | Debt, interest rates, liquidity issues |

| Risk Example | Low sales, rising costs | High loan EMIs, investment losses |

Both businessmen and students need to explore risks individually. This is how they decide on better long-term plans. Business organizations can only be conscious of the nature and distinction of each event of the risk encounter and hence avoid inappropriately blending them and thus envisage better outcomes.

What is Financial Risk?

Financial risk poses a grave threat to any business as unexpected events can quickly unravel careful strategies. Over-dependence on borrowing or poor investment choices leaves little margin for error, ready to be exposed by shifts beyond control. At its core, utilizing funds from external backers like loans and investments without adequate plans for repayment or returns breeds instability.

Eager to scale at pace, a number of enterprises take bank or investor debts, gambling on profits enough to repay mounting obligations. Underperformance in revenue attached to given timelines unravels a high-pressure situation, squeezing out any earnings that could have accrued to owners. In grimmer encounters, this involves divesting assets to repay mounting deficits, something that business owners will try their utmost to avoid. This situation justifies the greatest attention toward financial risk.

In India, major enterprises are essentially powered by bank loans. Therefore, righteous risk management becomes essential. A solitary miscalculation in preparation can start a downward spiral impossible to recover from or arrest. For instance, a factory acquiring machinery through loans may find demand wilting against unforeseen market changes, curtailing income relied on to fulfill expanding loan payments. Left unaddressed, such issues compound into substantial losses jeopardizing continued operations.

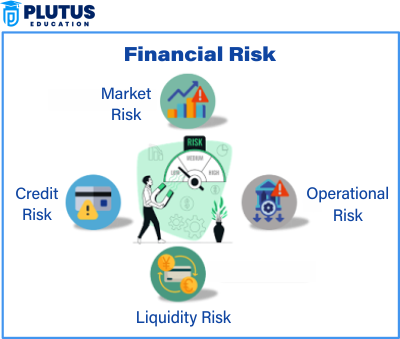

There are different types of financial risks:

- Lending Risk: Default risk arises when businesses sell products or services to their customers on credit. In some cases these consumers may owe an organization a lot of money without having paid for the goods or services received earlier. The fall in the payments made by some of them can be very dangerous to the organization’s financial status.

- Liquidity Risk: At times, even profitable enterprises struggle to quickly access the funds needed to pay ongoing expenses. Illiquid assets incapable of swift conversion to cash could prevent an organization from meeting payroll, settling invoices from suppliers, or fulfilling property rental obligations.

- Market Risk: Forces outside of a company’s control, such as shifts in interest rates set by central banks, rising inflation, or fluctuating foreign currency exchange values, can undermine financial planning. Global economic conditions transforming standard business calculations introduce risk.

- Operational Financial Risk: Despite employing accounting and information technology professionals, no enterprise operates without vulnerabilities. Internal mismanagement of money, system glitches disrupting bookkeeping accuracy, or employee fraud surreptitiously stealing assets endanger steady cash flows.

- Legal Risk: Involvement in litigation or regulation noncompliance exposing an organization to penalties financially punishes business operations and consumes funds originally intended for other priorities.

As financial risk can affect both small and large businesses, the latter suffer along with the former, as their capabilities to remedy the situation are lower. The knowledge of managing and decreasing security risk is a big factor for the students of business.

Examples of Financial Risk

Payment advice and bake goods financial investment speaks the same language. Rather than murmur, a more successful entrepreneur makes meaningful negotiations between him and suppliers.

- High Bank Loans amid Diminishing Demand: A prominent garment manufacturer in Delhi procures a sizable loan of Rs. 20 lakhs to expand output. However, owing to a slow retraction in the market, its sales markedly decline. Unable to realize sufficient earnings to fulfill equated monthly installments, penalties are levied and their credit rating is damaged.

- Rising interest rates hit housing hard: A housing development corporation avails itself of a variable interest loan, while the Reserve Bank of India raises rates, thus necessitating higher cash outflows on a monthly basis. This results in an increased cost on cutting profits.

- Currency fluctuations affect exporters: A well-respected handicraft exporter based in Jaipur does business with clients in America. Compensation is rendered in dollars but a strengthening rupee against the dollar constricts earnings when converted to rupees.

- Nonpayment from Insolvent Buyers: A hardware supplier furnishes materials on 90-day credit terms. Regrettably, the purchaser declares bankruptcy, failing to settle the debt. The provider must absorb the loss.

- Over-extended stock market speculation: A final dream of snappy profits from an enterprise, which invests just about one-third of its resources in the most uncertain of the stock market, comes crashing down when it finally crashes thus causing heavy losses that seem almost impossible to recover.

The financial risk impact on loans is exemplified by the above examples. It includes any financial trouble related to financial decisions such as making losses, buying goods that cost more than the money available, and getting into debt because of medical expenses. Hence, every company should take it easy with money issues and be more responsible.

Consequences of Financial Risk

Mistakes in financial risk management can come with high repercussion and catatastrophic results. The problems in finances don’t just disappear, instead they become worse over time if they are not dealt with. Although they mostly deal in profits, trouble can negatively affect the company’s name, operations, and future visions. By simply knowing the possible conseqeunces, companies can make wise financial decisions.

One major consequence is bankruptcy. If lenders take legal action, the company may lose its assets or shut down completely. In India, even large businesses like Kingfisher Airlines collapsed under the weight of poor financial planning and risk management.

Another pressing issue is damaged creditworthiness. When a company misses payments or EMIs, banks stop trusting them. It becomes tremendously difficult to secure new loans, and interest rates skyrocket for any financing approved.

Exorbitant interest costs also stem from overly ambitious borrowing. Companies burdened with towering monthly repayments find profits drained. Funds better spent on innovation and growth are instead funneled to debt settlement.

Cash flow shortfalls present another hazard. Meeting regular expenses like inventory purchase, wages, and operations demands consistent liquidity. But delays or mismanaged working capital can suddenly induce insolvency, grinding the gears of business to a halt.

Financial strain additionally imperils employee morale. When salaries are erratic or austerity measures commence, trusted talent departs, compounding complications.

Lastly, the owner and leadership suffer mentally and emotionally under pressure. Decisions made under duress often deteriorate the situation. Both operations and individuals are imperiled by precarious finances.

The effects of financial risk endure for years, marring the brand in the eyes of customers and vendors. In such dire straits, even minor issues mushroom into full-blown crises.

To circumvent these perils, businesses must treat financial risk as an urgent priority from the genesis. Strong accounting, consistent auditing and expert counsel can help maintain financial stability and avert disaster.

Steps to Manage Financial Risk

Artfully dealing with the financial side of the project becomes much more doable when carried out with the necessary seriousness. A company would have to observe a certain way of doing things every month and every quarter in order to achieve this. The financial status remains healthy if this practice is put into place. So, let us discuss the main ways financial risks can be managed very well.

- Developing a cash flow forecast is essential for any business to understand incoming and outgoing cash on a monthly basis. Carefully track revenue streams as well as all expenses to facilitate improved financial planning going forward.

- Reduce reliance on debts that do not directly enhance revenue. When loans are unavoidable, choose lower interest options or use personal funds if possible to save on interest costs.

- Establish a sizable emergency reserve to cushion unavoidable delays in payments or unexpected outlays. Such a buffer provides valuable security in times of unforeseen financial pressures.

- Diversify earnings streams to avoid overdependence on single products or clients. Consider additional service offerings or new markets to ensure steady income even if sections falter.

- Closely monitor credit terms extended to trusted clients and set clear limits. Send timely payment reminders and regularly follow up to collect amounts owed without delay.

- Constantly review spending to identify wasteful areas ripe for cuts. Search out suppliers with competitive deals to trim expenses judiciously without compromising quality.

- Acquire necessary insurance coverage for business assets, employees, and ventures to protect against losses from fires, theft, accidents or litigation.

- Consult experienced financial advisors or accountants who can track key metrics and furnish helpful recommendations to optimize finances.

What is Business Risk?

Business risk refers to the unpredictability inherent in corporate operations and market fluctuations that could jeopardize expected profits. Internally or externally triggered, risk is an omnipresent adversary that does not discriminate between highly leveraged enterprises and those with minimal liabilities. No commercial entity, regardless of scale, is invulnerable to the vulnerabilities imposed by chance and changeability.

The root of business risk lies in the pervasive lack of certainty endemic to entrepreneurial endeavors. Customers, trends, and regulations are in a state of constant flux as the marketplace evolves, demanding that organizations nimbly adapt or suffer the losses resultant from stuck-in-the-past strategies unable to respond dynamically. Even relatively minor hitches such as an equipment malfunction or an offhand online critique carry the potential to precipitously undermine the bottom line, a sobering reminder of risk’s omnipotence.

There are many types of business risk:

1. Strategic Risk: When executive leadership crafts long-term blueprints devoid of marketplace realities. For example, introducing a novel offering without cautiously surveying needs and trends.

2. Operational Risk: When daily processes break down due to human lapses, deficient preparation, or system crashes.

3. Compliance Risk: Disregarding directives, statutes, or levies from governing bodies often results in penalties and legal troubles. This leads organizations down perilous paths.

4. Reputational Risk: When an entity earns ill repute because of poor customer treatment or questionable ethics. Competitive Risk: When rivals unveil more appealing products or name lower prices and capture market share.

Across India, small enterprises confront unpredictability stemming from deficient infrastructure, abrupt policy shifts, or weak demand. Numerous shops closed amidst COVID-19 as they struggled to pivot operations rapidly enough.

Examples of Business Risk

Examples make it easy to understand business risk. Let’s look at some common ones Indian businesses face:

1. Market Demand Drop: A saree shop in Chennai sees fewer buyers due to changing fashion trends. Sales fall. The shopkeeper cannot cover rent and staff salary.

2. Poor Product Quality: A food factory in Gujarat skips quality checks to save time. The snacks cause food poisoning. The brand gets bad reviews. Sales drop.

3. Delay in Government Approval: A solar power company in Maharashtra waits 6 months for a government permit. This delays project work and creates losses.

4. Competitor Launch: A popular bakery in Mumbai opens a branch next to a local bakery. Most customers shift. The local shop’s business suffers.

5. Natural Disaster: Heavy rains damage stock in a Kolkata clothing store. The shop cannot deliver on time and loses customer trust.

Each of these cases shows that business risk can come without warning. But those who prepare in advance and take quick action recover faster.

Steps to Manage Business Risk

Managing business risk means planning before problems come. It is about knowing your weaknesses and building strength in those areas.

- Proper research must be conducted before launching any new product or service. Take time to understand customer demands, assess local market potential, and determine reasonable pricing.

- Developing a clear business plan from the start is crucial. Within the plan, establish objectives, anticipate challenges, devise solutions, and create a timeline for execution and review. Staying focused begins with a well-defined strategy.

- Consistent training helps staff perform at their best. By avoiding errors and ensuring quality standards are met, businesses weather tough times with a skilled team.

- Obey registration requirements, pay taxes promptly, and comply with regulations to steer clear of legal trouble. Safety rules exist to protect all.

- Leverage technology where possible to streamline operations. Software can efficiently manage inventory, sales records, and more. Precision and speed result.

- Monitor industry peers to learn from achievements as well as failures. Adapting innovative tactics keeps businesses ahead of the competition.

- Ask the customers what they like and dislike. Continuous improvement stems from addressing feedback.

- Foresee potential challenges and plan alternatives in advance. Backup stock, additional personnel, and alternative suppliers form a prudent safety net.

Relevance to ACCA Syllabus

The gravity of business risk and the financial risk is being witnessed in the Financial Management (FM) and Strategic Business Leader (SBL) papers. The students are gauged for their capability to recognize, evaluate, and control these risks in the actual business scenario. Knowing these hazards is the basis for a strong financial plan, decision-making and risk mitigation strategies, which are crucial for both exams and the professional employment process.

Business Risk and Financial Risk ACCA Questions

Q1: What is the main source of business risk?

A) Changes in tax laws

B) Poor investment decisions

C) Operational uncertainty

D) Loan default

Answer: C) Operational uncertainty

Q2: Which of the following best describes financial risk?

A) Risk of products being returned

B) Risk of not being able to repay debt

C) Risk of business operations being disrupted

D) Risk from losing employees

Answer: B) Risk of not being able to repay debt

Q3: In financial risk management, which of the following tools is commonly used to reduce currency risk?

A) Product diversification

B) Hedging using forward contracts

C) Outsourcing

D) Leasing equipment

Answer: B) Hedging using forward contracts

Q4: Which ratio best helps in assessing financial risk related to debt?

A) Gross profit margin

B) Current ratio

C) Debt-to-equity ratio

D) Inventory turnover

Answer: C) Debt-to-equity ratio

Q5: High financial risk usually leads to:

A) More sales

B) Higher profits without risk

C) Higher cost of capital

D) Better customer feedback

Answer: C) Higher cost of capital

Relevance to US CMA Syllabus

Being a subject in Part 2 – Strategic Financial Management, financial risk, capital structure, and enterprise risk management (ERM) are the core knowledge of CMA examining future business executives. For example, understanding a business and financial risk, this enables the candidate to evaluate the influence of strategic decisions on the profitability and the long-term sustainability of the company.

Business Risk and Financial Risk CMA Questions

Q1: What type of risk arises when a company uses more debt in its capital structure?

A) Operational risk

B) Business risk

C) Financial risk

D) Compliance risk

Answer: C) Financial risk

Q2: Which of the following increases business risk?

A) Stable demand

B) Variable production costs

C) Lower interest rates

D) More equity financing

Answer: B) Variable production costs

Q3: Enterprise Risk Management (ERM) primarily aims to:

A) Boost short-term profits

B) Eliminate all business risks

C) Identify and manage all types of risk

D) Reduce marketing expenses

Answer: C) Identify and manage all types of risk

Q4: A company with high operating leverage is more exposed to:

A) Liquidity risk

B) Currency risk

C) Business risk

D) Political risk

Answer: C) Business risk

Q5: Which of the following is a common financial risk faced by manufacturers?

A) Bad product design

B) Machinery breakdown

C) Interest rate fluctuations

D) Labor unrest

Answer: C) Interest rate fluctuations

Relevance to US CPA Syllabus

BEC (Business Environment and Concepts) and AUD (Auditing) sections of the CPA syllabus are centered on mastery of subjects such as internal control, risk management, and financial reporting. During audit reliability, business and financial risk must be thoroughly comprehended by ethical and sound decision makers.

Business Risk and Financial Risk CPA Questions

Q1: Business risk is best defined as the risk that:

A) Financial statements are misstated

B) A company fails to meet its debt obligations

C) A company fails to achieve operational goals

D) Taxes are underpaid

Answer: C) A company fails to achieve operational goals

Q2: What is the auditor’s concern regarding financial risk?

A) That the company sells too many products

B) That liabilities may be understated

C) That debt affects financial statement reliability

D) That the client uses too little debt

Answer: C) That debt affects financial statement reliability

Q3: Which risk affects the audit plan directly?

A) Strategic risk

B) Financial reporting risk

C) Business continuity risk

D) Customer service risk

Answer: B) Financial reporting risk

Q4: In risk assessment, which type of risk is increased when the company has high fixed costs?

A) Credit risk

B) Business risk

C) Inflation risk

D) Legal risk

Answer: B) Business risk

Q5: Which of the following is a financial risk indicator in audit engagements?

A) Low profit margins

B) Employee satisfaction

C) High working capital

D) Unpaid taxes

Answer: A) Low profit margins

Relevance to CFA Syllabus

The CFA curriculum contains a wide range of topics and subjects to a great extent, (in the Variants of I and II in particular) some of these are in the area of operational risk management, corporate finance, and portfolio management. Candidates must learn every detail about the Qualitative and Quantitative parts of financial and business risks, and how those are going to be the firms’ values and investors’ returns.

Business Risk and Financial Risk CFA Questions

Q1: Which financial ratio best indicates financial risk to equity investors?

A) Quick ratio

B) Return on assets

C) Interest coverage ratio

D) Days sales outstanding

Answer: C) Interest coverage ratio

Q2: Which is a component of business risk in the CAPM model context?

A) Market risk premium

B) Beta

C) Unsystematic risk

D) Financial leverage

Answer: C) Unsystematic risk

Q3: Which type of risk is reduced through diversification?

A) Systematic risk

B) Interest rate risk

C) Unsystematic business risk

D) Sovereign risk

Answer: C) Unsystematic business risk

Q4: Financial risk increases with an increase in:

A) Inventory turnover

B) Leverage

C) Asset turnover

D) Return on equity

Answer: B) Leverage

Q5: In capital budgeting, a project’s financial risk is considered through:

A) Dividend policy

B) Payback period

C) Cost of capital

D) Inflation indexing

Answer: C) Cost of capital