Chartered Accountancy is one of the most popular professional courses in India. The second level of this journey is called CA Inter. It is short for Chartered Accountancy Intermediate. You must pass the CA Foundation to move to this level. The CA Inter exam tests your skills in accounting, law, tax, audit and finance. Students often ask, what is CA Inter? CA Inter is the second step of the CA course that prepares students to become professionals in accounting and finance. It builds a strong base for the final CA level.CA Inter is tough but not impossible. It needs smart planning, discipline, and daily revision. This exam helps students get ready for real-life accounting and auditing work. Students who wish to become Chartered Accountants must take CA Inter seriously. The syllabus covers practical and theory subjects. Many Indian students join coaching or online classes to prepare well. ICAI conducts the CA Inter exams twice every year.

CA Inter Eligibility Criteria

To appear for CA Inter, students must follow the rules set by ICAI. These rules help ensure that only prepared candidates appear for this level. Knowing the eligibility helps avoid mistakes during registration.

Who can apply for CA Inter?

ICAI allows two paths to enter CA Inter:

1. Foundation Route

This is the most common way. You can apply if:

- You passed the CA Foundation exam.

- You registered for CA Inter at least 8 months before the exam month.

2. Direct Entry Route

Graduates and postgraduates can apply directly without the CA Foundation. Conditions are:

- Commerce graduates need 55% marks.

- Other graduates need 60% marks.

- You must also register for practical training after clearing ICITSS.

CA Inter eligibility also includes ICITSS (a soft skill and IT training course). You must complete this before articleship training.

Many Indian students take the Foundation Route. But working professionals or commerce graduates mostly choose the Direct Entry Route.

CA Inter Syllabus and Subjects

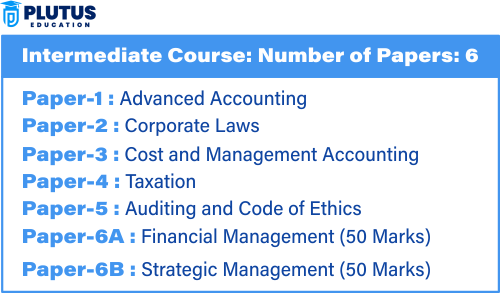

CA Inter syllabus is vast and covers practical and theory-based subjects. ICAI recently revised the syllabus and now there are 6 papers. You must clear all papers to complete this level.

Group I Subjects

- Advanced Accounting

- Corporate and Other Laws

- Taxation

Group II Subjects

- Cost and Management Accounting

- Auditing and Code of Ethics

- Financial Management and Strategic Management

Each paper is of 100 marks. You must score at least 40 marks in each paper and 50% overall to pass a group.

CA Inter new syllabus (from 2024 onwards) includes ethical practices and practical case-based questions. This helps you think like a professional.

Tips for syllabus preparation:

- Study all modules provided by ICAI.

- Revise daily.

- Solve mock tests.

- Focus more on practical topics like accounting and taxation.

Students often search for “CA Inter subjects with marks”. Here is a table to help:

| Group | Subject | Marks |

| I | Advanced Accounting | 100 |

| I | Corporate and Other Laws | 100 |

| I | Taxation | 100 |

| II | Cost and Management Accounting | 100 |

| II | Auditing and Code of Ethics | 100 |

| II | Financial & Strategic Management | 100 |

CA Inter Registration and Fees

Knowing how to register and fee details is important. Many students miss deadlines or face errors during online form filling.

How to register for CA Inter?

- Go to ICAI official website (icai.org).

- Click on Self Service Portal.

- Fill the registration form.

- Upload required documents.

- Pay registration fees.

CA Inter fees structure (as of 2025):

| Particulars | Indian Students | Foreign Students |

| Registration (Both Groups) | INR 18,000 | USD 1,000 |

| Registration (Single Group) | INR 13,000 | USD 600 |

| Student Journal (Optional) | INR 200 | USD 20 |

The fees may change. Always check ICAI’s website before payment.

Once registered, ICAI sends you study material to your address. You can also download PDF versions.

CA Inter Exam Pattern and Duration

Understanding the exam pattern helps you plan better. It tells you how the paper looks, number of questions, and time to complete.

CA Inter paper pattern:

- Each paper carries 100 marks.

- Time per paper is 3 hours.

- Some papers have 30% MCQ-based questions.

- No negative marking for MCQs.

Marking System:

- You must score 40% per subject.

- You must score 50% in total for the group.

- If you fail one paper, you must reappear in that group.

CA Inter exam happens in May and November every year. ICAI releases the CA Inter exam date and timetable a few months before. You can download the admit card from the portal.

Many students ask, “How many attempts are there in CA Inter?” ICAI allows unlimited attempts within 8 years from registration. But students must revalidate registration after 4 years.

How to Prepare for CA Inter Exam

Preparation is the key to success in CA Inter. You must plan early and revise daily.

Tips to crack CA Inter in first attempt:

- Make a study plan for all subjects.

- Focus more on practical subjects like accounting and tax.

- Revise the syllabus multiple times.

- Solve past year papers and mock tests.

- Join good coaching or online classes.

Many toppers follow the “3-time revision rule”. They revise the whole syllabus at least three times. This helps them score well.

Also, use the ICAI module and RTPs (Revision Test Papers). They are very useful. Stick to limited sources for better focus.

Best time to study:

- Early morning is best for theory subjects.

- Afternoon is good for practical subjects.

- Take short breaks between study sessions.

CA Inter exam preparation needs strong time management and daily practice. Always stay positive.

Mistakes to Avoid in CA Inter

Many students work hard but still fail. This happens due to some common mistakes.

Common errors CA Inter students make:

- Ignoring ICAI material.

- Not solving mock tests.

- Studying only theory and skipping practical parts.

- Not revising daily.

- Procrastinating till last month.

How to avoid these mistakes:

- Follow a daily routine.

- Use only ICAI sources and 1-2 reference books.

- Solve at least 3 past papers per subject.

- Join a test series.

Avoiding these mistakes can boost your score. Also, stay away from social media distractions. Use the phone only during breaks.

CA Inter FAQs

Q1. What is the full form of CA Inter?

CA Inter means Chartered Accountancy Intermediate. It is the second level in the CA course.

Q2. Can I skip CA Foundation and directly apply for CA Inter?

Yes, through Direct Entry Route. You must be a graduate with required marks.

Q3. How many subjects are there in CA Inter?

There are 6 subjects in total. ICAI divided them into 2 groups.

Q4. How long is CA Inter valid?

CA Inter registration is valid for 4 years. You can revalidate for another 4 years.

Q5. Is CA Inter tough to pass?

Yes, but with smart study and revision, you can pass it.