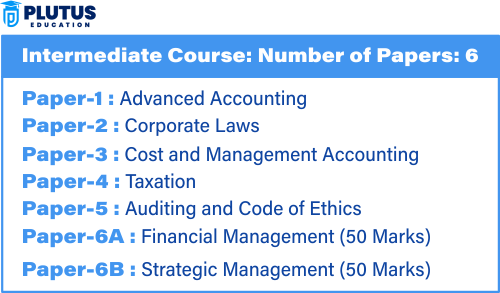

The CA Inter syllabus forms a very crucial part of the Chartered Accountancy course, encompassing the concepts of accounting, taxation, and financial management, among others. The syllabus has two groups, comprising a total of 8 papers written to ascertain the theoretical knowledge of the candidate and the practical application skills. Whether you are preparing for the CA Inter new syllabus or want to know the updates in the new CA Inter Group 1 subjects new syllabus and CA Inter Group 2 subjects new syllabus, this article will break down each paper in detail.

CA Inter Syllabus

The CA Inter syllabus has been designed by ICAI to prepare the students for the advanced concepts of commerce, business, and accountancy. This course bridges the gap between the foundational CA course and the final stage of becoming a Chartered Accountant. The CA Inter syllabus consists of two groups: Group I and Group II, comprising four papers in each group. Students can appear for either of the groups or both at one time.

The CA Intermediate syllabus follows practical learning, which gets regularly updated to include the latest accounting standards, taxation laws, and auditing practices. In this way, students will be adequately prepared to face practical scenarios that they will encounter in their professional careers.

| CA Intermediate Syllabus | |

| Group I | Group II |

| Paper – 1: Advanced Accounting | Paper – 4: Cost and Management Accounting |

| Paper – 2: Corporate and Other Laws | Paper – 5: Auditing and Ethics |

| Paper – 3: TaxationSection A: Income Tax LawSection B: Goods & Services Tax | Paper – 6: Financial Management & Ethics ManagementSection A: Financial ManagementSection B: Ethics Management |

CA Intermediate Syllabus Group I: Paper

CA Intermediate Syllabus Paper 1: Advanced Accounting-New Scheme of Education and Training Chapter-wise coverage applicable for incoming exams covered under this paper. There are a total of 15 chapters in this paper.

| CA Intermediate Syllabus 2025 for Advanced Accounting | |

| Chapter No. | Chapter Name |

| Chapter 1 | Introduction to Accounting Standards |

| Chapter 2 | Framework for Preparation and Presentation of Financial Statements |

| Chapter 3 | Applicability of Accounting Standards |

| Chapter 4 | Presentation & Disclosures Based Accounting Standards |

| Chapter 5 | Assets Based Accounting Standards |

| Chapter 6 | Liabilities Based Accounting Standards |

| Chapter 7 | Accounting Standards Based on Items Impacting Financial Statement |

| Chapter 8 | Revenue Based Accounting Standards |

| Chapter 9 | Other Accounting Standards |

| Chapter 10 | Accounting Standards for Consolidated Financial Statement |

| Chapter 11 | Financial Statements of Companies |

| Chapter 12 | Buyback of Securities |

| Chapter 13 | Amalgamation of Companies |

| Chapter 14 | Accounting for Reconstruction of Companies |

| Chapter 15 | Accounting for Branches including Foreign Branches |

CA Intermediate Syllabus Group I: Paper-2

The syllabus of CA Inter Paper 2: Corporate and Other Laws under the New Scheme of Education and Training is divided into detailed segments in the table below. For comprehensive coverage and structured learning, this study material is split into three modules.

| CA Intermediate Syllabus 2025 for Corporate and Other Laws | ||

| PART I – Company Law and Limited Liability Partnership Law | ||

| Module 1 | Module 2 | Module 3 |

| Chapter 1: Preliminary | Chapter 7: Management & Administration | Chapter 12: The Limited Liability Partnership Act, 2008 |

| Chapter 2: Incorporation of Company and Matters Incidental Thereto | Chapter 8: Declaration and Payment of Dividend | _ |

| Chapter 3: Prospectus and Allotment of Securities | Chapter 9: Accounts of Companies | _ |

| Chapter 4: Share Capital and Debentures | Chapter 10: Audit and Auditors | _ |

| Chapter 5: Acceptance of Deposits by Companies | Chapter 11: Companies Incorporated Outside India | _ |

| Chapter 6: Registration of Charges | _ | _ |

| PART II – Other Laws | ||

| Chapter 1: The General Clauses Act, 1897 | Chapter 2: Interpretation of Statutes | Chapter 3: The Foreign Exchange Management Act, 1999 |

CA Intermediate Syllabus Group I: Paper-3

Paper 3 of the CA Intermediate syllabus is on Taxation. It is an independent paper and, therefore, there are two modules in this part. Please check the table given below for a detailed syllabus for CA Intermediate Paper 3: Taxation

| CA Intermediate Syllabus 2025 for Taxation | |

| Section A: Income Tax Law | |

| Module 1 | Module 2 |

| SECTION I Overview, Scenario, Crossword Puzzle Chapter 1: Basic Concepts Chapter 2: Residence and Scope of Total Income | SECTION III Overview, Scenario, Crossword Puzzle Chapter 4: Income of Other Persons included in Assessee’s Total Income Chapter 5: Aggregation of Income, Set-Off and Carry Forward of Losses Chapter 6: Deductions from Gross Total Income |

| SECTION II Overview, Scenario, Crossword Puzzle Chapter 3: Heads of Income Unit 1: Salaries Unit 2: Income from House Property Unit 3: Profits and Gains of Business or Profession Unit 4: Capital Gains Unit 5: Income from Other Sources | SECTION IV Overview, Scenario, Crossword Puzzle Chapter 7: Advance Tax, Tax Deduction at Source and Tax Collection at Source Chapter 8: Provisions for filing Return of Income and Self Assessment |

| SECTION V Overview, Scenario Chapter 9: Income Tax Liability– Computation and Optimisation | _ |

| Section B: Goods and Services Tax | |

| Module 1 | Module 2 |

| Chapter 1: GST in India – An Introduction Chapter 2: Supply under GST Chapter 3: Charge of GST Chapter 4: Place of Supply Chapter 5: Exemptions from GST Chapter 6: Time of Supply Chapter 7: Value of Supply | Chapter 8: Input Tax Credit Chapter 9: Registration Chapter 10: Tax Invoice; Credit and Debit Notes Chapter 11: Accounts and Records Chapter 12: E-Way Bill Chapter 13: Payment of Tax Chapter 14: Tax Deduction at Source and Collection of Tax at Source Chapter 15: Returns |

CA Intermediate Syllabus Group II: Paper-4

Following is the syllabus for the new education and training program’s CA Intermediate Course—Paper 4: Cost and Management Accounting: Paper 4 of the Syllabus CA Intermediate is divided into two parts. Candidates need to read the topics listed in the table to clear the CA Intermediate Exam in 2025.

| CA Intermediate Syllabus 2025 for Cost and Management Accounting | |

| Module 1 | Module 2 |

| Chapter 1: Introduction to Cost and Management Accounting | Chapter 8: Unit & Batch Costing |

| Chapter 2: Material Cost | Chapter 9: Job Costing |

| Chapter 3: Employee Cost and Direct Expenses | Chapter 10: Process & Operation Costing |

| Chapter 4: Overheads – Absorption Costing Method | Chapter 11: Joint Products and By-Products |

| Chapter 5: Activity Based Costing | Chapter 12: Service Costing |

| Chapter 6: Cost Sheet | Chapter 13: Standard Costing |

| Chapter 7: Cost Accounting Systems | Chapter 14: Marginal Costing |

| _ | Chapter 15: Budgets and Budgetary Control |

CA Intermediate Syllabus Group II: Paper-5

Below is the table showing the syllabus for the CA Intermediate Course – Paper 5: Auditing & Ethics according to the New Scheme of Education and Training. The syllabus is divided into two modules which are focused on key topics, which candidates should prepare for the CA Intermediate Exam 2025.

| CA Intermediate Syllabus 2025 for Auditing & Ethics | |

| Module 1 | Module 2 |

| Chapter 1: Nature, Objective and Scope of Audit | Chapter 6: Audit Documentation |

| Chapter 2: Audit Strategy, Audit Planning and Audit Programme | Chapter 7: Completion and Review |

| Chapter 3: Risk Assessment and Internal Control | Chapter 8: Audit Report |

| Chapter 4: Audit Evidence | Chapter 9: Special Features of Audit of Different Type of Entities |

| Chapter 5: Audit of Items of Financial Statements | Chapter 10: Audit of Banks |

| _ | Chapter 11: Ethics and Terms of Audit Engagements |

CA Intermediate Syllabus Group II: Paper-6

Below the table shows the syllabus for the CA Intermediate Course – Paper-6: Financial Management and Strategic Management – New Scheme of Education and Training. It contains two sections with two modules. These topics need to be prepared by the candidate for the exam in 2025.

| CA Intermediate Course – Paper-6: Financial Management and Strategic Management | |

| Section A – Financial Management | |

| Module 1 | Module 2 |

| Chapter 1: Scope and Objectives of Financial Management Chapter 2: Types of Financing Chapter 3: Financial Analysis and Planning – Ratio Analysis Chapter 4: Cost of Capital Chapter 5: Financing Decisions – Capital Structure Chapter 6: Financing Decisions – Leverages | Chapter 7: Investment Decisions Chapter 8: Dividend Decision Chapter 9: Management of Working Capital Unit I: Introduction to Working Capital Management Unit II: Treasury and Cash Management Unit III: Management of Inventory Unit IV: Management of Receivables Unit V: Management of Payables (Creditors) Unit VI: Financing of Working Capital |

| Section – B Strategic Management | |

| Chapter 1: Introduction to Strategic Management Chapter 2: Strategic Analysis: External Environment Chapter 3: Strategic Analysis: Internal Environment | Chapter 4: Strategic Choices Chapter 5: Strategy Implementation and Evaluation |

CA Intermediate Syllabus Paper wise Weightage

Each paper of CA Intermediate Group I and Group II comprises 100 questions. As per the new scheme, 30% of questions are MCQs, and 70% are subjective questions. Here is the sectional weightage for the exam:

| CA Intermediate Syllabus Paper wise weightage | ||

| CA Intermediate Papers | Subjective Questions Marks | Objective Questions Marks |

| Paper 1 Advance Accounting | 70 | 30 |

| Paper 2 Corporate Law | 70 | 30 |

| Paper 3 Cost and Management Accounting | 70 | 30 |

| Paper 4 Taxation | 70 | 30 |

| Paper 5 Audit and Code Ethics | 70 | 30 |

| Paper 6 Financial and Strategic Management | 35 | 15 |

CA Inter Syllabus FAQs

1. What is the CA Inter syllabus?

The 8 papers in the CA Inter syllabus, are into Group I and Group II.

2. What are the CA Inter Group 1 subjects in the new syllabus?

Accounting, Corporate and Other Laws, Cost and Management Accounting, and Taxation are all included.

3. Does the CA Inter Group 2 subjects new syllabus bring about any change?

It certainly does, as seen by its updated curriculum that covers advanced.

4. How to prepare for CA Intermediate Syllabus?

ICAI study guide, practice exams, and join the best coaching classes like Plutus Education.

5. The new syllabus of CA Inter is it applied for 2025 exams?

Yes, CA Intermediate new syllabus applicable for the 2025 exams.