The Chartered Accountancy (CA) course in India is one of the most respected professional qualifications. The journey to become a CA includes studying many topics across three levels. So, if you are wondering what CA subjects are, the answer is that these are structured topics taught in CA Foundation, CA Intermediate, and CA Final levels. Each level includes subjects that build knowledge in accounting, taxation, finance, and law. The Institute of Chartered Accountants of India (ICAI) introduced a new syllabus in 2024, which changed the subjects and structure. The new subjects match modern business needs and focus on deeper understanding, ethics, and decision-making skills. These subjects are not just for passing exams but for developing real-world problem-solving skills.

CA Foundation Subjects

The CA Foundation is the first level of the CA course. It builds a strong base for accounting and business knowledge. The subjects at this stage are simple and useful for school pass-outs. They help students understand key topics like accounting, laws, and economics.

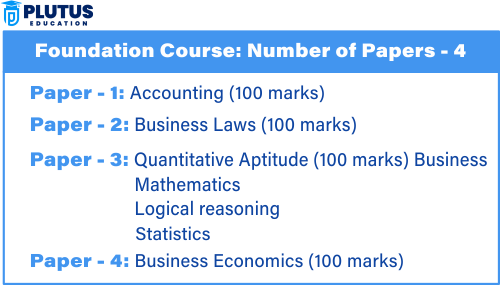

There are four papers in the CA Foundation as per the new 2024 syllabus:

| Paper | Subject Name |

| 1 | Accounting |

| 2 | Business Laws |

| 3 | Quantitative Aptitude |

| 4 | Business Economics |

Overview of Each Subject

- Accounting: This paper teaches basic principles of accounting, journal entries, ledgers, trial balance, and final accounts. It is the starting point for understanding business records.

- Business Laws: Students learn about contracts, the Sale of Goods Act, and basic company laws. It helps in knowing the legal side of doing business.

- Quantitative Aptitude: This subject includes three parts—business math, logical reasoning, and statistics. It builds calculation speed and analytical thinking.

- Business Economics: It covers basic economic principles, types of markets, demand and supply, and how businesses work in the economy.

These subjects help build a strong foundation for the next level.

CA Intermediate Subjects

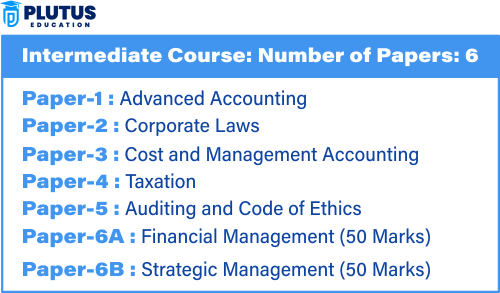

The CA Intermediate level is the second stage of the course. It helps students gain deeper knowledge in core areas like law, accounting, audit, and taxation. Students can appear for Group I and Group II exams. Each group has three subjects, making a total of six.

| Group | Paper | Subject Name |

| I | 1 | Advanced Accounting |

| 2 | Corporate and Other Laws | |

| 3 | Taxation | |

| II | 4 | Cost and Management Accounting |

| 5 | Auditing and Ethics | |

| 6 | Financial Management and Strategic Management |

What These Subjects Teach

- Advanced Accounting: This teaches company accounts, partnership accounts, and accounting standards. It prepares students for real company bookkeeping.

- Corporate and Other Laws: This subject goes deeper into company laws, LLP laws, and legal matters that affect firms.

- Taxation: Includes direct taxes (Income Tax) and indirect taxes (GST). Students learn how to calculate taxes and follow rules.

- Cost and Management Accounting: Teaches cost control, budgeting, standard costing, and decision-making using cost data.

- Auditing and Ethics: Students learn how to check company books, find errors, and follow ethics in professional practice.

- Financial Management and Strategic Management: This paper teaches financial planning, working capital, and business strategies to grow and compete.

These subjects prepare students for actual CA work in offices and firms.

CA Final Subjects

CA Final is the last and most advanced level. The subjects here need full knowledge and deep understanding. Students apply what they learned in previous levels. They must think like professionals, not just students.

There are two groups with three subjects each in the new 2024 syllabus:

| Group | Paper | Subject Name |

| I | 1 | Financial Reporting |

| 2 | Advanced Financial Management | |

| 3 | Advanced Auditing, Assurance and Professional Ethics | |

| II | 4 | Direct Tax Laws and International Taxation |

| 5 | Indirect Tax Laws | |

| 6 | Integrated Business Solutions |

What Students Learn

- Financial Reporting: Teaches preparation of company financial statements, including advanced accounting standards and corporate reporting.

- Advanced Financial Management: Covers deep finance topics like capital structure, risk analysis, and investment decisions.

- Advanced Auditing and Ethics: Teaches detailed audits of companies and ethical duties of a Chartered Accountant.

- Direct Tax Laws and International Taxation: Students learn about Indian and international tax rules, including complex calculations.

- Indirect Tax Laws: Focuses on GST and customs laws in depth. Helps students understand tax filing and compliance.

- Integrated Business Solutions: A case-study-based paper that checks overall business understanding. It uses real situations to test knowledge from all subjects.

This level transforms students into job-ready professionals.

Self-Paced Online Modules

The new syllabus also includes Self-Paced Modules. These are online papers that students can learn at their speed. They must complete these modules during their CA journey.

Four Sets of Self-Paced Modules

| Set | Module Type |

| A | Corporate and Economic Laws (Mandatory) |

| B | Strategic Cost and Performance Management (Mandatory) |

| C | Elective Modules (Choose One) |

| D | Multidisciplinary Modules (Choose One) |

- Set A and Set B are compulsory for all.

- Set C gives options like Risk Management, International Taxation.

- Set D offers modules like Digital Ecosystem, Entrepreneurship, and others.

These modules give extra learning beyond core papers. They help students grow skills in specific areas.

CA Subjects FAQs

1. What are the subjects in CA Foundation under the new syllabus?

There are four subjects: Accounting, Business Laws, Quantitative Aptitude (includes Math, Reasoning, Stats), and Business Economics.

2. How many CA subjects are there in the CA Intermediate level?

There are six subjects in total, split into two groups. Group I includes Accounting, Laws, and Taxation. Group II includes Cost Accounting, Auditing, and FM & SM.

3. What are the CA Final subjects as per the new scheme?

CA Final has six main subjects: Financial Reporting, Advanced Financial Management, Auditing and Ethics, Direct Tax, Indirect Tax, and Integrated Business Solutions.

4. What are Self-Paced Modules in CA course?

Self-Paced Modules are online papers in four sets (A, B, C, D). Sets A and B are mandatory. You can choose topics in Sets C and D based on your interests.

5. Is the new CA syllabus difficult compared to the old one?

The new syllabus focuses more on concepts and application. It removes some outdated topics and adds case-based learning. With regular study, it is manageable.