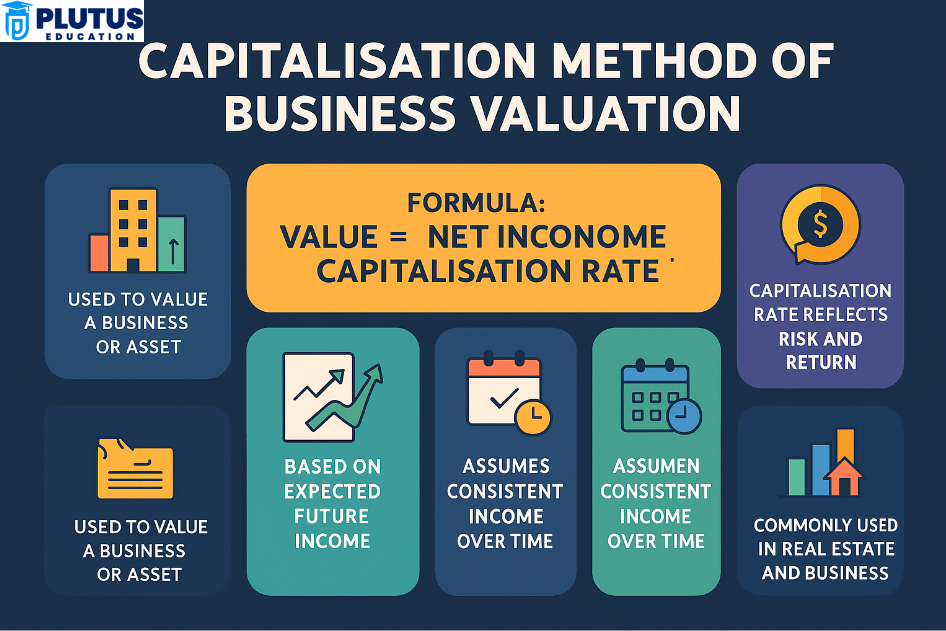

Capitalisation is one of the most widely used techniques for valuing businesses and income-generating assets. It helps estimate the present value of a company, investment, or property based on its expected future earnings. This method is commonly used in real estate, business acquisitions, and investment analysis because it gives a clear and simple valuation based on predictable income streams. By applying a capitalisation rate to net operating income or profits, investors can determine what the asset is worth today. In industries with stable income, this method remains a go-to valuation strategy.

What is the Capitalisation Method in Business Valuation?

The capitalisation method determines the value of a business by converting its anticipated future profits into present value. It assumes that the company will continue to generate a consistent income stream over time, making it ideal for firms with stable and recurring revenues. This valuation technique is based on dividing the net annual income by a capitalisation rate, which reflects the investor’s expected rate of return.

Capitalisation Formula Explained

The basic formula used in this method is:

Business Value = Net Annual Profit ÷ Capitalisation Rate

For example, if a business earns ₹10,00,000 annually and the capitalisation rate is 10%, the business value would be ₹1 Crore. This direct relationship between income and expected return makes it easy for investors to assess worth and compare opportunities.

Types of Capitalisation Method

The capitalisation profit method is a specific version of the capitalisation method where the valuation focuses on expected annual profits rather than total income. It is beneficial in evaluating operating businesses with a stable profit margin. This method uses post-tax profits and applies a suitable capitalisation rate to calculate the present business value.

Step-by-Step Approach

- Determine Net Profits: Calculate the average net profits after all expenses, taxes, and provisions.

- Choose the Capitalisation Rate: The rate is based on industry risk, return expectations, and market trends.

- Apply the Capitalisation Formula: Divide net profit by the cap rate to get the present value.

Example

A company makes ₹15,00,000 in annual profit. If the capitalisation rate is 12%, its value is:

Business Value = ₹15,00,000 ÷ 0.12 = ₹1,25,00,000

This method gives a reliable estimate of whether profits are stable and predictable.

How to Determine a Capitalisation Rate?

The capitalisation rate (or cap rate) is a crucial element in the capitalisation method. It reflects the expected return and risk of the investment. A lower cap rate indicates lower risk and results in a higher valuation, while a higher cap rate implies more risk and leads to a lower business value.

Factors That Affect Cap Rate

- Risk Profile: High-risk ventures use higher cap rates.

- Industry Standards: Each sector has a common cap rate based on stability.

- Economic Conditions: Interest rates, inflation, and market sentiment can influence cap rates.

- Growth Potential: Businesses with promising growth prospects usually have lower cap rates.

Capitalisation Rate Formula

Cap Rate = Net Operating Income ÷ Current Market Value

Example

If a property earns ₹10,00,000 and its market value is ₹1 Crore:

Cap Rate = ₹10,00,000 ÷ ₹1,00,00,000 = 10%

Choosing the correct cap rate ensures realistic and competitive valuations.

Capitalisation Method Example: Real Case Scenario

Practical Understanding Through Example

Real-world application of the capitalisation method makes its usefulness more apparent. This example explains how a stable business with consistent profits is valued.

Illustration

Suppose a small enterprise earns a steady ₹20,00,000 annually. Analysts agree on a capitalisation rate of 8% based on its industry and financial profile.

Business Value = ₹20,00,000 ÷ 0.08 = ₹2,50,00,000

This shows that the business is worth ₹2.5 Crore if investors seek an 8% return. The assumption is that income will continue at the same pace, and no major disruptions are expected. This makes capitalisation a strong tool in business sales and investment decisions.

Advantages and Drawbacks of Capitalisation Method

While powerful and widely accepted, the capitalisation method has strengths and limitations. It suits businesses with predictable profits but may not work for dynamic, growth-stage companies.

Key Advantages

- Simple and easy to apply.

- Ideal for businesses with regular earnings.

- Helps set fair market value in mergers and acquisitions.

- Recognised by investors and financial institutions.

Main Drawbacks

- Assumes consistent profits indefinitely, which may not always be true.

- Heavily dependent on an accurate capitalisation rate.

- Not suitable for startups or companies with fluctuating income.

- Ignores intangible and non-financial factors like brand value or leadership.

- Assumes no future capital reinvestment, which is rarely realistic.

Despite these issues, when used correctly, this method provides strong insights into value, especially for well-established businesses.

Capitalisation Method vs Other Valuation Methods

The capitalisation method is one of several valuation methods. It is often compared with discounted cash flow (DCF), asset-based valuation, and market multiples.

Why Choose the Capitalisation Method?

| Criteria | Capitalisation Method | DCF Method | Asset-Based Method |

| Profit Consistency | Required | Not always needed | Not needed |

| Easy to Apply | Yes | Complex | Medium |

| Best for Stable Businesses | Yes | No | Sometimes |

| Future Growth Consideration | Limited | Strong | None |

For long-standing businesses with predictable profits, the capitalisation method remains one of the most reliable and accepted methods in financial valuation.

Capitalisation Method FAQs

What is the capitalisation method in valuation?

It is a technique that calculates the present value of a business by dividing its net income by a capitalisation rate. It helps estimate what the company is worth based on future income potential.

How do you determine the capitalisation rate?

Cap rate is calculated using the formula: Net Operating Income ÷ Market Value. It also reflects industry risk and expected return on investment.

What are the drawbacks of using the capitalisation method?

It assumes constant income and ignores non-financial aspects like brand value. It is also susceptible to changes in the cap rate.

Can the capitalisation method be used for startups?

No. Since startups have irregular profits, methods like DCF or market comparables are more suitable.

Is the capitalisation method suitable for real estate valuation?

Yes, it is commonly used in real estate, where rental income is stable, making it ideal for such income-generating assets.