Cash flow analysis is an important financial tool for business persons to understand how cash flows in and out of the business. It determines whether a company has good liquidity, will be able to generate cash to pay off debts, or if it can fund its operational expenses and investments. Through such an analysis, organizations can evaluate the financial health of any business and thereby make adequate business decisions.

What Is Cash Flow Analysis?

Cash flow analysis involves reviewing inflows and outflows of cash to a business for a specified period. Such disclosure provides more vivid information on how cash is made and spent, providing insights about the sources and applications of funds. It allows tracing and understanding of the liquidity position so that cash should be adequate to meet obligations when they fall due and diagnose potential financial problems before they arise to be calamitous.

Primary Objectives of Cash Flow Analysis

- Identify Cash Generating Activities: Understand which business activities are bringing cash into the books.

- Track the Cash Outflows: Track how much money is being spent and on what.

- Determine the Liquidity Position: Ascertain that the business has adequate cash to pay off short-term liabilities.

Why Cash Flow Statement Analysis Is Important

A cash flow statement analysis is quite basic to a business since it allows the organization to gain a clear picture of its financial stability. Unlike an income statement indicating profitability, a cash flow statement only tracks cash activities and provides insights into how well a company manages its cash.

Key benefits of analyzing the cash flow statement:

- Liquidity assessment: It assists in determining whether the business has ample liquid assets to settle its short-term liabilities.

- Financial planning: Proper cash flow management helps in forecasting future financial requirements.

- Investment Decisions: Cash flow analysis guides investors in making the right decisions regarding their ability to generate returns for the company.

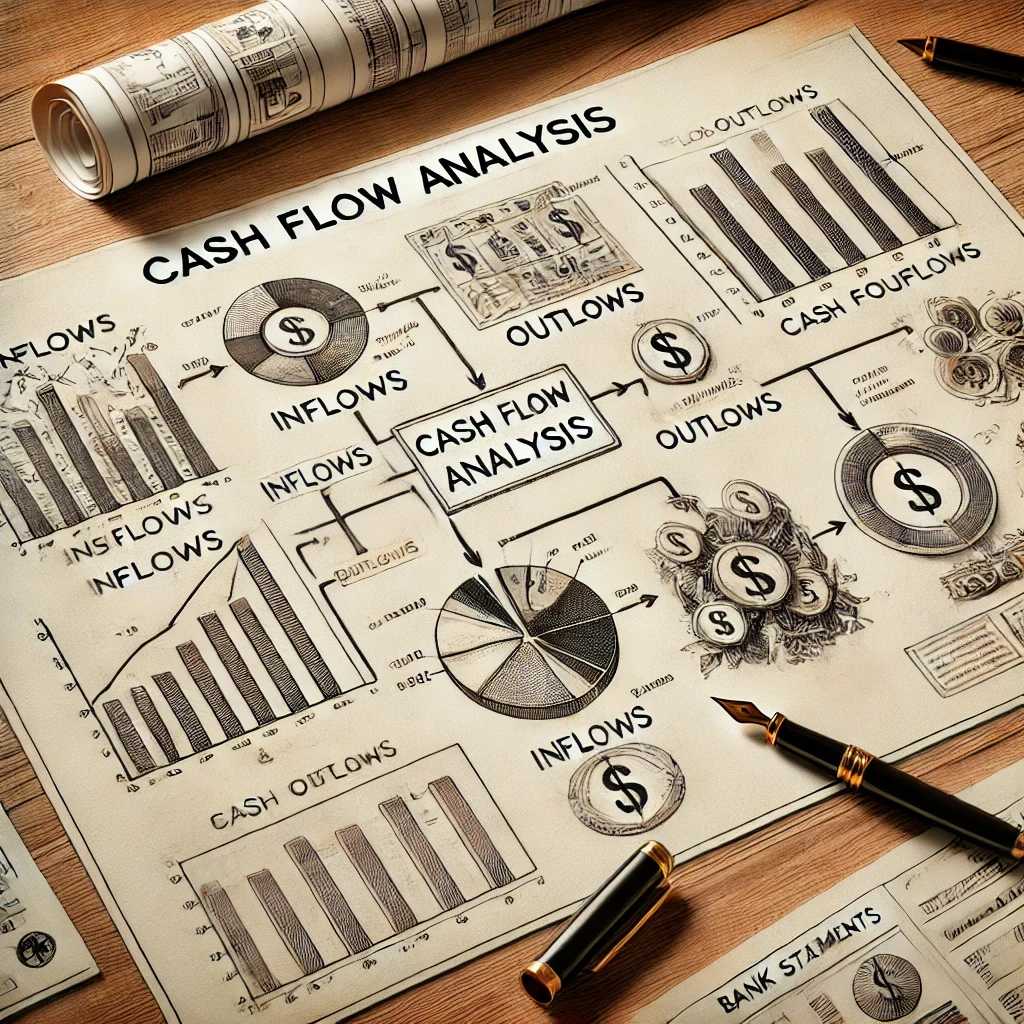

What Are the 3 Types of Cash Flows?

Understanding the three main types of cash flows is critical for an effective cash flow analysis.

- Operating Cash Flow (OCF): It shows the cash realized by the company from the core business activities. That means the company is able and capable of sustaining and expanding the business for longer periods.

- Investing Cash Flow: This implies cash flow transactions, which involve the acquisition or selling of assets such as equipment, investments, or even securities. That shows the investment strategy adopted by the company and its growth prospects.

- Financing Cash Flow: It accounts for the debt and equity and dividends paid. This cash flow illustrates the method of financing the firm’s activities and growth through borrowings or funds obtained from investors.

Preparing a Cash Flow Statement: Step-by-step

Creating a cash flow statement is a systematic process that requires a step-by-step approach to accurately capture all the cash transactions.

Step 1: Calculate Cash Flow from Operating Activities

- Prepare net income with the indirect method by making it ready to adjust against changes in working capital.

- Must include depreciation and change in accounts receivables and payables after adjustment

Step 2: Determine Cash Flow from Investing Activities

- Cash inflow for sales of assets or investments.

- Cash outflow for purchasing new assets or long-term investments.

Step 3: Assess Cash Flow from Financing Activities

- Cash inflow from issuing equity or accepting loans;

- Pay off existing loans and pay dividend cost is deducted.

Step 4: Consolidate the Cash Flow Statement

- Add all the three categories to determine how much cash flows into and out of the business;

- Analyzing the final position about cash by cash-related issues.

What Is Difference Between Fund Flow and Cash Flow Analysis?

Both fund flow analysis and cash flow analysis are used to assess the financial status of a business, but they serve different purposes.

Key Differences

- Scope: Cash flow analysis focuses on the cash movement, whereas fund flow analysis considers broader financial resources.

- Time Period: Generally, cash flow is analyzed on shorter periods, like monthly or quarterly, whereas fund flow is considered for a longer duration, for instance, yearly.

- Use: Cash flow analysis is applied for liquidity assessment and fund flow analysis to understand the financial position and how the fund has been allocated from time to time.

Conclusion

Cash flow analysis is pretty significant to be applied by businesses to manage their finances more effectively. By conducting such cash movements, the companies ensure that they keep proper liquidity to fulfill their obligations, provide strategic investment, and make proper planning for sustainable growth. Consequently, understanding and applying the principles of cash flow analysis may significantly enhance a company’s financial stability and strategy planning.

Cash Flow Analysis FAQs

What is cash flow statement analysis?

Cash flow statement analysis is the process of reviewing a company’s cash inflows and outflows to understand its liquidity, financial position, and overall cash management.

Why is cash flow more important than profit?

Cash flow is more important than profit because it directly affects a company’s ability to pay bills, manage expenses, and invest in growth. Even profitable companies can fail without proper cash flow.

How does operating cash flow differ from net income?

Operating cash flow represents the cash generated from business activities, while net income includes non-cash items and accounting adjustments that may not reflect actual cash.

What is the primary purpose of a cash flow statement?

The primary purpose of a cash flow statement is to provide insights into the company’s liquidity by detailing cash inflows and outflows from operating, investing, and financing activities.

How does cash flow analysis help in investment decisions?

Cash flow analysis helps investors assess a company’s ability to generate cash and its financial stability, making it easier to predict its potential for returns and growth.