Cash inflows represent the total amount of money coming into the organization. The financial measure is important in checking how well a company runs, whether it is liquid, and its ability to grow. A profitable business can still fail if there isn’t enough money going into the organization. This guide is detailed to understand the meaning of cash inflows, the components that makeup cash inflows, the factors influencing cash inflows, and strategies to enhance cash inflows.

What is Cash Flow?

Cash flow can be referred to as the net movement of money within a business. It is comprised of two sides: cash inflows, such as money received, and cash outflows, which are money spent. Often, cash flow is one of the most accurate gauges of financial health and whether a company’s expenses, investments, and growth are being guided properly.

Cash flow measures everything in a business, from daily operations to long-term planning, and is the extent to which a business can pay its bills on time, invest for growth, or be solvent under unfavorable financial conditions. Negative cash flow leads to liquidity problems and operational disruptions.

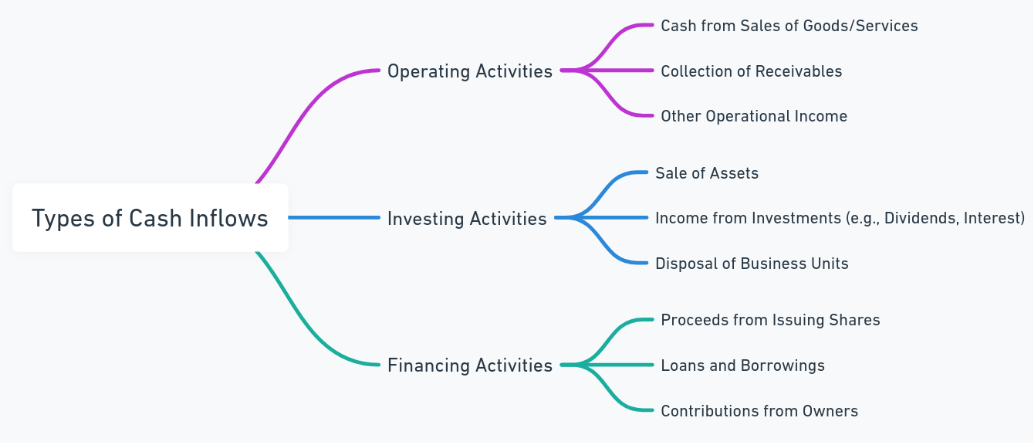

Categories of Cash Flow

- Operating Cash Flow: Generated from core business activities such as sales and services.

- Investing Cash Flow: Stemming from investments in assets or returns from such investments.

- Financing Cash Flow: Inflows and outflows related to borrowing, equity issuance, or dividends.

Each category plays a unique role in shaping the financial stability of an organization.

Cash Inflow Meaning

Cash inflow refers to the net amount of money that flows into a business within a given period. A cash inflow may be derived from different sources, among which are customer payments and investments. Cash inflows set the pace for business growth. This is because a positive cash flow defines a healthy business. When cash inflow is more than cash outflow, then the business is growing.

Cash Inflow Examples

- Revenue from Sales: The most common and sustainable form of cash inflow.

- Investment Gains: Income from dividends, interests, or selling assets.

- Borrowings: Loans or funds raised through bonds.

- Equity Funding: Proceeds from issuing shares.

Understanding the different sources of cash inflows allows businesses to strategize and optimize their financial planning effectively.

Major Contributors to Cash Inflows

Several factors contribute to the total cash inflow a business can generate. These elements are the foundation of an organization’s financial structure and its ability to sustain operations.

- Product and Service Sales: The primary and most consistent source of cash inflows.

- Efficient Accounts Receivable Management: Ensures timely collection from credit sales.

- Income from Investments: Includes dividends, interest, and capital gains.

- Financing Activities: Includes funds raised through loans, equity, or other financing instruments.

| Source | Examples | Impact |

|---|---|---|

| Product Sales | Revenue from selling goods/services | Sustains daily operations |

| Investment Returns | Dividends or stock sales | Enhances financial reserves |

| Borrowed Funds | Loans or bonds | Supports capital expenditures |

What Can Affect a Business’s Cash Flow Statement?

A cash flow statement is an account of how money flows into and out of a company, demonstrating both liquidity and financial stability. It is also considered to show the viability of a company in the long term.

Factors Impacting Cash Flow

- Seasonal Variations: Businesses with seasonal demand often experience uneven cash inflows.

- Delayed Payments: Late payments from customers or clients can disrupt cash flow.

- Economic Changes: Recessions or booms affect consumer behavior and cash inflows.

- Operational Inefficiencies: High operating costs reduce the net cash available.

- Investment Activities: Selling assets can generate cash inflows, but buying assets may reduce them.

Difference Between Cash Inflow and Cash Outflow

Understanding the distinction between cash inflow and cash outflow is essential for maintaining a balanced cash flow.

| Aspect | Cash Inflow | Cash Outflow |

|---|---|---|

| Definition | Money entering the business | Money leaving the business |

| Examples | Sales, loans, investments | Salaries, utilities, rent |

| Impact on Liquidity | Positive effect | Negative effect |

Cash inflows must be equal to the amount of funds needed to finance outflows. Persistence in imbalances between the two may lead to business instability when there are significantly more outflows as compared to inflows of cash. Protecting the balance will surely help in covering expenses and saving for growth opportunities.

How to Improve Cash Inflow

Enhancing cash inflow requires targeted strategies and effective management of revenue streams. Businesses need to focus on both increasing income and optimizing operational processes.

- Improve Receivables Management: Introduce early payment incentives or penalties for late payments.

- Increase Product or Service Sales: Launch promotional campaigns, expand into new markets, or enhance customer retention strategies.

- Optimize Inventory: Avoid overstocking and invest in inventory management tools.

- Secure External Funding: Explore loans, grants, or equity funding for immediate cash flow needs.

- Leverage Technology: Use financial software to monitor and predict cash flow trends.

Cash Inflows FAQs

What are examples of cash inflows?

Examples include sales revenue, loans, dividends, returns from investments, and proceeds from asset sales. These represent the various sources of money entering a business.

How does cash inflow impact a company’s liquidity?

Positive cash inflows enhance liquidity, ensuring a company can pay its short-term obligations, whereas negative inflows may result in cash shortages and operational challenges.

What is the difference between operating and investing cash inflows?

Operating cash inflows arise from core business activities like sales, while investing cash inflows result from the sale of assets or returns on investments.

Can seasonal variations impact cash inflows?

Yes, businesses with seasonal products or services often experience fluctuations in cash inflows, requiring careful financial planning to maintain stability throughout the year.

How can small businesses improve their cash inflows?

Small businesses can enhance cash inflows by shortening receivable cycles, offering discounts for early payments, exploring new markets, and using tools like invoice factoring.