The stock market is full of terms that can confuse beginners. One such topic is cash market vs future market. These two markets work differently, but both are important for investors. The main difference between them lies in how and when you buy or sell the asset. In the cash market, the trade happens immediately. The buyer pays the full price right away, and the seller gives the shares. But in the future market, the trade happens at a later date. Both parties agree today on a price, but the deal is completed in the future. This means the cash market vs future market topic is about the timing and agreement in trades. You buy and sell things either instantly or later with a fixed deal. This is important for every investor to know. If you want to invest for short-term gains or long-term holdings, you must understand how both markets work. These markets also involve different levels of risk, money needs, and planning.

What is Cash Market?

The cash market is also called the spot market. This is where people buy and sell stocks or assets immediately. The trade happens in real-time. The buyer pays the full money, and the seller gives the stock. Everything is settled right away or within a day or two.

The cash market is best for people who want to own the stocks fully. You can keep them for a long time or sell them when the price goes up. It is simple to use. Most people who use stock apps or online brokers in India trade in this market.

Features of Cash Market

The cash market has many features that make it easy to understand:

- Trades are done on the spot or within two days (T+2).

- Full payment is needed at the time of buying.

- You get full ownership of the stock.

- You can sell the stock anytime after buying.

- You don’t need a high-risk plan or big strategies.

In India, most students and small investors start in the cash market. They buy a few shares of big companies and hold them. They wait for the price to go up. This market is good for learning, low risk, and growing your money slowly.

Advantages of Cash Market

- You don’t need to understand complex strategies.

- You get full ownership of the shares.

- You can get dividends and voting rights.

- Less risky than the future market.

- Best for long-term investing.

Disadvantages of Cash Market

- You need to pay the full amount.

- Profits are usually slower and smaller.

- You may lose money if the stock price falls.

- Less chance to earn in falling markets.

So, the cash market is good for people who want to grow their money with less risk and don’t want to trade every day. It is simple, clear, and easy to manage.

What is the Future Market?

The future market is different from the cash market. Here, people agree to buy or sell something at a fixed price, but the trade happens in the future. This could be days, weeks, or months later. This is not for beginners. It needs planning and risk-taking.

The future market is based on contracts. These contracts are promises. They say that one person will buy, and the other will sell at a fixed price on a set date. Even if the market price changes, the contract stays the same.

Features of Future Market

- The trade happens at a future date.

- You don’t pay the full amount. You pay a margin (part of the full cost).

- You don’t get real shares until the contract ends.

- You can sell the contract before it ends.

- Used for trading or hedging (saving from losses).

In India, future trading happens in markets like NSE and BSE. Many advanced investors and traders use this to make quick profits or to protect their cash market stocks from losses.

Advantages of Future Market

- You can earn money even if the market falls.

- You can buy more with less money (due to margin).

- Big profits are possible in a short time.

- You can protect your stocks from price drops (hedging).

Disadvantages of Future Market

- High risk of loss.

- Needs good market knowledge.

- Not for beginners.

- You may lose more than what you paid.

The future market is not for long-term investors. It is used mostly by people who trade often or who want to earn fast with market movements. You must understand charts, trends, and news to use it well.

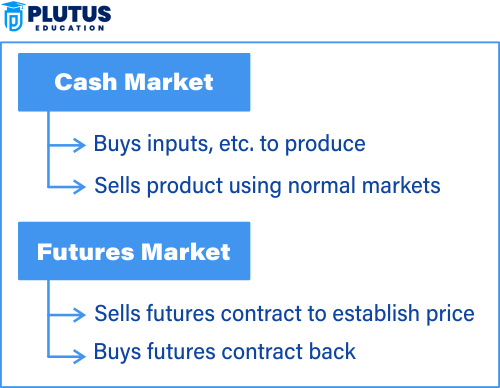

Cash Market vs Future Market

Understanding the difference between the cash market and future market helps you pick the right one for your goals. They differ mainly in trade timing, ownership, payment method, and risk level.

| Feature | Cash Market | Future Market |

| Trade Time | Immediate or T+2 | On a future date |

| Ownership | You get the asset (stock) | You get a contract, not the asset |

| Payment | Full amount at the time of trade | Only margin money required |

| Risk Level | Low to Medium | High |

| Use Case | Long-term investment | Short-term speculation or hedging |

| Profit Type | Slow and steady | Fast but risky |

| Dividends/Voting Rights | Yes | No |

| Market Knowledge Required | Basic | Advanced |

Real-life Examples of Cash and Future Market

Let us understand with real Indian examples.

Cash Market Example:

Riya is a student. She has ₹5,000. She buys 2 shares of Infosys at ₹2,500 each. She now owns those shares. She waits. After 2 months, the price becomes ₹3,000. She sells and makes ₹1,000 profit. This is a cash market deal.

Future Market Example:

A trader sees Reliance stock is at ₹2,400. He thinks it will rise. He buys a future contract of Reliance (lot of 250 shares). He pays a margin of ₹30,000. The stock goes up to ₹2,500 in 10 days. He sells the contract and earns ₹25,000 profit.

But if the price had dropped, he could have lost money quickly.

Cash Market vs Future Market FAQs

1. What is the main difference in the cash market vs future market?

The cash market involves real-time trades and ownership. The future market is based on contracts for a future date.

2. Can students trade in the future market?

Yes, but it is risky. Beginners should learn well before trying the future market.

3. Is the cash market good for long-term investing?

Yes. It suits people who want slow and steady returns with less risk.

4. Do I need full money to buy in the future market?

No. You only pay a margin. But the risk is still high.

5. Can I make profit in falling markets?

Yes, in the future market. You can short sell and earn even if prices fall.