In any corporation, share capital is represented as the funds raised by the company through the issuance of shares to investors. These shares form ownership in the company and are a very important part of its financial structure. The categories of share capital refer to all the different types and classifications of capital that a company can raise. These categories are important for investors, entrepreneurs, and students of finance to understand the financial structure of a company, its investment potential, and ownership sharing.

What is Share Capital?

Share capital comprises the funds invested in a company by shareholders in return for shares of stock. This represents the financial base of a company and is a reflection of the ownership share the shareholder owns in the company. Companies often issue various categories and values of shares depending on their respective financial requirements, formation, and business strategies.

On formation, the amount of share capital that would be needed in a company is decided by the founders. It is then divided into shares that can be sold to raise capital. Share capital is an integral component of the equity of the company and not a debt because it confers ownership rights. It provides a right in the profits arising out of the business with a divergence into a share in the profits in the form of dividends and voting rights over the decisions in the company.

Classes of Share Capital

The classes of share capital are various types of shares that a company can issue. These can either be equity shares or preference shares in nature, the former offering different rights and privileges than the latter.

Common or Equity Share Capital

Equity share capital is the shareholding interest in the company. These are the most issued shares among share capital and are mostly given to investors. Shareholders possessing equity shares have voting rights and entitlement to dividends, although an entitlement on the quantum and periodicity of which cannot be ascertained. Equity shareholders incur the highest risk since they are paid last in a liquidation scenario. On the other hand, they also have a possibility of enjoying the fruits of the company in terms of capital gain and dividends.

Key Features of Equity Shares:

- Voting rights in general meetings.

- Entitlement to dividends (subject to the company’s profitability).

- Risk of loss, as equity shareholders are the last to be paid in liquidation.

- Capital appreciation is in line with the company’s growth.

Preferred Share Capital

Preference shares, commonly referred to as the preferred shares, constitute another type of share capital. They rank preference shareholders over equity shareholders about dividend payments and their repayment in the event of liquidation. However, unless a company defaults on paying dividends, preference shareholders usually do not have voting rights.

Key Features of Preference Shares:

- Fixed dividend payments are often at a higher rate than equity shares.

- Preference over equity shareholders in the event of liquidation.

- Limited or no voting rights.

- Lower risk compared to equity shares.

Preferred share capital is generally adopted by the company if it wishes to raise funds but does not want to dilute control by offering voting rights to common shareholders. It is therefore very appealing for the investor seeking a steady income stream through dividends without assuming the full risk associated with equity shares.

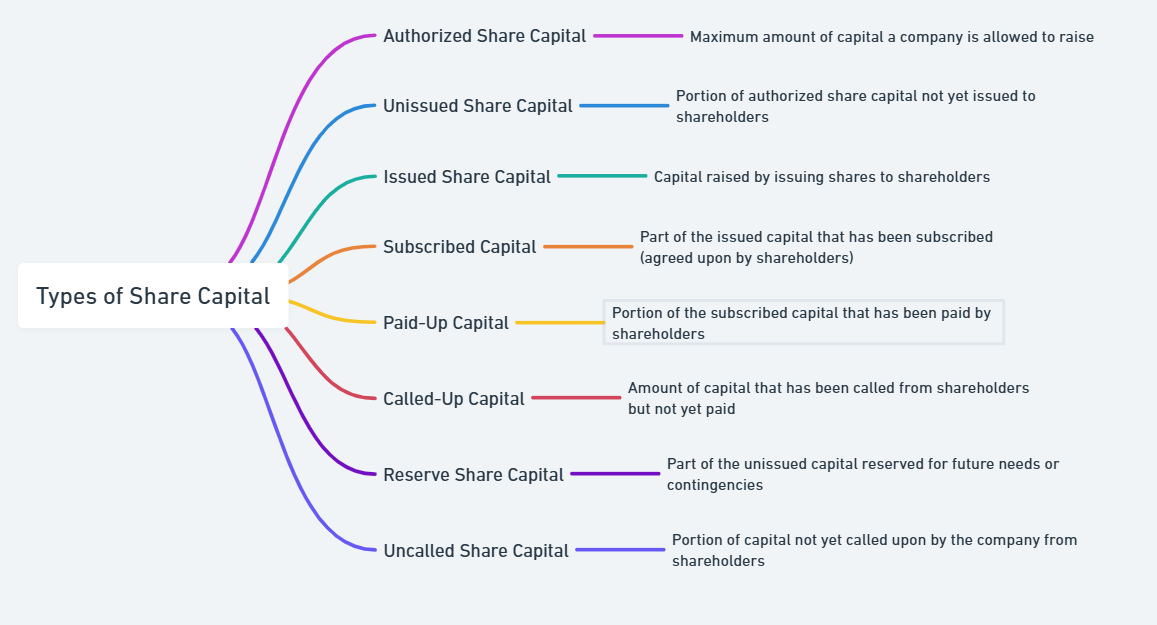

Types of Share Capital

Share capital can be further divided into subcategories based on its status in the company’s capital structure. Each category contributes to determining the overall financial health and structure of the company.

Authorized Share Capital

Authorized share capital means the maximum amount of share capital that can be raised by a company through issues of shares. This is indicated in the memorandum of association of the company and would limit up to what extent the company may issue shares. The company can issue shares up to the authorized capital, but a step beyond that would not be allowed without increasing the authorized capital.

- The maximum share capital that a company can issue.

- Stipulated in the company’s memorandum of association.

- Can be increased with shareholder consent.

- Provides a ceiling on the company’s ability to raise funds by issuing shares.

Unissued Share Capital

Unissued share capital is that portion of the authorized share capital, which the company has not yet issued to the public or investors. This is essentially the capital that the company has the potential to raise in the future. Thus, giving the company flexibility in managing the needs of capital. The unissued shares are usually kept in reserve by the company for some future requirements to raise funds.

- Represents the portion of authorized capital that has not been issued.

- Provides flexibility for future fundraising.

- Unused shares can be issued at the company’s discretion.

Issued Share Capital

Issued share capital would, therefore, be the portion of the authorized share capital that has been issued to investors or shareholders. This amount represents the actual shares issued and taken up by the shareholders. Once these shares are issued, they become part of the company’s equity base and contribute to its financial resources.

- The amount of share capital raised by the company through issuing shares.

- Represents ownership in the company.

- Can be less than or equal to the authorized share capital.

Subscribed Capital

Subscribed capital means the portion of issued share capital that the shareholders have agreed to subscribe to. It is therefore the amount that the investors commit to putting up in the company. Put in other words, subscribed capital is that portion of issued capital accepted and paid for by investors.

- The amount of share capital that shareholders have agreed to purchase.

- This represents a commitment from investors to fund the company.

- Directly impacts the company’s financial health and stability.

Paid-Up Capital

Paid-up capital is that part of the subscribed capital that the shareholders have paid to the corporation actually. It refers to the amount of money received by the company in return for the issued shares. The amount of capital that the company receives can then be used for its operations.

- The amount shareholders have paid to the company for their shares.

- Represents the real financial resources available to the company.

- Determines the company’s financial capability for operations.

Called-Up Capital

Called-up capital is the share capital that a company asks for from the shareholder, according to the terms of the issue of shares. The companies can issue partly paid shares, where the shareholder need not pay the full amount of share capital at once, but the remaining amount is called up at a later date.

- The portion of share capital that the company demands from shareholders.

- Can be called up in installments or as needed by the company.

- This usually applies to partly paid shares.

Reserve Share Capital

Reserve share capital is that kind of share capital that a company holds in reserve and thus does not immediately issue out. The company may use this reserve to issue shares later when necessary, thereby often raising further funds to expand or meet other needs.

- Capital is kept in reserve for future use.

- Can be issued when the company requires additional funds.

- Provides a safety net for future growth.

Uncalled Share Capital

Uncalled share capital means the unsubscribed capital of a company. In other words, it refers to the portion of subscribed capital that has not yet been called by the company. This is capital which the company has the right to call upon in the future when required. It remains in the hands of the shareholders until the company decides to call it up.

- Represents capital that the company can call upon in the future.

- Does not affect the shareholder until called up.

- Provides flexibility for the company to raise additional funds without immediately requesting payment.

Share Capital in the Balance Sheet

The treatment of share capital in a company’s balance sheet is an important aspect of financial reporting. Share capital is usually found in the “equity” section of the balance sheet, because share capital represents ownership in that company. The representation of share capital in the balance sheet can be used to understand how much financial health and stability a particular company has.

Treatment of Share Capital in Financial Statements

Share capital falls under the category of “Shareholders’ Equity” in the balance sheet, which also includes retained earnings, reserves, and other equity components. The share capital area will print a notice of the authorized amount, the issued amount, and the amount paid-up along with the number of shares issued and their nominal value.

- Listed under “Equity” in the balance sheet.

- Represents the funds raised through the issuance of shares.

- Helps stakeholders understand the company’s financial position and capital structure.

Advantages of Raising Share Capital

Share capital can also be raised to assist the company to achieve its growth and expansion desires. Some of the key benefits of raising share capital include a fairly large amount of funds available for financing, good financial flexibility, and an increase in the credibility level of the company in the market.

Key Advantages of Share Capital

- No Repayment Obligations: Unlike loans or debts, share capital does not incur repayment obligations, thus offering long-term financial stability.

- Ownership Distribution: It enables the company to distribute ownership, thus attracting investors who can provide capital and expertise.

- Increased Creditworthiness: Companies having substantial share capital tend to get better loans and other financial resources.

- Better Financial Flexibility: In case of a need for additional funds, a firm can raise it by issuing more shares, thus giving better flexibility in capital raising.

Disadvantages of Raising Share Capital

While raising share capital offers many benefits, it also provides some negative consequences. This aspect of dilution of ownership causes founders or original shareholders to lose ownership in the company, while raising share capital requires lengthy and effortful procedures, involving compliance with legal and regulatory aspects.

Key Disadvantages of Share Capital

- Dilution of Ownership: The issue of new shares dilutes the proportionate ownership in the hands of the existing shareholders.

- Cost and Complexity: Raising capital by issuing shares is a cost and complex affair, involving legal and administrative expenses and what have you.

- Dividend Expectations: Shareholders may expect dividends, even if the company is not earning profits.

- Market Volatility: The price volatility of shares negatively impacts the company’s reputation and investor confidence.

Categories of Share Capital FAQs

What is the difference between equity share capital and preference share capital?

Equity share capital represents ownership in the company, and shareholders have voting rights and the potential for higher returns. Preference share capital provides priority for dividends and repayment in case of liquidation, but preference shareholders generally do not have voting rights.

What is authorized share capital?

Authorized share capital refers to the maximum amount of share capital that a company is allowed to raise by issuing shares. It is stated in the company’s memorandum of association.

What is the significance of paid-up capital in a company?

Paid-up capital represents the amount of money shareholders have actually paid to the company in exchange for shares. It indicates the financial resources available to the company for its operations and growth.

How does called-up capital differ from paid-up capital?

Called-up capital refers to the portion of share capital that a company requests from shareholders as per the terms of share issuance. Paid-up capital, on the other hand, is the amount shareholders have already paid.

Why is share capital important in the balance sheet?

Share capital is an important component of a company’s equity, reflecting its financial health. It indicates the funds raised through shares, providing insights into the company’s ownership structure and capital strength.