Understanding the CFA Level 1 passing score is essential for every candidate preparing for the exam. The passing score decides if the candidate can move ahead to Level 2. The CFA Level 1 passing score is not fixed every year, but it usually stays between 65% and 70%. CFA Institute does not publish an official cut-off, but this range is considered the minimum benchmark to pass.

What is CFA Level 1 Passing Score?

The CFA Level 1 passing score is the minimum score a candidate must achieve to pass the CFA Level 1 exam. CFA Institute does not disclose an exact cut-off, but experts and data from previous years suggest that candidates need to answer at least 65% to 70% of the questions correctly to pass.

- CFA Level 1 has 180 multiple-choice questions divided into two sessions of 2 hours and 15 minutes each. Each question carries equal weight. Candidates must answer enough questions correctly to reach the CFA Level 1 minimum passing score.

- The scoring does not involve negative marking. So, incorrect answers do not reduce the overall score. Therefore, answering all questions, even if unsure, gives candidates better chances. Most students aim for 120 to 126 correct answers, which is around 67% to 70%, as this aligns with the general CFA Level 1 pass criteria.

- Understanding the concept of the CFA Level 1 passing marks helps candidates set realistic targets. Knowing how many questions to get right gives clear goals. It also reduces stress and builds exam-day confidence.

How is CFA Level 1 Exam Scored and Evaluated?

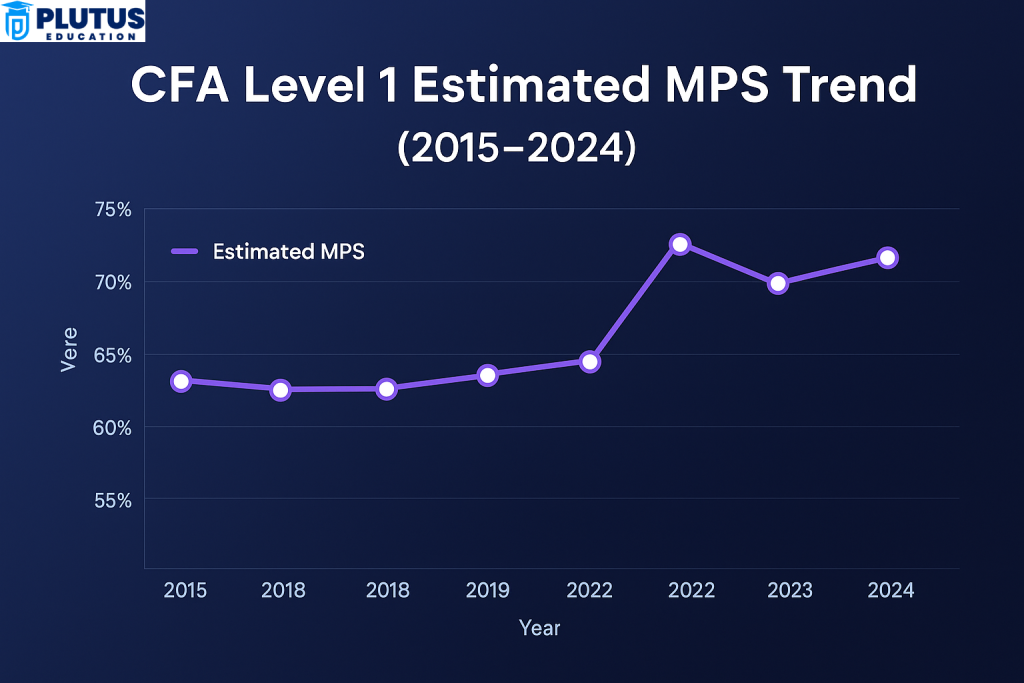

CFA Institute follows a detailed and structured scoring system. Each candidate’s performance is measured based on a Minimum Passing Score (MPS). The CFA Level 1 score calculation happens after a panel of CFA charterholders, psychometricians, and experts review global performance data and question difficulty.

Detailed Overview of CFA Level 1 Scoring Method

- Each question carries equal weight.

- The score is based on the number of correct answers.

- There are no penalties for wrong answers.

- After the exam, the board sets the CFA exam passing score based on overall performance metrics.

CFA Institute also follows the Angoff Method to decide the CFA Level 1 cutoff. In this method, experts judge how a borderline candidate might perform on each question. These judgments combine to create a benchmark score. Additionally, the CFA Level 1 grade system classifies performance by topic. The result breakdown includes band categories, which show strong or weak areas. The CFA Level 1 exam scoring method ensures fairness and reliability. It allows candidates from different backgrounds and countries to be assessed on a consistent scale.

CFA Level 1 Pass Rate Trends Over the Years

Every year, the CFA Institute releases data on the CFA Level 1 pass rate. This rate helps students understand the exam difficulty and how others have performed. The pass rate gives insight into what effort is needed to clear the test.

CFA Level 1 Pass Rate Historical Table

| Year | CFA Level 1 Pass Rate |

| 2020 | 49% |

| 2021 | 22% (Feb), 25% (May) |

| 2022 | 36% |

| 2023 | 39% |

| 2024 | 41% |

| 2025* | Expected ~42% |

(*2025 data estimated based on trend)

The data shows that the CFA Level 1 pass rate in 2025 is expected to be close to previous years. However, the lowest pass rate was recorded during the COVID-19 pandemic. This proves how preparation and exam environment affect results. The pattern suggests that about 4 out of 10 candidates pass Level 1. Therefore, preparation needs consistency and a clear plan. Candidates must study according to the CFA Level 1 exam weightage, giving more time to high-weight topics like ethics, financial reporting, and quantitative methods.

Key Factors That Affect CFA Level 1 Pass Probability

Several things affect the chances of achieving the CFA Level 1 passing score. These factors include study hours, topic strength, time management, and mock test performance.

- First is the study discipline. Candidates who follow a structured study schedule often perform better. Most successful candidates spend over 300 hours preparing. The CFA exam level 1 difficulty is moderate to high, so regular revision is essential.

- Next, mock exams help simulate real exam conditions. Candidates must take at least 4 to 5 full-length mocks before the real exam. This helps them analyse mistakes and learn time control.

- Another factor is how well a candidate understands the CFA Level 1 exam weightage. Some topics, like ethics and FR, carry high weight, so ignoring them can hurt the final score. Candidates who perform well in these areas have better chances.

- Lastly, exam-day preparation matters. Getting good rest, eating well, and staying confident improve focus and avoid mistakes. Candidates who avoid guesswork and stick to concepts often cross the CFA Level 1 passing percentage.

How Many Questions Do You Need to Get Right in CFA Level 1?

Understanding how many correct answers are needed gives clarity. With 180 questions and a minimum 65% to 70% passing threshold, a candidate must get about 117 to 126 questions right. The table below explains the required correct answers:

| Passing Score (%) | Correct Answers Needed (out of 180) |

| 65% | 117 |

| 68% | 122 |

| 70% | 126 |

This range is an estimate, but most past candidates report similar cut-offs. The CFA Level 1 scoring system supports accuracy over speed. So, candidates must focus on getting each question right rather than attempting all quickly. Candidates should also review performance by topic. Some topics weigh more, and mastering them ensures better results. Ethics, Financial Reporting, and Quantitative Methods make up nearly 50% of the total weight. Knowing how many correct answers are required to pass the CFA Level 1 helps set a practical target. It also prevents overconfidence and encourages complete syllabus coverage.

Tips to Increase Your CFA Level 1 Pass Probability

Scoring well in CFA Level 1 requires more than just hard work. Smart study and exam-day tactics help improve the score. Candidates need the right strategies to cross the CFA Level 1 minimum passing score.

- The curriculum must first be divided into weekly goals. There are a total of 10 topics on the CFA syllabus. Each one of them should be finished in about 10 to 12 days, and revision should follow at the end of each month.

- After that, candidates must do the end-of-chapter questions from the CFA Institute books. These carry the feel of the real exam. Also, focus on the mock examinations. Candidates who take 6 or more mocks tend to perform much better.

- Knowledge about CFA Level 1 results from previous examinations also helps. Candidates should analyse results from the official forums and compare them to ascertain the scoring trends.

- Time management is an essential factor. During the exam, candidates should spend around 1.5 minutes on a question. One needs to use the mock exams in a time-based setting to develop both speed and accuracy.

- Do not cram; instead, do conceptual studies. Ethics and FRA should be revised many times because of a reasonably heavier weightage and their ability to swing overall results.

- If followed consistently, these strategies can boost the average score to pass the CFA Level 1, thereby helping the candidates join the 40% of successful candidates each year.

CFA Level 1 Passing Score FAQs

1. What is the CFA Level 1 passing score?

The CFA Level 1 passing score ranges from 65% to 70%. This means that a candidate must answer at least 117 to 126 questions correctly out of 180.

2. What is the CFA Level 1 exam weightage?

The CFA Level 1 exam weightage gives more marks to Ethics, Financial Reporting, and Quantitative Methods. These three subjects make up nearly 50% of the exam.

3. What is the CFA Level 1 scoring system?

The CFA Level 1 scoring system uses the total number of correct answers. There is no negative marking. The CFA Institute applies the Angoff method to set the cut-off score.

4. What is the CFA Level 1 pass rate for 2025?

The CFA Level 1 pass rate 2025 is estimated to be around 42%, based on previous trends from 2023 and 2024.

5. How do you pass CFA Level 1 on the first attempt?

To learn how to pass the CFA Level 1, study 300+ hours, practice mock exams, and focus on high-weight topics like Ethics and FRA. Review regularly and stay calm during the exam.