When you start to acquire the fundamentals of finance, finding out the distinguishing features between CFP vs CFA is the factor that turns things around. It is the case that they are both globally recognized but perform different functions in the world of finance. The CFP (Certified Financial Planner) certification caters most to a comprehensive financial plan, while the CFA program, on the other hand, is mainly for investment management and analysis.

- Financial analysis is the primary subject of a chartered financial analyst (CFA).

- Financial planning expertise is owned by a Certified Financial Planner.

- Each examination and the payment of the fee are necessary for the candidate to achieve the certification in both cases.

This article offers a fair and balanced view of the two professions—the requirements, the career paths, the levels of difficulty, and salaries—so that you can determine which one is right for you.

What is CFP (Certified Financial Planner)?

The Certified Financial Planner (CFP) credential is a global qualification that is mainly useful for the personal finance space. CFPs deal with individuals and families in regards to money management, investment planning, retirement planning, tax planning, and even estate planning. The certification is provided by the CFP Board (USA) or FPSB (Financial Planning Standards Board) in some other countries, such as India.

Scope & Responsibilities of a CFP

- Personal Financial Planning: Personal Financial Management encompasses advising the clients about management of their savings, investments, and debts.

- Retirement Planning: The retirement planning process (RP) consists of making plans that ensure retired people will have enough money in their no work years.

- Taxation: It is personal taxes’ management, which means that it is helping individual invest in the way that it is done in favor of the tax bill reduction.

- Wealth Planning: This is the case when the money is concerned and the inheritance is transferred to the next generation in a proper way.

CFP Certification Requirements

- Educational Qualification: Completion of bachelor’s degree (to happen not more than 5 years after expiration of examination).

- CFP Exam: A test covering financial planning, taxation, risk management, creation of wills and trusts, as well as investments.

- Experience: Minimum of three (3) years of full-time equivalent work (financial planning) or two years in an apprentice model.

- Ethics and Code of Conduct: A professional code of ethics is mandatory for all CFPs.

What is CFA (Chartered Financial Analyst)?

The CFA (Chartered Financial Analyst) credential is an extremely important professional certificate in investment management and financial analysis. It is given by the CFA Institute (USA) and has good acceptance in the entire finance sector, especially in portfolio management, equity research, and investment banking. The curriculum of the CFA program is based on analytical skills, quantitative techniques, and the financial market.

Scope & Responsibilities of a CFA

- Investment Management: Handling investments in the form of portfolios for clients such as individuals, companies, and investment groups.

- Financial Research: Providing the analysis of the market, stocks, and corporate entities to make investments.

- Portfolio Management: Creating an investor’s portfolio to get the best returns and the least risks.

- Risk Analysis: Measuring possible financial risks and generating measures to avert those losses.

How to Become CFA?

You can become a Chartered Financial Analyst (CFA) by going through the tough process that’s been tailored to provide the candidates with the relevant skills and the ability to analyze financial situations apart from investment management.

- Academic Credentials: The candidates must either have completed a Bachelor’s degree program or alternatively be expected to finish their last year at college in order to be qualified for the CFA certification program. This gives them the assurance that they know the basic theory of finance.

- Professional Background: A minimum of four years of practical hands-on experience and that too in the field of financial analysis or investment management must be present, this should be the emphasis of the financial concepts application.

- CFA Course Structure: The CFA program is constituted of three steps: –

- Level I provides knowledge about investments and the fundamental concepts, for instance, ethics, economics, and financial reporting.

- Level II gets more to do with asset valuation and as well as deeper financial analysis mainly in such investments as equities and derivatives.

- Level III deals with portfolio management and wealth planning, the course combines knowledge from the previous levels to deal with planning, strategy, and risk management.

- Duration: Normally, it would take around three to four years to accomplish the entire series of the CFA exams; naturally, each part will be building on the one before. The process of becoming a CFA is a difficult one, but it is recognized in the finance industry as attaining a prestigious credential that implies a high proficiency in the areas of financial analysis and investment strategies.

CFP vs CFA Which is Better?

Understanding the differences between CFP vs CFA helps determine which certification aligns better with your career aspirations. Below is a detailed comparison of the two programs.

| Aspect | CFP | CFA |

| Focus | Personal financial planning and wealth management | Investment analysis, portfolio management, and financial research |

| Certifying Body | FPSB (Financial Planning Standards Board) | CFA Institute (USA) |

| Levels of Exams | Single-level exam | Three levels of exams (CFA Levels I, II, III) |

| Time to Complete | 1 to 2 years | 3 to 4 years |

| Work Experience Requirement | 3 years (financial planning) | 4 years (financial analysis/investment management) |

| Career Paths | Financial planner, wealth manager, personal finance consultant | Portfolio manager, investment banker, equity analyst |

| Primary Skills | Client communication, tax planning, investment advice | Analytical skills, risk management, portfolio analysis |

| Global Recognition | Recognized in wealth management and personal finance sectors | Highly valued in investment banking and asset management |

| Exam Difficulty | Moderate | High |

CFP vs CFA Which is Harder?

1. CFP Exam: A single all-encompassing test around personal finance concepts. The pass rate stands at around 60%, therefore it is moderately difficult. The emphasis is laid on practical financial planning rather than on theoretical financial models.

2. CFA Exam: Candidates must sit three levels of examinations which vary in degrees of difficulty. The pass percentage of Level I is about 40%, while Level II and III have less than 50% pass percentages. It necessitates command over quantitative finance portfolio management and ethical conduct.

CFP vs CFA Salary

Although both the CFP and CFA certifications provide worth out of their career choices, CFAs happen to earn more which is a principal matter due to their proper understanding of institutional investment and asset management.

| Certification | Average Salary (India) | Career Opportunities |

| CFP | ₹6 – 10 lakhs per year | Financial planner, wealth manager, insurance advisor |

| CFA | ₹10 – 20 lakhs per year | Portfolio manager, equity analyst, investment banker |

Although the CFP vs CFA Income difference may depend on clear experience and geography, it is worth mentioning that CFAs are accustomed to higher salaries primarily owing to their sophisticated nature of work and the sectors they work in.

Conclusion

The decision on whether to take the CFP or CFA course mainly depends on one’s professional objective. For instance, if personalized services to individuals, personal financial planning, or wealth management are your strongholds, then, the most suitable professional option is the CFP. On the contrary, if investment management, risk-adjusted portfolio optimization, and engaging with capital markets rank high on your list of interests, then, the CFA graduate-level program would fit you the most. Both certificates present great work opportunities and one has to choose one that will take them towards achieving their career goals. Both CFP and CFA are equally important in the world of finance with their unique advantages.

CFP vs CFA FAQs

Is CFA harder than the CFP?

The CFA exam is a more difficult examination due to its having three levels with very low pass rates of candidates, in contrast to a CFP which is less difficult because there is a higher pass rate.

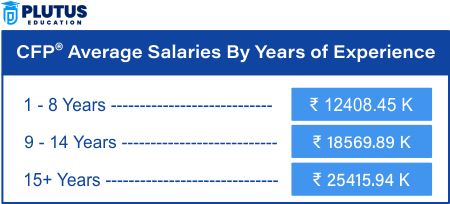

What is the average salary of a CFP in India?

The average CFP salary in India is approximately in a range of between six and ten lakh rupees per year based on experience and the nature of work.

Who earns more CFA or CFP?

CFA charterholders tend to earn more than CFP certified professionals, especially in roles focused on investment analysis and portfolio management, although CFP salaries can also be high, particularly with experience and a strong client base.

How does CFA compare with CPA in India?

CFA vs CPA India analysis states that CFA deals with investment management while CPA deals with accounting and auditing. The two have different career paths.

Can I study for a CFA after finishing a CFP?

Yes, a CFA can be taken after a CFP because it will give you more investment management skills and allow even more career avenues to be opened.