Closing stock is the value of unsold stock kept by a business at the close of an accounting period. It is one of the critical aspects in accounting and impacts the financial statements since it directly affects the presentation of the profit and loss statement and balance sheet. Calculating closing stock accurately ensures that there is a proper presentation of profitability and valuations of assets through accurate reporting.

Closing Stock Meaning

Simple terminology for the closing stock is referred to as unsold or leftover goods or materials, including materials, work-in-progress, and finished goods ready to sell by the end of an accounting period. The actual calculation of closing stock value makes it possible to reflect businesses’ true income and proper asset valuation.

Why Closing Stock Matters

The stock also affects the closing stock through COGS, hence having an impact on gross profit. Understatement of the closing stock reduces the level of net profit, but overstatement inflates net profit. Hence, closure stock valuation is essential as needed for financial performance reporting.

Closing Stock Formula

To calculate closing stock, businesses use a straightforward formula:

Closing Stock = Opening Stock + Purchases – Cost of Goods Sold (COGS)

- Opening Stock: Inventory available at the beginning of the period.

- Purchases: Total additional inventory acquired during the period.

- Cost of Goods Sold (COGS): Direct costs associated with production, including labor, materials, and overhead.

This formula adjusts inventory levels by accounting for new purchases and subtracting the goods sold during the period, leaving the value of the remaining inventory.

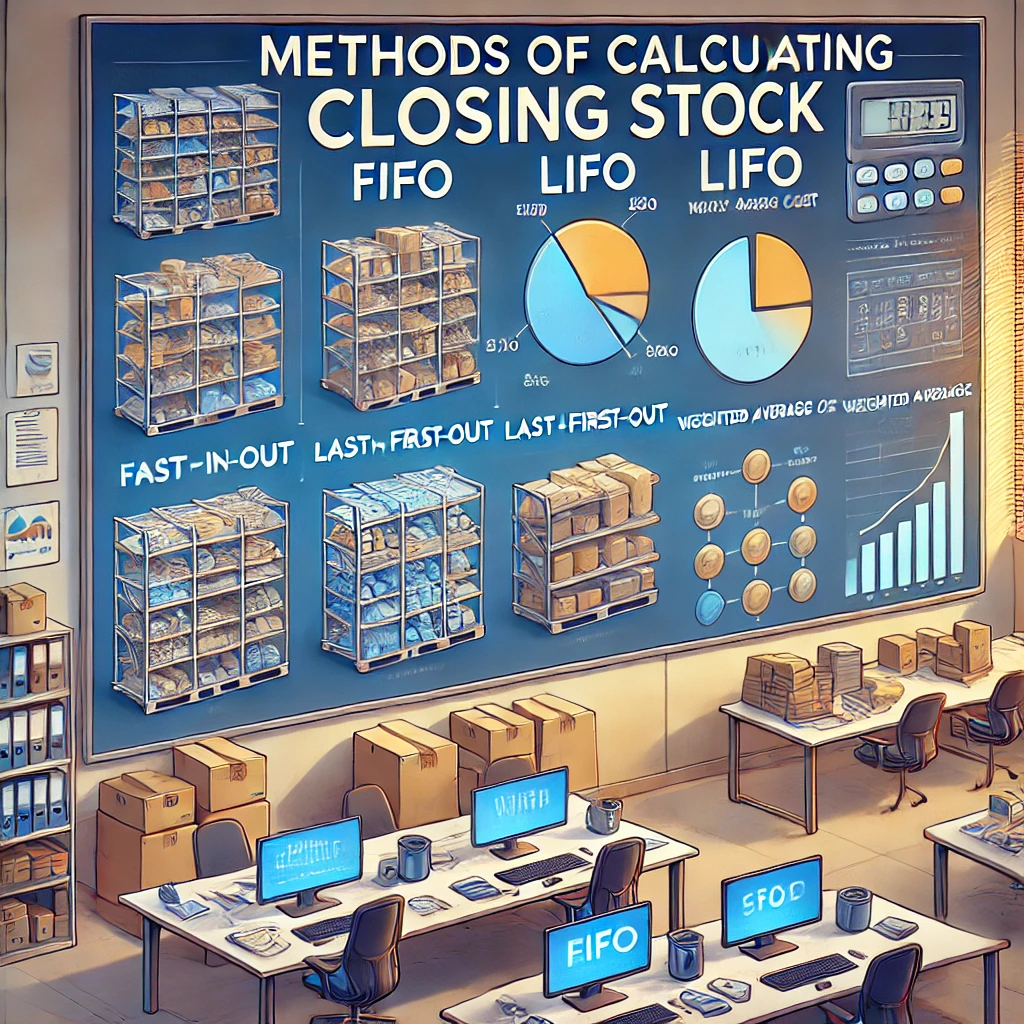

Methods of Calculating Closing Stock

Businesses have several methods for calculating closing stock, each with different implications on financial reporting and tax liability.

1. FIFO (First-In, First-Out)

The oldest inventory items are sold first. This method typically increases the closing stock value in inflationary times since the cost of the latest (and often most expensive) inventory remains on the balance sheet.

2. LIFO (Last-In, First-Out)

The latest inventory is sold first, which lowers closing stock values in inflationary periods. While LIFO provides tax advantages by reducing profits during inflation, it may undervalue stock on the balance sheet.

3. Weighted Average Cost (WAC)

Here, the total cost of goods available for sale is divided by the total units available, applying a consistent cost to all units. This method smooths out price fluctuations over the accounting period.

4. Specific Identification

Used when inventory items are uniquely identifiable (e.g., cars, real estate). Each item’s cost is matched with its sale, leading to precise closing stock values.

Closing Stock in Balance Sheet

Closing stock features the balance sheet under the heading of current assets. The inventory section carries the entry regarding closing stock. Thus, the computation of accurate closing stock is very necessary in the context of developing an accurate balance sheet to provide sound working capital as well as liquidity ratios.

Balance Sheet Impact of Closing Stock

- Assets: Closing stock increases current assets, enhancing a company’s liquidity.

- Owner’s Equity: Higher closing stock can boost net income, leading to an increase in retained earnings under owner’s equity.

| Method | Balance Sheet Impact |

|---|---|

| FIFO | Higher asset value during inflation |

| LIFO | Lower asset value, tax advantage |

| Weighted Average | Stable asset value regardless of price changes |

| Specific ID | Accurate but complex calculation |

Valuation of Closing Stock

Valuing closing stock accurately is crucial for truthful financial reporting. The method of valuation impacts both the cost of goods sold and asset valuation. Key methods include:

1. Market Value or Net Realizable Value (NRV): This value is the estimated selling price minus any costs required for the sale. NRV ensures inventory is not overvalued by accounting for expenses necessary to sell the items.

2. Cost Price: If the cost price is lower than the market value, businesses often report the lower value to stay conservative in financial reporting.

3. Lower Cost or Market (LCM): A combination of the cost and NRV approaches, the LCM method helps businesses avoid inflating inventory values, which ensures a conservative balance sheet.

Calculating closing stock is very essential to providing accurate financial reporting. Since the valuation method adopted can affect the representation of assets, tax liability, and profitability, businesses have to be careful to choose a method that will suit their financial strategy. Understanding the details of closing stock methods and valuations will make business financial statements more consistent with economic reality, giving the truest sense of performance.

Closing Stock FAQs

How is closing stock valued in accounting?

Closing stock is valued at cost or net realizable value, whichever is lower. This conservative approach ensures that inventory is not overvalued on the balance sheet.

Why is the closing stock important for calculating profit?

Closing stock reduces the cost of goods sold, thus increasing gross profit. Accurate closing stock calculation ensures correct profit reporting.

Does closing stock appear on the income statement?

Yes, closing stock is subtracted from the cost of goods sold in the income statement, affecting gross profit.

Which method is best for closing stock valuation?

The best method depends on business conditions. FIFO works well in inflationary times, while WAC is suitable for stable pricing, and LIFO offers tax advantages.

What happens if closing stock is not calculated correctly?

Incorrect closing stock calculation misrepresents profit and inventory values, affecting financial statements and business decisions.