In accounting, closing stock refers to the value of goods or inventory that remains at the end of an accounting period. The closing stock component is essential in the calculation of the cost of sold goods and offers a core means for accurate reporting of profit by businesses. The figure of closing stock calculates the number of preparations of financial statements, including the balance sheet and profit & loss account. The current chapter discusses the concept of closing stock, how it is computed, and its importance in financial reporting as well as methods of its determination.

What is Closing Stock?

Closing stock is the remaining stock that has not been sold at the end of an accounting period. Generally, this happens at the end of the financial year or quarter. Closing stock refers to raw materials, work-in-progress, and finished goods that the company has not sold. This value is very crucial for companies trading in physical commodities since it indirectly influences not only the balance sheet but the profit and loss account as well.

In accounting, the closing stock could be classified as a current asset in the balance sheet since it consists of inventory that is expected to be sold out shortly. Closing stock also applies in the calculation of the cost of goods sold, which determines the gross profit of the firm.

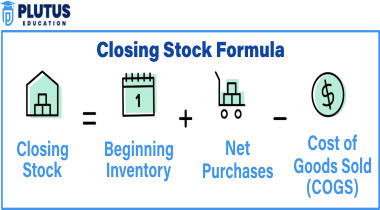

Formula to Calculate Closing Stock

Closing stock is easily calculated, though it might be composed of different elements depending on the approach applied. In general, a formula used to calculate closing stock is:

Closing Stock Formula:

Closing Stock = Opening Stock + Purchases − Cost of Goods Sold (COGS)

Here’s a breakdown of the terms:

- Opening Stock: The inventory available at the beginning of the accounting period.

- Purchases: The total value of additional stock purchased during the accounting period.

- Cost of Goods Sold (COGS): The cost incurred in producing the goods sold during the period.

This formula ensures that the total stock at the end of a period reflects what has been sold and what remains unsold.

Example:

- Opening Stock: $10,000

- Purchases during the period: $5,000

- COGS: $7,000

Using the formula:

Closing Stock = 10,000 + 5,000 – 7,000 = 8,000

So, the closing stock is $8,000.

Closing Stock Calculation Methods

There are some methods of calculating the closing stock value, each giving a different view regarding the inventory valuation. A method chosen might lead to differences in the financial results, for example, profit and tax liability. Some of these common methods include:

1. First In, First Out (FIFO)

The FIFO method assumes sales of the goods sold last occur first. In most firms undertaking business in perishable goods, their shelf life is relatively short. This means that the closing stock value is comprised of the newest purchases.

Advantages:

- Reflects the actual flow of goods in businesses like supermarkets.

- Yields a higher closing stock value during periods of inflation.

2. Last In, First Out (LIFO)

The LIFO method assumes that the last good purchased is sold first. As a result, stock closing accounts for the earlier purchased stock. It is not as widely used but may prove handy in some other industries to allow better tax minimization during inflationary periods.

Advantages:

- This can result in lower taxable income since the most recent (and often higher-priced) inventory is considered sold.

- May better match current costs with revenues in times of rising prices.

3. Weighted Average Cost

The weighted average cost method averages the cost of all the inventory items, irrespective of the purchase date. It therefore tends to smooth out price variations over time and provides a consistent valuation.

Advantages:

- Easy to apply and provides a middle ground in terms of valuation.

- Smooths out price fluctuations, making it ideal for industries with volatile pricing.

Closing Stock in the Balance Sheet

Closing stock in the financial reports is reported as a current asset on the balance sheet because the closing stock is comprised of goods expected to be sold during the next accounting period or sold/consumed within it. Accurate valuation of closing stock will form the appropriate picture regarding the company’s liquidity and working capital.

Difference Between Opening Stock and Closing Stock

The distinction between opening stock and closing stock is crucial in understanding a company’s inventory flow and financial health.

| Basis | Opening Stock | Closing Stock |

|---|---|---|

| Definition | The stock was available at the start of the period. | The stock remaining at the end of the period. |

| Time Period | Relates to the beginning of the accounting cycle. | Relates to the end of the accounting cycle. |

| Financial Impact | Used to calculate the cost of goods sold. | Used to report current assets and calculate net profit. |

The two values go hand in hand. Suppose one considered the closing stock of the preceding period as the opening stock of the subsequent period. Proper tracking and management of these values are extremely necessary to ensure efficient inventory and correct financial reporting.

Closing stock in financial accounting is a crucial component, especially for companies dealing with physical products. The method for arriving at closing stock considerably affects the reported profits and tax liability of a company and its financial position. As such, a business must choose a method of closing stock provision that will suit the operation model it has chosen. Closing stock is an important measure meant to be properly valued to obtain accurate financial reports.

Closing Stock FAQs

What is the closing stock formula?

The closing stock formula is:

Closing Stock = Opening Stock + Purchases – Cost of Goods Sold (COGS)

What is the difference between opening stock and closing stock?

Opening stock is the value of inventory at the beginning of the accounting period, while closing stock is the value at the end. The former is used to determine the cost of goods sold, and the latter is reported as a current asset.

How is closing stock recorded in the balance sheet?

Closing stock is recorded under current assets in the balance sheet as it represents inventory that is expected to be sold in the near future.

Which method is best for calculating closing stock?

The best method depends on the nature of your business. FIFO is ideal for industries with perishable goods, while LIFO can be beneficial for businesses facing inflation. The weighted average method is useful for businesses with fluctuating prices.

Can closing stock be negative?

No, closing stock cannot be negative. A negative closing stock would indicate that the company has sold more goods than it had in inventory, which is generally not possible unless there are accounting errors.