The Cost and Management Accounting (CMA) course provides an evolutionary path for future finance professionals. Covering various levels and accommodating flexible timetables, the CMA qualification equips candidates for strategic accounting, finance, and business leadership positions. The CMA course provides flexible timetables if you want to finish the course quickly or juggle it with employment or a degree. In this section, we’ll explore the typical duration for each level, break down the fees, and highlight the exciting career opportunities CMA opens up in domestic and international markets.

What is the CMA Course?

The CMA or Cost and Management Accountant Course is a professional program offered by the Institute of Cost Accountants of India (ICAI) whose goal is educating the candidates regarding cost control, budgeting, taxation, and financial reporting so that they can carve out careers in corporate finance, cost audit, strategic planning, and management accounting. The course develops analytical and managerial skills to help companies make better financial decisions. CMA certification is globally acknowledged and opens many opportunities in the public and private sectors.

Why Choose the CMA Course in India?

CMA, as one of the most affordable certifications, detains international recognition and hence guarantees fast-track career engagements. The students can start their training immediately after the Class 12 exams and complete the course probably within 2.5–3 years. The course structure is very competent, being step-by-step, and so designed that students can write exams twice every year, in June and December, at their convenience, along with working professionals who register for Part I of the course in June. CMAs are in high demand across manufacturing, FMCG, BFSI, consulting, and government departments. The course builds strong financial insight and cost management expertise.

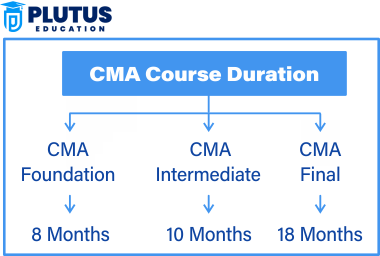

CMA Course Duration

The CMA course typically takes about 2.5 to 3 years to complete when pursued without gaps and cleared in one attempt. It consists of three levels: Foundation, Intermediate, and Final. Each level has a specific duration and set of subjects. Additionally, candidates must complete 15 months of practical training, usually during or after intermediate. This total duration makes CMA one of the most time-efficient finance certifications compared to CA, CFA, or MBA programs.

CMA Course Timeline

Students can pursue CMA through a fast-track route by appearing in consecutive exam sessions (June & December) and completing training in parallel. In this model, the course can be completed in as little as 24–30 months. Candidates who delay exams or take breaks may take 3.5 to 4 years or more. This flexible timeline makes the course adaptable for students and professionals with different schedules.

Tips to Complete the CMA Course Faster

- Attempt exams every cycle without skipping (June & December).

- Clear both groups at once in Intermediate and Final for time efficiency.

- Start practical training early to overlap with the Final level studies.

- Enroll in structured coaching or online prep courses.

- Use ICAI’s study material, mock tests, and RTPs regularly.

Following these tips helps students finish the course in 2–2.5 years.

CMA Course Levels: Foundation, Intermediate & Final

The CMA course is divided into three core levels—Foundation, Intermediate, and Final—each building a more substantial base of professional expertise. These levels are designed to progressively develop knowledge from basic accounting and economics to advanced strategic management and financial analysis. Each level comes with its subjects, exams, and preparation requirements. Understanding the structure and expectations of each stage is key to planning your preparation and career goals effectively. In this section, we’ll give you a concise overview of each CMA level and how they work together to shape a proficient cost and management accountant.

Foundation Level

This is the entry point for students who have completed Class 12. It covers basic accounting, economics, law, and mathematics. This level lasts 6 to 8 months, and it prepares students for the core concepts in management accounting.

Intermediate Level

The intermediate level is for students who have passed the foundation or hold a recognised graduation degree. It includes cost accounting, taxation, corporate law, and financial management. This level takes about 1 year, assuming both groups are cleared together in one attempt.

Final Level

The final stage is the most advanced level and includes strategic cost management, cost audit, performance evaluation, and corporate reporting. It takes about 12–15 months, and students must begin or complete 15 months of practical training to be eligible for exams.

CMA Eligibility Criteria by Level

Before embarking on your CMA journey, knowing the eligibility criteria for each level is essential. The CMA course has a tiered entry process; hence, your academic qualifications and background dictate the level at which you can enrol. From high school graduates seeking the foundation level to commerce graduates entering the intermediate stage directly, every level has specific academic and document-based requirements. In this section, we will explain the eligibility criteria at the Foundation, Intermediate, and Final levels so you can determine where you belong and how to start your CMA journey.

Foundation Level Eligibility

Students must have passed Class 10 and Class 12 from a recognised board. No minimum percentage is required. It is the best route for students entering the field directly after school.

Intermediate Level Eligibility

Candidates must pass the CMA Foundation or hold a Bachelor’s degree in any discipline (except fine arts). CA or CS Foundation qualifiers can also apply directly. Graduates often choose this path to skip the foundation level.

Final Level Eligibility

Students must pass the CMA Intermediate and complete a minimum of 6 months of practical training before appearing for the Final exams. This stage integrates practical exposure with academic concepts.

CMA Course Fees Breakdown

The CMA course is economically feasible and highly rewarding. Here’s a breakdown of the approximate fee structure:

| Level | Duration | Fees (INR) |

| Foundation | 6–8 months | ₹6,000 |

| Intermediate | 1 year | ₹23,000 |

| Final | 1–1.5 years | ₹25,000 |

| Total | ~3 years | ₹50,000–60,000 |

The fee includes registration, study material, and examination costs. No hidden charges make it student-friendly.

CMA Exam Pattern & Attempt Flexibility

CMA exams are conducted in June and December every year, which allows students to plan and attempt levels strategically. Each paper is for 100 marks, and students must score at least 40% in each paper and 50% aggregate per group to pass. Intermediate and Final levels each consist of two groups of four subjects. Students can attempt one or both groups as per their preparedness.

CMA Syllabus & Subjects by Level

The Certified Management Accountant (CMA) course is a globally recognized professional credential offered by the Institute of Management Accountants (IMA) and also by ICMAI (Institute of Cost Accountants of India) for Indian aspirants. The curriculum is updated regularly to stay aligned with dynamic industry demands, global business practices, and technological advancements. Whether you are pursuing the CMA USA or CMA India path, the course is divided into levels or parts, each with its distinct set of subjects and learning objectives. These levels test your academic knowledge, practical understanding, and analytical skills.

Foundation Level Subjects

- Fundamentals of Accounting

- Economics and Management

- Business Mathematics and Statistics

- Fundamentals of Laws and Ethics

This level builds a strong foundation in accounting and business principles.

Intermediate Level Subjects

- Cost Accounting

- Direct & Indirect Taxation

- Company Accounts

- Laws & Ethics

- Financial Management

It prepares candidates for middle-level finance and management roles.

Final Level Subjects

- Strategic Cost Management

- Corporate Financial Reporting

- Cost & Management Audit

- Advanced Financial Strategy

- Business Valuation

This level aims to produce finance leaders and strategic advisors.

Practical Training in the CMA Course

Fifteen months of practical training is a mandatory requirement so that students can have enough exposure to cost systems, budgets, and internal audit processes. The training must be done with an approved firm or a practising CMA. This can start post-intermediate or during final preparation; in this way, the students will be able to put theory into practice. This requirement greatly enhances the employability of CMA graduates.

CMA Career Scope and Salary Insights

CMAs work in roles such as cost accountant, financial analyst, internal auditor, CFO, and budget analyst. They are hired across manufacturing, infrastructure, healthcare, FMCG, IT, and government enterprises.

- Entry-level salary: ₹6–8 LPA

- Mid-level roles: ₹12–20 LPA

- Senior positions (CFO/VP-Finance): ₹30 LPA+

These figures show the immense value and growth potential of CMA certification.

CMA Job Profiles & Responsibilities

Gaining a CMA (Certified Management Accountant) designation unlocks a broad range of high-value career opportunities in industries ranging from finance and manufacturing to consulting, technology, and healthcare. CMAs are not just number crunchers but also business consultants, decision makers, and critical drivers of organizational success.

Cost Accountant

An accountant for costs studies costs of operation, pricing of products, and efficacy of cost minimization. It facilitates management decision-making by identifying ‘cost drivers’ and suggesting improvements in the respective process.

Internal Auditor

CMAs frequently act as internal auditors who examine financial controls, compliance, and internal risk. They contribute to the effectiveness and transparency within the company by ensuring transparency and efficiency.

Financial Analyst

CMAs also excel in the role of financial analysts, where they analyze trends, make reports, and assist in maximizing budgetary allocations. Their knowledge of cost behavior makes them superior to students of general finance.

CMA vs CA Duration and Cost

When selecting a professional course in accounting or finance, students usually compare CMA (Cost and Management Accounting) and CA (Chartered Accountancy)—two of India’s most prestigious designations. While both result in satisfying careers in finance, they greatly vary regarding duration, cost pattern, difficulty level in exams, and the areas of specialization. Based on these principal differences, career aspirants can make a practical choice based on their career objective, time dedication, and purse. Below is a side-by-side comparison between CMA vs CA to help you choose the correct avenue.

| Feature | CMA India | CA India |

| Course Duration | 2.5–3 years | 4.5–5 years |

| Exam Frequency | Twice a year | Twice a year |

| Cost of Course | ₹50k–₹60k | ₹1,00,000+ |

| Practical Training | 15 months | 3 years |

| Difficulty Level | Moderate | High |

CMA offers a faster career launch and lower cost than CA, making it ideal for students seeking early industry exposure.

CMA Course Benefits

The CMA course is not a certification but a career booster. It goes deep into cost control, budgeting, and financial decision-making, areas necessary for profitable business management. CMAs are well-capable of analyzing data, optimizing processes, and streamlining organizational expenses—capabilities needed by industries. With the possibility of working in both public and private sectors, the CMA course guarantees stability and long-term career development. The return on investment (ROI) is also good, so it is a good money move.

CMA Course Duration FAQs

Q1. What is the CMA course duration?

The CMA course duration in India typically ranges from 2.5 to 3 years. The course has three levels:

- Foundation

- Intermediate

- Final

Each level generally takes 8 to 10 months to complete, provided the student clears the exams on the first attempt. If you’re a graduate, you can skip the Foundation level and start directly from the Intermediate level, which shortens the duration.

However, the actual time depends on how consistently you study and clear the exams in each session.

Q2. What is CMA in salary?

The CMA salary in India varies based on experience, skills, and company. Here’s a basic idea:

| Experience Level | Average Monthly Salary |

| Fresher (0–1 year) | ₹30,000 – ₹50,000 |

| Mid-Level (2–5 years) | ₹60,000 – ₹90,000 |

| Senior (5+ years) | ₹1,00,000 – ₹2,00,000+ |

In multinational companies, CMAs with 3–5 years of experience can earn up to ₹20 lakhs per year. The CMA salary also depends on whether you are working in manufacturing, finance, or consultancy sectors.

Q3. Is CMA harder than CA?

In general, CA (Chartered Accountancy) is considered more difficult than CMA (Cost and Management Accounting) in terms of syllabus complexity and passing percentage. Here’s why:

- CA has a lower pass rate, especially at the Final level (as low as 5–10%).

- CMA syllabus is more focused on costing, management, and finance, which some students find more application-based and practical.

- CA covers auditing, law, and taxation in much greater depth.

That said, CMA is not easy and needs regular study, strong conceptual understanding, and good exam strategy.

Q4. Can I do CMA in 6 months?

No, it is not possible to complete the entire CMA course in 6 months. However:

- You can prepare for and pass the Foundation level in about 6 months if you study full-time.

- For graduates, the Intermediate level preparation alone can take 6 to 8 months.

So, while you can complete one level in 6 months, finishing all three levels of CMA requires a minimum of 2.5 to 3 years, especially when considering exam schedules and results.

Q5. When are CMA exams conducted

Exams are held twice a year – in June and December.