The Certified Management Accountant (CMA) is the most prestigious certification course. It prepares an accountant to specialize in strategic management and financial decision-making roles. Applicants enrolling for the CMA 2025 exams have to prepare as per the CMA new syllabus that was released on June 9, 2022. The subjects of the CMA syllabus will give detailed knowledge about the financial and non-financial areas of business management. The updated syllabus is designed to meet global industry standards and ensures that CMA professionals are capable of handling modern challenges in cost management, performance analysis, budgeting, and corporate strategy.The CMA course structure consists of three stages – Foundation, Intermediate, and Final – each covering crucial aspects of accounting and management. The revised syllabus places greater emphasis on practical learning, analytical skills, and ethical considerations, enabling candidates to become future-ready finance professionals. Students preparing for the 2025 exams must carefully review this updated syllabus and align their study plans accordingly.

CMA Syllabus 2025: An Overview

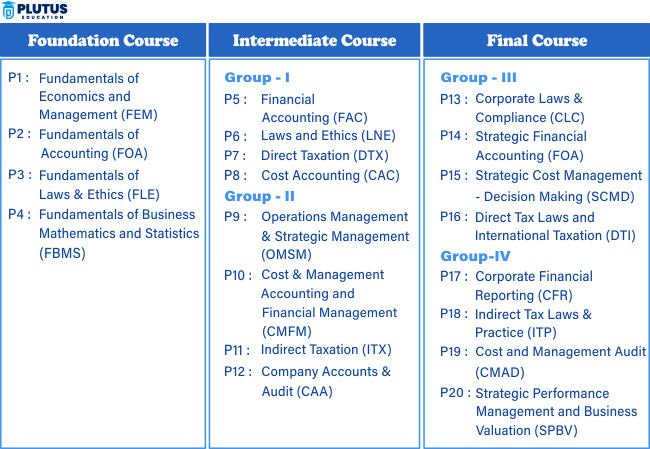

The entire CMA new syllabus is divided into three parts: foundation, intermediate, and final level. They target different aspects of management accounting. The topics covered are very vast and important for the current business environment. The CMA 2025 syllabus will be used for designing the CMA question papers. Once a candidate clears the CMA Foundation exam, s/he will then be eligible for the Intermediate and Final exams. Here is the detailed syllabus for CMA foundation, intermediate, and final level examinations.

CMA Course Syllabus for Foundation Level

Foundation level exam builds a strong foundation, equipping CMA students with the essential knowledge required to progress to the intermediate and final stages. Four papers are there in the CMA Foundation level examination. The ICWAI or Institute of Cost Accountants of India (ICAI) states the following topics under the CMA Foundation exam:

| Paper No | Paper Name | Section | Weightage |

| 1 | Fundamentals of Business Law & Business Communication | Section A: Fundamentals of Business Law | 80% |

| Section B: Business Communication | 20% | ||

| 2 | Fundamentals of Financial & Cost Accounting | Section A: Fundamentals of Financial Accounting | 70% |

| Section B: Fundamentals of Cost Accounting | 30% | ||

| 3 | Fundamentals of Business Mathematics & Statistics | Section A: Fundamentals of Business Mathematics | 40% |

| Section B: Fundamentals of Business Statistics | 60% | ||

| 4 | Fundamentals of Business Economics & Management | Section A: Fundamentals of Business Economics | 70% |

| Section B: Fundamentals of Business Management | 30% |

CMA Intermediate Course Syllabus

The CMA Intermediate Course syllabus bridges foundational knowledge and advanced concepts, focusing on financial accounting, cost management, and taxation. The intermediate CMA exam syllabus is divided into Group I and Group II. Here look at the topics mentioned in the table below.

CMA Intermediate Course Syllabus Group – I

Four papers are conducted under the CMA Intermediate syllabus Group I. These subjects help students with essential knowledge and skills for analyzing and managing financial and legal aspects. Let’s take a look at that.

| Paper No | Paper Name | Section | Weightage |

| 5 | Business Law & Ethics | Section A: Business Laws | 30% |

| Section B: Industrial Laws | 15% | ||

| Section C: Corporate Laws | 40% | ||

| Section D: Business Ethics | 15% | ||

| 6 | Financial Accounting | Section A: Accounting Fundamentals | 15% |

| Section B: Accounting for Special Transactions | 10% | ||

| Section C: Preparations of Financial Statements | 20% | ||

| Section D: Partnership Accounting | 20% | ||

| Section E: Lease, Branch, Departmental Accounts, etc. | 15% | ||

| Section F: Accounting Standards | 20% | ||

| 7 | Direct & Indirect Taxation | Section A: Direct Taxation | 50% |

| Section B: Indirect Taxation | 50% | ||

| 8 | Cost Accounting | Section A: Introduction to Cost Accounting | 40% |

| Section B: Methods of Costing | 30% | ||

| Section C: Cost Accounting Techniques | 30% |

CMA Intermediate Course Group II

CMA Intermediate Course Group II builds analytical skills. It allows students to handle complex financial scenarios and prepare for the CMA Final level effectively. Group II has four examinations mentioned in the table below.

| Paper No | Paper Name | Section | Weightage |

| 9 | Operations Management & Strategic Management | Section A: Operations Management | 60% |

| Section B: Strategic Management | 40% | ||

| 10 | Corporate Accounting & Auditing | Section A: Corporate Accounting | 50% |

| Section B: Auditing | 50% | ||

| 11 | Financial Management & Business Data Analytics | Section A: Financial Management | 80% |

| Section B: Business Data Analytics | 20% | ||

| 12 | Management Accounting | Section A: Introduction to Management Accounting | 5% |

| Section B: Activity Based Costing | 10% | ||

| Section C: Decision Making Tools | 30% | ||

| Section D: Standard Costing & Variance Analysis | 15% | ||

| Section E: Forecasting, Budgeting & Budgetary Controls | 15% | ||

| Section F: Divisional Performance Measurement | 10% | ||

| Section G: Responsibility Accounitng | 5% | ||

| Section H: Decision Theory | 10% |

What is CMA Final Course Syllabus?

The CMA Final Course syllabus is divided into Group III and Group IV at an advanced level. At this stage, students are equipped with specialized expertise, critical decision-making skills, and a strategic outlook. Thus, preparing them for leadership roles in their chosen fields. Here are the topics that fall under this exam:

CMA Final Course Syllabus Group III

Group III of the CMA Final Course syllabus emphasizes advanced financial and cost management concepts. These topics are made to build strategic decision-making skills, allowing students to handle complex financial scenarios and contribute to organizational growth. Check out the syllabus for CMA Final Course Group III.

| Paper No | Paper Name | Section | Weightage |

| 13 | Corporate & Economic Laws | Section A: Corporate Laws | 60% |

| Section B: Economic Laws & Regulations | 40% | ||

| 14 | Strategic Financial Management | Section A: Investment Decision | 25% |

| Section B: Security Analysis & Portfolio Management | 35% | ||

| Section C: Financial Risk Management | 20% | ||

| Section D: International Financial Management | 15% | ||

| Section E: Digital Finance | 5% | ||

| 15 | Direct Tax Laws & International Taxation | Section A: Direct Tax Laws | 60% |

| Section B: International Taxation | 40% | ||

| 16 | Strategic Cost Management | Section A: Strategic Cost Management for Decision Making | 60% |

| Section B: Quantitative Technique in Decision Making | 40% |

CMA Final Course Syllabus Group IV

Group IV of the CMA Final Course focuses on advanced concepts critical for professional excellence. The syllabus for the CMA Final Course has 4 papers. Here is the table that explains the four exams of the CMA Final Course.

| CMA Papers | Syllabus |

| 17 | Cost and Management Audit |

| 18 | Corporate Financial Accounting |

| 19 | Indirect Tax Laws and Practice |

| 20 | 20 A: Strategic Performance Management and Business Valuation |

| 20 B: Risk Management in Banking and Insurance | |

| 20 C: Entrepreneurship and Startup |

CMA Syllabus for Financial Planning, Performance, and Analytics

Part A of the CMA syllabus focuses on financial reporting, planning, performance management, and application of analytics in making business decisions. This will be a very essential segment of the course for candidates to understand what aspects of finance drive the decisions of businesses.

Section A: External Financial Reporting Decisions

- Financial Statements: It refers to how financial statements are prepared and analyzed under different accounting standards.

- Recognition, Measurement, and Valuation: The principles that govern the recognition, measurement, and valuation of assets, liabilities, equity, revenue, and expenses.

- Disclosure: It highlights the importance of appropriate disclosure of information in financial reporting.

Section B: Planning, Budgeting, and Forecasting

- Strategic Planning: The process of setting long-term objectives and identifying the resources that will be needed to attain them.

- Budgeting Concepts: The different techniques of budgeting, zero-based budgeting, flexible budgeting, and rolling forecasts.

- Forecasting Techniques: The technique for making an educated guess about future financial performance.

Section C: Performance Management

- Cost Management: To understand cost concepts, cost behavior, and cost management techniques.

- Internal Controls: It is for designing and evaluating internal controls to properly protect the assets and ensure fairness in financial reporting.

- Variance Analysis: To study the differences between actual performance and budgeted targets.

Section D: Cost Management

- Costing Systems: Introduce job order costing, process costing, and activity-based costing.

- Overhead Costing: Allocation and analysis of overhead costs

- Supply Chain Management: The role of management accounting in optimizing supply chain processes.

Section E: Internal Controls

- Risk Management: Identification and management of risks within an organization.

- Corporate Governance: Knowledge of corporate governance principles and their impact on internal controls.

- Ethics in Management Accounting: The ethical responsibilities of management accountants.

Section F: Technology and Analytics

- Information Systems: Information systems in support of FP&A.

- Data Analytics: Financial data analysis techniques in support of business decisions.

- Emerging Technologies: Impact of emerging technologies such as AI, blockchain, and big data in the field of management accounting.

CMA Syllabus for Strategic Financial Management

Part 2 of the CMA syllabus contains topics on financial management, strategy, decision analysis, and risk management. The information in this section helps to prepare candidates on how to make strategic financial decisions within a business set-up.

Section A: Financial Statement Analysis

- Ratio Analysis: Analysis of a company’s performance through the use of financial ratios.

- Cash Flow Analysis: Utilization of cash flows to analyze the liquidity, solvency, and financial flexibility of a company.

- Earnings Quality: How to assess the quality and sustainability of earnings.

Section B: Corporate Finance

- Ratio Analysis: Approaches to determining an appropriate mix of debt and equity in the capital structure.

- Cash Flow Analysis: How to Calculate the Cost of capital and its implications for capital investments.

- Earnings Quality: Theories and practices for determining dividend policy.

Section C: Decision Analysis

- Cost-Volume-Profit Analysis: Effects of various costs and volumes on profit.

- Pricing Decisions: Approaches for pricing a product for maximum profit.

- Make or Buy Decisions: Understanding the financial implications of outsourcing.

Section D: Risk Management

- Types of Risks: Understanding different types of risks: financial, operational, and strategic

- Hedging Techniques: Risk management strategy to offset one risk with a contrary position in another item

- Risk assessment: estimation of the chance of occurrence and its impact on risks

Section E: Investment Decisions

- Capital Budgeting: Techniques for evaluating the desirability of investments

- Valuation Methods: Different types of techniques to value an asset and business

- Mergers and Acquisitions: Financial dimensions of a merger and acquisition.

Section F: Professional Ethics

- Ethical Considerations: Ethics in financial management—its importance

- Corporate Social Responsibility: CSR in corporate strategy

- Ethical Leadership: To lead with integrity and create an ethical work culture.

Skills Developed through CMA Syllabus

The CMA syllabus is not only designed to test one’s knowledge of the theory. But the same can also build practical skills and competencies that will be of much help in the practice of management accounting. Some of the key competencies acquired include:

- Analytical Skills: Capability to analyze financial data and put out relevant insights for action

- Strategic Thinking: Knowing the long-term impact that financial decisions will have on business strategy

- Decision Making: Making informed decisions that align with business objectives.

- Risk Management: It refers to a process of risk identification and management that may have an impact on the financial well-being of an organization.

- Ethical Judgment: It refers to the navigation of complex ethical dilemmas posed within a business.

CMA Syllabus 2025 FAQs

What is the syllabus of CMA?

The CMA syllabus is divided into two parts, one is, Financial Planning, Performance, and Analytics and part 2 is Strategic Financial Management.

Will the CMA syllabus change yearly?

No, the CMA syllabus does not change yearly. It was last changed in 2022 by ICMAI.

Is CMA very difficult?

Yes, CMA is a difficult exam that tests your academic knowledge. The average passing rate for both subjects is 45%, which is less than half of the people taking this exam.

Is CMA as tough as CA?

According to many students, CA is tougher than CMA because there are various students who pass the CMA exam with better marks as compared to CA.

Where can I get CMA question papers?

Candidates can download question papers of CMA syllabus from official website of The Institute of Cost Accountants of India.