The CMA (Certified Management Accountant) and ACCA (Association of Chartered Certified Accountants are both highly reputable accounting certifications with their focus & benefits. US CMA is like a master’s in financial management; it gives an insight into corporate financing and internal Job roles. This includes going deeper into corporate accounting and financial management, enabling you to take a broader path and open up career opportunities across sectors, including public practice and cooperation finance. Both are worldwide recognized certifications, and they can open a wide range of opportunities for your career but focus on different professional goals or areas. Knowing the differences between them can assist people in selecting which one is right under their career plan.

Introduction of CMA and ACCA

The CMA (Certified Management Accountant) and ACCA (Association of Chartered Certified Accountants) are credentials for diverse sectors in the accounting career. CMA is all about management accounting and financial strategy; it prepares professionals for roles in internal corporate sides, like an area of FP&A.

ACCA is a comprehensive global accounting qualification, covering all aspects of financial accounting (especially for those looking to work in audit and assurance) & taxation, which makes it extremely advantageous as compared to ICB. Each recognition is internationally renowned and highly valued, promising powerful job avenues and promotion.

What is US CMA?

The CMA (Certified Management Accountant) designation is geared toward financial and management accounting professionals. This program is for those wanting to further their careers in internal corporate roles requiring robust financial planning, analysis and strategic decision-making skills. The CMA certification from the Institute of Management Accountants (IMA) covers cost management, internal controls and financial strategy, making it ideal for a corporate finance or management accounting career.

What is ACCA?

ACCA full form is Association of Chartered Certified Accountants). It is a global accounting body providing an all-rounded certification in accountancy and finance. The ACCA qualification covers financial accounting, taxation, and management accounting, opening up more career options for its pass-outs who can work as consultants to accountancy firms and the regulatory backdrop of corporate finance.

CMA vs ACCA Which is Better?

CMA and ACCA are both well-known accounting certifications. However, they have different proficiencies. CMA concentrates more on management accounting and financial strategy, which may best suit students seeking internal corporate finance or strategic management roles. The ACCA sounds better for a wider accounting education, where students learn financial accounting and taxation, which helps them get jobs at public accounting firms or other sectors.

Aspect | CMA (Certified Management Accountant) | ACCA (Association of Chartered Certified Accountants) |

|---|---|---|

| Focus | Management accounting, financial planning, and strategic management | Comprehensive accounting education including financial accounting and taxation |

| Target Roles | Corporate finance, management accounting, internal financial strategy | Public accounting, taxation, financial management, and consulting |

| Certification Body | Institute of Management Accountants (IMA) | ACCA (Association of Chartered Certified Accountants) |

| Number of Exams | Two parts: Part 1 (Financial Reporting, Planning, Performance, and Control) and Part 2 (Financial Decision Making) | Multiple levels: Applied Knowledge, Applied Skills, and Strategic Professional |

| Work Experience Requirement | Two years in management accounting or financial management roles | Three years of relevant work experience in accounting or finance |

| Exam Duration | Each part is 4 hours long | Each level varies, typically 3 hours per paper at Applied Knowledge and Applied Skills, and 3 hours per paper at Strategic Professional |

| Preparation Time | Typically 1-2 years, depending on study pace and prior knowledge | Typically 3-4 years, given the extensive syllabus and multiple exam levels |

| Cost | Generally lower overall cost compared to ACCA | Higher overall cost due to multiple levels and required materials |

| Global Recognition | Widely recognized for internal corporate roles globally | Globally recognized for a broad range of accounting and finance roles |

| Core Competencies | Cost management, internal controls, financial strategy | Financial accounting, taxation, financial management, business strategy |

CMA vs ACCA Difficulty Analysis

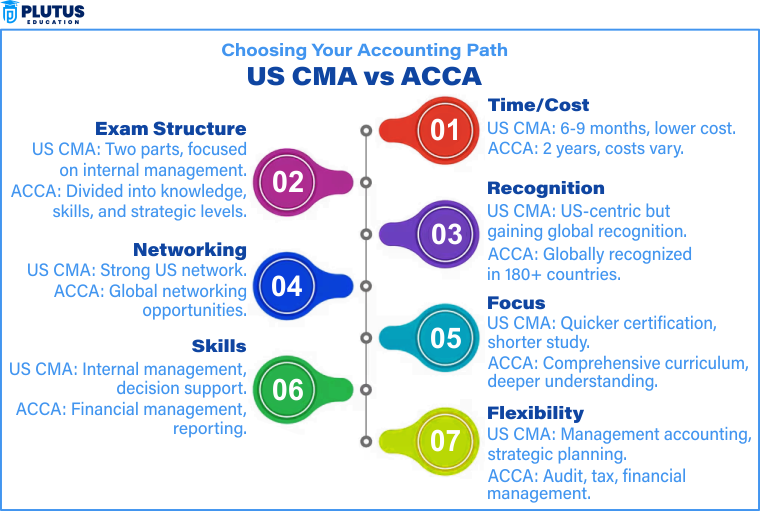

While the ACCA is tough, obtaining a CMA would be easy. Still, there are some reasons why this concept might not be true for everyone. The US CMA is a bit harder, but it normally has two parts in the management accounting process: financial strategy and strategic decision-making. Thus, you can break these topics into small areas with a concentration study over 1 to hopefully no more than 2 years.

On the other hand, ACCA provides a more detailed curriculum across multiple levels, including financial accounting and reporting, audit & assurance, taxation, and management. Every level of the ACCA exams is based on what you have learned in previous levels. There are many topics to be understood better & thus it normally takes longer time for preparation which can range anywhere within 3–4 years.

CMA vs ACCA Salary

Several factors must be considered when determining why a CMA (Certified Management Accountant) salary would ideally stack up against or even outperform the salaries offered to ACCAs, and we will consider some of these differences here. As a rule, CMAs specializing in management accounting and financial planning & strategic decision-making are highly paid when seeking corporate finance roles like top-level managers or CFOs of corporations.

ACCA professionals have more extensive accounting education in the financial-reporting tax field, and studying opportunities are also available to industries other than public practice, such as corporate finance advisers or consultants. In most localities, ACCA-qualified people should expect to receive a salary better than non-professionals because of the wide scope of their qualifications and their suitability for various accounting and finance roles.

The exact salary can vary widely based on location, experience level, and the specific industry in which the individual is employed. The salary of CMA is Rs. 1.25 to 1.50 LPA, and an ACCA is Rs. 3 LPA.

ACCA vs CMA India

Although ACCA (Association of Chartered Certified Accountants) and CMA are esteemed professional qualifications in India, they target separate career paths in the broader accounting/financial field. With a curriculum that includes financial accounting, taxation and management, the ACCA is relevant to public accountancy practice in all three sectors.

On top of that, ACCA offers large diversity in terms of global opportunities across a broad set of industries as part of employment or investment opportunities. In contrast, the CMA is better suited for corporate finance and cost accounting or internal financial strategy fields, primarily focusing on management accounting, financial planning and strategic management.

Conclusion

There is no particular option that fits every denomination. Deciding between CMA vs. ACCA depends on your career goals and passion. The CMA targets those wanting to work in management accounting and internal financial strategy. Whereas ACCA offers a broad accountancy knowledge base, which could make you eligible for bigger types of accounting & finance jobs. Either certification can provide skills and opportunities; thus, choosing between the two depends on your prospective longer-term career aims and whether you wish to work specifically within all other areas of accounting.

CMA vs ACCA FAQs

What is the main focus of the CMA compared to the ACCA?

The CMA focuses on management accounting, financial planning, and strategic organisational management. The ACCA covers various finance, taxation, and management accounting topics. This makes the CMA more specialized, while the ACCA offers a more comprehensive accounting education.

CMA vs ACCA which is better for a career in public accounting?

The ACCA is generally more suited for a career in public accounting due to its extensive coverage of financial accounting and taxation. The CMA, while valuable, is more focused on internal management and strategic financial roles. ACCA’s broad curriculum is tailored for those seeking roles in audit firms or public accounting practices.

How long does it typically take to complete each certification?

The CMA can typically be completed in 1 to 2 years, depending on study pace and exam schedule. The ACCA generally takes 3 to 4 years, given its extensive syllabus and multiple exam levels. Both timelines can vary based on individual circumstances and prior knowledge.

What are the key differences in exam structure between CMA and ACCA?

The CMA exams have two parts, each focusing on management accounting and financial decision-making. The ACCA exams are divided into Applied Knowledge, Applied Skills, and Strategic Professional levels, covering various accounting and finance topics. This means the ACCA has a more extensive exam structure than the CMA.

Is one certification more valuable than the other in the global job market?

The value of each certification depends on your career goals and location. The CMA is highly regarded for internal corporate roles and management accounting, while the ACCA is valued globally for a broad range of accounting and finance positions, including public accounting. Both certifications are respected, but their relevance can vary based on industry and geographic region.