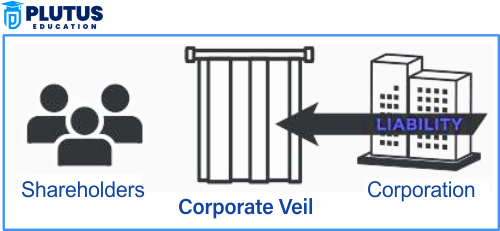

The corporate veil is a legal idea that separates a company from the people who run it. When you create a company, it becomes its legal person. This means the company differs from its owners, directors, or shareholders. It can own property, enter into contracts, and even sue or get sued in its name. This rule protects people who invest in companies. If the company fails, its owners do not lose their money or house. Only the company’s cash is at risk. So, if a business fails and owes money to people, the law does not force the owner to pay from his pocket. This protection is called the corporate veil. But, sometimes, people misuse this rule. They form fake companies to cheat others, hide money, or break the law. In those cases, courts remove the corporate veil and look at who is behind the company. This is called “lifting the corporate veil.”

What Does Corporate Veil Mean in Company Law?

The corporate veil is the legal wall that separates a company from its owners. Once a business becomes a registered company, it gets its own identity. It becomes like a legal person. This concept comes from company law and is used in all modern business laws.

Basic Meaning of Corporate Veil

When you form a company, it becomes different from you. Even if you started it, the law treats the company as a new person. This new legal person owns the company’s property, pays taxes, and signs agreements.

For example, if you open a company and it buys a car, that car belongs to the company, not to you. If someone sues the company, they cannot take your things like your home or savings. This wall between you and the company is the corporate veil.

Why Is Corporate Veil Important?

- It protects the personal property of shareholders and directors.

- It helps people invest without fear of losing everything.

- It supports the growth of businesses because it offers legal safety.

- It builds trust in the legal system that the company and owner differ.

So, the corporate veil is a big reason why people start companies. It gives them freedom to do business without risking all their wealth.

Key Features of Corporate Veil

The concept of the corporate veil has many essential features. These features help us understand how company law treats registered businesses and their members.

Separate Legal Entity

When a company is registered under the law, it becomes a separate legal person. This means it can sue and be sued. It can buy land, take loans, and do business like a person.

The best example of this is the case of Salomon v. Salomon & Co. Ltd. In this case, the court said that even if one person owns all shares, the company is still a different person.

Limited Liability

Limited liability means shareholders are only responsible for the company’s loss up to the amount they invested. If a company goes bankrupt, the court cannot ask shareholders to sell their house or car.

This makes it safe for people to put their money in businesses. It also gives them the confidence to take calculated risks.

Property Ownership

The company, not the owners, owns all the assets. Even if you built the office with money, it belongs to the company. If you sell your shares, the office will remain with the company.

This rule keeps business and personal property separate and clear.

Perpetual Succession

The company continues even if owners die or leave. It has a life of its own. The corporate veil ensures that the company does not end with one person. This helps in long-term planning.

Transferability of Shares

Owners can sell or give their shares to someone else. This does not affect the company’s business. It continues without any break.

All these features make the corporate veil a strong wall between a company and its people.

Importance of Corporate Veil in Business and Law

The corporate veil is not just a legal rule. It plays a vital role in how businesses grow and how laws work.

Protects Investors and Promotes Business

People are likely to start companies if they know their homes, savings, and gold are safe. The corporate veil gives that safety. This leads to more startups, more jobs, and a better economy.

Even big companies like Tata, Infosys, and Reliance started small. Because of the corporate veil, their owners took bold decisions without personal fear.

Encourages Risk-Taking

No business can grow without taking risks. But if your personal life is at risk, you may never try. Limited liability encourages people to take business risks. Even if the company fails, the person gets a second chance.

Builds Legal Clarity

When a company is a legal person, it becomes easy to manage contracts, taxes, and cases. Banks, customers, and governments know whom to deal with.

Also, when the law sees a company as a person, it can give punishment or order payment without confusion.

Helps in Credit and Loans

Banks check the company’s credit record, not the owner’s. So, a good company gets loans even if the owner is not wealthy. This builds trust and a better credit system.

In short, the corporate veil gives companies a strong legal identity. It makes business life smoother, safer, and more productive.

Circumstances When Corporate Veil Is Lifted

Even though the corporate veil is strong, courts can remove it in some exceptional cases. This is called lifting the corporate veil. When this happens, the court ignores the company’s separate identity and looks at the people behind it.

When Courts Lift the Corporate Veil

- Fraud or cheating: The court lifts the veil if someone uses the company to cheat people or hide money.

- Evasion of tax or law: If a company is made only to avoid tax or legal duties, the court can see through the veil.

- Sham or fake companies: If a company is made only on paper and has no real business, the law does not protect it.

- Enemy company during war: If people from an enemy country control a company, the veil is lifted for national safety.

- Avoiding government rules: If companies intentionally break the rules using loopholes, courts can take action.

Case Law Examples

- Delhi Development Authority v. Skipper Construction Co. (1996)

The court lifted the veil as the company was used to cheat homebuyers.

- Gilford Motor Co. v. Horne (1933)

An employee started a company to break a contract. The court lifted the veil and punished the person.

- LIC of India v. Escorts Ltd. (1986)

The court examined the real people behind the firms in a case involving foreign investments and fake companies.

Lifting the corporate veil is rare but very powerful. It protects society from fraud and illegal actions.

Corporate Veil under the Companies Act 2013

The Companies Act 2013 is the main law that governs companies in India. While the Act does not directly define the term “corporate veil,” it includes many rules and sections where courts or the Registrar of Companies can take action if people misuse a company.

Sections That Allow Lifting of the Corporate Veil

- Section 7(7) – Incorporation of Company by False Information

If someone gives fake details during registration, the court can remove the company’s status and punish those responsible.

- Section 251 – Fraudulent Application for Strike Off

The law holds promoters personally responsible if the company tries to close its name from the register for dishonest reasons.

- Section 339 – Fraudulent Conduct of Business

Officers act fraudulently, they must personally pay the debts. This is if a company is winding up and removing the protection of the corporate veil.

- Section 34 and 35 – Misstatement in Prospectus

If the company gives false information to attract investors, its directors can be personally punished.

- Section 447 – Punishment for Fraud

The law clearly says that anyone using the company as a mask to commit fraud will be punished. This includes directors, promoters, and managers.

Protection and Responsibility Go Together

The law gives protection to company owners through the corporate veil. But simultaneously, it ensures that this protection is not misused. That is why the Act has many clauses where the corporate veil can be lifted when justice is at risk.

Famous Case Studies of Lifting the Corporate Veil

Courts in India and abroad have handled many cases where they decided to remove the corporate veil. These real examples show how and why the veil was lifted.

1. Salomon v. Salomon & Co. Ltd. (UK, 1897)

This was the first and most important case. Mr. Salomon formed a company and transferred his business to it. The court said the company was a separate legal person, even though he was the only shareholder. This case created the concept of the corporate veil.

Lesson: A registered company has its own identity, even if one person owns it.

2. Delhi Development Authority v. Skipper Construction Co. (India, 1996)

In this case, the court found that the company was used to cheat flat buyers. The court lifted the corporate veil and held the directors personally liable.

Lesson: If people use a company to cheat others, the law removes their protection.

3. Gilford Motor Co. v. Horne (UK, 1933)

An employee signed a contract not to compete. He left the company and formed a new company in his wife’s name to break that contract. The court said the company was just a mask and lifted the veil.

Lesson: Companies made to escape contracts will not be protected.

4. State of Rajasthan v. Gotan Lime Stone Khanij Udyog Pvt. Ltd. (India, 2016)

The company sold mining rights to another company owned by the same promoters to avoid royalties. The Supreme Court lifted the veil and called it an illegal method to transfer assets.

Lesson: When corporate structure is used to break state rules, the veil is lifted.

These case studies show that the law protects good businesses but punishes bad intentions.

Corporate Veil FAQs

Q1. What is a corporate veil, in simple words?

The corporate veil is the legal separation between a company and its owners. This means that the company is treated differently from the shareholders.

Q2. Why do courts lift the corporate veil?

Courts lift the corporate veil when the company is used for fraud, tax evasion, or to break the law. It helps hold the real people behind the company accountable.

Q3. What is the main benefit of the corporate veil?

The main benefit is limited liability. It protects shareholders’ personal property if the company faces loss or legal action.

Q4. Does the Companies Act talk about the corporate veil?

Many sections of the Companies Act 2013 allow the lifting of the corporate veil in case of fraud, mismanagement, or wrong information during company formation.

Q5. Can the corporate veil be lifted in criminal cases?

Yes. If the company is involved in criminal activities or used to hide crimes, the court can lift the veil and punish the people behind it.

Q6. Is the corporate veil the same as limited liability?

They are related. Limited liability is a result of the corporate veil. The veil creates a legal wall, and limited liability is the protection it gives.

Q7. What happens after the veil is lifted?

Once the corporate veil is lifted, courts treat the company and its owners as the same. Owners may have to pay debts, face punishment, or follow court orders.