The cost unit and the cost center are two of the most important concepts in both cost accounting and financial management, allowing the tracking, allocation, and analysis of costs, which normally benefits organizations toward attaining operational efficiency and hence an adequate basis for decisions. A cost center is any one of the parts or departments of an organization that incur a cost but do not generate any revenue in direct return. A cost unit would be a measurable output or quantity of some product or service to which such costs are assigned. Concepts such as these form the basis for not only cost control and pricing strategy but also profitability analysis.

Cost Center Meaning

A cost center is a division, department, or some other organization entity where the costs are incurred. It does not directly contribute to the generation of revenue for the company but serves as an auxiliary source to the core revenue-generating activities. The main goal of a cost center is to monitor and control expenses to provide the company with the most efficient work.

Key Characteristics of a Cost Center

- Non-Revenue Generating: Cost centers focus solely on expenses rather than profit generation.

- Expense Tracking: All costs associated with the operation, such as labor, materials, and utilities, are monitored here.

- Supports Operations: Essential for smooth organizational functionality, even if they don’t produce revenue directly.

- Examples: IT departments, R&D, human resources, and maintenance.

Cost centers help businesses evaluate which operations or departments are consuming resources disproportionately. Thereby aiding in strategic decision making to enhance cost efficiency.

Types of Cost Centers

Cost centers can be broadly classified based on their functions and responsibilities within an organization. These categories ensure precise cost tracking and better financial control.

- Production Cost Center: Directly involved in the process or production of manufacture. Example: An automobile factory line with an assembly line, or with welding stations.

- Service Cost Center: It has the role of providing key services to other departments or cost centers. Examples: IT support, cafeteria, and maintenance.

- Operation Cost Center: Examines specific operation processes. Examples: Quality assurance or packaging units.

- Personal Cost Center: Centers include people or teams within an organization. Examples: Sales team or customer service representatives.

- Equipment Cost Center: Specialized equipment or machinery. Focuses on particular equipment or machinery used in production. Examples: CNC machines, printing press.

Cost Centre Example

The production department, in a furniture-producing company, is a cost center. Here, the costs in the form of raw materials (wood and nails), labor in the form of carpentry staff, and utility costs in terms of electricity supplied to machinery are involved. Accounting records the cost of such a center so that the company can analyze its operational efficiency.

What is Unit Cost?

The total amount of spending on one unit’s production, storage, and selling of a product or service is what has been described as unit cost. This represents one of the most significant measures in determining whether the pricing strategies can work efficiently with cost management and profitability.

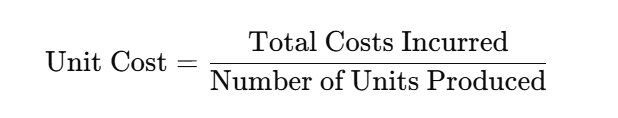

Formula:

Factors Influencing Unit Cost:

- Economies of Scale: Producing in bulk reduces per-unit costs.

- Input Costs: Fluctuations in raw material or labor costs impact unit costs.

- Production Efficiency: Streamlining operations lowers unit costs.

Example of a Cost Unit

In various industries, cost units vary depending on the nature of the output.

| Industry | Cost Unit |

|---|---|

| Electricity | Per kilowatt-hour (kWh) |

| Transportation | Per passenger-kilometer |

| Hospitality | Per room night |

| Manufacturing | Per piece |

For instance, in the transportation industry, if a bus travels 100 kilometers with 50 passengers, the cost per passenger-kilometer helps allocate costs effectively.

Cost Center and Cost Unit Difference

Although cost centers and cost units are interrelated, they differ significantly in purpose and application. A cost center better articulates consolidated expenses through cost savings that help in evaluating how efficiently the resources are being utilized. On the other hand, a cost unit sets a benchmark for profitability and pricing strategies across products or services. Together, they ensure comprehensive cost control and financial transparency.

| Aspect | Cost Center | Cost Unit |

|---|---|---|

| Definition | A specific location or department where costs are incurred. | A measurable quantity of output or service. |

| Purpose | Tracks and manages expenses. | Assigns costs to units of production or service. |

| Examples | IT department, machinery. | Per piece, per kilometer. |

| Primary Role | Operational cost management. | Cost allocation and pricing. |

Cost Center and Cost Unit FAQs

What are cost centers used for in organizations?

Cost centers track and manage expenses, helping businesses allocate resources effectively and improve financial accountability.

How are cost units helpful in pricing strategies?

Cost units standardize cost allocation, providing insights into the minimum selling price needed to achieve profitability.

What is the main difference between a cost center and a profit center?

Cost centers focus on expense tracking, while profit centers aim to maximize revenue and profits.

Can an entity function as both a cost center and a profit center?

Yes, for example, a sales department may track operational costs (cost center) while generating revenue (profit center).

Why is unit cost crucial in cost accounting?

Unit cost enables precise cost analysis per product or service, aiding in cost control and strategic planning.