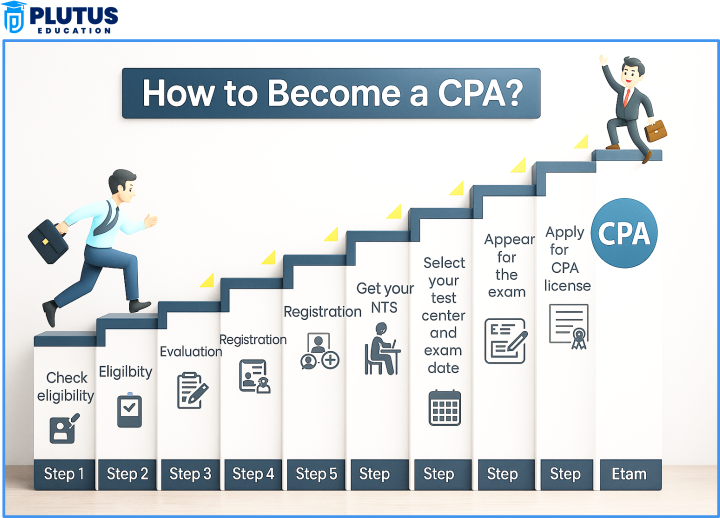

The Certified Public Accountant (CPA) credential is among the most respected qualifications in global accounting. It is particularly suited for professionals aiming to build careers in finance, auditing, and taxation, especially within U.S.-based companies or multinational corporations. Administered by the American Institute of Certified Public Accountants (AICPA), this certification is recognized in over 100 countries. For Indian students, qualifications like B.Com, M.Com, CA, or CMA often fulfill most eligibility requirements to pursue CPA. With this credential, professionals gain access to high‑paying roles, strong job security, and diverse career opportunities worldwide, making it a preferred choice for finance aspirants.

What is CPA?

CPA stands for Certified Public Accountant, a licensed accounting designation issued by the AICPA in the United States. A CPA can sign financial statements, conduct audits, and handle U.S. tax matters. The credential verifies your U.S. GAAP, IFRS, auditing, economic analysis, and taxation expertise. It’s often compared to India’s CA qualification, but CPA is globally focused, while CA is India-specific. Holding a CPA can open doors to jobs in top consulting firms, global banks, and Fortune 500 companies.

CPA Course Duration

The CPA course consists of four papers and typically takes 12–24 months to complete. The average Indian student takes around 18 months, depending on study hours and working status. Once a candidate clears one paper, they must finish the remaining three within an 18-month “rolling window.” This structure ensures that candidates study consistently and complete the course quickly. Flexible exam scheduling through Prometric centers in India helps students and professionals manage their preparation better.

| Component | Duration |

| Full Course | 12–24 months |

| Each Paper | 2–3 months |

| Rolling Exam Window | 18 months |

| Prometric Centers | Delhi, Mumbai, Chennai, Hyderabad |

| Online Exam Scheduling | Yes |

CPA Eligibility for Indian Students

To be eligible for the CPA exam, Indian students must meet education and credit hour requirements. Most U.S. states require 120–150 credit hours of study, roughly equal to a Master’s degree in India. Chartered Accountants (CAs), M.Com, or MBA holders often meet these requirements. Indian B.Com graduates may fall short and need additional certification or coursework. Every candidate must also have their transcripts evaluated by agencies like NASBA or NIES to verify eligibility.

| Criteria | Requirement |

| Basic Degree | B.Com + M.Com / CA / CMA |

| Credit Hours | 120–150 |

| Evaluation Agency | NASBA / NIES |

| Experience Requirement | 1–2 years (for license) |

| Best State Boards (India) | Alaska, Guam, Colorado |

CPA Fees in India

The total CPA course fees in India varies between ₹2.5 lakh and ₹3.5 lakh, depending on the state board, training providers, and exchange rate. Exam fees for all four sections range from ₹64,000 to ₹80,000, paid to NASBA. Other expenses include application fees, evaluation charges, international test fees, and study materials. International candidates like Indians must also pay an extra testing fee of ₹80,000–₹1,20,000. Many students opt for Becker or Wiley for preparation, which adds to the cost but improves the success rate.

| Component | Estimated Cost (INR) |

| Exam Fees (4 Papers) | ₹64,000 – ₹80,000 |

| Evaluation Fees | ₹8,000 – ₹24,000 |

| Application Fees | ₹8,000 – ₹12,000 |

| Study Materials | ₹50,000 – ₹1,50,000 |

| International Fee | ₹80,000 – ₹1,20,000 |

| Licensing Fee | ₹4,000 – ₹40,000 |

| Total | ₹2,50,000 – ₹3,50,000 |

CPA Syllabus

The CPA syllabus is divided into four papers: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Regulation (REG), and Business Environment & Concepts (BEC). Each paper covers essential accounting and business areas aligned with U.S. standards. The syllabus includes U.S. GAAP, audit procedures, taxation, business law, ethics, and IT governance. CPA candidates gain the comprehensive knowledge needed to handle accounting responsibilities globally. Preparing for each paper involves using mock tests, simulations, and review materials.

| Section | Topics Covered |

| AUD | Ethics, Risk, Internal Controls, Reporting |

| FAR | U.S. GAAP, IFRS, Financial Reporting |

| REG | Taxation, Business Law, Ethics |

| BEC | Economics, Financial Management, IT, Writing |

CPA Exam Pattern

The CPA exam is 100% computer-based and consists of MCQs, Task-Based Simulations (TBS), and Written Communication Tasks (WCT). Each section is 4 hours long and tests technical knowledge and practical application. A minimum score of 75 out of 99 is required to pass a section. Exams are held year-round, and candidates can take them at Prometric centres across India. The exam format is rigorous, and candidates should take multiple practice tests to get familiar with question types.

| Section | MCQs % | TBS % | WCT % |

| AUD | 50% | 50% | NA |

| FAR | 50% | 50% | NA |

| REG | 50% | 50% | NA |

| BEC | 50% | 35% | 15% |

CPA Exemptions for Indian Students

Indian students with professional qualifications like CA, CMA, or CS may receive exemptions from evaluation or coursework. For example, CA-qualified candidates often meet the 150-credit hour requirement through their CA and B.Com degrees. ACCA affiliates may receive subject exemptions but must take India-specific bridge courses. CS-qualified students may get limited exemptions in business law subjects. However, all students must still pass the CPA exams—AICPA provides no paper exemptions.

| Qualification | Possible Benefit |

| CA (ICAI) | Credit hour & experience waiver |

| CMA (India) | Similar to CA |

| ACCA | Must pass bridge exams |

| CS (India) | Business law exemption (limited) |

| MBA / M.Com | Credit hour benefit (state-dependent) |

CPA Salary in India

CPA professionals in India earn between ₹6–₹10 LPA as freshers and can rise to ₹25–₹35 LPA or more with experience. Big 4 firms like Deloitte, PwC, EY, and KPMG regularly recruit CPA-qualified accountants. Roles include financial analyst, auditor, controller, and tax consultant. Professionals with CPA and CA/MBA combinations are preferred for senior finance leadership roles. Those who relocate to the U.S. or UAE earn more, ranging between ₹50 LPA and ₹1 crore annually.

| Experience Level | Job Role | Salary (INR) |

| 0–2 years | Analyst, Associate | ₹6 – ₹10 LPA |

| 3–5 years | Manager, Sr. Analyst | ₹10 – ₹20 LPA |

| 6+ years | CFO, Financial Controller | ₹25 – ₹35+ LPA |

| Global Roles | Sr. Manager, Head of Finance | ₹50 LPA – ₹1 Cr+ |

CPA vs CA Comparison

CPA (Certified Public Accountant) and CA (Chartered Accountant) are respected accounting designations, hey differ in scope, curriculum, and global recognition. AICPA governs CPA in the United States and focuses on U.S. GAAP, IFRS, and international taxation, making it ideal for professionals aiming for global careers. In contrast, CA is administered by ICAI in India and emphasizes Indian taxation, laws, and financial regulations, which suit those planning to work within India. While CA takes 4–5 years to complete with multiple levels, CPA can be completed in 18–24 months. Professionals with a CPA enjoy broader international mobility, especially in U.S.-based roles or multinational corporations.

| Feature | CPA (US) | CA (India) |

| Governing Body | AICPA + State Boards | ICAI |

| Duration | 18–24 months | 4.5 – 5 years |

| Global Recognition | Very High | Moderate |

| Focus Area | U.S. GAAP, IFRS, U.S. Tax | Indian Taxation & Audit |

| Job Demand in India | Big 4, MNCs, Finance Sector | Indian Firms, Tax Practice |

CPA FAQs

1. What is the complete form of CPA, and why is it important?

CPA stands for Certified Public Accountant, a globally recognized U.S. accounting license. It offers global job opportunities and higher salaries in finance and audit.

2. What is the total cost of pursuing a CPA in India?

The total cost ranges from ₹2.5 lakh to ₹3.5 lakh. This includes exam, evaluation, training, and international testing fees.

3. How long does it take to complete the CPA course?

CPA can be completed in 18–24 months. All four papers must be cleared within a rolling 18-month window.

4. What are the eligibility criteria for a CPA in India?

You need B.Com + CA/M.Com or 120–150 U.S. credit hours. Credential evaluation is mandatory for Indian degrees.

5. What is the starting salary of a CPA in India?

Fresh CPAs earn ₹6–₹10 LPA. With experience, it can rise to ₹25–₹35 LPA or more in senior roles.