The CPA (Certified Public Accountant) exam has strict eligibility criteria, particularly in terms of educational qualifications. While you cannot pursue CPA immediately after completing your 12th standard, this stage is ideal for planning your career path. After 12th, aspiring CPAs should focus on enrolling in undergraduate courses like B.Com or equivalent programs that align with CPA educational requirements. Making informed decisions early helps you meet the eligibility faster and stay on track toward this globally prestigious certification in accounting and finance. The CPA credential opens opportunities in auditing, taxation, and financial management for professionals worldwide.

CPA Full Form

The full form of CPA is Certified Public Accountant. It is an internationally respected accounting certification administered by the American Institute of Certified Public Accountants (AICPA) . CPAs are highly skilled professionals in accounting, finance, auditing, and taxation.

They are entrusted with important tasks such as conducting audits on financial statements, offering tax guidance, and maintaining financial records. CPAs work in all kinds of industries like finance, government, public accounting, and health care. Pursuing the CPA designation allows for the innumerable career paths available in the realms of public accounting, corporate finance, taxation, consulting, and more. Having this title is a badge of recognition of your deep knowledge in the financial world, and you are an absolute prime candidate for well-paid employment.

The term CPA is not only a kind of certification, but it is also a sign of trust in the financial world. A guarantee that the holder of the CPA designation possesses a broad understanding of the accounting principles of the world and is capable of utilizing that knowledge in real business environments. As compared to other accounting professionals, CPAs are the only ones with the power to audit public firms, provide attestations, and represent clients before the IRS, distinguishing them with greater regulatory duties and a wider practice scope.

CPA After 12th

CPA after the 12th cannot be persuaded directly. You cannot directly enter the CPA program after 12th grade. Yet, it is possible to begin the process by taking the right academic and career route. In order to qualify for the CPA exam, the following conditions must be fulfilled:

- Educational Qualification: The CPA exam requires candidates to have a minimum of 120-150 credit hours of education, which is equivalent to a bachelor’s degree. Usually, this is done by the attainment of a bachelor’s degree in commerce, accounting, or business administration. In several states in the U.S. candidates are also accredited by being in possession of a master’s degree or credits above the undergraduate level.

- Work Experience: In most jurisdictions, CPA candidates must acquire 1-2 years of related work experience in accounting, auditing, or taxation before they can get licensed as CPAs.

How Can You Prepare for CPA After the 12th?

Even though the CPA examination is not something you can take right after 12th grade, you can begin laying the foundation for your CPA career. Here’s how:

- Choose the Right Undergraduate Degree: After completing your 12th in commerce or any relevant stream, enroll in a bachelor’s program such as B.Com (Bachelor of Commerce), BBA (Bachelor of Business Administration), or B.Sc. in Accounting. These courses will enable you to learn the essentials of accounting and finance necessary for CPA preparation.

- Focus on Accounting and Finance Subjects: Undergraduate study should encompass core courses such as financial accounting, taxation, business law, and auditing. These are foundational topics for the CPA exam.

- Earn Additional Credits if Needed: There may be students who are unable to achieve the 150 credit hour requirement with only a baccalaureate degree. In such situations, you may consider obtaining a master’s degree, diploma, or further certificate program in accounting to satisfy this requirement.

- Gain Early Work Experience: Apart from your studies, it will be good to have work experience in the accounting/accountancy area. Internships/part-time work in auditing, bookkeeping, or tax will provide you with some hands-on experience and boost your profile.

- Stay Updated About CPA Requirements: The CPA examination requirements are not uniform across the U.S. states in which you intend to take the exam. Conduct research into these requirements as early as possible and plan your academic and professional course of action accordingly.

By following these steps, you can systematically prepare yourself to qualify for the CPA exam and begin your journey toward earning this prestigious designation.

CPA Certification

The CPA certification is a globally reputable certificate being delivered by the AICPA to those who prove knowledge and skill in accounting, taxation, and auditing. It signifies that a professional has met the highest standards of competency and ethics in the accounting profession. The CPA certification is one of the most highly regarded credentials in the financial field. Here’s why you should consider pursuing it:

- Career Advancement: A CPA certification can fast-track your career and open up senior-level positions in accounting, finance, and management.

- Gaining Practical Experience: Internship opportunities during college provide practical exposure and foundational skills, serving as a crucial stepping stone for students in the accounting field. Entry-level positions at accounting firms offer hands-on experience and professional growth, crucial for early career development. These roles are essential for meeting the work experience requirements needed to obtain CPA licensure, ensuring readiness for more advanced responsibilities.

- Global Opportunities: CPAs are in high demand worldwide, particularly in countries like the U.S., Canada and Australia.

- Higher Salary: CPA-certified professionals earn significantly more than non-certified accountants.

- Versatile Skills: The CPA license provides a wide array of skills that can be used across different sectors, including public accounting, and investment banking.

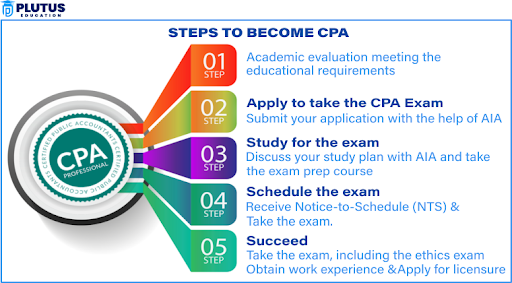

Steps to Earn CPA Certification

This certification shows us that a person has undergone rigorous academic, ethical, and experiential requirements. It opens the doors of international career, with the prestige and recognition in the financial sector. Steps to earn CPA certification.

1. Meet Educational Requirements: Complete a bachelor’s degree or equivalent with at least 120-150 credit hours.

2. Pass the CPA Exam: Successfully clear all four sections of the CPA exam.

3. Fulfill Work Experience Requirements: Gain 1-2 years of experience in relevant fields working with a licensed CPA.

4. Apply for a CPA License: Submit your application to the state board of Accountancy and become certified by obtaining your CPA license.

CPA Course

The CPA course is a professional certification program designed to give participants a deep understanding and competency in accounting, auditing, financial management, and taxation. It is the gold standard in the accounting profession and is greatly desired by employers around the globe.

- Structure of the CPA Course: The CPA course comprises four principal modules which are all focus on different accounting and finance topics. These are:

- Auditing and Attestation (AUD): This section focuses on audit procedures, professional ethics, and risk assessment. Candidates learn to plan, execute, and assess audit engagements.

- Financial Accounting and Reporting (FAR): FAR addresses financial reporting frameworks such as U.S. GAAP and IFRS. It is one of the most difficult sections in terms of requiring detailed knowledge of accounting standards and financial reports.

- Regulation (REG): This section focuses on taxation, business law, and ethics. Applies tax law, estate planning, and responsibilities limitations from the perspective of an accountant.

- Exam Format: The CPA exam is computerized, with multiple-choice, task-based simulations, and written communication tasks. In order to be successful, applicants have to get at least 75 on all sections during 18 months.

The CPA course is demanding and one needs to make a high commitment to coursework. Still, the cost is justified because to pass the CPA examination an exciting career path in public accounting, corporate finance, and consulting is available.

The Future of the CPA Profession

The CPA profession is undergoing significant transformations due to various factors:

- Technological Changes Impacting the Profession: Automation and artificial intelligence are transforming jobs historically done by CPAs. Technologies such as blockchain and data analytics are increasingly becoming core, necessitating new skills in dealing with sophisticated financial information and guaranteeing transparency.

- Emerging Trends in Accounting and Financial Services: Sustainability and ESG reporting is becoming increasingly emphasized. CPAs are increasingly being asked to comment on non-financial metrics affecting a company’s performance and long-term sustainability.

- Changing Competency Sets for Effective CPAs: Modern-day CPAs require a combination of technical and interpersonal skills. Skill in digital tools is as important as strategic thinking and communication skills. CPAs need to change by acquiring competency in cybersecurity, digital finance, and strategic advisory to remain effective and at the forefront of their profession.

These trends suggest that the role of CPAs is expanding beyond traditional boundaries, making adaptability and continuous learning essential traits for success.

CPA After 12th FAQs

Can I do CPA after 12th?

No you cannot directly pursue CPA after 12th grade. To meet the Professional Certification Board (CPAB) exam candidacy criteria, a Bachelor’s degree or its equivalent should be earned with a minimum of 120-150 credit hours.

What is the average salary for a CPA?

The average salary for a Certified Public Accountant (CPA) in India varies depending on experience and location, but generally ranges from ₹6 to ₹13.8 lakh per year.

What is eligibility for CPA?

To be eligible for the CPA exam in the US, candidates typically need a bachelor’s degree, a specific number of credits in accounting and related subjects (often 120 or 150), and some relevant work experience. Many states also require candidates to pass the Uniform CPA Exam and meet additional requirements for licensure.

How to become CPA in USA after 12th?

The minimum eligibility for US CPA is a graduation degree or 120 college credit hours. While there are no exemptions for US CPA, you can choose any commerce or accounting course and post your 12th grade and then complement it with a US CPA degree.

What is the CPA course?

The course in CPA, because it is a professional course, provides professional accounting, tax, auditing, and financial management knowledge. It prepares candidates for senior finance and accounting positions.

What are CPA course fees?

CPA course fees usually cost between ₹2,05,000 to ₹3,30,000,

What is CPA certification?

CPA certification is a certification awarded to individuals, by way of completion of the CPA exam and adherence to educational standards and requirements for workplace experience. It validates expertise in accounting and financial management.