The CPA certification course is ranked one of the world’s most accredited professional qualifications in accountancy and finance. The course benefits students by giving them an edge in being more competitive when aiming for lucrative careers in auditing, taxation, financial management, and consultancy practices. A CPA course duration would typically take about 12 to 18 months. This depends on the speed of preparation and scheduling the candidate makes for his four sections of exams. It is known as rigorous and is a credible credential-the CPA certificate opens a wide world for one’s movement for work positions in the finance and accounting field. The article guides all areas of the CPA course from eligibility to licensing and also gives a glimpse into career outcomes.

What is CPA?

CPA full form Certified Public Accountant. It is one of the most prestigious accounting qualifications under the American Institute of Certified Public Accountants. In short, the CPA designation has been considered the top and most coveted proof of an individual’s capability in accounting principles, auditing, taxation, and financial analysis. In most countries in the rest of the world, a CPA designation is yet to be deemed as the epitome of perfection that many organizations in diverse industries seek after and earn.

The CPA certification reflects its value across public practice, corporate finance, and government services. Moreover, unlike other certifications, the CPA encompasses a broad range of skills, making professionals highly valuable to organizations. Furthermore, it demonstrates not only technical expertise but also a strong commitment to high ethical standards. As a result, CPAs serve as trusted business advisors, effectively guiding financial decisions that are both accurate and precise.

Why Study CPA?

CPA course is a game-changer for accounting professionals, preparing candidates with high-end skills to make them stand out in competitive job markets. Gaining recognition around the world, the CPA certification stands for credibility and competence. It gives them the ability to work in any public accounting and private firms and any government agencies; it opens doors to higher-paying positions and long-term prospects in the finance, IT, healthcare, and consulting world. CPAs often hold key leadership positions as they advise on mergers, tax planning, and audits, making them essential to decision-making processes.

The AICPA administers the US CPA exam, covering accounting, auditing, taxation, and business topics. Well-prepared candidates who pass the exam earn the distinguished CPA title, signifying excellence in the accounting profession.

CPA Course Duration

The US CPA course typically takes 12–18 months, depending on preparation, exam scheduling, and study pace. It includes four sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG), requiring 400–800 hours of study. Candidates must complete all sections within 18 months of passing the first. Full-time students often finish in 12 months, while working professionals may take longer. Familiarity with accounting concepts can reduce preparation time, especially for business majors. Timely receipt of the Notice to Schedule (NTS) and resources like Becker or Wiley help streamline the process. Proper planning ensures timely completion.

| Aspect | Details |

| Total Duration of CPA Course | 12–18 months (Varies by preparation time, scheduling of exams, and study pace). |

| Exam Sections | Auditing and Attestation (AUD) |

| Business Environment and Concepts (BEC) | |

| Financial Accounting and Reporting (FAR) | |

| Regulation (REG) | |

| Study Time Per Section | 100–200 hours (Per section, depending on familiarity with the subject). |

| Total Study Time | 400–800 hours (Cumulative across all four sections). |

| Exam Scheduling Flexibility | Candidates can schedule each of the four sections at their convenience. |

| All four sections must be completed within 18 months of passing the first section. | |

| Full-Time Candidates | Typically complete the course in 12 months. |

| Working Candidates | Typically requires 18 months or more, due to balancing work and studies. |

| Factors Impacting Timeline | Preparation time for each section. |

| Delays in receiving the Notice to Schedule (NTS) after exam registration. | |

| Familiarity with accounting, finance, and business topics. | |

| Use of supplemental resources such as Becker, Wiley, or Gleim CPA Review materials. | |

| Key Strategies for Completion | Develop a structured study plan with dedicated hours for each section. |

| Schedule exams based on personal strengths and areas requiring more preparation. | |

| Use mock exams and practice simulations to identify weak areas early. | |

| Additional Considerations | Candidates with accounting/business backgrounds often complete faster. |

| Candidates without related college coursework may require more preparation time. | |

| Application and Approval Delays | Some jurisdictions have delays in approving CPA applications, affecting start dates. |

| Planning for Success | Completing the CPA course in 12 months requires intensive preparation and planning. |

| A maximum of 18 months is available to complete the exams after passing the first one. |

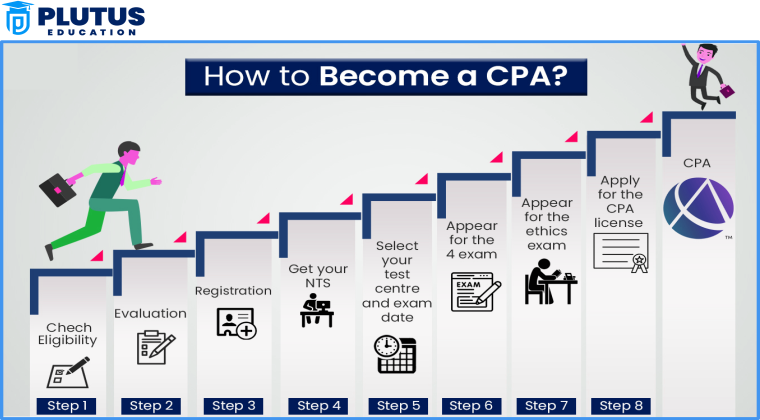

How to Become a CPA?

US CPAs are stringent learning and professional routes that include deep learning, strenuous training, and experience. Candidates have to pass tests and evaluations and receive a license from the body to be considered qualified in accounting. Steps on How to Become a CPA are listed below:-

Step 1: Be Eligible to Become a CPA

CPA Eligibility is the base for taking the CPA journey.Each state has its own requirements. In general, the eligibility factors include the following:

- Educational Qualification: Bachelor’s degree in accounting or any relevant field with a minimum of 120–150 credit hours including financial accounting, auditing, taxation, and business law, usually completed in 5 years.

- Work Experience: In most states, supervised accounting experience is required for at least 1–2 years to ensure practical understanding.

- Ethics Requirement: Some states require taking and passing an ethics examination before sitting for the CPA exam.

Step 2: Apply for Admission to the CPA Exam

If the candidates are eligible to sit for the CPA exam, then have to apply for that through their respective state’s Board of Accountancy. Attach the transcript and record of education, substantiating their qualifications for the said eligibility. Make payment of the requisite fees followed by the Notice to Schedule (NTS), permitting them to enter into any of the open schedules of the CPA exam. In most of the states, the NTS is valid for six months.

Step 3: Preparation for the CPA Exam

It consists of four parts testing a specific knowledge area. Preparing for this exam requires so much time and effort. Cpa Exam Pattern and CPA subjects are listed below:-

- Auditing and Attestation (AUD): Focuses on auditing processes, ethics, risk appraisal, audit procedures, internal controls, evidence evaluation, and reporting findings. Ethical standards and auditor responsibilities are key areas.

- Business Environment and Concepts (BEC): Corporate governance, economics, IT systems, risk management, and strategic planning. Written communication tasks require you to present complex business concepts concisely.

- Financial Accounting and Reporting (FAR): The most difficult section covers financial reporting topics, including US GAAP, IFRS, financial statements, consolidations, government and nonprofit accounting, and complex transactions.

- Regulation (REG): It covers federal taxation, business law, and ethics. This will include individual/corporate taxation, estate taxes, and the legal aspects of doing business.

Step 4: Pass All Four CPA Exam Sections

The Exam Format and Passing Criteria are:-

- The CPA exam is 16 hours in total. Each portion of the exam lasts four hours. Candidates must score at least 75 on each section to pass.

- The CPA exam uses a computer-based format and includes multiple-choice questions, task-based simulations, and written communication tasks for the BEC section.

- The scheduling flexibility allows candidates to take the exam all over the year at Prometric testing centers worldwide. However, preparation requires consistent study, effective use of CPA review materials, and strong time management skills.

Step 5: Complete Work Experience Requirements

You need 1–2 years of experience after passing the CPA exam, which must be supervised by a licensed CPA. Furthermore, this stage provides valuable practical accounting exposure and ensures you can effectively apply theoretical knowledge in real-life scenarios. Various CPA jobs exist in the form of auditors, tax consultants, forensic accountants, financial analysts, and corporate controllers in the public and private sectors.

Step 6: Obtain a CPA License

After completing the educational, examination, and work experience requirements, one is eligible to apply for the CPA license. Present proof of completion of education passed exams, and documented work experience. Some states may require additional ethics exams, above the licensing procedure.

Step 7: Continuing CPA Certification.

The CPA certification distinguishes professionals in the competitive job market, demonstrating mastery of financial concepts and ethical standards. To earn it, candidates must enroll, pass the exam, and obtain licensure. CPAs must maintain their certification by completing 40–80 annual Continuing Professional Education (CPE) hours (varies by state) and adhering to AICPA’s code of conduct. CPE ensures CPAs stay updated on industry changes, regulations, and emerging trends.

CPA Course Duration FAQs

How many months will the CPA course take?

The time frame for the completion of the CPA course is roughly 12 to 18 months.

How many months does it take to clear all four parts of the CPA examination?

You must finish all four parts of the CPA exam within 18 months of passing one section.

Is it possible to finish the CPA course in under 12 months?

Yes, a full-time student or even one with extensive knowledge in accounting can complete the CPA course within 12 months.

How many hours do you need to study for each section of the CPA exam?

You need to study about 100–200 hours for each section, totaling around 400–800 hours for all four sections.

Does prior work or education affect the time needed to complete the CPA course?

Yes, full-time workers will likely take about 18 months; however, those with prior accounting education will finish much sooner.