Choosing between a CPA and a CA is difficult for commerce students and professionals because both qualifications ensure paths to high-value careers worldwide. The question is always raised as to whether CPA or CA which is better. The answer would depend on the individual goals; for example, if someone wants to pursue international opportunities, a CPA is ideal, and if someone wants to be an ace in accounting and finance within the region of India or other countries where the CA qualification is more recognized, CA is ideal.

What is CPA?

CPA full form is Certified Public Accountants. The International Certified Public Accountant is a globally accepted certificate by the American Institute of Certified Public Accountants(AICPA). It is a globally recognized designation for which aspirants must take the Uniform CPA Examination and pass it. In India, the Chartered Accountant (CA) designation is equivalent to the US CPA. Best suited for professionals looking for a profession in accounting, auditing, and finance across global markets, especially in the United States.

- Eligibility Criteria: Every state has its CPA exam prerequisites, but some standard eligibility criteria are:

- At least Graduation or equivalent degree

- 150 semester hours of college courses to earn a CPA license

- 1-2 years of experience under any CPA

- Eligibility Criteria For Indians: Indian students should have one of the following qualifications. They should be members of either ICAI, ICMAI, or ICSI. Other than being a member of one of these organizations, they can possess an MBA or M.Com degree.

- Scope: Specialized CPAs deal with taxation, audit, financial analysis, and compliance with regulatory procedures. Their skill is highly needed in multinational firms and Big Four firms.

- Global Acceptance: A CPA has an advantage in countries where US business is significant, such as Canada, the Middle East, and Australia.

- Skill Set Building: The CPA program focuses on US GAAP and IFRS, and taxation, making it a must for those who want to work in US-based companies.

What is CA?

CA full form is Chartered Accountant. It is the flagship designation in India for accounting and finance professionals. CA falls under the Institute of Chartered Accountants of India. It will be apt for those who would like to work in India or countries having business tie-ups with India.

The CA exams, conducted by the Institute of Chartered Accountants of India (ICAI), rank among the most challenging tests in the country. Divided into three levels – CA Foundation, CA Intermediate, and CA Final – successful completion leads to ICAI membership and the prestigious title of Chartered Accountant (CA). CA Intermediate and Foundation exams occur thrice a year during May/June, September, and January Final exams occur twice annually during the May and November sessions.

- Eligibility Criteria: After clearing Class 12, a student needs to qualify for the Foundation, CPT. A graduate bypasses this stage and directly enters the Intermediate.

- Moving on to the CA Intermediate Level, there are two routes for registration: the CA foundation route and the direct entry route. Under the CA foundation route, students must pass the CA foundation exam with an overall score of 50% and a minimum of 40% marks in each subject.

- For the Direct Entry Route, graduates from any stream can apply directly, with eligibility criteria set at 55% marks for commerce students and 60% marks for science students in their graduation.

- As for the CA Final Level, eligibility requires passing both groups of the CA Intermediate Level and completing a minimum of 2.5 years of articleship training under a certified firm.

- Scope: The CAs are masters of financial reporting, auditing, taxation, and corporate governance. They constitute a very crucial part of Indian companies, regulatory bodies, and government departments.

- Indian Relevance: The CA program is well framed keeping in mind Indian laws, tax regulations, and accounting standards.

- Professional Standing: Being a CA in India is considered an honor. One gets scope for public practice, consultancy, and industry leadership.

CPA & CA Program Completion Requirements

Program completion requirements as a CPA or CA ensure that the candidates have the academic and practical skills to succeed in the profession. To be a US CPA, one has to pass four stringent exams within 18 months of registration. These exams cover some of the important areas such as financial accounting, audit, taxation, and business environments. However, practical acumen has to be proven through relevant working experience under a licensed CPA. CPAs have to complete Continuing Professional Education (CPE) credits regularly after certification to maintain their credentials and be updated on changes in the field.

A CA aspirant has to clear three levels of examinations- Foundation, Intermediate, and Final. These are broad in the topics covered; Indian taxation, accounting standards, and auditing practices. Unlike the CPA, a 3-year articleship program is an integral part of the CA route; here, a candidate works under a practicing Chartered Accountant for practical experience. There is no formal requirement for a CPE after qualification, but professional development is recommended to keep abreast with industry standards that evolve with time. For the CA Foundation Level, students must meet the eligibility criteria set by ICAI. This involves passing class 12 or an equivalent exam from a recognized board. Students are required to score a minimum of 50% marks in class 12 to qualify for the CA foundation level.

CPA & CA Exam Format

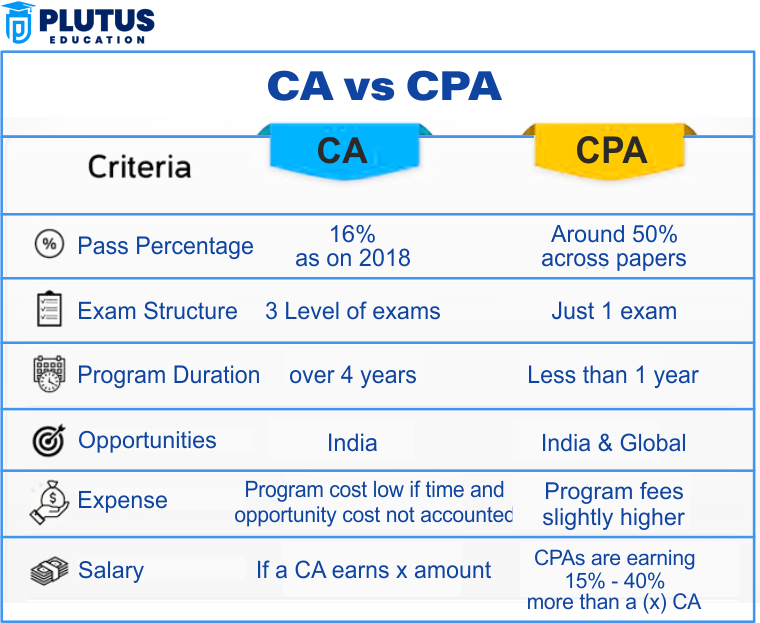

The exam format of CPA and CA differs vastly in terms of levels, duration, and areas of focus. CPA is a one-tier program having four exams: Financial Accounting and Reporting (FAR), Auditing and Attestation (AUD), Regulation (REG), and Business Environment and Concepts (BEC). Every exam is around four hours long and can be attempted in any order by the candidates. The pass rate for each paper is approximately 50%, making CPA exams difficult yet not an impossible hurdle to cross for targeted candidates. The emphasis was placed on US GAAP, IFRS, and tax laws, which are in keeping with international accounting standards.

In contrast, the CA program has three levels: Foundation, Intermediate, and Final. The exams are spread over several years, including the mandatory articleship. The pass rate for CA exams is much lower, generally between 5–15%, making them one of the toughest professional qualifications in the world. The syllabus is mainly on Indian laws, tax regulations, and accounting standards catering to domestic industries and businesses.

| Aspect | CA | CPA |

| Levels | Three: Foundation, Intermediate, and Final | Single-tier, four sections |

| Number of Papers | 20+ papers across three levels | Four papers: FAR, AUD, REG, BEC |

| Exam Duration | 3 hours per paper | 4 hours per paper |

| Passing Criteria | 40% per paper and 50% aggregate | 75% score per section |

| Exam Frequency | Bi-annual (May and November) | Multiple testing windows throughout the year |

| Format | Written and practical problem-solving | MCQ, task-based, and written communication. |

| Syllabus Focus | Indian laws, taxation, and accounting standards | Auditing and Attestation (AUD),Business Environment and Concepts (BEC),Financial Accounting and Reporting (FAR), Regulation (REG) |

| Difficulty Level | High, with low pass rates (5–15%) | Moderate, with pass rates around 50% per paper |

| Practical Training | 3-year mandatory articleship | 1–2 years of work experience required |

Duration and Flexibility

Important things to think about the suitability of programs for applicants are duration and flexibility. The fact that the CPA course duration is achieved within 18 months makes it well-suited to the professional intent of getting started as soon as possible. There are many invigilated periods throughout the year, so candidates can sit as and when they like. This, therefore, presents an opportunity for working professionals or students who opt for self-pacing. However, the eligibility criteria for CPA are stringent, requiring candidates to meet specific educational prerequisites.

On the other hand, the CA program takes around 4–5 years on average, and the period of articleship forms a part of that. It requires a long-term commitment since it has a structured time frame and fewer numbers of examinations. Though strictness in the CA program ensures full training, it does not suit anyone who wants to climb up the career ladder fast. The CA aspirant needs to prepare for a grueling journey that expects unwavering dedication and endurance.

CPA & CA Course Fee Structure

The cost of the CPA and CA qualification differs considerably. The certification for the CPA is a costly affair. The average total cost of a US CPA exam fee in India comes to approximately Rs. 3.5 – 4 lakhs depending upon the number of attempts and related costs. Training programs, workshops, and international testing fees will also be added if the candidates sit for the examinations outside the United States. The cost is worth it; the international recognition and career opportunities that come through the CPA designations are amazing.

CA is the relatively more cost-effective option wherein the total amount ranges between ₹75,000 to ₹1 lakh. The majority of the costs were only in exam fees and just basic study material. In CA, stipends are paid to students when they undergo article ship. In this manner, the program pays for some or all of these costs. Given this aspect of affordability, the CA is well-suited to Indian students whose financial backgrounds vary widely.

Earning Potential in CPA & CA Program

Earning potential is another area of variation in average salary of CPA and CA professionals. Roles, industries, and locations significantly impact earning potential. An entry-level CPA can expect ₹6–₹8 lakh in India. This figure goes as high as ₹15–₹30 lakh for a senior role in a multinational company. Higher packages are paid for CPAs with international market experience and demand for US GAAP and IFRS expertise.

On the other hand, in India, the CAs are a highly respected profession with entry-level remuneration often between ₹7–₹10 lakh annually. Inexperienced positions such as CFO or directors, could be even up to ₹25–₹40 lakh and more for seniors in top Indian firms or multinational organizations. The campus placement by ICAI campus places many students after qualification, thus making it one of the highly rewarding professions.

Career Opportunities for CPA & CA Students

The career prospects vary for both professionals based on qualifications and target market. CPAs have a huge market in roles such as CFO, auditor, and tax consultant. The demand lies in industries related to IT, banking, and multinational corporations. The international acceptance of the CPA designation makes high mobility across the countries possible, hence this is preferred when international opportunities are sought.

The CA roles, on the other hand, excel in roles related to Indian taxation, auditing, and corporate governance. The value they offer in the manufacturing, finance, and Indian corporate sectors is significant. Global mobility of CAs is moderate; however, the value they can provide for businesses domestic to India remains irreplaceable.

CPA or CA Which is Better?

The choice between CA or CPA involves the in-depth analysis of goals and aspirations connected with career goals, geographical locations, and strengths. Both are the coveted credentials leading to a career. However, both cater to different markets and professional aspirations. Let’s deep dive to find out which aligns better with various ambitions.

CPA- Certified Public Accountants

It is quite ideal for a professional seeking employment within international organizations or markets. Focused on U.S. accounting standards in the form of GAAP or Generally Accepted Accounting Principles and IFRS for International Financial Reporting Standards, the CPA is crucially linked to nearly all multinational corporate positions, thereby highly related to the United States of America. The CPA endorsement is also very valuable in countries like Canada, Australia, and even in the Middle East in which U.S. business practices are very common. The benefits of Choosing a CPA are:-

- Global Opportunities: A CPA degree enhances your resume for global finance, auditing, taxation, and business consulting positions.

- Duration of Time: While CA requires 4–5 years, CPA can be completed in just 18 months.

- Flexibility: it is the system of CPA exams that enables the individual to complete tests according to his schedule so it is a huge benefit to those who also want qualification accompanied by service.

- A job in Compliance Department and US Firm: companies such as McDonald’s and Walgreens look for only AICPA professionals for employment or recruitment of experts in accounting issues into their departments at the various bases of global operating firms that offer AICPA credentials.

CA – Chartered Accountants

Even up to this day, CA is still the gold standard qualification for accounting professionals in India. It focuses much on Indian laws, taxation policies, and accounting standards. That’s the very reason why it is the favorite qualification for most of the candidates who aspire to a healthy career within India. The comprehensive training would distinguish CAs with their skills in financial reporting, auditing, corporate governance, and strategic management. The advantages of CA are:

- Indian Market Relevance: The CA qualification gives the most extensive knowledge of Indian financial systems, tax laws, and regulations. This, of course, results in a great demand for such qualifications in domestic markets.

- Esteem Status: CA is a hallmark of excellence and integrity in the Indian business fraternity.Career Advancement in Top Management: Many CAs ultimately end up as CFO or Managing DDirectorsin Indian corporations and regulatory bodies.

- Cost-Effective: The CA program is relatively cost-effective and accessible to a wider range of aspirants as compared to the much costlier CPA pathway.

Which Qualification is Tougher: CA or CPA?

Often regarded as a much tougher qualification than a CPA in terms of evaluation of difficulty as it encompasses an all-inclusive syllabus, multi-level examination, and a mandatory 3-year articleship. Pass rates in the CA exams are pretty low and normally range between 5%–15%, which is an indication of how stringently ICAI Institute sets its examination standards.

In comparison, CPA has a higher pass rate of nearly 50 percent for each paper. Though CPA is very preparatory, a comparatively short time coupled with well-planned syllabi renders it relatively not more taxing as compared to the CA.

Career Opportunities for CPA & CA

CPA vs CA has different career lines in terms of geographical coverage.

CPA Career Line: CPAs are in high demand in multinational corporations, financial institutions, and international consulting houses. Commonly held CPA job posts include:

- Financial Analyst

- Tax Consultant- US taxation

- Auditor for US-based clients

- Compliance Manager for international regulations

These jobs are available in the US or other countries with substantial US companies. Indian CAs will get at least ₹6–₹8 lakh in minimum compensation. However, experienced persons can look for high positions in MNCs and make ₹30 lakh a year.

CA Career line: The finance industry in India is led by the CAs and has scope within Indian companies, public practice, and government employment. Some of the important ones include: Corporate Auditors.

- Expert on GST and Indian tax law Tax Advisor

- CFO of Indian conglomerates

- Strategic Adviser to the government regulatory authority

The newly qualified salaries range from ₹7 lakh-₹10 lakh to ₹40 lakh or more for the leadership roles.

Cost and Time

The CPA program is more expensive, costing ₹3.5–₹4.0 lakh in total, including the testing fees of the international examination. Given that it is relatively shorter, the aspirants would get an early start to start earning early on to recoup their initial investment.

The total fee for the Chartered Accountant (CA) course in India can range from ₹1 lakh to ₹3 lakh. The fees vary depending on the coaching institute and the number of attempts required to pass the exams. hence it acts as an economical solution for aspirants in India. It would delay the entry to the workforce, however.

Final Verdict CA or US CPA?

Choose CPA if You want an international career, wish to complete your qualification in less time, and want to specialize in US accounting standards. For people targeting multinational corporations, financial consultancy firms, or international tax advisory roles, the best option is the CPA.

Choose CA if Your focus is developing a strong career in India or Indian markets abroad. CA is unsurpassed in terms of depth knowledge of Indian financial and regulatory systems, making it the preferred choice for roles in auditing, taxation, and corporate leadership within India.

| Criteria | CPA (Certified Public Accountant) | CA (Chartered Accountant) |

| Global Recognition | Highly recognized worldwide, especially in the US, Canada, and the Middle East. | Prestigious reputation in India; recognized moderately in global markets. |

| Geographical Focus | Ideal for professionals targeting global roles in multinational corporations. | Best suited for professionals aiming to work in Indian firms and sectors. |

| Exam Structure | Four single-tier exams covering US GAAP, IFRS, taxation, and audit. | Three levels: Foundation, Intermediate, and Final, with comprehensive content on Indian laws. |

| Completion Time | 1.5–2 years on average. | 4–5 years, including 3 years of mandatory articleship. |

| Pass Rate | Approximately 50% per exam. | Ranges between 5–15%, making it one of the toughest qualifications globally. |

| Practical Training | Requires 1–2 years of experience under a licensed CPA. | Requires a 3-year articleship under a practicing CA. |

| Cost | Expensive: ₹2.5–₹3.5 lakh, including international testing fees. | Affordable: ₹75,000–₹1 lakh. |

| Career Roles | CFO, Auditor, Tax Consultant, and Financial Analyst in multinational firms. | CFO, Auditor, Tax Advisor, and Financial Consultant in Indian corporations. |

| Salary (India) | Entry: ₹6–₹8 lakh; Senior: ₹15–₹30 lakh or more. | Entry: ₹7–₹10 lakh; Senior: ₹25–₹40 lakh or more. |

| Relevance in India | Moderate: Limited to US-affiliated businesses and MNCs. | High: Covers Indian financial, regulatory, and taxation frameworks. |

| Work-Life Balance | Flexible exam schedules allow professionals to balance work and study. | Rigorous exams and articleship require a long-term commitment. |

| Difficulty Level | Moderate; exams are challenging but manageable due to high pass rates. | High; extensive syllabus and low pass rates increase difficulty. |

| Target Audience | Professionals aspiring for international exposure. | Professionals focused on domestic markets and regulatory roles. |

CPA USA Or CA FAQs

Is CPA better than CA in India?

CPA provides international exposure, but CA is more relevant to the Indian market because it is more concerned with domestic regulations.

Which one is tougher, CA or CPA?

CA is tougher because of low pass rates and a long articleship period, whereas CPA is tough but shorter in duration.

What is the cost difference between CPA and CA?

CPA costs significantly more, with fees between ₹2.5–₹3.5 lakhs, compared to CA’s affordable range of ₹75,000–₹1 lakh.

Can a CPA work in India?

Yes, CPAs are highly valued in Indian multinational corporations, especially those with US affiliations.

Is CA or CPA more recognized globally?

CPA enjoys higher global recognition, while CA is predominantly respected in India.