Cross price elasticity of demand is the most important economic measure that measures the relationship between the percentage change of a product’s price and its influence on the quantity demanded of another product. It tells one about the linkage of products in the market. From this, one can infer whether products are substitute, complementary, or not related. In the corporate arena, cross price elasticity of demand plays a central role in forming price strategies, gauging competition, and maximizing sales.

Cross price elasticity of demand is calculated with one very straightforward formula. But its implications can be quite profound. Understanding CPED helps businesses and policymakers take into account the subsequent behavior of consumers, according to shifts in prices, adapting these strategies and making better decisions regarding their pricing, marketing, and production.

What Is Cross Elasticity of Demand?

The cross elasticity of demand is the measure of how responsive the demand for a given good is to a price change in some other good. In contrast to own price elasticity, CPED looks not at the demand change for the same good but rather at the relationship between two different goods. It is what helps classify goods into either substitutes, complements, or unrelated goods.

Why Is Cross Elasticity of Demand Important?

Understanding CPED enables businesses to:

- Competitive Strategies Development: Based on the substitutes and their CPED, companies take appropriate pricing action to induce more consumers from competitors.

- Bundling Optimization: A bundling strategy for complementary goods at a low price could induce higher sales.

- Market Analysis and Forecasting: CPED would reveal demand interdependencies, which can be helpful for businesses predicting market reactions.

Cross Elasticity of Demand Formula

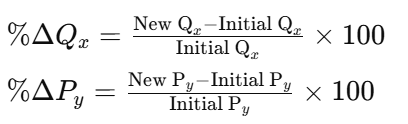

Formula to measure cross elasticity of demand:

Where:

- %ΔQx: Percentage change in the quantity demanded of Good X.

- %ΔPy: Percentage change in the price of Good Y.

Formula Components

- Numerator (%ΔQx): It measures the degree of demand fluctuation for Good X.

- Denominator (%ΔPy): It accounts for the relative price change of Good Y.

- Result Interpretation:

- Positive CPED: Indicates substitute goods. Demand for Good X rises when Good Y’s price increases.

- Negative CPED: Denotes complementary goods. Demand for Good X falls when Good Y’s price increases.

- Near-zero CPED: Suggests unrelated goods.

Key Observations

- High CPED Values: Strong substitutes or complements.

- Low CPED Values: Weak relationship between goods.

How to Calculate Cross Elasticity of Demand

- Select Two Goods: Determine which products to evaluate (Good X and Good Y).

- Record Data:

- Initial and new quantities of Good X.

- Initial and new prices of Good Y.

- Calculate Percentage Changes:

4. Apply the Formula:

- Substitute the values into the CPED formula.

Example Calculation

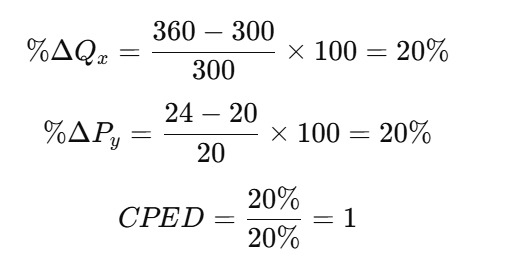

Consider the following data:

- Initial quantity of Good X: 300 units.

- New quantity of Good X: 360 units.

- Initial price of Good Y: $20.

- New price of Good Y: $24.

Interpretation: Good X and Good Y are close substitutes with unitary elasticity.

Cross-Price Elasticity of Substitute Products

Substitutes are those goods that substitute for one another to fulfill consumer needs. A positive CPED value means when the price of one increases, others’ demand for that substitute also increases. This is an important relationship that needs to be understood in competitive markets where consumers are sensitive to prices.

Examples

- Smartphones: Android vs. iPhone.

- Beverages: Tea vs. Coffee.

Characteristics of Substitutes

- High Substitutability: A minor price difference can lead to demand shifts.

- Brand Competition: Many substitutes compete within the same category, such as Coke and Pepsi.

- Elastic Demand: Consumers are more likely to switch if substitutes are easily available.

Cross-Price Elasticity of Complementary Products

Complementary goods are consumed together, such as cars and fuel. If a CPED value is negative then the price increase in one reduces its demand for the other. Businesses dealing with complementary goods have to be careful with the strategies they undertake on pricing and demand.

Examples

- Gaming consoles and games.

- Airline tickets and hotel bookings.

Characteristics of Complements

- Mutual Dependency: Consumption of one depends on the other.

- Bundling Opportunities: Discounts on one good can boost overall sales.

- Market Sensitivity: Price changes in one good directly affect the other’s sales.

Cross-Price Elasticity of Unrelated Products

For unrelated goods, the demand for one does not depend on the price change of another. Values near zero for CPED show no significant relationship. Businesses generally exclude unrelated goods from strategic considerations.

Characteristics

- Independence: Price changes in one product do not impact the other.

- No Substitutability or Complementarity: These goods fulfill entirely different needs.

- Examples:

- Shoes and smartphones.

- Books and kitchen appliances.

Cross Price Elasticity of Demand Formula FAQs

How does cross price elasticity of demand influence market strategies?

It helps businesses decide pricing strategies, target competition, and enhance profitability by understanding inter-product relationships.

Why is CPED critical for complementary goods?

Negative CPED values show interdependency, guiding bundling strategies and pricing tactics to maximize combined demand.

What CPED value indicates unrelated goods?

A value close to zero shows no significant demand relationship between the goods.

Can CPED be negative for substitute goods?

No, substitutes always have positive CPED, as price increases in one good boost demand for the other.

How do policymakers use CPED?

They use CPED to analyze market dependencies, regulate competitive practices, and predict the impact of taxation or subsidies.