One of the most important measures to be used in assessing the company’s financial structure is the debt-to-asset ratio. This gives an indication of whether a business has adequate assets to service its liabilities, thereby offering insights into stability and risk. It is one of the keys to making strategic decisions in financing, debt management, and the expansion of operations to businesses. For stakeholders, the level of risk involved in investing or lending to a company also needs to be evaluated.

What is Debt to Asset Ratio?

Debt to asset ratio determines the percentage of the sum total of the company’s assets that are debt-funded. Mathematically it would be total debt divided by total assets. This, in fact brings out a picture of a particular company’s current leveraged position and is being used with respect to financial risks associated with a firm. Generally, the greater the debt-to-asset ratio suggests dependence on huge amounts of debt to fund the assets and is more susceptible to financial risks in case it fails-to-service the loans through good cash flows.

Leverage Meaning

Lenders define leverage as utilizing borrowed funds to fund the firm’s assets or activities in order to boost the return on investment the firm might realize. Leverage becomes increased financial risk when an increased amount of debt incurred necessitates interest payment increases. In situations of declining revenues from the company, a rise in this means declining profits.

High debt to asset ratio may indicate that the company has high leverage, meaning the assets of the company are funded with more debt. When revenues are high, the company can easily amplify its profits, but when the revenue is low, this high leverage may lead to a strain on the company’s financials. On the other hand, a low debt to asset ratio might imply that the company relies less on debt and would have more flexibility to absorb any financial shocks.

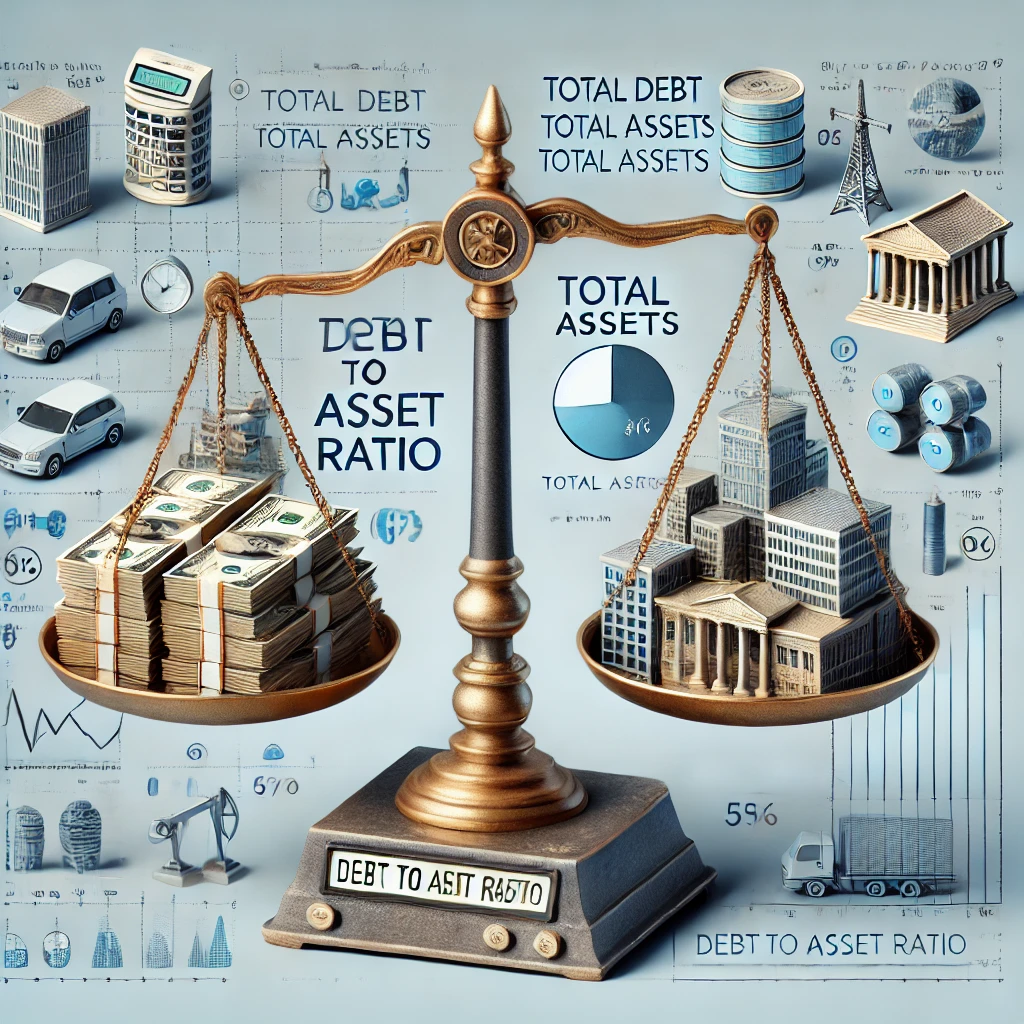

Calculating Debt to Asset Ratio

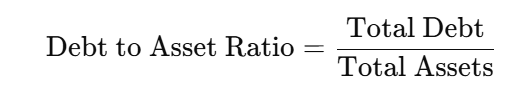

To calculate the debt to asset ratio, use the following formula:

- Total Debt: This includes all short-term and long-term obligations the company owes.

- Total Assets: This encompasses all assets the company owns, such as cash, equipment, and investments.

For example, if a company has $2 million in total debt and $5 million in total assets, the debt-to-asset ratio would be:

This result means that 40% of the company’s assets are financed by debt.

Example of Debt to Asset Ratio Calculation:

| Item | Amount ($) |

|---|---|

| Total Debt | 2,000,000 |

| Total Assets | 5,000,000 |

| Debt to Asset Ratio | 0.4 or 40% |

A ratio above 50% suggests that more than half of the company’s assets are financed by debt, indicating potentially high leverage and financial risk.

What is Good Debt to Asset Ratio?

What constitutes a “good” debt to asset ratio can vary depending on industry norms and the economic environment. Generally:

- Below 40%: Indicates a conservative approach, with lower reliance on debt. This suggests the company has a stronger equity base, which may appeal to risk-averse investors.

- 40%-60%: Often seen as a moderate range, indicating balanced financing through debt and equity.

- Above 60%: Typically considered high leverage, signaling greater reliance on debt. This could pose a higher risk, especially if interest rates rise or revenues decline.

Industries like utilities and telecommunications often have higher debt-to-asset ratios due to capital-intensive operations, while sectors such as technology may exhibit lower ratios.

Important Considerations about Debt to Asset Ratio

- Industry Context: Ratios are to be viewed in industry context. A 60% ratio could be above average in one industry, and normal in another.

- Asset Quality: The asset quality on the balance sheet is very crucial. Physical assets such as real estate often times are able to secure debt more effectively than intangible assets such as goodwill.

- Economic Conditions: A high debt-to-asset ratio during the period of economic decline is likely to increase financial distress, since revenue might have declined and interest payments might be more difficult to pay.

- Interest Rates: A rise in interest rates makes borrowing expensive, which in turn hurts the financial situation of companies with high levels of leverage.

- Debt Maturity: The ratio does not identify between short-term and long-term debt. A firm with short-term debt primarily would be suffering from liquidity since it would need frequent refinancing.

- Cash Flow Stability: Companies with stable cash flows can afford higher debt-to-asset ratios because it is likely that the company will be able to meet its debt obligations in a regular manner.

The debt to asset ratio is an important indicator as it throws light upon health of the company finances with regard to the risk profile. A lower ratio often expresses conservatism, and high, or a higher, one may indicate high risks or high dependence on debt. As this ratio helps an investor formulate sound investment decisions according to the stability and growth possibilities regarding the company, one tends to be more conservative as concerns high risks. The debt to asset ratio, in combination with other financial ratios, can be analyzed to understand and appreciate the overall financial strategy and stability of the company.

Debt to Asset Ratio FAQs

What is the debt to asset ratio used for?

The debt to asset ratio is used to assess the proportion of a company’s assets financed through debt, indicating its leverage and financial risk.

How does the debt to asset ratio affect company risk?

A higher debt to asset ratio suggests greater financial risk, as more assets are financed by debt, increasing interest obligations and potential insolvency risk during downturns.

What is the ideal debt to asset ratio for companies?

An ideal ratio varies by industry, but a range between 40% and 60% is typically considered moderate. Some industries may sustain higher ratios, depending on their asset base and cash flow stability.

Is a high debt to asset ratio always bad?

Not necessarily. High ratios are common in capital-intensive industries, where companies use debt to finance substantial assets, generating revenue to service the debt.

How does the debt to asset ratio impact investors?

Investors use the debt to asset ratio to gauge a company’s financial risk. A higher ratio may indicate higher returns due to leveraged growth but also suggests potential vulnerability to economic fluctuations.