Profits are essential for every business, but not all profits mean the same thing. People often talk about how much profit a company makes, but very few understand that there are two types of profit in business decisions: accounting profit and economic profit. Many students and new business owners get confused between these two terms. Accounting profit looks only at the visible and recorded expenses. It tells you how much money is left after you pay for rent, salaries, bills, and materials. It is the number that shows in your business report or income statement. But economic profit looks deeper. It includes opportunity cost—the value of what you gave up by choosing this business instead of doing something else.

What is Accounting Profit?

Accounting profit is the most common kind of profit. It is also called book profit or net income. Every business calculates this to see how much it earns after paying all regular, day-to-day expenses. These are called explicit costs because they are directly paid in cash or by bank and are written in books.

You can calculate accounting profit using this formula:

| Accounting Profit = Total Revenue – Explicit Costs |

Explicit costs include:

- Rent paid for the shop or office

- Salaries and wages given to staff

- Electricity, water, and internet bills

- Cost of raw materials or goods purchased

- Marketing and advertisement expenses

- Transport and delivery costs

For example, imagine a small business earns ₹10,00,000 in one year. The business spends ₹3,00,000 on staff, ₹2,00,000 on rent, ₹1,00,000 on electricity, and ₹2,00,000 on goods. The accounting profit is:

₹10,00,000 – (₹3,00,000 + ₹2,00,000 + ₹1,00,000 + ₹2,00,000) = ₹2,00,000

Why Is Accounting Profit Important?

Accounting profit is essential because:

- It shows the actual earnings in company books

- It is used to pay income tax.

- Banks use it to decide if a company is eligible for loans.

- Investors use it to check if a company is doing well.

It is easy to calculate and is accepted by government bodies and legal systems. But it doesn’t tell the whole story because it doesn’t include what you could have earned by doing something else.

What is Economic Profit?

Now, let’s go a level deeper. Economic profit is not just about what you earn after paying bills. It is about understanding whether you made the best possible use of your resources like time, skills, and money. This is why it includes implicit costs, also known as opportunity costs.

The formula for economic profit is:

| Economic profit = Accounting Profit – Opportunity Cost |

Opportunity cost is the benefit you gave up when you made a choice. If you open a business instead of taking a high-paying job, that salary becomes your opportunity cost.

Let’s say your accounting profit from your business is ₹2,00,000. But if you had taken a job, you would have earned ₹3,50,000. Then:

Economic Profit = ₹2,00,000 – ₹3,50,000 = –₹1,50,000

So even though your business made ₹2,00,000, your economic profit is negative. That means you could have done better in another way.

Why Is Economic Profit Useful?

- It helps you know if your business decision was wise or not.

- It shows the real value of your business compared to other choices.

- It helps you think about long-term sustainability.

- Big companies use it for project evaluation and strategy.

Economic profit does not appear in financial statements. However, innovative businesses always consider it when making big decisions like entering a new market, launching a product, or investing in a new factory.

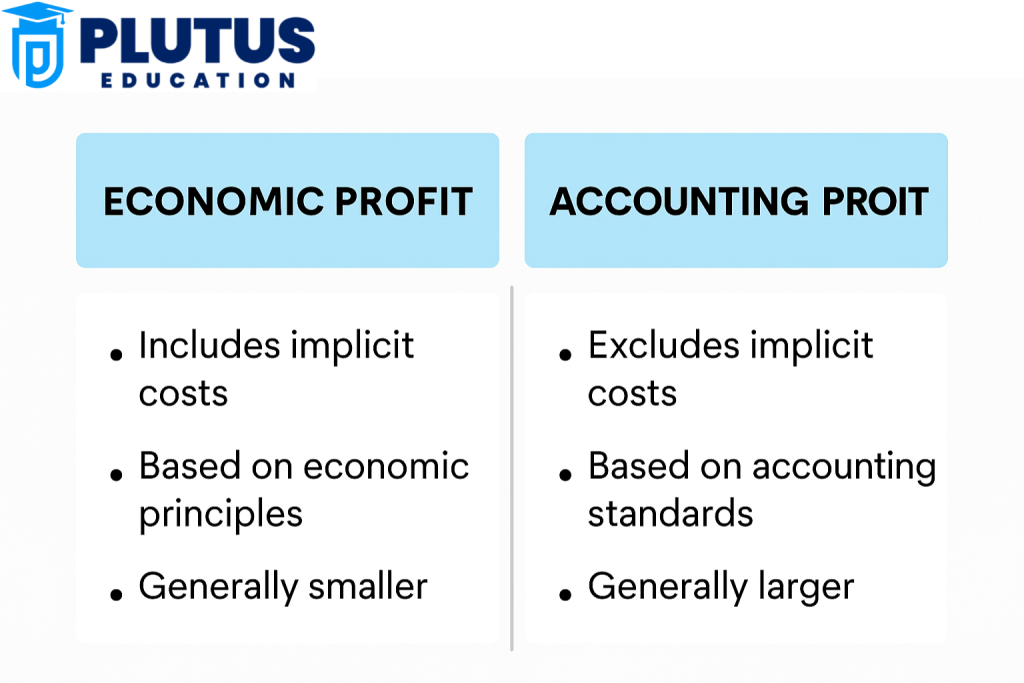

Difference Between Accounting Profit and Economic Profit

The difference between accounting profit and economic profit lies in the costs considered and the insight each provides. While accounting profit focuses solely on explicit costs, economic profit incorporates both explicit and implicit costs, offering a broader perspective on resource allocation and true profitability.

| Feature | Accounting Profit | Economic Profit |

| Other Name | Book profit | Pure profit |

| Cost Type Included | Only explicit costs | Explicit + implicit (opportunity) costs |

| Use | Tax, income statement, loan approval | Business strategy, investment decisions |

| Calculation | Revenue – recorded costs | Accounting Profit – Opportunity Cost |

| Common Users | Accountants, auditors, tax officers | Economists, CEOs, analysts |

| Appearance in Books | Yes, in income statements | No, only for internal evaluation |

| Can It Be Negative? | Rarely | Yes, often in early or risky businesses |

| Best for | Daily accounting | Big decision-making and comparisons |

Real-Life Examples of Accounting vs Economic Profit

Real-life examples of accounting vs. economic profit show how both profit types work in real business situations. These examples help us understand how accounting profit looks only at regular costs, while economic profit also includes the cost of missed chances. By using real numbers and stories, we can clearly see how a business may show a profit in its books but still lose out when we consider better options that were given up.

Example 1: Priya’s Boutique Business

Priya runs a boutique in Mumbai. She earns ₹12,00,000 per year. Her expenses are:

- Rent: ₹3,00,000

- Staff: ₹4,00,000

- Materials and utilities: ₹2,00,000

So, accounting profit = ₹12,00,000 – ₹9,00,000 = ₹3,00,000

But Priya holds an MBA and could have taken a job paying ₹5,00,000 a year. So:

Economic profit = ₹3,00,000 – ₹5,00,000 = –₹2,00,000

Although Priya’s business shows profit in her books, her economic profit is negative. She could have earned more in a job.

Example 2: Arjun’s Software Startup

Arjun runs a tech startup. He earns ₹15,00,000 a year. His expenses are:

- Office rent: ₹2,00,000

- Tools, hosting: ₹3,00,000

- Freelancers: ₹4,00,000

Accounting profit = ₹15,00,000 – ₹9,00,000 = ₹6,00,000

Arjun could earn ₹4,00,000 working in a company. So:

Economic profit = ₹6,00,000 – ₹4,00,000 = ₹2,00,000

Arjun’s decision is a good one. He earns more in his business than he would have as an employee.

Uses of Both Profits in Different Fields

Using both profits in different fields means using accounting profit and economic profit in other parts of business, finance, and planning. Accounting profit helps with reports, taxes, and tracking money earned. Economic profit enables you to make better choices by looking at what you could have earned by doing something else. Both have their uses, and different people, like business owners, investors, and managers, use them differently.

Accounting Profit Is Used For:

- Paying taxes to the government

- Preparing balance sheets and income statements

- Getting loans from banks

- Attracting investors and shareholders

- The filing company returns every year.

Economic Profit Is Used For:

- Checking whether to start a business or not

- Choosing between two projects or investments

- Understanding if resources are used wisely

- Planning company strategy and expansion

- Studying competition and long-term survival

Difference Between Accounting Profit and Economic Profit FAQs

1. What is the main difference between accounting profit and economic profit?

Accounting profit includes only actual, recorded expenses. Economic profit includes both actual and opportunity costs, giving a clearer idea of real business value.

2. Can economic profit be negative even when accounting profit is positive?

Yes. If the money you could have earned doing something else is more than what you earn now, then your economic profit is negative.

3. Why do economists prefer economic profit?

Economists study whether resources are used in the best way. Economic profit includes opportunity cost and helps in comparing real value across choices.

4. Is economic profit shown in financial reports?

No. Financial reports only show accounting profit. Companies use economic profit for internal thinking and future planning.

5. Which profit should I use when deciding between a job and business?

You should use economic profit. It helps you know whether your business brings more value than a job.