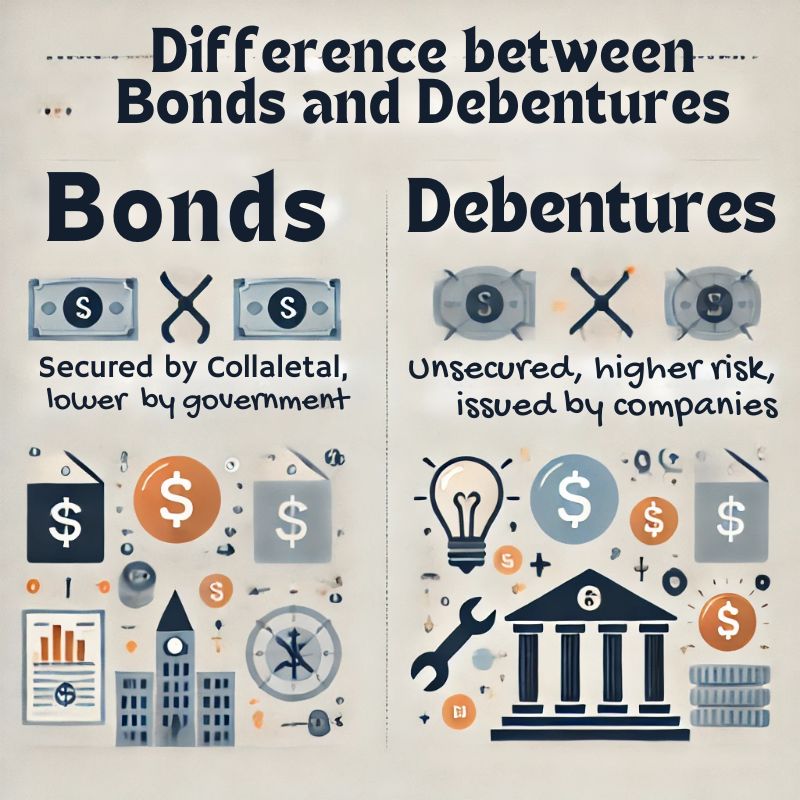

Most investors and businesses care about the distinction between a bond and a debenture since both are methods of raising capital, but they have very different features and risk profiles. A bond and a debenture are fixed-income financial instruments wherein an investor lends money to a company or government in exchange for regular interest payments. Although they are of debt type, these two can be considered essentially different from one another in terms of security provision, the type of issuer, and risk.

What are Bonds and Debentures?

Bonds are secured debt instruments usually issued by governments or big companies to raise long-term capitals. It is supported by specific assets or collateral which would grant more security to investors. As a safer investment, especially for bonds issued by the government since these kinds are guaranteed in repayment.

Debentures are unsecured debt issued typically by private issuers. They are not secured against any tangible asset since this raises the risk profile associated with them relative to bonds. They represent the general creditworthiness of the issuer company and offer a higher interest rate to correlate with increased risk.

Bonds and debentures pay interest at fixed intervals and return the principal at maturity but vary in their relative safety and complexity.

Who Should Make the Investment in Bonds?

Investment in bonds aptly is recommended for conservative investors wanting to have low-risk investment opportunities yet stable in a portfolio. Bonds are featured with regular fixed interest payments and secured return of principal amount at the end of the term. The investment suits the capital for securing more safety rather than higher returns. A few important points regarding who should consider investing in bonds include:

Risk Averse Investors

Bonds are the most conservative type of investment available. That is particularly so for the government type of bond. Bonds are, therefore, the best security for the capital preservation-conscious investor who is not willing to take on his or her capital’s risk.

Bonds have been very popular for retirement plans or even for pre-retirement, where the repayment policy will result in predictable income through payments in the form of interest, which can be used for covering the living expenses during retirement.

Diversification

Bonds are great instruments that should be included in a portfolio for diversification purposes. The presence of bonds helps balance the swings of the stocks and prevents too much volatility in it.

Thus, income seekers gain as their source of interest income is steady. Therefore, income seekers are quite benefitted through bonds. In other words, they are best suited for those who require income through their investments.

Bonds also have maturity features varying from short-term bonds to long-term bonds, so investors can pick and choose according to their financial goals and time horizon.

Who Should Make the Investment in Debentures?

Debentures are suitable investments for those who are prepared to take on a middle-level risk for higher returns. Since debentures are unsecured, the risks associated with it are relatively higher than that of bonds, but the rate is often compensated with a higher rate of interest. It is for such who should invest in debentures:

Moderate Risk Takers

Those moderate risk-takers who seek a little more risk for higher returns are likely to be interested in the investment of debentures. Although, by comparison, debentures are more risky than bonds, their high interest rates tend to compensate and make the investment even more attractive to investors.

The higher yields are also an attractive proposition for seeking investors. Desensitizing the fact that debentures generally earn relatively better interest compared to bonds, this type can be very profitable for the portfolio when assuming risk arising from the creditworthiness of the issuing company.

Long-term Investors

Debentures are issued for long maturity. Hence, if the investors are not required to meet liquidity on an immediate basis, they may benefit from the higher returns on debentures.

Corporate Focused Investors

Investors who plan to invest in the corporate debt market may opt for debentures as debentures represent the most common form of debt in which corporate entities raise funds.

Unlike bonds, debentures rely on the credit rating and reputation of the issuing company and therefore are more suited to investors comfortable with the risk of corporate credit.

What Are the Key Features of Debentures and Bonds?

So with fixed returns, debentures and bonds vary in terms of security, risk, and issuer. Here are the key features:

1. Security

Bonds: Mostly secured by collateral or physical assets. As government bonds are the first on the list to be guaranteed by the national treasury, they become nearly risk-free.

Debentures: Generally, they are not secured and depend on the credibility of the issuer. Debentures are more risky than bonds because there is no underlying asset that secures such bonds.

2. Issuer

Bonds: Governments as well as large companies issue them. Government bonds, commonly known as treasury bonds, are supposed to be the safest. While the corporate bonds may be riskier comparatively.

Debentures: These are issued by private companies to raise long-term capital. They are one of the preferred instruments that companies do not wish to pledge an asset.

3. Rate of Interest

Bonds: Bonds carry a lesser, fixed rate of interest due to its risk-free nature. Stability is what attracts the bond to a risk-averse investor.

Debentures: These carry higher rates of interest than bonds since these are unsecured and carry more risk.

4. Priority in Liquidation

Bonds: In case of corporate liquidation, the bondholder claims his companies’ assets before debenture holders and hence is a safer investment.

Debentures: Debenture holders have a lower priority while going through liquidation. So, it is riskier compared to bonds. Should default occur, they might not get the full amount invested.

5. Convertibility

Bonds: Irredeemable bonds, that is, these can not be converted into shares.

Debentures: Certain debentures are convertible into equity shares after a particular time if the company share price goes up, which one can gain in terms of capital.

Uses of Debentures

Debentures are primarily raised by a firm to raise long-term capital. Debentures are flexible sources of funds wherein equity need not be sacrificed through ownership. The primary uses of debentures are as follows:

1. Capital Expansion: A company issues debentures for financing new projects, to expand existing operations or venture into new markets. This enables expansion without dilution of equity or ownership.

2. Refinancing of the existing debt: Debentures help to refinance already prevailing high-interest debts to reduce the overall cost of capital of any company. Improving its financial position by issuing debentures at a lower interest rate, a company can manage to do so.

3. Working Capital: Debentures are a source of stable working capital. Meaning businesses can run continually, sustaining their daily operations, inventory, and short-term liabilities without placing a strain on their financials.

4. Corporate Restructuring: It is mainly used for mergers and acquisitions. The rationale is that debentures enable large-scale company adjustment without cash reserve depletion.

Conclusion

A bond is distinct from a debenture, which depends on security and risk, depending on the type of issuer and the degree of guarantee that is afforded to the investor. Bonds are secured, safer investments; they often involve backing by physical assets or even government guarantees. Debentures are definitely considered the unsecured form of loan since, obviously, they are premised on the creditworthiness of the issuing firm, requiring higher interest rates as compensation for risk. Both instruments are crucial in corporate and government finance and may provide benefits according to the level of appetite for risk and the financial objectives of investors.

Difference Between Bond and Debenture FAQs

What are the differences between bonds and debentures?

Bonds are secured and issued by the government or corporation. They are unsecured and issued by private companies. Bonds afford low interest rates with high security, while debentures afford high interest rates with more risk.

Who should invest in bonds?

Bonds are ideal for risk-averse investors, retirees, or those seeking predictable income. They are good for investors seeking low-risk, stable returns.

Who should invest in debentures?

Those who are willing to take on a bit of moderate risk for greater returns will find debentures very attractive. Those not averse to corporate credit risk may even prefer debentures over bonds.

Can debentures be converted into shares?

Yes, some debentures are convertible to equity shares after a specified period, so capital gains can be affected if share prices in the company go up.

Compare bonds with debentures. Are bonds safer than debentures?

Bonds are relatively safer than debentures in terms of nature and rank higher in liquidation.