In a country’s balance of payments, the current account differs from the capital account in the sense that it records different kinds of transactions. Current account records day-to-day trade and services, whereas the capital account records measure transfers and financial investments. Both are equally important when discussing international trade. Whenever India trades with other countries, money is coming in and out. These flows are tracked through two main accounts — the current account and the capital account. The current account records income from exports, imports, services, and transfers like remittances. The capital account records loans, foreign investments, and assets like land or factories. Think of the current account, like your daily spending – groceries, school fees, and monthly income. The capital account is like buying or selling a house, gold, or starting a new business. These are long-term or one-time investments.

What is the Current Account?

The current account records all the everyday transactions a country makes with other countries. These include the buying and selling of goods and services, receiving salaries or interest from foreign investments, and transferring money without getting anything in return. This account reflects the economic health of the country over a short period, usually a year.

It helps us know whether a country is earning more than it spends. A current account surplus means the country exports more than it imports. A deficit means it imports more than it exports. For India, tracking the current account helps policymakers understand where money is coming from and where it is going.

Types of Transactions in the Current Account

Goods (Visible Trade)

Goods refer to the physical items that are traded between countries. When India sells goods like spices, textiles, or cars to another country, it earns money—this is an export. When it buys oil, electronics, or machinery from other countries, it spends money—this is an import. All such physical transactions are part of the goods section of the current account. These trades are visible because customs records them when goods move in and out of ports.

Services (Invisible Trade)

Services are non-physical items that one country provides to another. India is well known for its IT and software services. Indian companies provide these services to clients in the United States and Europe. This brings money into the country. Tourism, banking, and insurance also fall into this category. These are called invisible trade because there is no physical exchange of items, but money is still earned or spent.

Income

Income includes the money people and businesses earn across borders. This could be in the form of salaries, rent, interest, or dividends. For example, an Indian investor who has shares in a US company may receive dividends from those shares. This income is added to India’s current account. Similarly, if an Indian company pays interest to a foreign lender, that payment is deducted.

Current Transfers

These are one-way transfers of money where the sender does not expect anything in return. Remittances sent by Indians working abroad to their families in India are a major part of this section. Foreign aid, gifts, and donations also fall under this category. These transfers are important because they bring foreign currency into the country and support many households.

What is the Capital Account?

The capital account records financial transactions that involve ownership of assets or investments. These are not day-to-day transactions but long-term ones. The capital account includes money that comes into the country when foreign companies invest or when the government takes loans from international banks. It also records the money that leaves the country when Indian firms invest abroad.

This account shows how attractive the country is to investors. If a lot of money flows into the country, it means investors believe in the growth of the economy. If money flows out, it could mean investors are not confident about the future. The capital account is very important for developing countries like India that need foreign funds for infrastructure and industrial growth.

Types of Transactions in the Capital Account

Foreign Investments

Foreign investments are of two types: Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI). FDI is when a foreign company builds a factory or sets up a business in India. It brings not only money but also jobs and technology. FPI is when foreign investors buy shares or bonds in Indian companies. This money can move in and out quickly, depending on market conditions.

Loans and Borrowings

This part of the capital account includes loans that India takes from foreign lenders, like international banks or financial institutions. These are called External Commercial Borrowings (ECBs). These loans help finance large projects like building highways, railways, and airports. It also includes short-term borrowings by Indian companies to meet working capital needs.

Banking Capital

Banking capital refers to the movement of money through banks. This includes deposits made by Non-Resident Indians (NRIs) in Indian banks and changes in the country’s foreign currency reserves. If NRIs invest more in Indian banks, the capital account will improve. This section also includes interbank loans and other financial movements.

Capital Transfers

Capital transfers involve transactions where assets are moved between countries. This could be a company relocating its head office or a government forgiving a loan it gave to another country. These are usually one-time transactions that are not repeated every year. They also include the transfer of ownership of physical assets such as land or factories.

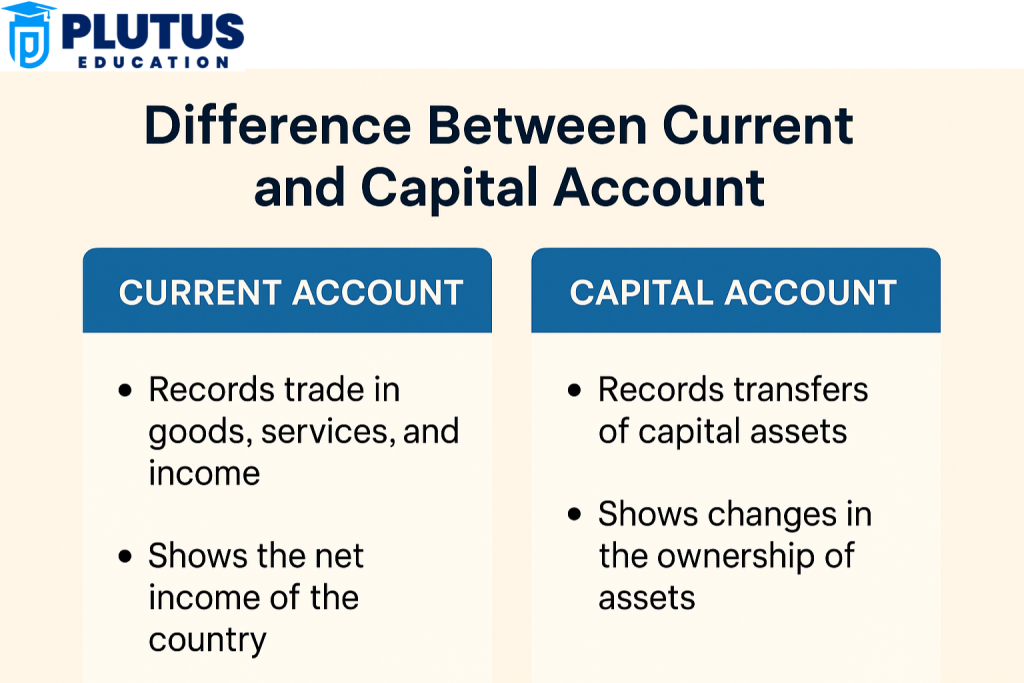

Key Difference Between Current Account and Capital Account

The difference between current account and capital account is a core concept in understanding international economics. These two accounts together form the balance of payments of a country. However, they record very different types of transactions, and their impact on a country’s economy is also very different. The current account looks at the flow of income and goods, while the capital account tracks financial and capital investments across borders.

| Aspect | Current Account | Capital Account |

| Nature of Transactions | Records day-to-day transactions like trade in goods, services, income, and transfers | Records long-term financial transactions like foreign investments and external loans |

| Examples | Export of goods, import of oil, software services, remittances from abroad | Foreign Direct Investment (FDI), portfolio investment, external commercial borrowings |

| Purpose | Tracks income and expenditure from regular operations | Tracks inflow and outflow of capital or investment funds |

| Time Horizon | Short-term transactions that occur regularly | Long-term transactions that impact future finances |

| Impact on Economy | Shows current economic performance and trade balance | Reflects investment flow and economic stability for future growth |

| Parties Involved | Individuals, businesses, and service providers | Governments, foreign investors, NRIs, multinational corporations |

| Affects What? | Affects national income and currency stability | Affects asset ownership and foreign exchange reserves |

| Volatility | More stable due to regular transactions | More volatile due to sensitive investment decisions |

| Link to Foreign Reserves | Impacts reserves if there’s a deficit or surplus | Directly adds or removes funds from foreign exchange reserves |

| Balance of Payments Role | One of the two main parts of the BoP | Second part of the BoP alongside current account |

| Government Influence | Managed through trade policies, subsidies, and export incentives | Managed through FDI policies, borrowing regulations, and investment norms |

Why Do Both Accounts Matter in the Indian Economy?

India is a growing economy that participates actively in global trade and finance. To support this growth, it must manage both its current account and capital account efficiently. These two components together show the country’s overall external economic position and form the complete balance of payments.

Role of the Current Account in India

India’s current account is crucial because it tells us whether the country earns more from the world than it spends. India is a service-based economy and earns a large part of its income from software services. Companies like Infosys, TCS, and Wipro generate foreign currency income through their software exports. In addition, remittances from Non-Resident Indians working in the Gulf, US, and UK form a strong income stream.

However, India also imports a lot of crude oil, gold, and machinery. These imports often exceed exports, causing a current account deficit. Policymakers watch this deficit closely because if it becomes too large, the country may face currency pressure or need to borrow from foreign sources.

By promoting exports and reducing unnecessary imports, India tries to reduce the deficit and strengthen the current account.

Role of the Capital Account in India

India needs a lot of investment for building infrastructure, manufacturing plants, roads, and power stations. The capital account plays a big role in bringing in funds from outside. Foreign Direct Investment (FDI) is particularly useful because it brings not just money but also jobs, new technology, and better skills. Recent initiatives like “Make in India” aim to attract FDI in manufacturing and innovation sectors.

Foreign Portfolio Investment (FPI) is another part of the capital account. It provides funds to Indian stock markets, helping companies raise money for business. However, FPI can move out quickly if global conditions become uncertain. This makes it less stable than FDI.

India also takes loans through External Commercial Borrowings (ECBs) for infrastructure and industrial growth. These borrowings are part of the capital account and help bridge the gap when domestic funds are not enough.

Factors Affecting Current and Capital Accounts

Both the current account and capital account are sensitive to various internal and external economic factors. These factors influence how much money flows in and out of a country, and they help determine whether the accounts show a surplus or a deficit. Understanding these factors is especially important for policymakers, economists, and even students preparing for competitive exams.

Factors Affecting the Current Account

Several important factors influence the current account. One of the most critical factors is the exchange rate. When the value of a country’s currency becomes stronger compared to other currencies, its exports become more expensive, and imports become cheaper. This can reduce export earnings and increase spending on imports, leading to a current account deficit. On the other hand, if the currency weakens, exports become cheaper and more competitive in international markets, which can help improve the current account.

Another major factor is a country’s trade policy. If the government imposes higher tariffs on imported goods or gives subsidies to domestic exporters, it can affect the volume of imports and exports. For example, export promotion schemes in India encourage companies to send more goods and services abroad, which helps earn foreign currency and improves the current account balance.

Inflation and price levels also play a key role. If domestic prices rise faster than those in trading partner countries, exports become less competitive, and imports may increase because they are relatively cheaper. This causes the current account to worsen. Additionally, domestic consumption patterns and oil prices have a large impact on India’s case. Since India imports most of its crude oil, any rise in global oil prices can significantly increase the import bill and widen the current account deficit.

Factors Affecting the Capital Account

The capital account is mainly affected by investment climate, interest rates, and political stability. Investors prefer to put their money in countries that offer stable governance, a strong legal framework, and economic growth. If India maintains political and economic stability, foreign investors feel safe investing through FDI or FPI.

One key factor is interest rate differentials. In the event that interest rates in India are higher than in other countries, an environment is created that would encourage foreign investors to invest more in Indian bonds and debt instruments since they yield better returns, thereby inducing capital inflows, leading ultimately to a surplus in the capital account. However, with falling interest rates or sudden changes in the interest rate regime, capital may be easily switched into other more profitable destinations.

The ease of doing business, transparency in government processes, and the ease in repatriation of profits also matter. For example, if investors find it difficult to take their profits out of India or face too many rules, they may avoid investing. India has worked to improve its rank in the World Bank’s “Ease of Doing Business” index to attract more capital.

Another influencing factor is global economic trends. If the world is facing a financial crisis, investors may move their funds to safer economies, which may lead to capital outflows from developing countries like India. Similarly, if there’s a global boom, more investments may flow into emerging markets.

Can a Country Have a Surplus in Both Accounts?

A very common question among students is whether a country can have both a current account surplus and a capital account surplus at the same time. Technically, it is possible, but in practical terms, it is rare. The balance of payments system is designed in such a way that one account usually offsets the other. Let us explore how this works and what it means.

Understanding the Balance Concept

In theory, the balance of payments always balances. That means if a country has a current account surplus, there will usually be a capital account deficit of the same size, and vice versa. For instance, if a country is exporting a lot and earning more foreign currency than it spends, it does not need to borrow or attract investment. So, the capital account might show fewer inflows or even an outflow as the country lends to others or buys assets abroad.

However, in some special conditions, both accounts may show a surplus. This could happen if a country is exporting a lot and attracting massive foreign investments. But in such a case, the country’s foreign exchange reserves will grow, and that increase is what balances the accounts. In India’s context, when the capital account surplus is more than the current account deficit, the extra money goes into increasing the foreign exchange reserves.

Real World Cases

China is often cited as a country that has run a surplus in both the current and capital accounts. It exports far more than it imports and also attracts a lot of FDI due to its large market. However, the Chinese government controls capital movements very strictly. In open economies like India, capital flows are more flexible, so it is harder to maintain a surplus in both accounts at the same time.

For India, a current account deficit and a capital account surplus are more common. India imports a lot of oil, gold, and electronics, which leads to a current account deficit. However, this is usually financed by capital inflows like FDI and portfolio investments. Any excess inflow contributes to foreign exchange reserves.

Difference Between Current Account and Capital Account FAQs

1. What is the difference between a current account and a capital account in the balance of payments?

The current account records regular economic transactions such as exports, imports, services, income from abroad, and remittances. The capital account includes financial flows related to investments, loans, and ownership of assets. Both are parts of the balance of payments and show how a country interacts financially with the rest of the world.

2. What comes under the current account?

The current account includes four main components: trade in goods (exports and imports), trade in services (like IT and tourism), income (salaries, dividends, interest from abroad), and unilateral transfers (remittances, foreign aid, and gifts). These are short-term and frequent transactions that reflect a country’s economic activity in the present.

3. What is an example of a capital account transaction?

An example of a capital account transaction would be when a foreign company sets up a factory in India, which is foreign direct investment. Another example is when Indian companies take loans from international banks to finance projects. Even when NRIs deposit money into Indian banks, it is recorded in the capital account.

4. What are the current account and capital account in simple words?

In simple words, the current account shows daily economic activities, like what a country earns from exports and what it pays for imports. The capital account shows big investments and loans that affect the country’s long-term finances. Think of the current account as your monthly salary and expenses and the capital account as your investments and loans.

5. Can individuals open a capital account like a bank account?

In the context of international economics, a capital account is not something individuals can open. It refers to a section of a country’s balance of payments. However, in banking, the term capital account may refer to business capital accounts for partners or investors, which is a different concept.