A company’s current ratio and liquid ratio are indispensable measures of its short-term liquidity. These financial metrics indicate the ability of an organization to meet its short-term obligations with its assets. The current ratio encompasses a larger scale of analysis of liquidity by taking into account all current assets, whereas the liquid ratio takes a narrower approach, focusing only on the most liquid assets, such as cash, bank accounts, and short-term investments, excluding inventory and prepaid expenses. Understanding these ratios is essential for stakeholders, including investors, creditors, and financial managers, to assess financial stability and operational efficiency.

Current Ratio vs Liquid Ratio: Key Difference

The current ratio differs from the liquid ratio only by the scope and focus. The current ratio measures the liquidity position of a company as a whole by using the ratio of current assets to current liabilities. It measures if the company has the funds to settle its short-term obligations. The liquid ratio, also known as the quick ratio, is more conservative. It removes the less liquid assets, which are inventory and prepaid expenses. It focuses on immediate solvency.

| Aspect | Current Ratio | Liquid Ratio |

|---|---|---|

| Definition | Measures the company’s ability to pay short-term obligations using all current assets. | Measures the ability to meet obligations using only liquid assets. |

| Formula | Current Assets ÷ Current Liabilities | (Current Assets – Inventory – Prepaid Expenses) ÷ Current Liabilities |

| Inclusion of Inventory | Includes inventory in the calculation | Excludes inventory and prepaid expenses |

| Ideal Benchmark | 2:1 | 1:1 |

| Purpose | Provides a broader view of liquidity. | Provides a stricter measure of liquidity. |

| Applicability | Suitable for general liquidity assessment. | Useful for evaluating immediate financial solvency. |

| Focus | Emphasizes total short-term assets. | Focuses on liquid assets. |

What is the Current Ratio?

The current ratio measures a company’s ability to pay its short-term liability using its current assets. The current ratio, more generally, is a measure of a firm’s short-term liquidity position. It is a measure of the short-term liquidity of a business. Current Assets are those items on a company’s Balance Sheet that they can convert into cash within a year. Current Liabilities are the obligations and debts of a company that they have to pay off within a year.

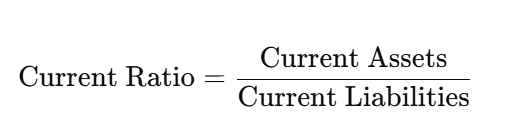

Formula

- Current Assets: These are cash, accounts receivable, inventory, and other marketable securities that can be liquidated within a year. For example, a departmental store could count its cash in hand, stock, and receivables as current assets.

- Current Liabilities: This comprises duties like accounts payable, short-term loans, and accrued expenses payable within a year.

How to Calculate Current Ratio?

Calculating the current ratio is straightforward and involves summing up current assets and dividing them by current liabilities.

Step-by-Step Process

- Identify Current Assets: All the short-term resources must be included, such as cash, receivables, inventory, and marketable securities.

- Add Up Current Liabilities: Add accounts payable, accrued expenses, and short-term borrowings as obligations.

- Apply the Formula: The ratio formula is used to compute liquidity.

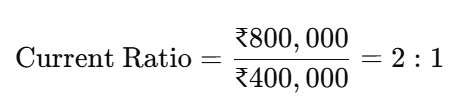

Example Calculation

- Current Assets: ₹800,000

- Current Liabilities: ₹400,000

This indicates the company has twice the assets needed to cover its short-term debts.

What is Liquid Ratio?

Liquid ratio is another strict measure of a firm’s ability to meet short-term obligations by using only its most liquid assets. The liquid ratio excludes inventory and prepaid expenses because, in some instances, these can take some time to convert into cash. The liquidity ratio is an important indicator in industries where liquidity is crucial, including finance and technology. It ensures that firms have a higher reserve to fulfill their obligations without resorting to slower-moving assets.

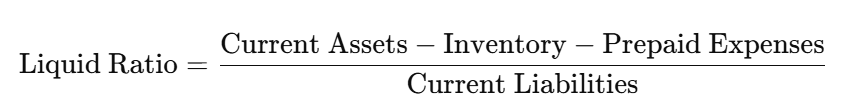

Formula

Why Exclude Inventory?

Inventory is excluded because it may not be immediately sold for cash. For instance, in market downturns or specific industries such as manufacturing, inventory turnover may slow, thereby reducing liquidity.

How to Calculate the Liquid Ratio

Calculating the liquid ratio involves adjusting current assets by subtracting inventory and prepaid expenses before dividing by current liabilities.

Step-by-Step Process

- Liquid Assets: Add cash, marketable securities, and accounts receivable to the equation.

- Non-Liquid Assets Excluded: Subtract inventory and prepaid expenses from total current assets.

- Ratio Calculation: Divide adjusted liquid assets by current liabilities.

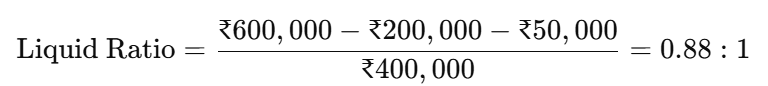

Example Calculation

- Current Assets: ₹600,000

- Inventory: ₹200,000

- Prepaid Expenses: ₹50,000

- Current Liabilities: ₹400,000

This suggests the company needs to improve its liquidity for immediate obligations.

Factors Impacting Current and Liquid Ratios

Several factors influence these ratios, making their analysis industry and context-dependent. It’s essential to monitor these factors to understand the context behind the ratios.

- Industry Norms: Retail carries high inventories, which affects the current ratio more so than the liquid ratio.

- Efficiency in Operations: Efficient collection of receivables increases both ratios.

- Credit Policy: Stiff credit terms increase ratios by decreasing the receivables.

- Market Conditions: Economic slowdown affects the inventory turnaround, impacting both ratios negatively under different circumstances.

Current Ratio and Liquid Ratio FAQs

Why is the liquid ratio stricter than the current ratio?

The liquid ratio excludes inventory and prepaid expenses, focusing on assets easily convertible to cash.

What is the ideal benchmark for the current ratio?

The ideal benchmark is 2:1, meaning the company has twice as many current assets as liabilities.

How do prepaid expenses affect liquidity ratios?

Prepaid expenses are excluded from the liquid ratio as they are not convertible to cash.

Can inventory-heavy companies rely on the liquid ratio?

They might find the liquid ratio less useful as it excludes inventory, a key asset in such industries.

How does credit policy impact these ratios?

Flexible credit terms increase receivables, potentially inflating both ratios.