In finance and investments, equity and stock are terms often used interchangeably. But they carry subtle differences that are important to consider for both investors and businesses. The understanding of these helps clarify the nuances about who owns which companies, rights, and financial implications. While equity represents ownership in a company, stock is the individual unit of such ownership. This article discusses and delves into the differences between equity and stock, focusing on their definitions, characteristics, and relevance in various contexts.

Key Difference Between Equity and Stock

Equity is simply ownership interest held by stakeholders of the company. These encompass all forms of ownership capital. Stock, on the other hand, refers to the individual units or shares into which the company’s equity is divided. While equity is broader and includes retained earnings, reserves, and more, stock deals specifically with shares held by investors.

| Basis | Equity | Stock |

|---|---|---|

| Definition | Represents ownership in assets minus liabilities. | Refers to shares or units of ownership in a company. |

| Scope | Broader, includes stock and other ownership interests. | Narrower, specific to company shares. |

| Financial Statement | Reflected as the total equity on a balance sheet. | Represented as shares held in a portfolio. |

| Types | Common equity, preferred equity, retained earnings. | Common stock, preferred stock. |

| Value | Calculated as assets minus liabilities. | Value determined by market price. |

| Ownership | Indicates the proportionate share in the company. | Value is determined by market price. |

What Are Equities?

Equities represent the value that shareholders own in a company after liabilities are accounted for. This term is used in multiple contexts, including investments, accounting, and real estate.

Equity in the context of business refers to the residual interest in the assets of a company after deducting liabilities. The purchase of an equity investment is typically with the expectation that the value of the investment will increase over time. For instance, when you have equity in a business, you expect the value of the business to increase so that you can benefit from your stake in the business. By having equity, you are essentially staking your money on the company’s future success.

Key Features of Equities

- Equity Ownership Stake: Through equity, owners become shareholders in a firm.

- Residual Claim: In case of liquidation and settlement of all liabilities, shareholders are entitled to whatever remainder a firm holds.

- Voting Rights: Common equities usually carry voting rights on corporate decisions.

- Risk and Returns: High return is associated with a high risk as compared to fixed-income securities.

- Dividends: Companies can allow a part of the profits to the owners in the form of dividends.

Examples of Equities

- Common shares in a corporation.

- Retained earnings in the company balance sheet.

- Private equity stakes in startups.

Equities are vital for raising capital, as they allow companies to pool funds without immediate repayment obligations.

What Are Stocks?

Stocks, a subset of equities, represent units of ownership in a company. These are the tangible shares that individuals can buy or sell in the stock market. The cost of the stock at the hour or at the time of the issue is determined through a valuation practice which, by and large, results in charging a premium over the presumptive worth or the face value of each stock.

Stock is a term that denotes the shares issued by a company to raise funds. Stocks are categorized based on voting rights, dividend preferences, and market behavior.

Key Features of Stocks

- Value-Driven by Market: Market supply and demand, as well as the company’s performance determine stock prices.

- Transferable: One can easily sell and buy stocks on an exchange.

- Ownership Unit: Each stock represents fractional ownership in the company.

- Income Potential: Stocks generate returns through price appreciation and dividends.

Examples of Stocks

- Apple Inc. (AAPL) shares traded on NASDAQ.

- Preferred stock of a utility company with fixed dividends.

Stocks form a critical component of the investment portfolios of individuals and institutions, offering opportunities for wealth creation.

Types of Stock

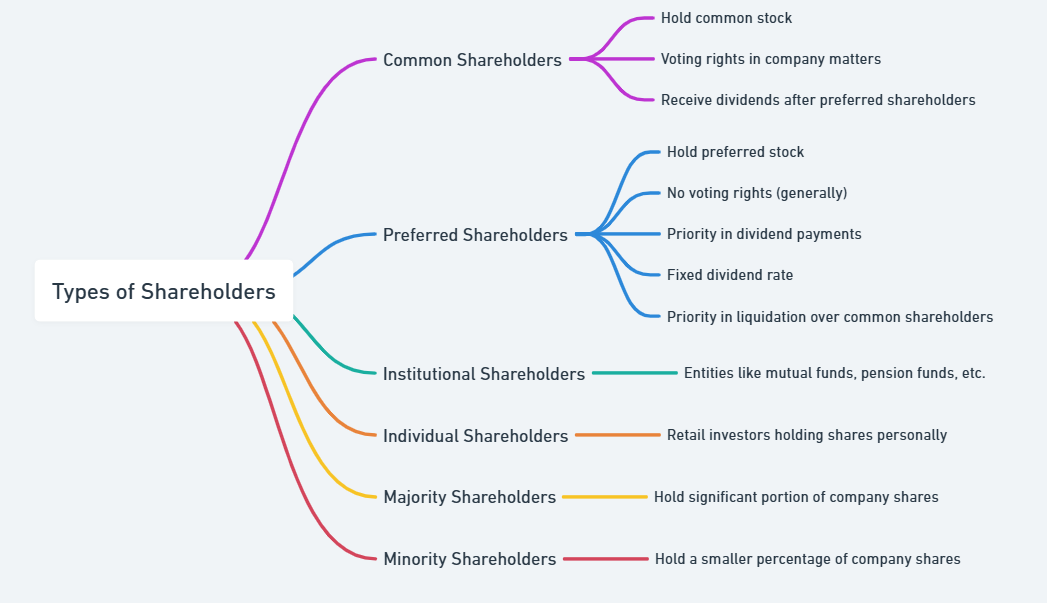

Stocks are broadly classified based on ownership rights, financial returns, and market characteristics. Understanding the category of stocks will help in determining their respective roles and priorities in a firm. Commonly, stocks are divided into common and preferred shareholders.

1. Common Stock

Common shareholders are the primary owners of a company’s equity. Anyone who owns common stock in a company can vote on corporate policies and elect members of your board of directors. However, common shareholders shoulder a bit more risk—if a company is liquidated, they can only claim assets after bondholders, preferred shareholders, and other debtholders have been paid in full.

- Rights and Privileges:

- Voting rights in corporate decisions, including board elections and significant policy changes.

- Entitlement to dividends, which may vary depending on the company’s profitability.

- Residual claims on assets after creditors and preferred shareholders are paid during liquidation.

2. Preferred Stock

Preferred shareholders have a higher claim on a company’s earnings and assets compared to common shareholders but lack voting rights. Preferred shareholders usually can’t vote on policies or elect board members, so they don’t have a say in a company’s future. However, they take on a bit less risk. Preferred shareholders can claim assets before common stakeholders, if a company liquidate.

- Key Characteristics:

- Fixed dividend payouts, providing a predictable income stream.

- Priority over common shareholders in asset distribution during liquidation.

- Limited or no participation in corporate decision-making.

3. Other Classifications

- Growth Stocks: Shares of companies expected to grow at an above-average rate.

- Value Stocks: Stocks trading below their intrinsic value.

- Dividend Stocks: Shares that consistently provide high dividend yields.

Common vs. Preferred Stock

| Feature | Common Stock | Preferred Stock |

|---|---|---|

| Voting Rights | Yes | Usually No |

| Dividend Payments | Variable, based on company performance. | Fixed, predetermined rate. |

| Risk | Higher | Lower |

| Claim on Assets | After preferred stockholders. | Before common stockholders. |

Equity and Stock FAQs

Can equity and stock be used interchangeably?

Equity and stock are related but not synonymous. Equity is a broader concept encompassing all ownership interests, while stock specifically refers to shares in a company.

What is the primary difference between equity and stock?

Equity represents overall ownership, including retained earnings and reserves, while stock signifies individual shares issued by a company.

How is equity calculated in accounting?

Equity is calculated by subtracting liabilities from total assets, represented in the balance sheet as shareholders’ equity.

Are all stocks equities?

Yes, all stocks are equities, but not all equities are stocks. Equities can include other forms of ownership like private equity.

What are common and preferred stocks?

Common stocks offer voting rights and variable dividends, while preferred stocks provide fixed dividends with limited or no voting rights.