The term difference between public and private companies refers to the distinct features that set these two types of companies apart. Both public and private companies are formed under the Companies Act. Both types aim to carry out business and earn profit. But they work under different rules. They have different ownership, structure, and legal needs. A public company can invite the public to buy its shares. It can trade shares on the stock exchange. A private company cannot do that. It raises money from its owners, friends, or private investors. A public company has stricter rules. A private company gets more freedom. Public companies need to tell the public about their accounts and meetings. Private companies do not have to do all that.

Meaning of Public Company

A public company is a company that can sell shares to the public. It must register with the Registrar of Companies (ROC). It must follow rules given under the Companies Act, 2013. A public company must have at least 7 members. There is no maximum limit. It must have at least 3 directors.

A public company can raise funds from the public through Initial Public Offering (IPO). It can list its shares on the stock exchange. It must publish its financial reports and follow SEBI rules. Anyone can buy or sell shares of a public company.

Meaning of Private Company

A private company is a company that cannot sell shares to the public. It is owned by a small group. It must also register with the ROC. It must follow the Companies Act, 2013. A private company must have at least 2 members and can have a maximum of 200 members. It must have at least 2 directors.

A private company cannot raise money from the public. It can raise funds through private sources. These sources include friends, relatives, or private investors. A private company does not need to publish its accounts or follow strict SEBI rules.

Key Features of Public and Private Companies

Public and private companies have different features. These features affect how they work and grow. It also affects how they raise funds and follow laws.

Features of Public Company

- Public Share Offering: A public company can offer its shares to the general public, which helps in raising large amounts of capital through the stock market.

- Stock Exchange Listing: It has the option to get listed on recognized stock exchanges like NSE or BSE, which provides liquidity and better visibility.

- SEBI Compliance: It must follow strict rules set by the Securities and Exchange Board of India (SEBI), ensuring transparency and investor protection.

- Unlimited Shareholders: There is no limit to the number of shareholders in a public company, which increases the capital base.

- Annual General Meetings: Holding AGMs is compulsory to update shareholders on the company’s performance and make key decisions collectively.

Features of Private Company

- Restricted Share Transfer: Shares of a private company cannot be freely transferred, which ensures more control among existing shareholders.

- No Public Subscription: It cannot invite the public to subscribe to its shares, so capital is raised from private sources like family or friends.

- Limited Members: A private company can have a maximum of 200 members, making it more manageable and closely held.

- No SEBI Regulations: It does not need to follow SEBI rules as it does not deal with public funds, reducing compliance burdens.

- No AGM Requirement: A private company is not legally required to hold Annual General Meetings, which simplifies internal administration.

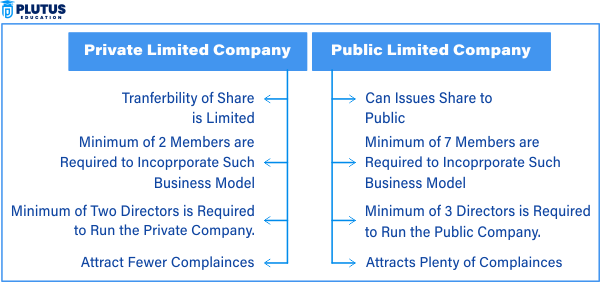

Difference Between Public and Private Company

The difference between public and private companies lies mainly in how they operate, raise capital, and disclose their information. Public companies invite investments from the general public and must follow strict rules from SEBI and other authorities. They have high transparency and must file regular reports. On the other hand, private companies work in a closed structure with limited members and less regulatory pressure. They raise funds privately and can make faster decisions due to fewer owners. Their goals, flexibility, and control systems vary greatly, depending on the type of ownership they choose.

| Point | Public Company | Private Company |

| Minimum Members | 7 | 2 |

| Maximum Members | Unlimited | 200 |

| Minimum Directors | 3 | 2 |

| Public Share Offering | Allowed | Not Allowed |

| Stock Exchange Listing | Yes | No |

| SEBI Compliance | Mandatory | Not Required |

| AGM Requirement | Yes | No |

| Disclosure of Accounts | Public | Not Public |

| Fundraising Options | Public issue, private placement | Private placement only |

Ownership and Control

Ownership structure in public and private companies is very different. This changes how decisions are made and who controls the company.

Ownership in Public Company

In a public company, ownership is spread among many shareholders. People buy shares in the stock market. These shareholders can change often. The management works through a board of directors. Shareholders vote to elect them. Large companies like Infosys and Tata Steel are public companies. Many people own a small part.

This wide ownership means less control by any single person. Decisions are taken by vote. The company must care about all investors.

Ownership in Private Company

In a private company, the owners are usually a small group. These may be family members or a group of close investors. They make quick decisions. There is no need for public voting. Examples include startups, family-run companies, or joint ventures.

This tight control helps the company stay focused. It avoids delays. But it can also limit outside ideas and funds.

Fundraising and Capital

How a company raises money affects its growth. Public and private companies use different methods.

Public Company Fundraising

Public companies raise funds by selling shares to the public. This is called an IPO. After that, they can also sell more shares or issue bonds. They can raise large capital easily. The public market gives them many options. But they must follow rules by SEBI and stock exchanges.

They also face more scrutiny. Investors and media watch them closely. The share price depends on market conditions.

Private Company Fundraising

Private companies cannot sell shares to the public. They raise money through:

- Personal Savings: Founders use their own money to start the company, which helps in early-stage operations without outside interference.

- Friends and Family: They seek help from known people who trust them and provide financial support without formal procedures.

- Angel Investors: These are wealthy individuals who fund startups and take equity in return, offering money as well as mentorship.

- Venture Capital: Private equity firms invest in promising companies with high growth potential in return for ownership stake.

They have fewer options. But they avoid public pressure. They can use private funds for growth. It works well for small and mid-size businesses.

Compliance and Regulation

Public companies and private companies follow different levels of rules. These rules come from the Companies Act, SEBI, and stock exchanges.

Public Company Compliance

- Financial Disclosures: They must submit quarterly and yearly financial reports to stock exchanges, keeping investors informed and maintaining transparency.

- SEBI Guidelines: Public companies must follow SEBI rules strictly, covering issues like shareholding pattern, insider trading, and related party transactions.

- Auditing: Independent audits are mandatory, and audit reports must be shared with the public to ensure correct financial reporting.

- Director Disclosures: Salaries, shareholdings, and board meeting details of directors must be published, enhancing accountability.

Private Company Compliance

- Annual Returns: They must file annual returns and financial statements with the Registrar of Companies to maintain legal status.

- Audit Requirements: Only companies above a certain turnover or capital must get audited, reducing compliance for small firms.

- Board Meetings: Private companies are not bound to hold regular board or shareholder meetings unless required by their own rules.

- No Public Reporting: Financial information is not shared with the public, which keeps business secrets safe from competitors.

Advantages and Disadvantages

Each type of company has its own pros and cons. These depend on business goals, size, and needs.

Advantages of Public Company

- Access to Capital: Public companies can raise large sums from the market, which helps in expanding operations and entering new markets.

- Share Liquidity: Shares are traded on stock exchanges, so investors can easily buy and sell, making it attractive to invest.

- Public Image: Being listed improves brand value, reputation, and trust among customers and partners.

- Employee Stock Options: Public companies can offer shares to employees as incentives, which helps in retaining talent.

Disadvantages of Public Company

- Regulatory Burden: They must follow strict SEBI, Companies Act, and exchange rules, which need more staff and higher costs.

- Ownership Dilution: Selling shares to the public reduces control of original owners, and decisions may face resistance.

- Market Pressure: Public companies face investor and media pressure to perform, often focusing on short-term results.

- Risk of Takeover: Shares being public means hostile takeovers are possible if a person or group buys majority shares.

Advantages of Private Company

- Operational Flexibility: Private companies can make quick decisions without long meetings or public approvals.

- Focused Ownership: Founders retain more control and can follow their vision without external pressure.

- Less Regulation: They don’t need to follow SEBI rules or publish financial results, saving time and cost.

- Better Confidentiality: Business strategies and financials remain private, which helps beat competition.

Disadvantages of Private Company

- Limited Capital Access: They cannot raise money from the general public, which limits growth in big markets.

- Investor Attraction: Fewer people are willing to invest without public share trading, so finding funds is harder.

- Exit Issues: Shareholders find it tough to sell their stake as there is no stock market for private shares.

- Limited Recognition: Being private means less public visibility, which can affect partnerships and trust.

Difference Between Public and Private Company FAQs

Q1. What is the key difference between public and private companies?

Public companies can offer shares to the public. Private companies cannot.

Q2. Can a private company become public?

Yes, it can after following legal steps and offering IPO.

Q3. Who controls a public company?

Shareholders elect a board. The board manages the company.

Q4. Does a private company need to follow SEBI rules?

No. Only public companies must follow SEBI rules.

Q5. Which type is better for startups?

A private company is better as it needs fewer rules and offers more control.