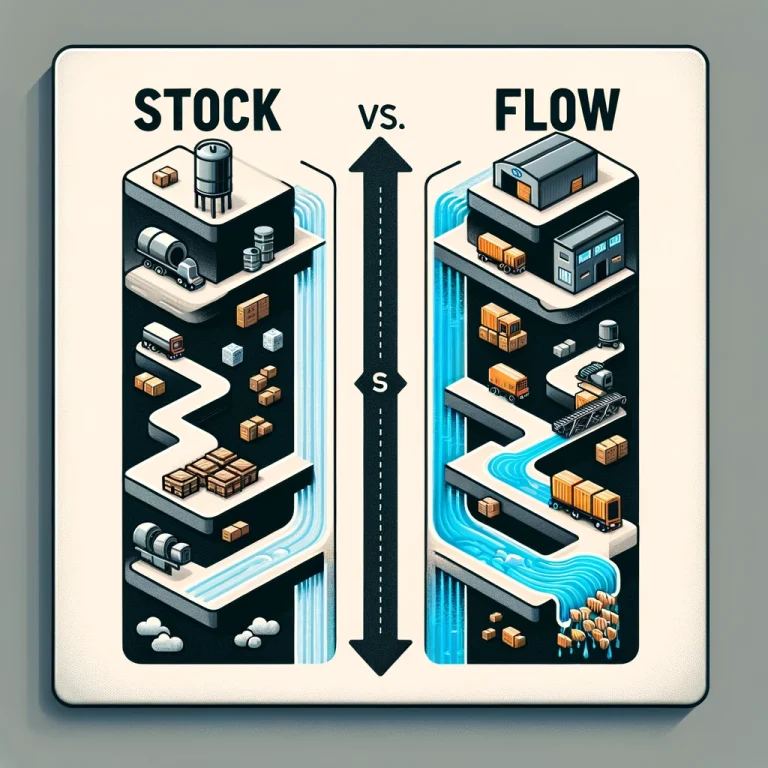

In the study of economics and accounting, stock and flow are the basic terms applied to the analysis of financial data and economic concepts. A stock is the measure of a quantity at any given point in time and can be measured as capital, assets, or wealth, while the flow is the measurement of a quantity over time as income, expenses, or cash flow. It is of paramount importance to students and professionals alike because it forms the basis of the analysis of economic activity and financial health.

What Sets Stock and Flow Apart? Stock vs Flow

The difference between stock and flow is based on its concept of measurement. Whereas stock values exist at an instant, giving a snapshot into an entity’s assets or liabilities, flow represents a rate at which a stock value changes over a specific period. The relationship between stock and flow is significant enough to help assess both conditions in the present and future financial performance.

| Basis | Stock | Flow |

|---|---|---|

| Definition | Measured at a specific time | Measured over a period of time |

| Examples | Wealth, capital, inventory | Income, expenditure, cash flow |

| Nature | Static | Dynamic |

| Measurement | Snapshot | Rate over time |

| Representation | Represented on a balance sheet | Represented on an income statement |

What is Stock?

Stock is the measure of any resource at a given point in time. It is a quantity that does not change unless there is an intervention, such as an investment in case of capital stock or depletion due to consumption.

Characteristics of Stock

- Time-Based: Stock is measured at a single point, which means it provides a status update rather than a timeline.

- Static: Since stock represents values at a fixed point, it doesn’t inherently change over time. For instance, the capital stock of a company reflects its assets on the date the balance sheet was generated.

Examples in Economics:

- Capital Stock: The accumulated investment in a business, such as equipment or property.

- Inventory: The total value of goods available for sale in a business.

- Wealth: The total value of assets owned by an individual or company at a certain point.

Role of Stock in Financial Analysis

Stock values appearing in the financial statements depict the long-term assets and liabilities that a business or an economy is carrying. By the interpretation of the stock figures, one is able to understand whether a company is financially healthy.

What is Flow?

Flows refer to activities or quantities measured over a given period. For instance, income could be measured over a month, and expenses could be measured over a year. Flows can either be positive or negative, meaning an increase or a decrease in resources.

Characteristics of Flow

- Dynamic: Flow is inherently dynamic, changing as time progresses, and is useful in tracking a company’s or economy’s performance.

- Rate-Based: Flow provides a measurement rate, making it relevant for comparisons, like monthly sales or yearly GDP.

Examples in Economics:

- Income Flow: Total revenue generated by a business over a specific time frame.

- Cash Flow: Measures inflow and outflow of cash over a period, essential for liquidity analysis.

- Production Output: The quantity of goods produced over a given timeframe, such as quarterly production figures.

Role of Flow in Financial Analysis

Flow values help stakeholders measure the operating efficiency of a firm by monitoring performance indicators, like revenue growth or operating expenses. It is normally disclosed in the income statement, stating whether there is a profit or loss.

Considerate Differences Between Stock and Flow

Understanding the nuanced differences between stock and flow is critical for accurate financial analysis and economic interpretation.

Measurement Frequency

Stock is a static term measured at a particular point in time and is thus well-suited to an analysis of assets or liabilities on the balance sheet. Flow is taken over a period and can be found in the cash flow statement or income statement as reflecting changes in stock over periods.

Dependency on Time

Stock is not necessarily time-sensitive as it measures something present. Flow is sensitive to time; it measures the performance over an interval, thus very significant for period-specific financial account tracking.

Practical Application in Economics

- GDP (Gross Domestic Product), for instance, is a flow that measures a country’s economic output over a year.

- National Wealth is a stock measure, showing the accumulation of assets within a nation at a certain time.

At the core of financial and economic analysis lies the difference between stock and flow, which gives a complete picture of wealth accumulation and resource generation or consumption over time. Stock values are the amounts owned or owed by an entity at any particular point in time, whereas flow is the changes to these stocks over time. Together, they provide a comprehensive framework for financial analysis and economic forecasting.

Stock and Flow FAQs

What are stock variables and flow variables?

Stock variables are quantities measured at a specific point in time, such as capital, whereas flow variables are measured over time, like cash flow or income.

Is GDP a stock or a flow?

GDP is a flow variable, as it measures economic production over a year.

How are stock and flow related?

Flow values, over time, accumulate to form stock. For example, continuous income flows add up to an individual’s wealth, a stock.

Can stock values change without flows?

Stock values change due to inflows and outflows. For instance, a change in cash stock results from cash inflows or outflows.

Why is cash flow important for a business?

Cash flow measures liquidity over a period indicating a business’s capacity to meet its short-term obligations.