Trade discounts and cash discounts are some of the strategic discounts that are offered to buyers in business transactions. These two concepts are strategic discounts that differ in their purpose and application. Trade discounts encourage merchants to offer more in bulk, while cash discounts promote earlier payments. Understanding how these discounts operate would help the vendors and purchasers optimize cash flow, inventory management, and relations with customers.

What is Discount?

Discounts are price reductions a seller offers to attract customers, ensure timely payment, or encourage bulk purchases. Business firms use discounts as a monetary reward to boost sales and loyalty. The discount can be decided based on transaction terms, volumes, and payment periods.

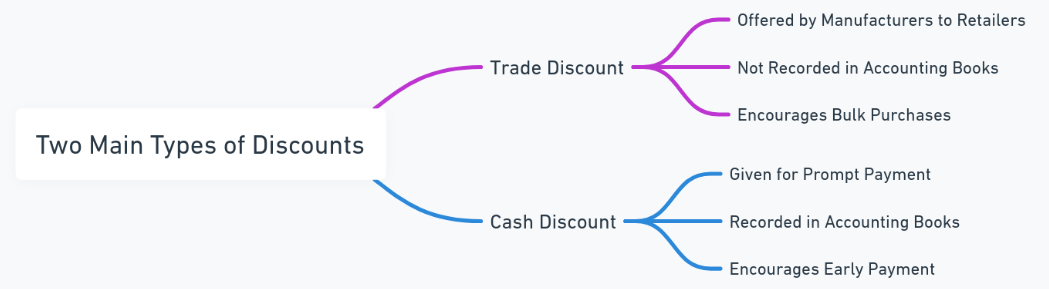

What Are the Two Main Types of Discounts?

In commerce, discounts are primarily classified into Trade Discounts and Cash Discounts. Both types serve unique purposes and affect financial records differently.

- Trade Discount: A reduction on the list price given at the time of purchase, usually to encourage bulk buying.

- Cash Discount: A discount given for early payment within a specific period, encouraging prompt settlement of accounts.

What is Trade Discount?

A trade discount is granted on sale when a discounted price is charged from the catalog price. It can be provided to wholesalers or retailers and sometimes even a mass purchaser. As no difference occurs in the payment through an invoice, it’s not shown as a discount in the books.

Example of Trade Discount Calculation

Suppose the list price of an item is $1,000. A trade discount of 10% is offered for bulk orders. The discount amount will be $100, making the final selling price $900 for the buyer.

Why Are Trade Discounts Offered?

Businesses offer trade discounts for several reasons:

- Encouraging Bulk Purchases: By providing discounts on large orders, companies move inventory faster and enhance cash flow.

- Building Relationships with Retailers: Regular discounts for bulk buyers help in fostering lasting business relationships.

- Managing Inventory Efficiently: Large sales due to discounts allow businesses to manage inventory turnover and storage more effectively.

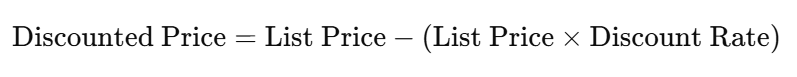

How Are Trade Discounts Calculated?

Trade discounts are calculated as a percentage reduction from the listed price. The calculation is straightforward:

For example, with a list price of $1,500 and a 20% trade discount:

What is Cash Discount?

A cash discount is the reduction of the payable amount when the customer pays within a certain period. It is usually granted once the sale has been done and affects the books.

Example of Cash Discount Calculation

If a company offers a 5% discount on an invoice of $1,000 if paid within 10 days, the discount amount will be $50, and the buyer will pay $950 if they meet the early payment terms.

Why Are Cash Discounts Given?

Cash discounts benefit both the buyer and the seller.

- Encouraging Prompt Payments: Early payments improve cash flow and reduce credit risk for the seller.

- Promotion of Good Customer Relations: Any incentive for early payment will encourage customer loyalty.

- Lessening Collection Efforts: Discounts naturally lessen the need for follow-ups or other collection efforts for due payments.

Trade Discount vs Cash Discount

The primary differences between trade discounts and cash discounts have been explained below:

| Factor | Trade Discount | Cash Discount |

|---|---|---|

| Purpose | Incentivizes bulk or wholesale purchases | Encourages early or prompt payments |

| When Applied | During the purchase transaction | After the sale, when payment is made |

| Record in Books | Not recorded as it affects the initial selling price | Recorded as it impacts cash receipts and payments |

| Common Users | Wholesalers, retailers, bulk buyers | Any buyer or customer with payment terms |

| Example | 10% off for orders above $500 | 5% off if paid within 15 days |

Conclusion

Both trade discounts and cash discounts play essential roles in commercial transactions. Trade discounts focus on promoting bulk sales, impacting initial selling prices, and benefiting merchants looking to move large volumes. Cash discounts, on the other hand, aim at improving cash flow through prompt payments. Understanding when and why each discount is used can enhance financial efficiency, foster client relationships, and optimize business cash flow.

Trade Discount and Cash Discount FAQs

What is the primary difference between trade discount and cash discount?

Trade discounts apply to bulk purchases and are not recorded in accounting books, while cash discounts apply to prompt payments and are recorded as they affect cash flow.

Why is trade discount not recorded in books?

Trade discounts reduce the list price before the final sale, so the transaction amount reflects the discounted price, making additional records unnecessary.

Who benefits more from cash discounts?

Both parties benefit: sellers enjoy improved cash flow, and buyers get a cost reduction for paying early.

Are trade and cash discounts used together?

Yes, a buyer may receive a trade discount for bulk purchasing and a cash discount if they pay promptly within the agreed period.

How does cash discount impact cash flow?

Cash discounts encourage faster payments, thereby improving the seller’s cash flow and reducing outstanding receivables.