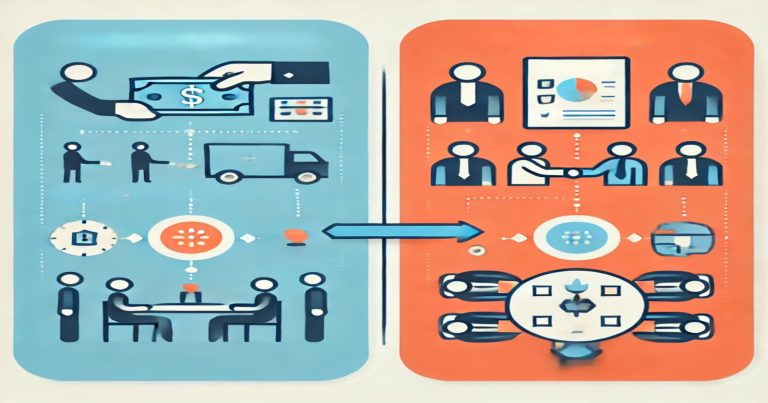

In accounting, understanding the difference between transaction and event is very important. Both help maintain business records, but they are not the same. A transaction always affects the accounts, while an event may or may not affect them. In simple words, a transaction involves money or measurable change, but an event may not always show this change. A transaction always has a direct financial impact and needs to be recorded in the accounting books. It includes actions like sales, purchases, or payments. An event, on the other hand, might influence future decisions but doesn’t always involve money right away. For example, hiring a new employee is an event, not a transaction. Knowing this helps accountants record only the right activities in financial statements. Let us now understand each of these terms and the difference between them in detail.

What is Transaction?

Transactions happen every day in a business. They are actions where something valuable is exchanged. In accounting, we record each transaction because it changes the financial records of the business.

A transaction is when two parties exchange something. It can be money, goods, or services. For example, when a customer buys a product and pays cash, this is a transaction. It has a clear financial effect. In other words, if it changes the balance sheet or income statement, it is a transaction.

The accounting transaction definition is very clear. It says that a transaction is a business activity that affects the accounting records. A transaction must always have at least two accounts involved—one gets a debit, and the other gets a credit. This is also called double-entry accounting.

A business cannot run without transactions. Every time something is bought, sold, paid, or received, it is recorded. This is why understanding what a transaction is in accounting becomes very important for students and business owners.

Types of Transactions in Accounting

We divide transactions into different types based on what they involve. Understanding these types helps you manage accounts better. It also helps to find out where the money goes and comes from. Below are some common types:

- Cash Transactions: Here, money is paid or received in cash at the time of the activity. For example, paying cash for electricity.

- Credit Transactions: The money is not paid right away. It will be paid later. For example, buying goods and agreeing to pay next month.

- Internal Transactions: These do not involve any outside party. For example, depreciation on machines.

- External Transactions: These involve other parties. For example, selling a product to a customer..

What is an Event?

Events are things that happen in or around the business. Some may affect the business accounts, and some may not. But all events are important in the life of a business. An event is any event that can have an impact on the business. But not all events are transactions. Some events may lead to future transactions. Others may never affect the accounts. The accounting event meaning says that an event is any occurrence that may have a future effect on the business.

For example, if a company signs a contract to buy a machine, it is an event. But until they make the payment or receive the machine, it is not a transaction. Events are often the first step before a transaction happens.

Types of Events in Accounting

Understanding what is an event in accounting helps to track the business situation. Some events are only recorded in notes or reports but not in the main accounts. We can divide events into different types, like this:

- Internal Events: These happen inside the business. For example, loss due to fire or machine failure.

- External Events: These happen due to outsiders. For example, market changes or new rules from the government.

Some events lead to business transaction vs business event comparisons. A transaction always affects the accounts, but an event may not. Another way to look at events is as follows:

- Financial Events: These can be measured in money. For example, a loan taken from the bank.

- Non-Financial Events: These cannot be measured in money. For example, an employee resigns.

By understanding the types, students and accountants can prepare better reports. It helps in forecasting and planning.

What is a Transaction and an Event?

In the world of accounting, every business activity is classified as either a transaction or an event. While both influence a company’s financial position, they are not the same. A transaction involves a measurable exchange of value — such as cash, goods, or services — and is always recorded in the books of accounts. On the other hand, an event may or may not involve money but still impacts the business, like a flood damaging stock or the resignation of a key employee.

Understanding the difference between a transaction and an event is essential for accurate financial reporting and decision-making. Whether you’re a student or an aspiring accountant, mastering this distinction lays the groundwork for deeper concepts in financial accounting.

Both terms are often used in accounting. But they are different. This section gives more detailed meaning and how they work together in business.

The Link Between Transaction and Event

You can think of events as a wider term. Transactions are a part of events. All business activities are events, but only those that affect accounts are transactions. For example, starting a new business is an event. But putting capital into it is a transaction.

Understanding both terms is useful. It helps you make better reports and keep accurate records. In Indian accounting systems, every transaction must be recorded. But events are often only noted.

Why Should Students Learn This?

For accounting students in India, this topic is covered in many exams. Many job interviews also ask about the difference between transaction and event. So, it is useful for both exams and jobs Learning it helps in:

- Clearing basic concepts

- Understanding double-entry system

- Preparing correct balance sheets

- Scoring well in theory questions

Examples of Transaction and Event

In accounting, transactions and events are key concepts that impact a business’s financial position. A transaction involves a measurable exchange, like buying goods, while an event may or may not involve money but still affects the business. Understanding both with clear examples helps build a strong foundation in financial accounting. Let us look at some examples of transactions and events to understand better:

| Example | Transaction or Event? | Why? |

| Sale of goods for ₹1,000 | Transaction | It involves money and changes accounts |

| Flood damage to stock | Event | It may not be recorded unless it affects value |

| Purchase of computer | Transaction | Money is paid and asset increases |

| Employee joining a company | Event | No immediate change in financial records |

In short, if the activity changes the financial position and can be measured in money, it is a transaction. Otherwise, it is just an event.

Difference Between Transaction and Event

Every business activity affects a company in some way. However, to manage finances, you must know which activities need to be recorded in accounting books. This is where we need to understand the difference between transaction and event clearly. Though people often use these words interchangeably, they do not mean the same thing in accounting.

A transaction is a business activity that always affects the financial position of the company. It always includes an exchange that can be measured in money. A business event is a broader term. It includes everything that happens inside or outside the business. However, some events may not change the accounts or financial statements. So, all transactions are events, but all events are not transactions.

Transaction vs Event

Understanding this difference is important. It helps in proper bookkeeping, error-free accounting, and building financial reports that show the real health of a business. This clarity is also useful for students preparing for exams in commerce, CA Foundation, ACCA, or B.Com courses. Let us now go deeper and break down every part of this difference.

1. Effect on Accounts

- A transaction always changes one or more financial accounts. For example, if you buy furniture, your cash goes down, and your assets go up. This must be recorded in the books.

- However, an event may not change the accounts. If an employee joins the company, it is important. But it doesn’t change the company’s financial records at that point.

2. Measurability in Money

- We can always measure transactions in money. That is why accounting can record them. Selling goods for ₹5,000 has a clear money value.

- Events do not always have a value. If a manager resigns or the government announces a new rule, you cannot assign a monetary value to it right away.

3. Recording in Accounting Books

- Transactions always go into the journal, ledger, and financial statements. These are mandatory.

- Events may only appear in reports or management discussions. Not all events go into official books unless they lead to a transaction.

4. Timing

- A transaction happens at the time of exchange. It is an immediate action. However, an event can happen in stages or lead to something in the future.

- For example, signing a contract is an event. But when money is paid, or goods are delivered, the transaction happens.

5. Legal or Binding Nature

- Transactions are legal actions. They involve formal agreements between two parties—like buyer and seller.

- Events may not have legal value on their own. They can be announcements, plans, or natural events like floods or fires.

6. Need for Journal Entry

- You always write a journal entry for a transaction. It shows the debit and credit accounts and makes sure books are balanced.

- For an event, you may not write any journal entry unless it turns into a transaction.

| Criteria | Transaction | Event |

| Definition | An activity that affects the financial records and involves value exchange | Any occurrence that may or may not affect accounts |

| Effect on Accounts | Always changes one or more accounts | May or may not change accounts |

| Recorded in Books | Yes, must be recorded with proper entry | Not always recorded unless financially important |

| Measurable in Money | Always | Not always |

| Examples | Sale of goods, payment of salary, purchase of raw material | Signing a contract, hiring a manager, company event |

| Involves Parties | Usually involves two parties | May involve internal or external parties |

| Need for Documentation | Requires invoice, receipt, or bill | May or may not have documents |

| Legal Proof Needed | Yes, has legal proof and impact | Not always needed |

| Causes Financial Change | Yes, always | Sometimes yes, sometimes no |

| Included in Financial Reports | Always included | Only if it has monetary impact |

| Nature | Concrete and measurable | General and may be abstract |

| Type of Activity | Accounting activity | Business or non-accounting activity |

Importance in Accounting

In accounting, transactions and events are key concepts that impact a business’s financial position. Knowing the difference between transaction and event helps in:

- Making correct financial reports

- Avoiding mistakes in accounting

- Understanding what to record

- Planning future activities

Relevance to ACCA Syllabus

This topic is key in ACCA’s Financial Accounting (FA) and Financial Reporting (FR) modules. ACCA students must understand the distinction between measurable transactions and broader events for accurate financial statement preparation under IFRS. Events that don’t meet recognition criteria still require disclosures, making this topic essential for compliance and transparency.

Difference Between Transaction And Event ACCA Questions

Q1: What best describes a transaction in financial reporting?

A) Any activity that influences the market price

B) A measurable economic event recorded in financial statements

C) A planned future activity

D) An external event without financial impact

Ans: B) A measurable economic event recorded in financial statements

Q2: Which of the following would be classified as an event but not a transaction?

A) Purchase of inventory

B) Depreciation of machinery

C) Announcement of a new CEO

D) Issuance of shares

Ans: C) Announcement of a new CEO

Q3: What differentiates a transaction from an event in IFRS-based reporting?

A) Transactions involve internal activities only

B) Events are always monetary

C) Transactions must be measurable and recorded

D) Events are always excluded from financial reports

Ans: C) Transactions must be measurable and recorded

Q4: Which of these would be reported only in the notes and not as a transaction in financial statements?

A) Borrowing money from a bank

B) A pending lawsuit

C) Revenue from services

D) Asset Disposal

Ans: B) A pending lawsuit

Q5: Under IAS 10, which event is considered an “event after the reporting period” but not a transaction?

A) Acquisition of subsidiary after year-end

B) Sale of inventory

C) Payment of dividends

D) Issuance of bonds

Ans: A) Acquisition of subsidiary after year-end

Relevance to US CMA Syllabus

In the CMA exam, especially Part 1 (Financial Planning, Performance, and Analytics), understanding the distinction helps with preparing accurate financial statements and evaluating the timing and recognition of various accounting items. It forms a core concept in cost accounting and reporting.

Difference Between Transaction And Event CMA Questions

Q1: What defines a transaction in the context of the CMA syllabus?

A) An internal plan

B) A legally binding agreement

C) An exchange that is measurable and recordable

D) An employee announcement

Ans: C) An exchange that is measurable and recordable

Q2: Which of these is a business event but not a financial transaction?

A) Signing a lease agreement without immediate payment

B) Purchasing equipment

C) Receiving cash from customers

D) Paying off a loan

Ans: A) Signing a lease agreement without immediate payment

Q3: In managerial accounting, an event becomes a transaction when:

A) It is authorized by management

B) It has a direct impact on shareholders

C) It involves a third party

D) It can be measured and recorded financially

Ans: D) It can be measured and recorded financially

Q4: A change in market regulations is considered:

A) A transaction

B) A financial statement item

C) An event that may require disclosure

D) A cost allocation item

Ans: C) An event that may require disclosure

Q5: Which would be excluded from the general ledger but still require management attention?

A) Revenue from new contracts

B) Stock issuance

C) Machinery breakdown affecting production

D) Asset depreciation

Ans: C) Machinery breakdown affecting production

Relevance to US CPA Syllabus

This topic is covered in the FAR (Financial Accounting and Reporting) section of the CPA exam. Differentiating between transactions and events is vital to recognizing what should be journalized and how disclosures should be handled under GAAP.

Difference Between Transaction And Event CPA Questions

Q1: According to GAAP, a financial transaction must:

A) Be initiated internally

B) Be publicly disclosed

C) Be measurable and involve a change in financial position

D) Affect legal status of a firm

Ans: C) Be measurable and involve a change in financial position

Q2: A major fire damaging a warehouse is classified as:

A) A transaction

B) A non-recognizable event

C) An extraordinary gain

D) An accounting error

Ans: B) A non-recognizable event

Q3: Under GAAP, how are non-transactional events handled?

A) Ignored in all cases

B) Reported as prior period adjustments

C) Disclosed in the financial statement notes

D) Recorded as liabilities

Ans: C) Disclosed in the financial statement notes

Q4: What qualifies a financial occurrence as a transaction in accounting terms?

A) Subjective valuation

B) Investor expectation

C) Clear monetary value and measurable impact

D) Media coverage

Ans: C) Clear monetary value and measurable impact

Q5: A customer’s bankruptcy post-year-end is:

A) A financial transaction

B) A transaction requiring revaluation

C) A non-adjusting event

D) A retrospective accounting change

Ans: C) A non-adjusting event

Relevance to CFA Syllabus

The CFA curriculum emphasizes the correct interpretation of financial statements, especially in Levels I and II. Understanding which events are recognized as transactions helps in accurate financial analysis, valuation, and risk assessment.

Difference Between Transaction And Event CFA Questions

Q1: In financial analysis, a transaction must:

A) Affect non-financial stakeholders

B) Change shareholder voting rights

C) Be recorded due to its economic impact

D) Be related to equity financing only

Ans: C) Be recorded due to its economic impact

Q2: A board meeting announcement is an example of:

A) A financial transaction

B) An event with no accounting entry

C) A deferred liability

D) A revenue recognition issue

Ans: B) An event with no accounting entry

Q3: From an investor’s perspective, what is a key feature of a transaction?

A) It changes the management structure

B) It reflects in earnings per share

C) It involves a transfer of resources

D) Shareholders vote on it

Ans: C) It involves a transfer of resources

Q4: Which of these is an event likely to be considered in valuation but not recorded in accounting?

A) Increase in accounts payable

B) Asset impairment

C) Product recall due to defects

D) Receipt of customer prepayments

Ans: C) Product recall due to defects

Q5: Events not recorded in financial statements may still be:

A) Used in sensitivity analysis

B) Discarded in equity valuation

C) Expensed immediately

D) Recorded as intangible assets

Ans: A) Used in sensitivity analysis