Disposable income includes income after taxes. This indicates the amount of property in the hands of the consumer that can be referred to as income in itself. Within a week, inflation rises and affects one’s finances. However you budget essentials, you need to know your disposable income when deciding on investments and savings. This enables you to be tactful and courageous in the handling of money.

What is Disposable Income?

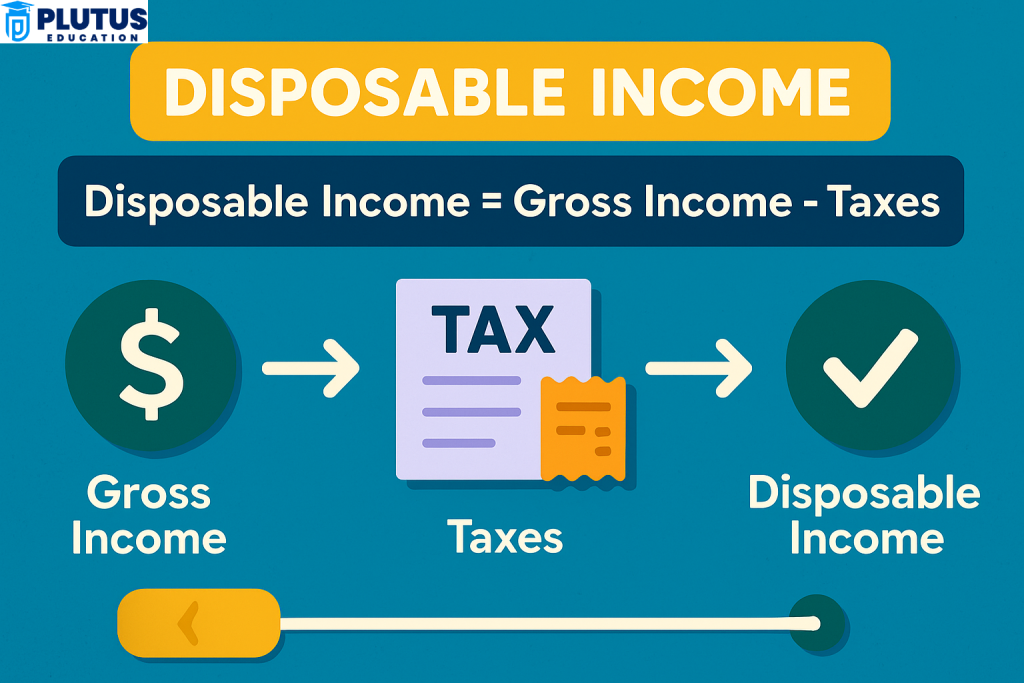

Disposable income is the income that remains after meeting direct taxes, such as income taxes. It is generally referred to as “take-home salary” and reflects the amount available to decide on living expenses and financial goals. From a policymaker’s viewpoint, this figure measures consumer sentiment and financial muscle for economic strategy and tax reform.

Disposable Income vs. Gross Income

Gross income differs from disposable income since gross income is all your earnings before any deductions are made, and disposable income shows what is left after the government takes its share. By knowing this difference, you should avoid spending on gross figures, for that may mislead budgeting efforts.

Disposable Income vs Discretionary Income

Discretionary income is the amount left after the deduction of taxes and basic expenses (rent, food, utilities), and it is shown to become a subset of disposable income. This is emphasized as the part available for luxury spending or investment. Being able to distinguish between both makes it easier to keep in check excess consumption of non-essentials.

Personal Income and Its Components

Disposable income can best be calculated after the total personal income has been determined initially. Personal income comprises not just your base salary; other income from dividends, rental property, interest income, side jobs, or even amounts given from government benefits should also be included. On this note, an individual will look at a better, more accurate, and holistic understanding of the extent of their earnings.

Types of Personal Income

Most people forget things like working on the side, selling things online, making passive money on investments, or being rewarded by the business for the work one does at home seasonally. However, tracking one or two of these additional inflows usually helps boost disposable income. For students, retirees, or those who earn part-time, identification is the only income source to establish the real available amount for use or growth.

Disposable Income Formula

Disbursement from gross personal income is essentially quite simple:

Disposable Income = Personal income – Income taxes

It gives one an idea of how much of their income they are genuinely in possession of. Assuming that someone earns SGD 90,000 as personal annual income and pays SGD 18,000 as income tax, the disposable income will then be equal to SGD 72,000, which is the foundation for all financial decisions ranging from spending limits to targets of monthly savings.

Using the Formula in Monthly Budgeting

Employing the principles for a monthly income allows breaking down cash into digestible portions to avoid massive, uncontrolled flows. For example, say about SGD 7,500 in earnings per month, you have to pay out SGD 1,500 in taxes on those earnings. Then, the disposable income is defined to be SGD 6,000 insofar as monthly expenses are said to be undertaken for savings and investments. It makes planning very easy and avoids running short of cash before the month-end.

Actual Disposable Income: Inflation Adjustment

Owing to the inflation rate in the world, it cannot be said that nominal disposable income tells the entire story. Real disposable income corrects your income for inflation and thus reveals how your money is really worth in terms of purchasing power. This seems to be a more realistic and, therefore, much more relevant figure in terms of long-term planning.

Real vs. Nominal Income

Nominal disposable income has nothing to do with inflation, whereas real disposable income reports how far your earnings can stretch in an inflated economy. For example, if your income stays fixed but inflation rises 6%, your real disposable income decreases significantly, negatively affecting your ability to sustain the lifestyle you have always enjoyed.

Importance of Long-Term Financial Planning

Through tracking real disposable income, reality-based conclusions can be drawn with regard to whether or not salary increases keep up with inflation over a more extended period. It is essential to establish whether someone is really improving themselves financially or just paddling water, as it would be with many retirees and those with fixed earnings, and whether their savings can form a buffer when costs are rising.

Role of Disposable Income in Budgeting and Saving

Disposable income is essentially the central pillar around which budgeting is to be constructed. It defines limits of expenditure and directs how much to assign to fixed expenses, flexible spending, and even financial goals such as saving or investing. Without understanding what figure means, high earners can, very well, end up in debt or have no savings at all.

Formulating a Spending Plan Informed by Disposable Income

With all said and done, individuals can prioritize essential needs to minimize on-the-spot purchases and channel the remaining money to be saved. It will also enable one to set up an emergency fund and prepare for significant life events such as weddings, home ownership, or retirement.

Savings and Investment Allocations

You can decide how much can be invested every month into a Systematic Investment Plan (SIP), retirement account, or high-yield savings account, depending on your disposable income. This maintains a balance between your short-term needs and long-term goals for very sound, optimum wealth accumulation without the pain of wrangling finances.

Influence over Credit, Loans, and Debt Management

Disposable income is the main deciding factor in determining whether one is creditworthy. Lenders evaluate a borrower’s disposable income to determine whether the borrower can sustain loan repayment. The more disposable income is available to a borrower, the higher the probability that a loan will be approved and granted with better terms or interest rates.

Banks and Ratios of Disposable Income

Banks calculate income-to-debt ratios to arrive at a figure for the commissions set on loans and EMI burdens. If your disposable income per month is high, your eligibility increases quite significantly. On the other side, if most of your disposable income goes to paying debts, any new applications for credit may be turned down or approved at a higher rate.

Disposable Income and Its Economic Significance

At the macro level, disposable income affects broad trends within nations’ economies. It drives demand for goods and services in life, nurtures business development, and, above all, indicates consumer confidence. Disposable income generally increases with GDP growth and positive labour market growth.

Government Use in Policy Decisions

The welfare GDP or disposable income data above may inform tax policy decisions, determine adjustments in benefits related to subsidies, and indicate effects on social welfare. A decline in average disposable income for households, for example, might result in tax relief measures or increases in expenditure on some social dimension of life outside income.

Disposable Income Formula FAQs

What is the disposable income formula?

The formula is: Disposable Income = Personal Income – Income Taxes. It tells how much money you can actually use after paying taxes.

What is the difference between personal income and disposable income?

Personal income includes all earnings before taxes. Disposable income is what remains after income tax is subtracted from personal income.

Why is real disposable income unnecessary

It shuns unnecessary inflation that affects your purchasing power. It provides a more accurate view of how much value your income really has.

How does CPI affect disposable income calculations?

When CPI increases, your real disposable income decreases. That means you can buy less with the same income because of rising prices.

Can disposable income impact economic growth?

Yes, higher disposable income boosts consumer spending, which supports business profits and drives economic expansion.