The dissolution of a partnership firm is when a partnership’s business operations are brought to an end and all the associated activities halt. The main processes involved are liquidating assets, settling liabilities, and distributing the remaining profit to the partners according to the partnership agreement. This is done mainly because of disagreement among partners, the business purpose is fulfilled, or insolvency, incapacity, or other legal reasons. Dissolution is not the same as reconstitution, which only alters the form of the partnership rather than terminating it.

What is Dissolution of Partnership

It dissolves the legal existence of a partnership, and business activities come to an end. This is different from simple reconstitution, wherein a partner may leave or a new partner joins without the firm coming to an end. Dissolution requires detailed financial and legal steps to settle all the business matters, including the liquidation of assets, repayment of debts, and then distribution of any remaining assets or profits among the partners according to their agreed share.

When the business is dissolved:

- The business does not continue under the name of a partnership.

- Agreements and contracts with suppliers, customers, and creditors are either resolved or ended.

- Rights and liabilities can further be assigned to the partners as per the process. Usually, they are included in the partnership agreement.

Dissolution vs. Reconstitution

- Reconstitution: Occurs when the partnership changes, such as a partner joining or leaving, but the business continues.

- Dissolution: Involves the complete termination of the business and settlement of all affairs.

Types of Partnership

Understanding the various types of partnerships is critical for deciding how to approach dissolution, as each structure affects partners’ rights and obligations differently.

General Partnership

In a general partnership, the partners share equal liability and have unlimited liability for the debts of a partnership. Each partner is also equally liable for the management and contribution to debt. Dissolution in general partnerships often involves mutual consent; however, other circumstances like the death or insolvency of a partner result in automatic dissolution.

Limited Partnership

A limited partnership is said to have general partners with unlimited liability and limited partners liable only for the amount of their contribution. The liability structure will affect the distribution of assets in case of liquidation.

Limited Liability Partnership (LLP)

All partners in an LLP get limited liability, and so the personal assets of a partner are protected beyond their investment in the business. Usually, the process of winding up an LLP is accompanied by settling debts from available assets, and liability on the part of the partners will be restricted to the extent of investment only.

Joint Venture Partnership

A joint venture is a temporary partnership that exists only for the sake of one project. It typically dissolves after completing the project. The dissolution depends on what each of them had initially brought into the business, as the contribution forms the share of every individual in a joint venture. It’s often not difficult to dissolve because it comes to an end with the project.

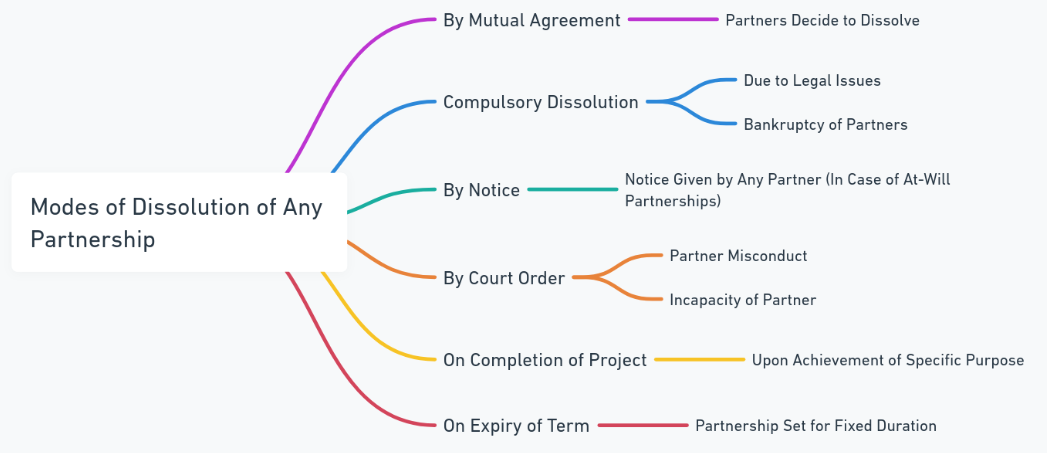

Modes of Dissolution of Any Partnership

There are various modes of dissolving a partnership, each with different procedures and implications.

Voluntary Dissolution by Agreement

The partners can mutually agree to dissolve the partnership, often as agreed upon in the partnership agreement. This method is by mutual consent and is typically straightforward, with assets and liabilities dealt with according to the original agreement.

Compulsory Dissolution

Compulsory dissolution can result from situations beyond the partners’ control:

- Insolvency of a Partner: If a partner becomes insolvent, the partnership is dissolved, especially when there is an agreement indicating the grounds for dissolution due to insolvency.

- Illegal Activities: When the business or its objectives become illegal, dissolution is compulsory so that no legal implications result.

- Expiry of Partnership Term or Completion of Objective: If the partnership was meant for a particular term or project, it is dissolved automatically once the time limit or project is complete.

Dissolution by Notice

In “partnership at will,” a partner may dissolve the firm by serving written notice to the others. This method gives flexibility for partners to exit, but it also requires clarity in the partnership agreement to avoid disputes.

Dissolution by Court Order

A partner may petition the court for dissolution under several conditions:

- Mental Incapacity or Incapability of a Partner: If a partner becomes incapable of performing his duties because of health or mental incapacity.

- Misconduct or Breach of Agreement: Misconduct or repeated breaches that prejudice the interest of the partnership may be considered a valid reason for dissolution by a court.

- Continuing Disputes: Continuing disagreements that interfere with the business may also be considered valid reasons for court intervention.

Rights After Dissolution

Upon dissolution, partners have certain rights, especially concerning asset realization, distribution of profits, and indemnity against liabilities.

Right to Realize Assets

Liquidation of a firm’s assets to settle creditors is among the rights given to partners. It is selling property, inventory, or equipment to convert it into cash and ensure that all outstanding obligations are settled before distribution.

Right to Claim Profits

All liabilities are paid, and the remaining assets or profits are divided between the partners. The profit-sharing ratio or capital contribution usually applies to the distribution under a partnership agreement.

Right to Indemnity

Any partner who may have suffered loss or expensed costs on behalf of the firm is considered eligible for recompense on the assets of the firm. Meaning they are given their reimbursed expenses before final distribution of profit for partners.

| Rights | Explanation |

|---|---|

| Realize Assets | Right to sell assets and use proceeds to settle debts. |

| Claim Profits | Right to claim a share in any remaining profits based on the profit-sharing ratio. |

| Right to Indemnity | Reimbursement for expenses incurred in the firm’s interest. |

Liabilities After Dissolution

After dissolution, partners are liable for clearing all firm obligations, including debts, partner settlements, and any legal claims.

Liability Towards Creditors

Liquidation proceeds are distributed first to the creditors of a partnership. If the firm’s assets are not enough to pay all outstanding debts, a partner may contribute according to his liability agreement on his own assets to pay outstanding debts.

Liability Towards Partners

The liability of partners is interdependent on the amount of capital they initially contributed. In case of a capital shortfall, the deficit can be covered by partners in proportion to the ratios determined in the agreement.

Liability in Case of Fraud or Misconduct

If the actions of a partner are fraudulent or otherwise wrong, then the losses can be held personally liable to the partners. The courts may require the responsible partner to compensate other partners before distributing the assets, especially if their actions directly harmed the financial standing of the partnership.

| Liabilities | Explanation |

|---|---|

| Creditors | Paid from liquidated assets; partners may contribute personal assets if funds are insufficient. |

| Partners | Settlements made based on capital contributions or loans. |

| Fraud/Misconduct | Liable for personal compensation if losses occur due to their actions. |

The dissolution of a partnership firm is a significant step involving the complete termination of business operations, asset liquidation, liability settlement, and distribution of any remaining profits or losses among the partners. The process may result from voluntary agreements, court orders, or other compelling circumstances like insolvency or completion of the business objective. Understanding the modes of dissolution, as well as the rights and liabilities that partners carry, helps ensure a smooth and fair dissolution process that protects each partner’s interests.

Dissolution of Partnership Firm FAQs

What happens to partnership assets upon dissolution?

Upon dissolution, assets are liquidated, and the proceeds are first used to settle outstanding debts. Any remaining funds are distributed among partners based on their profit-sharing ratio.

Who is responsible for liabilities after dissolution?

After dissolution, all partners share the responsibility to settle liabilities. They must clear debts according to their share in the firm, though personal liability can depend on the partnership type.

Can a partner dissolve the firm without others’ consent?

In a partnership “at will,” any partner can dissolve the firm by giving notice to other partners, even without mutual consent. However, in other cases, the decision may require agreement or court intervention.

How are profits distributed after dissolution?

Profits are distributed based on the profit-sharing ratio outlined in the partnership deed. Partners receive their shares after settling liabilities.

What if a partner disagrees with dissolution?

A court may order dissolution if valid reasons, like persistent conflict or misconduct, are proven, even if one or more partners disagree with the decision.