The two vastly recommended qualifications that facilitate improvement in career prospects in finance and accounting are CA and ACCA combinations in qualification. These two highly prestigious qualifications enhance technical skills and provide a global outlook toward accounting practices. In this article, we dwell upon the value of pursuing ACCA qualification in combination with CA by scrutinizing the benefits, drawbacks, and unique advantages of possessing both credentials.

Pursuing the CA and ACCA qualifications concurrently will be a fabulous strategy for professionals in the accounting and finance sector. Although each of them has its merits, combining them provides one with a robust skill set that opens doors to international opportunities and higher-level jobs. This article will discuss the idea of continuing to pursue ACCA after CA and highlight the pros and cons of the blend, which will help steer you in the right direction throughout your career.

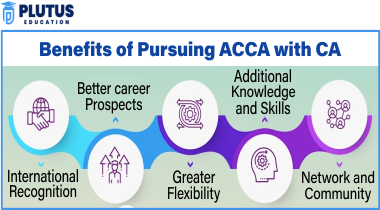

Pros of Pursuing ACCA After CA

ACCA and CA both have their unique advantages. So, once combined they form a comprehensive financial professional. Now let’s focus on how the addition of ACCA will enhance your CA qualification:

Global Recognition and Mobility

- Global Standards: As the ACCA is recognized globally, if you have qualifications from an ACCA, then you become eligible to work in a lot of countries. Global recognition hence gives high value to your career prospects, especially if you aspire to work abroad.

- International Job Market: A combination of CA through knowledge about the accounting principles of India and Global standard set by ACCA will provide much space for international working.

- Visa and Work Opportunities: People from such countries mostly preferred candidates having both CA and ACCA. It enhances mobility in terms of work visas and job placement. Countries like the UK, Canada, Australia, and the Middle East generally prefer people with both CA and ACCA to provide them more mobility in terms of work visas and job placement.

Diverse Career Opportunities

- Versatility: ACCA certification makes you suitable for careers other than merely an accountant, such as a financial analyst, tax consultant, and CFO.

- Sector Flexibility: You can easily adapt yourself to any industry, such as banking, consulting, and even IT finance, thereby boosting your employability across the sectors.

- Management and leadership roles: What the knowledge of international accounting standards acquired from ACCA will add to the technical expertise from CA is the preparation for leadership roles in multinational corporations.

Increased Earning Potential

- Higher Salaries: People having dual certification of CA and ACCA earn higher salaries compared with those having just one.

- Specialized Knowledge: Combining the two brings in a unique skillset that companies pay a premium price for, especially for strategic finance, risk management, and compliance roles

- Promotions: Having dual qualifications stimulates career progression to higher ranks, hence faster promotion and higher scales.

Cons of Pursuing ACCA After CA

Despite the numerous advantages, there are also some drawbacks to consider when pursuing ACCA after completing CA:

Time and Financial Investment

- Cost Factor: The cost can be a bit high when one considers the price of studying, examination fees, and other study materials.

- Time-Consuming: ACCA may call for a lot of time from you. As part of your present employment, balancing it with ACCA studies is difficult. It calls for a lot of time commitment.

- Opportunity Cost: There is also opportunity cost; you may be required to forego the chance of earning from your job to study.

Overlap in Curriculum

- Redundancy: Many subjects are duplicated within ACCA and CA curricula, especially on themes such as financial accounting, and taxation.

- Less Incremental Learning: If one already understands these areas well, the learning curve may not appear nearly as dramatic to the professional, which does not help in perceived value.

- Additional Exams: Although there is a high degree of overlap between the two qualifications, you will probably need to take several different exams to obtain your ACCA certificate – which can sometimes be a little repetitive.

Relevance in Specific Regions

- Regional Preference: In some regions, employers might not place as much weight on ACCA because most use national accounting standards. For example, India uses the ICAI for most of its accounting standards.

- Market Knowledge: ACCA tends to concentrate on international standards, which at times do not fit perfectly with local requirements for countries that consider CA holders.

The Power of Combining CA and ACCA Qualifications

Combining the CA and ACCA qualifications gives an extremely effective harmonization of regional knowledge with global perception. You’ll be one of the most in-demand candidates for the finance and accounting arena. Let’s take a look at why this combination is deemed so impactful:

Broader Knowledge Base

- Comprehensive Skill Set: This course makes you an expert in Indian taxation, and accounting, but the ACCA course would especially deal with IFRS and global practices.

- Cohesive Skill Set: It ensures that after completing the combination, there is strategic business insight coupled with hands-on technical skills to deal with complex financial scenarios.

- Analytical Skills: You acquire advanced analytical skills considered pertinent to making informed business decisions globally.

Enhanced Career Flexibility

- Multi-Regional Opportunities: The combination of CA and ACCA allows you to work anywhere in India or abroad without seeking additional certifications or appearing for any exams.

- Networking Opportunity: Being a part of the ICAI as well as the ACCA networks enlarges the professional circle and opens up more opportunities for career development.

- Adaptability: This double qualification equips one to adjust well in different business environments, different financial regulations, and diverse corporate governance practices worldwide.

Conclusion

Combining the CA and ACCA qualifications is undoubtedly a strategic move for professionals aiming for a robust career in finance and accounting. While there are challenges, such as time and financial investment, the long-term benefits of higher earning potential, global mobility, and diverse career opportunities make this combination worthwhile. With the dual advantage of local expertise and global knowledge, the CA-ACCA combination positions you as a valuable asset to any organization.

CA and ACCA Combination FAQs

Is it worth pursuing ACCA after completing CA?

Yes, pursuing ACCA after CA is worth it as it adds global recognition and opens up international career opportunities.

Can I get exemptions in ACCA exams if I have already completed CA?

Yes, ACCA grants exemptions for certain papers if you have a CA qualification, reducing the time required to complete the ACCA course.

What are benefits of CA and ACCA combination?

The combination provides an extensive skill set, making you eligible for global roles, higher salaries, and leadership positions in multinational companies.

Which is more difficult, CA or ACCA?

Both have their own challenges; CA is considered tougher in terms of its depth in Indian accounting standards, while ACCA covers a broader range of global standards.